Mosaic Sales Fall as Fertilizer Prices Decline

May 04 2016 - 9:11AM

Dow Jones News

By Austen Hufford

Mosaic Co. said profit and revenue fell in its first quarter as

prices for its main fertilizer lines fell.

Mosaic said its results were hurt by lower prices of its two

main products, potash and phosphate fertilizers, and as volumes

fell.

"The potash market is off to a slow start in 2016 with delayed

buying activity, particularly in China and India," Chief Executive

Joc O'Rourke said. "As a result, shipment volumes were at the low

end of our expectations and we operated our facilities at reduced

rates."

Sales of potash, a potassium-based fertilizer, slipped to $572

million in the quarter from $763 million last year. Sales of

phosphate fertilizers declined to $909 million from $1.2 billion a

year before.

Phosphate production fell to 75% of operational capacity from

79% a year ago as potash production fell to 77% of operational

capacity from 93%.

The agriculture sector faces challenges for years to come, and

farmers have already been grappling with years of declining prices

for major crops as supplies expand worldwide. The company had

previously brushed off concerns that a steep decline in prices for

corn, soybeans and other crops in the last two years would spur

farmers to save money by curtailing their fertilizer usage.

For the quarter, Mosaic posted a profit of $256.8 million, or 73

cents a share, down from $294.8 million, or 80 cents a share, a

year prior. Excluding items, such as foreign currency transaction

and derivatives, earnings slipped to 14 cents a share from 70 cents

a year ago.

Sales slipped 22% to $1.67 billion. Analysts polled by Thomson

Reuters had projected an adjusted profit of 14 cents a share on

revenue of $1.56 billion.

Still, the company expects results to improve in the coming

quarters.

"While the outlook for the first half of 2016 is muted, we see

stronger markets and anticipate better results in the second half,"

Mr. O'Rourke said. "We expect improved profitability to be driven

by lower raw material costs, combined with an acceleration in

shipment volumes."

For 2016, Mosaic cut the top end of its sales guidelines, now

expecting total phosphates sales in the range of 9 million to 9.75

million tons, cutting 250,000 tons of the top of the range. It

expects Potash volumes of between 7.5 million and 8.0 million, down

from the 7.5 million to 8.5 million range announced previously.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 04, 2016 08:56 ET (12:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

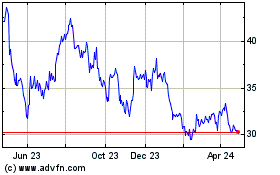

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

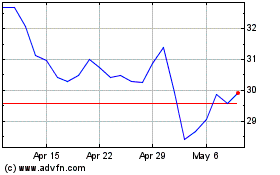

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024