Current Report Filing (8-k)

January 15 2015 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 15, 2015

MSC Industrial Direct Co., Inc.

(Exact Name of Registrant as Specified in

Its Charter)

| New York |

1-14130 |

11-3289165 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

75 Maxess Road, Melville, New York

(Address of principal executive offices) |

11747

(Zip code) |

| |

|

|

| Registrant’s telephone number, including area code: (516) 812-2000 |

| |

|

|

| |

Not Applicable |

|

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(e)

Approval of 2015 Omnibus Incentive

Plan. On January 15, 2015, MSC Industrial Direct Co., Inc. (the “Company”) held its 2015 Annual Meeting

of Shareholders (the “Annual Meeting”). At the Annual Meeting, the Company’s shareholders approved the

Company’s 2015 Omnibus Incentive Plan (the “2015 Omnibus Plan”). A summary of the material terms of the

2015 Omnibus Plan is set forth in the Company’s definitive proxy statement filed with the Securities and Exchange Commission

on December 5, 2014, which summary is incorporated herein by reference. The summary of the 2015 Omnibus Plan is subject to, and

qualified in its entirety by reference to, the full text of the 2015 Omnibus Plan, which is incorporated by reference as Exhibit

10.1 to this report.

Approval of Amended and Restated Associate

Stock Purchase Plan. At the Annual Meeting, the Company’s shareholders also approved the Company’s Amended

and Restated Associate Stock Purchase Plan (the “Stock Purchase Plan”). A summary of the material terms of the

Stock Purchase Plan is set forth in the Company’s definitive proxy statement filed with the Securities and Exchange Commission

on December 5, 2014, which summary is incorporated herein by reference. The summary of the Stock Purchase Plan is subject to, and

qualified in its entirety by reference to, the full text of the Stock Purchase Plan, which is incorporated by reference as Exhibit

10.2 to this report.

Item 5.07 Submission of Matters to a Vote

of Security Holders.

(a) and (b)

On January 15, 2015, the Company held the

Annual Meeting. A brief description of the matters voted upon at the Annual Meeting and the results of the voting on such matters

is set forth below. On all matters (including the election of directors) submitted to a vote of the Company’s shareholders,

the Company’s Class A common stock and Class B common stock vote together as a single class, with each holder of Class A

common stock entitled to one vote per share of Class A common stock and each holder of Class B common stock entitled to ten votes

per share of Class B common stock. Broker non-votes and abstentions are not considered votes cast at the Annual Meeting and are

not counted for any purpose in determining whether a matter has been approved, except that with respect to the proposals to approve

the 2015 Omnibus Plan and the amendment and restatement of the Stock Purchase Plan, abstentions are counted as votes cast and therefore

have the same effect as votes against the proposal.

| 1. | Election of directors to serve for one-year terms: |

|

Nominee |

Votes

Cast

For |

Votes

Withheld |

Broker

Non-Votes |

|

Percentage

of

Votes Cast For |

| Jonathan Byrnes |

174,096,970 |

1,465,338 |

1,846,888 |

|

99.2% |

| |

|

|

|

|

|

| Roger Fradin |

173,694,130 |

1,868,178 |

1,846,888 |

|

98.9% |

| |

|

|

|

|

|

| Erik Gershwind |

174,737,650 |

824,658 |

1,846,888 |

|

99.5% |

| |

|

|

|

|

|

| Louise Goeser |

173,935,162 |

1,627,146 |

1,846,888 |

|

99.1% |

| |

|

|

|

|

|

| Mitchell Jacobson |

173,863,115 |

1,699,193 |

1,846,888 |

|

99.0% |

| |

|

|

|

|

|

| Denis Kelly |

174,532,428 |

1,029,880 |

1,846,888 |

|

99.4% |

| |

|

|

|

|

|

| Philip Peller |

174,523,227 |

1,039,081 |

1,846,888 |

|

99.4% |

| |

|

|

|

|

|

| David Sandler |

173,879,626 |

1,682,682 |

1,846,888 |

|

99.0% |

Each of the nominees was re-elected

by the Company’s shareholders to serve on the board of directors for a one-year term expiring at the Company’s 2016

Annual Meeting of Shareholders, and until their respective successors have been elected, or until their earlier resignation or

removal.

| 2. | Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting

firm for fiscal year 2015: |

|

Votes

Cast For |

|

Votes

Cast Against |

|

Abstentions |

|

Percentage

of

Votes Cast For |

| 176,942,568 |

|

230,957 |

|

235,671 |

|

99.9% |

Proposal No. 2 was approved by the Company’s

shareholders.

| 3. | Approval, on an advisory basis, of the compensation of the Company’s named executive officers: |

|

Votes

Cast For |

|

Votes

Cast Against |

|

Abstentions |

|

Broker

Non-Votes |

|

Percentage

of

Votes Cast For |

| 173,670,985 |

|

1,664,159 |

|

227,164 |

|

1,846,888 |

|

99.1% |

Proposal No. 3, an advisory vote,

was approved by the Company’s shareholders.

| 4. | Approval of the Company’s 2015 Omnibus Incentive Plan: |

|

Votes

Cast For |

|

Votes

Cast Against |

|

Abstentions |

|

Broker

Non-Votes |

|

Percentage

of

Votes Cast For |

| 172,722,049 |

|

2,612,631 |

|

227,628 |

|

1,846,888 |

|

98.4% |

Proposal No. 4 was approved by the Company’s

shareholders.

| 5. | Approval of the Amendment and Restatement of the Company’s Associate Stock Purchase Plan: |

|

Votes

Cast For |

|

Votes

Cast Against |

|

Abstentions |

|

Broker

Non-Votes |

|

Percentage

of

Votes Cast For |

| 175,234,403 |

|

101,014 |

|

226,891 |

|

1,846,888 |

|

99.8% |

Proposal No. 5 was approved by the Company’s

shareholders.

| Item 9.01 | Financial Statements and Exhibits |

|

Exhibit

No. |

Description |

| 10.1 |

MSC Industrial Direct Co., Inc. 2015 Omnibus Incentive Plan (incorporated by reference to Exhibit 99.01 to the registrant’s Registration Statement on Form S-8 (333-201522) filed on January 15, 2015. |

| 10.2 |

MSC Industrial Direct Co., Inc. Amended and Restated Associate

Stock Purchase Plan (incorporated by reference to Exhibit 4.04 to the registrant’s Registration Statement on Form S-8 (333-201523)

filed on January 15, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MSC Industrial Direct Co., Inc. |

| |

|

| |

|

| Date: January 15, 2015 |

By: |

/s/ Jeffrey Kaczka |

| |

Name: |

Jeffrey Kaczka |

| |

Title:

|

Executive Vice President and Chief

Financial Officer |

| |

|

|

|

| Exhibit Index |

| |

|

Exhibit

No. |

Description |

| 10.1 |

MSC Industrial Direct Co., Inc. 2015 Omnibus Incentive Plan (incorporated by reference to Exhibit 99.01 to the registrant’s Registration Statement on Form S-8 (333-201522) filed on January 15, 2015. |

| 10.2 |

MSC Industrial Direct Co., Inc. Amended and Restated Associate

Stock Purchase Plan (incorporated by reference to Exhibit 4.04 to the registrant’s Registration Statement on Form S-8 (333-201523)

filed on January 15, 2015.

|

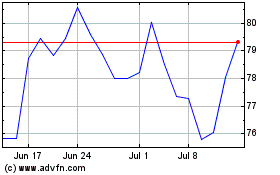

MSC Industrial Direct (NYSE:MSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

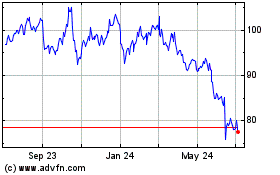

MSC Industrial Direct (NYSE:MSM)

Historical Stock Chart

From Apr 2023 to Apr 2024