Report of Foreign Issuer (6-k)

April 09 2015 - 2:56PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

—————————

Dated April 9, 2015

Commission File Number: 001-35788

ARCELORMITTAL

(Translation of registrant’s name into

English)

24-26, Boulevard d’Avranches

L-1160 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

[X] Form 40-F [_]

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes [_] No

[X]

If “Yes” marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________

On April 9, 2015, ArcelorMittal

issued the press release attached hereto as Exhibit 99.1 hereby incorporated by reference into this report on Form 6-K.

Exhibit List

| Exhibit No. |

Description |

|

Exhibit 99.1

|

Press release dated April 9, 2015 reporting that ArcelorMittal has announced the issuance of €400 million Floating Rate Notes and €500 million Fixed Rate Notes under its €6 billion EMTN Programme. |

| |

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: April 9, 2015

By: /s/

Henk Scheffer

Exhibit Index

| Exhibit No. |

Description |

|

Exhibit 99.1

|

Press release dated April 9, 2015 reporting that ArcelorMittal has announced the issuance of €400 million Floating Rate Notes and €500 million Fixed Rate Notes under its €6 billion EMTN Programme. |

| |

|

ArcelorMittal announces the issuance of €400 million

Floating Rate Notes and €500 million Fixed Rate Notes under its €6 billion EMTN Programme

Luxembourg, 9 April 2015 – ArcelorMittal ("ArcelorMittal"

or "the Issuer") announces the issuance of €400 million Floating Rate Notes due 9 April 2018 and €500 million

3.00 per cent. Notes due 9 April 2021 (the "Notes").

The issuance closed today. The Notes were issued under ArcelorMittal’s

€6 billion wholesale Euro Medium Term Notes Programme.

The proceeds of the issuance

will be used for general corporate purposes.

Important note: This press release does not, and shall

not, in any circumstances constitute a public offering by ArcelorMittal of the Notes nor an invitation to the public in connection

with any offer. No communication and no information in respect of the issuance of the Notes may be distributed to the public in

any jurisdiction where a registration or approval is required. No steps have been or will be taken in any jurisdiction where such

steps would be required. The offering or purchase of the Notes may be subject to specific legal or regulatory restrictions in certain

jurisdictions. ArcelorMittal takes no responsibility for any violation of any such restrictions by any person.

This press release is an advertisement and not a prospectus

within the meaning of Directive 2003/71/EC of the European Parliament and the Council of November 4th, 2003 (as amended and supplemented

from time to time, including by Directive 2010/73/EU and any relevant implementing measures in any member State of the European

Economic Area (the "Member States")), the ("Prospectus Directive"). The base prospectus of the €6 billion

wholesale Euro Medium Term Programme of ArcelorMittal dated as of 20 March 2015 (the “Base Prospectus”) and the final

terms prepared by the Issuer in connection with the issuance of the Notes have been prepared on the basis that any offer of Notes

in any Member State of the European Economic Area (each, a "Relevant Member State") will be made pursuant to an exemption

under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to publish a prospectus for

offers of the Notes. Accordingly, any person making or intending to make an offer in that Relevant Member State of the Notes may

only do so in circumstances in which no obligation arises for the Issuer or the joint lead managers acting in connection with the

issuance of the Notes to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant

to Article 16 of the Prospectus Directive, in each case, in relation to such offer. The Issuer and the joint lead managers acting

in connection with the issuance of the Notes have not authorized the making of any offer of Notes in any other circumstances. The

Base Prospectus and the final terms referred to above have been filed with the Commission de Surveillance du Secteur Financier

of Luxembourg and the Luxembourg Stock Exchange, respectively.

This press release is not an invitation nor is it intended

to be an inducement to engage in investment activity for the purpose of Section 21 of the Financial Services and Markets Act 2000

of the United Kingdom (the "FSMA"). This press release is only being distributed to and is only directed at (i) persons

who are outside the United Kingdom; (ii) persons who are investment professionals within the meaning of Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) of the United Kingdom (the "Financial Promotion

Order"); and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article

49(2)(a) to (d) of the Financial Promotion Order (all such persons together being referred to as "Relevant Persons").

Any Notes will only be available to, and any invitation, offer, agreement to subscribe, purchase or otherwise acquire such Notes,

or inducement to engage in any investment activity included within this press release is available only to, Relevant Persons and

will be engaged in only with Relevant Persons. Anyone other than a Relevant Person must not act or rely on this press release or

any of its contents.

This press release does not constitute an offer to sell or

a solicitation of an offer to purchase any securities in the United States. The Notes have not been and will not be registered

under the U.S. Securities act of 1933, as amended (the "Securities Act") or the laws of any state within the U.S., and

may not be offered or sold in the United States or to or for the account or benefit of U.S. Persons, except in a transaction not

subject to, or pursuant to an applicable exemption from, the registration requirements of the Securities Act or any state securities

laws. This press release and the information contained herein may not be distributed or sent into the United States, or in any

other jurisdiction in which offers or sales of the Notes would be prohibited by applicable laws and should not be distributed to

United States persons or publications with a general circulation in the United States. No offering of the Notes has been made or

will be made in the United States.

In connection with the issuance of the Notes, Crédit

Agricole Corporate and Investment Bank, in its capacity, as stabilising manager (or persons acting on behalf of any stabilising

manager) may over-allot the Notes or effect transactions with a view to supporting the market price of the Notes at a level higher

than that which might otherwise prevail. However, there is no assurance that the stabilising manager (or persons acting on behalf

of the stabilising manager) will undertake stabilisation actions. Any stabilisation action may begin on or after the date on which

adequate public disclosure of the terms of the offer of the Notes is made and, if begun, may be ended at any time, but it must

end no later than the earlier of 30 calendar days after the issue date of the Notes and 60 calendar days after the date of the

allotment of the Notes. Any stabilisation action or over-allotment must be conducted in accordance with all applicable laws and

rules.

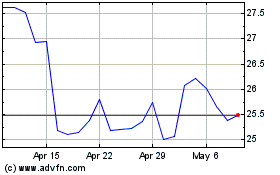

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

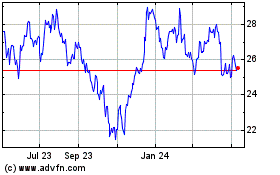

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024