UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 7, 2015

MSC Industrial Direct Co., Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

New York

|

1-14130

|

11-3289165

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

75 Maxess Road, Melville, New York

|

11747

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code: (516) 812-2000

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

ITEM 2.02

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

On July 7, 2015, MSC Industrial Direct Co., Inc. (the “Company”) issued a press release announcing financial results for its fiscal 2015 third quarter ended May 30, 2015. A copy of the press release is furnished with this report as Exhibit 99.1.

The information in this Current Report on Form 8-K and the Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

|

|

|

|

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

|

|

|

(d) Exhibits:

|

|

| 99.1

|

Press Release, dated July 7, 2015, issued by MSC Industrial Direct Co., Inc.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

MSC INDUSTRIAL DIRECT CO., INC.

|

|

|

|

|

Date: July 7, 2015

|

By:

|

/s/ Jeffrey Kaczka

|

|

|

Name:

|

Jeffrey Kaczka

|

|

|

Title:

|

Executive Vice President and Chief

Financial Officer

|

Exhibit Index

|

|

|

|

Exhibit No.

|

|

|

Description

|

|

99.1

|

Press Release, dated July 7, 2015, issued by MSC Industrial Direct Co., Inc.

|

Exhibit 99.1

|

|

|

|

|

MSC Industrial Supply Co.

Tel.800.645.7270

Fax.800.255.5067

www.mscdirect.com

|

MSC REPORTS FISCAL 2015 THIRD QUARTER RESULTS AND PROVIDES FISCAL FOURTH QUARTER GUIDANCE

- Net Sales of $745.5 Million; GAAP and Adjusted Diluted EPS of $1.03-

- Fiscal Q4 Guidance for GAAP and Adjusted Diluted EPS between $0.93 and $0.97 -

MELVILLE, NY and DAVIDSON, NC, July 7, 2015 - MSC INDUSTRIAL SUPPLY CO. (NYSE: MSM), “MSC” or the “Company,” a premier distributor of Metalworking and Maintenance, Repair and Operations (“MRO”) supplies to industrial customers throughout North America, today reported results for its fiscal third quarter ended May 30, 2015.

Net sales for the fiscal third quarter 2015 were $745.5 million compared to net sales of $720.5 million in the same quarter a year ago, an increase of 3.5% on an average daily sales basis. Adjusted operating income for the fiscal third quarter 2015 was $104.5 million, or 14.0% of net sales, compared to $107.3 million, or 14.9% of net sales, in the same quarter a year ago. GAAP operating income for the fiscal third quarter 2015 was $104.2 million, or 14.0% of net sales, compared to $104.9 million, or 14.6% of net sales, in the same quarter a year ago.

Excluding the after-tax effects of non-recurring costs, adjusted net income for the fiscal third quarter 2015 was $63.5 million, or $1.03 per diluted share, compared to $66.2 million, or $1.06 per diluted share, in the same quarter a year ago. GAAP net income for the fiscal third quarter 2015 was $63.3 million, or $1.03 per diluted share, compared to $64.7 million, or $1.03 per diluted share, in the same quarter a year ago.

Erik Gershwind, President and Chief Executive Officer, stated, “Our organic growth for the third quarter was in-line with our guidance and reflected the continued impact of the soft pricing environment and the lingering effects of the rapid change in oil prices, softening export demand, and foreign exchange headwinds, all of which continue to drag on broader manufacturing activity. We did, however, see growth well above the market driven by continued traction from our share gain programs as customers increasingly leverage our supply chain solutions.”

Jeff Kaczka, Executive Vice President and Chief Financial Officer, commented, “Despite the challenging demand environment, we achieved earnings per share well above our guidance range. A key driver was the prompt actions that we took to manage our operating expenses. We achieved operating expenses as a percent of sales at the same level as the year ago quarter, even though sales growth was only low single-digits and we increased our investment spending. The second driver was another quarter of gross margin stabilization, which reflected our successful countermeasure efforts, offset by the gross margin headwinds from large account growth and the soft pricing environment.”

Mr. Gershwind concluded, “We remain focused on our growth initiatives and growing above the market, executing on our gross margin stabilization countermeasures and managing expenses carefully, all factors under our control. Longer-term, the industry fundamentals remain favorable. Between the large and fragmented MRO marketplace where large customers are consolidating their spend, the positive impact that lower energy prices will have on U.S. manufacturing, and our actions to strategically grow our business in value-added, high-retention market segments, I have great confidence that we are well positioned.”

Outlook

MSC expects net sales for fiscal fourth quarter 2015 to be between $735 million and $747 million. At the midpoint, average daily sales growth is expected to be 2.0%. The Company expects GAAP and adjusted diluted earnings per share for the fiscal fourth quarter 2015 to be between $0.93 and $0.97.

An explanation and reconciliation of the non-GAAP financial measures contained in this press release to the most directly comparable GAAP financial measures are included in the attached tables.

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 2-

|

Conference Call Information

MSC will host a conference call today at 8:30 a.m. Eastern Time to review the Company’s fiscal third quarter 2015 results. The call, accompanying slides and other operational statistics may be accessed on MSC’s website located at: http://investor.mscdirect.com. A replay of the conference call will be available on the Company’s website until Friday, August 7, 2015.

Alternatively, the conference call can be accessed by dialing 1-888-317-6003 (U.S.) or 1-412-317-6061 (international). A replay will be available within one hour of the conclusion of the call and will remain available until Friday, August 7, 2015. The replay is accessible by dialing 1-877-344-7529 (U.S.) or 1-412-317-0088 (international) and entering passcode 10067016.

The Company’s reporting date for fiscal fourth quarter 2015 results will be October 27, 2015.

Contact Information

|

|

|

|

Investors:

|

Media:

|

|

John G. Chironna

|

Paul Mason

|

|

VP Investor Relations & Treasurer

|

Director, Corporate Communications

|

|

MSC Industrial Supply Co.

|

MSC Industrial Supply Co.

|

|

(704) 987-5231

|

(704) 987-5313

|

About MSC Industrial Supply Co. MSC Industrial Supply Co. (NYSE:MSM) is a leading North American distributor of metalworking and maintenance, repair, and operations (MRO) products and services. We help our customers drive greater productivity, profitability and growth with more than 1 million products, inventory management and other supply chain solutions, and deep expertise from more than 70 years of working with customers across industries.

Our experienced team of over 6,500 associates is dedicated to working side by side with our customers to help drive results for their businesses - from keeping operations running efficiently today to continuously rethinking, retooling, and optimizing for a more productive tomorrow.

# # #

Note Regarding Forward-Looking Statements: Statements in this Press Release may constitute "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future, including statements about expected future results, expected benefits from our investment and strategic plans, and expected future margins, are forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The inclusion of any statement in this release does not constitute an admission by MSC or any other person that the events or circumstances described in such statement are material. Factors that could cause actual results to differ materially from those in forward-looking statements include: problems with successfully integrating acquired operations, unanticipated delays or costs associated with expanding our customer fulfillment centers, current economic, political and social conditions, changing customer and product mixes, financial restrictions on outstanding borrowings, industry consolidation, the loss of key suppliers or supply chain disruptions, competition, general economic conditions in the markets in which we operate, volatility in commodity and energy prices, credit risk of our customers, risk of cancellation or rescheduling of orders, work stoppages or other business interruptions (including those due to extreme weather conditions) at transportation centers or shipping ports, the risk of war, terrorism and similar hostilities, dependence on our information systems and the risk of business disruptions arising from changes to our information systems, disruptions due to computer system or network failures, computer viruses, physical or electronics break-ins and cyber-attacks, dependence on key personnel, goodwill and intangible assets recorded as a result of our acquisitions could be impaired, disclosing our use of "conflict minerals" in certain of the products we distribute could raise reputational and other risks, and the outcome of potential government or regulatory proceedings or future litigation relating to pending or future claims, inquiries or audits. Additional information concerning these and other risks is described under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the reports on Forms 10-K and 10-Q that we file with the U.S. Securities and Exchange Commission. We assume no obligation to update any of these forward-looking statements.

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 3-

|

MSC INDUSTRIAL SUPPLY CO. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

May 30,

|

|

August 30,

|

|

|

2015

|

|

2014

|

|

|

(unaudited)

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

24,863

|

|

$

|

47,154

|

|

Accounts receivable, net of allowance for doubtful accounts

|

|

406,224

|

|

|

382,784

|

|

Inventories

|

|

510,783

|

|

|

449,814

|

|

Prepaid expenses and other current assets

|

|

39,370

|

|

|

40,410

|

|

Deferred income taxes

|

|

41,253

|

|

|

41,253

|

|

Total current assets

|

|

1,022,493

|

|

|

961,415

|

|

Property, plant and equipment, net

|

|

289,074

|

|

|

294,348

|

|

Goodwill

|

|

625,258

|

|

|

629,335

|

|

Identifiable intangibles, net

|

|

124,431

|

|

|

138,314

|

|

Other assets

|

|

31,983

|

|

|

37,335

|

|

Total assets

|

$

|

2,093,239

|

|

$

|

2,060,747

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

Revolving credit note

|

$

|

213,000

|

|

$

|

70,000

|

|

Current maturities of long-term debt

|

|

26,158

|

|

|

26,829

|

|

Accounts payable

|

|

114,380

|

|

|

116,283

|

|

Accrued liabilities

|

|

103,350

|

|

|

96,052

|

|

Total current liabilities

|

|

456,888

|

|

|

309,164

|

|

Long-term debt, net of current maturities

|

|

221,112

|

|

|

240,235

|

|

Deferred income taxes and tax uncertainties

|

|

112,697

|

|

|

112,785

|

|

Total liabilities

|

|

790,697

|

|

|

662,184

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

|

Preferred Stock

|

|

-

|

|

|

-

|

|

Class A common stock

|

|

56

|

|

|

56

|

|

Class B common stock

|

|

13

|

|

|

13

|

|

Additional paid-in capital

|

|

599,626

|

|

|

573,730

|

|

Retained earnings

|

|

1,198,070

|

|

|

1,286,068

|

|

Accumulated other comprehensive loss

|

|

(14,392)

|

|

|

(5,054)

|

|

Class A treasury stock, at cost

|

|

(480,831)

|

|

|

(456,250)

|

|

Total shareholders’ equity

|

|

1,302,542

|

|

|

1,398,563

|

|

Total liabilities and shareholders’ equity

|

$

|

2,093,239

|

|

$

|

2,060,747

|

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 4-

|

MSC INDUSTRIAL SUPPLY CO. AND SUBSIDIARIES

Condensed Consolidated Statements of Income

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

Thirty-Nine Weeks Ended

|

|

|

May 30,

|

|

May 31,

|

|

May 30,

|

|

May 31,

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Net sales

|

$

|

745,483

|

|

$

|

720,476

|

|

$

|

2,182,974

|

|

$

|

2,060,499

|

|

Cost of goods sold

|

|

407,066

|

|

|

387,082

|

|

|

1,193,534

|

|

|

1,105,429

|

|

Gross profit

|

|

338,417

|

|

|

333,394

|

|

|

989,440

|

|

|

955,070

|

|

Operating expenses

|

|

234,173

|

|

|

228,508

|

|

|

705,351

|

|

|

671,712

|

|

Income from operations

|

|

104,244

|

|

|

104,886

|

|

|

284,089

|

|

|

283,358

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

(1,807)

|

|

|

(827)

|

|

|

(4,786)

|

|

|

(2,641)

|

|

Interest income

|

|

166

|

|

|

5

|

|

|

606

|

|

|

14

|

|

Other income (expense), net

|

|

10

|

|

|

101

|

|

|

(370)

|

|

|

(377)

|

|

Total other expense

|

|

(1,631)

|

|

|

(721)

|

|

|

(4,550)

|

|

|

(3,004)

|

|

Income before provision for income taxes

|

|

102,613

|

|

|

104,165

|

|

|

279,539

|

|

|

280,354

|

|

Provision for income taxes

|

|

39,271

|

|

|

39,469

|

|

|

107,253

|

|

|

107,100

|

|

Net income

|

$

|

63,342

|

|

$

|

64,696

|

|

$

|

172,286

|

|

$

|

173,254

|

|

Per Share Information:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

1.03

|

|

$

|

1.04

|

|

$

|

2.79

|

|

$

|

2.77

|

|

Diluted

|

$

|

1.03

|

|

$

|

1.03

|

|

$

|

2.78

|

|

$

|

2.76

|

|

Weighted average shares used in computing net income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

61,287

|

|

|

61,896

|

|

|

61,294

|

|

|

62,137

|

|

Diluted

|

|

61,424

|

|

|

62,212

|

|

|

61,510

|

|

|

62,447

|

|

Cash dividend declared per common share

|

$

|

0.40

|

|

$

|

0.33

|

|

$

|

4.20

|

|

$

|

0.99

|

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 5-

|

MSC INDUSTRIAL SUPPLY CO. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Income

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

Thirty-Nine Weeks Ended

|

|

|

May 30,

|

|

May 31,

|

|

May 30,

|

|

May 31,

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Net income, as reported

|

$

|

63,342

|

|

$

|

64,696

|

|

$

|

172,286

|

|

$

|

173,254

|

|

Foreign currency translation adjustments

|

|

59

|

|

|

1,515

|

|

|

(9,338)

|

|

|

(319)

|

|

Comprehensive income

|

$

|

63,401

|

|

$

|

66,211

|

|

$

|

162,948

|

|

$

|

172,935

|

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 6-

|

MSC INDUSTRIAL SUPPLY CO. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

Thirty-Nine Weeks Ended

|

|

|

May 30,

|

|

May 31,

|

|

|

2015

|

|

2014

|

|

Cash Flows from Operating Activities:

|

|

|

|

|

|

|

Net income

|

$

|

172,286

|

|

$

|

173,254

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

Depreciation and amortization

|

|

52,095

|

|

|

48,354

|

|

Stock-based compensation

|

|

11,299

|

|

|

13,020

|

|

Loss on disposal of property, plant, and equipment

|

|

665

|

|

|

1,250

|

|

Provision for doubtful accounts

|

|

4,305

|

|

|

3,163

|

|

Deferred income taxes and tax uncertainties

|

|

(88)

|

|

|

-

|

|

Excess tax benefits from stock-based compensation

|

|

(3,770)

|

|

|

(4,741)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

Accounts receivable

|

|

(29,547)

|

|

|

(26,628)

|

|

Inventories

|

|

(62,832)

|

|

|

(9,826)

|

|

Prepaid expenses and other current assets

|

|

967

|

|

|

(4,878)

|

|

Other assets

|

|

3,356

|

|

|

1,884

|

|

Accounts payable and accrued liabilities

|

|

14,237

|

|

|

31,776

|

|

Total adjustments

|

|

(9,313)

|

|

|

53,374

|

|

Net cash provided by operating activities

|

|

162,973

|

|

|

226,628

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities:

|

|

|

|

|

|

|

Expenditures for property, plant and equipment

|

|

(38,176)

|

|

|

(55,882)

|

|

Investment in available for sale securities

|

|

-

|

|

|

(25,011)

|

|

Cash used in business acquisition, net of cash received

|

|

-

|

|

|

1,434

|

|

Net cash used in investing activities

|

|

(38,176)

|

|

|

(79,459)

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities:

|

|

|

|

|

|

|

Purchases of treasury stock

|

|

(26,411)

|

|

|

(115,606)

|

|

Payments of regular cash dividends

|

|

(74,143)

|

|

|

(62,010)

|

|

Payments of special cash dividend

|

|

(185,403)

|

|

|

-

|

|

Payments on capital lease and financing obligations

|

|

(1,574)

|

|

|

(1,545)

|

|

Excess tax benefits from stock-based compensation

|

|

3,770

|

|

|

4,741

|

|

Proceeds from sale of Class A common stock in connection with associate stock purchase plan

|

|

3,271

|

|

|

2,922

|

|

Proceeds from exercise of Class A common stock options

|

|

8,848

|

|

|

17,565

|

|

Borrowings under financing obligations

|

|

530

|

|

|

480

|

|

Borrowings under Credit Facility

|

|

306,000

|

|

|

50,000

|

|

Payments of notes payable and revolving credit note under the Credit Facility

|

|

(181,750)

|

|

|

(54,375)

|

|

Net cash used in financing activities

|

|

(146,862)

|

|

|

(157,828)

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash and cash equivalents

|

|

(226)

|

|

|

141

|

|

Net decrease in cash and cash equivalents

|

|

(22,291)

|

|

|

(10,518)

|

|

Cash and cash equivalents – beginning of period

|

|

47,154

|

|

|

55,876

|

|

Cash and cash equivalents – end of period

|

$

|

24,863

|

|

$

|

45,358

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information:

|

|

|

|

|

|

|

Cash paid for income taxes

|

$

|

88,553

|

|

$

|

91,446

|

|

Cash paid for interest

|

$

|

4,190

|

|

$

|

2,369

|

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 7-

|

Non-GAAP Financial Measures

To supplement MSC’s unaudited selected financial data presented on a basis consistent with Generally Accepted Accounting Principles (“GAAP”), the Company discloses certain non-GAAP financial measures, including adjusted operating income, adjusted net income, and adjusted net income per diluted share. The adjusted supplemental measures exclude non-recurring costs associated with the Class C Solutions Group (“CCSG”) acquisition, the co-location of our corporate headquarters in Davidson, North Carolina, and executive transition and separation costs, and related tax effects. These non-GAAP measures are not in accordance with or an alternative for GAAP, and may be different from non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with MSC's results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate MSC’s results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of Company performance.

In calculating non-GAAP financial measures, we exclude these non-recurring costs to facilitate a review of the comparability of the Company’s operating performance on a period-to-period basis because such costs are not, in our view, related to the Company’s ongoing operational performance. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, and for benchmarking performance externally against competitors. In addition, we use certain non-GAAP financial measures as performance metrics for management incentive programs. Since we find these measures to be useful, we believe that investors benefit from seeing results “through the eyes” of management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

|

|

|

|

|

|

•

|

The ability to make more meaningful period-to-period comparisons of the Company’s on-going operating results;

|

|

|

|

|

|

|

•

|

The ability to better identify trends in the Company’s underlying business and perform related trend analyses; and

|

|

|

|

|

|

|

•

|

A better understanding of how management plans and measures the Company’s underlying business.

|

The following tables reconcile GAAP operating income, GAAP net income and GAAP net income per diluted share (“EPS”) to non-GAAP adjusted operating income, adjusted net income, and adjusted net income per diluted share:

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

|

May 30, 2015

|

|

|

(dollars in thousands)

|

|

Margin

|

|

GAAP Operating income

|

$

|

104,244

|

|

14.0

|

%

|

|

Non-recurring costs

|

|

237

|

|

|

|

|

Adjusted Operating income

|

$

|

104,481

|

|

14.0

|

%

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

|

May 31, 2014

|

|

|

(dollars in thousands)

|

|

Margin

|

|

GAAP Operating income

|

$

|

104,886

|

|

14.6

|

%

|

|

Non-recurring costs

|

|

2,426

|

|

|

|

|

Adjusted Operating income

|

$

|

107,312

|

|

14.9

|

%

|

|

|

|

|

MSC INDUSTRIAL SUPPLY CO. REPORTS FISCAL 2015 THIRD QUARTER RESULTS

|

Page - 8-

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

Thirteen Weeks Ended

|

|

|

|

May 30, 2015

|

|

May 31, 2014

|

|

|

|

(dollars in thousands)

|

|

Net sales

|

|

$

|

745,483

|

|

$

|

720,476

|

|

Cost of goods sold

|

|

|

407,066

|

|

|

387,082

|

|

Gross profit

|

|

|

338,417

|

|

|

333,394

|

|

Operating Expenses

|

|

|

234,173

|

|

|

228,508

|

|

Income from Operations

|

|

|

104,244

|

|

|

104,886

|

|

Non-recurring costs

|

|

|

237

|

|

|

2,426

|

|

Adjusted Operating income

|

|

$

|

104,481

|

|

$

|

107,312

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

|

|

May 30, 2015

|

|

(dollars in thousands, except per share amounts)

|

|

$(after tax)

|

|

Diluted EPS

|

|

GAAP net income

|

|

$

|

63,342

|

|

$

|

1.03

|

|

Non-recurring costs*

|

|

|

146

|

|

|

-

|

|

Adjusted net income

|

|

$

|

63,488

|

|

$

|

1.03

|

|

|

|

|

|

|

|

|

|

* On a pre-tax basis includes approximately $237 of non-recurring executive transition costs related to the planned retirement of the Company's Chief Financial Officer. The non-recurring costs were calculated using an effective tax rate of 38.3%.

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

|

|

|

|

May 31, 2014

|

|

(dollars in thousands, except per share amounts)

|

|

$(after tax)

|

|

Diluted EPS **

|

|

GAAP net income

|

|

$

|

64,696

|

|

$

|

1.03

|

|

Non-recurring costs*

|

|

|

1,507

|

|

|

0.02

|

|

Adjusted net income

|

|

$

|

66,203

|

|

$

|

1.06

|

|

|

|

|

|

|

|

|

|

* On a pre-tax basis includes approximately $127 of non-recurring relocation costs associated with the Co-Location of the Company’s headquarters in Davidson, North Carolina and approximately $2,299 of non-recurring integration costs associated with the CCSG acquisition. The non-recurring costs were calculated using an effective tax rate of 37.9%.

|

|

** Individual amounts of earnings per share may not agree to the total due to rounding

|

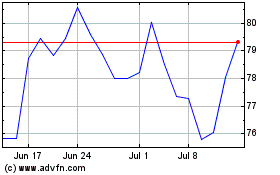

MSC Industrial Direct (NYSE:MSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

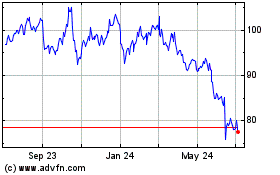

MSC Industrial Direct (NYSE:MSM)

Historical Stock Chart

From Apr 2023 to Apr 2024