UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| |

x | Preliminary Proxy Statement |

|

| |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

o | Definitive Proxy Statement |

|

| |

o | Definitive Additional Materials |

|

| |

o | Soliciting Material Pursuant to §240.14a-12 |

The Mosaic Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

|

| |

¨ | Fee paid previously with preliminary materials. |

|

| |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

|

| | | | |

| | PRELIMINARY COPY | |

| | | | Headquarter Offices: Atria Corporate Center, Suite E490 3033 Campus Drive Plymouth, MN 55441 Telephone (763) 577-2700 |

April 6, 2016

Dear Stockholder:

You are cordially invited to attend The Mosaic Company’s 2016 Annual Meeting of Stockholders on May 19, 2016, at 10:00 a.m. Central Time. A Notice of the Annual Meeting and a Proxy Statement covering the formal business of the meeting appear on the following pages. At the meeting we will report on our operations during the year ended December 31, 2015.

This year’s meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the annual meeting of stockholders online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/MOS16. You will also be able to vote your shares electronically at the annual meeting (other than shares held through our 401(k) Plan, which must be voted prior to the meeting).

We are excited to embrace the latest technology to provide ease of access, real-time communication and cost savings for our stockholders and the company. Hosting a virtual meeting will facilitate stockholder attendance and participation from any location around the world.

We hope that you will be able to attend the meeting. However, even if you are planning to attend the meeting, please promptly submit your proxy vote by telephone or Internet or, if you received a copy of the printed proxy materials, by completing and signing the enclosed proxy card and returning it in the postage-paid envelope provided. This will ensure that your shares are represented at the meeting. Even if you submit a proxy, you may revoke it at any time before it is voted. If you attend and wish to vote at the meeting, you will be able to do so even if you have previously returned your proxy card.

Your cooperation and prompt attention to this matter are appreciated. Thank you for your ongoing support of, and continued interest in, The Mosaic Company.

Sincerely, |

| |

| | |

| |

| | James (“Joc”) C. O’Rourke President and Chief Executive Officer |

|

| | | | |

| | | | |

| | | | Headquarter Offices: Atria Corporate Center, Suite E490 3033 Campus Drive Plymouth, MN 55441 Telephone (763) 577-2700 |

Notice of 2016 Annual Meeting of Stockholders

To Our Stockholders:

The 2016 Annual Meeting of Stockholders of The Mosaic Company, a Delaware corporation, will be held on May 19, 2016, at 10:00 a.m. Central Time (the “2016 Annual Meeting”). You will be able to attend the 2016 Annual Meeting, vote your shares and submit questions during the annual meeting via a live webcast available at www.virtualshareholdermeeting.com/MOS16. The following matters will be considered and acted upon at the 2016 Annual Meeting, each of which is explained more fully in the accompanying Proxy Statement:

|

| |

1. | Approval of an amendment to our Restated Certificate of Incorporation to delete references to the transition process from a classified board to a fully declassified board and to permit stockholders to remove any director with or without cause; |

2. | Approval of an amendment to our Restated Certificate of Incorporation to eliminate the authorized Class A and Class B Common Stock and provisions related thereto, and to decrease the total number of shares of capital stock that we have authority to issue from 1,279,036,543 to 1,015,000,000; |

3. | Election of eleven directors for terms expiring in 2017, each as recommended by our Board of Directors; |

4. | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm to audit our financial statements as of and for the year ending December 31, 2016 and the effectiveness of internal control over financial reporting as of December 31, 2016, as recommended by our Audit Committee; |

5. | An advisory vote to approve the compensation of our executive officers disclosed in the accompanying Proxy Statement; and |

6. | Any other business that may properly come before the 2016 Annual Meeting of Stockholders or any adjournment or postponement thereof. |

In accordance with our Bylaws and resolutions of the Board of Directors, only stockholders of record at the close of business on March 22, 2016 are entitled to notice of and to vote at the 2016 Annual Meeting of Stockholders.

By Order of the Board of Directors

Mark J. Isaacson

Senior Vice President, General Counsel and Corporate Secretary

April 6, 2016

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 19, 2016:

Our Proxy Statement and 2015 Annual Report are available at www.mosaicco.com/proxymaterials.

SUMMARY INFORMATION

This summary highlights information in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement and our 2015 Annual Report carefully before voting.

The Mosaic Company Annual Meeting of Stockholders

|

| | | |

Ÿ | Date and Time: | | May 19, 2016; 10:00 a.m. Central Time |

Ÿ | Virtual Meeting: | | Online at www.virtualshareholdermeeting.com/MOS16 |

Ÿ | Record Date: | | March 22, 2016 |

General Information

|

| | |

Corporate website: | | www.mosaicco.com |

Investor website: | | www.mosaicco.com/investors |

2015 Annual Report: | | www.mosaicco.com/proxymaterials |

Voting Matters

|

| | | | |

| | Board Recommendation | | Page |

Completion of Transition to Declassified Board | | FOR | | |

Elimination of Class A and Class B Common Stock and decreasing the total number of authorized shares of capital stock from 1,279,036,543 to 1,015,000,000 | | FOR | | |

Election of Eleven Directors | | FOR each director nominee | | |

Ratification of KPMG LLP as our independent registered public accounting firm | | FOR | | |

Say-on-Pay Advisory Proposal | | FOR | | |

Our Business

We are the world’s leading producer and marketer of concentrated phosphate and potash crop nutrients. We are the largest integrated phosphate producer in the world and one of the largest producers and marketers of phosphate-based animal feed ingredients in the United States. We are one of the four largest potash producers in the world. Through our broad product offering, we are a single source supplier of phosphate- and potash-based crop nutrients and animal feed ingredients. We serve customers in approximately 40 countries. We mine phosphate rock in Florida and process rock into finished phosphate products at facilities in Florida and Louisiana. We mine potash in Saskatchewan and New Mexico. We have other production, blending or distribution operations in Brazil, China, India and Paraguay, as well as strategic equity investments in a phosphate rock mine in the Bayovar region in Peru and a joint venture formed to develop a phosphate rock mine and chemical complexes in the Kingdom of Saudi Arabia (“WASPC” or the “Ma’aden joint venture”). Our distribution operations serve the top four nutrient-consuming countries in the world.

We were formed through the October 2004 business combination of IMC Global Inc. (“IMC”) and the fertilizer businesses of Cargill, Incorporated (individually, or in any combination with its subsidiaries, “Cargill”). On May 25, 2011, we facilitated Cargill’s exit from its ownership interest in us through a split-off (the “Split-off”) to its stockholders (“Exchanging Cargill Stockholders”) and a debt exchange with certain of its debt holders, and initiated the first in a series of transactions intended to result in the ongoing orderly disposition of the approximately 64% (285.8 million) of our shares that Cargill formerly held. We refer to these transactions as the “New Horizon Transaction” and have included additional information on the disposition of these shares under “Certain Relationships and Related Transactions” on page 72.

Business Highlights

Mosaic grew earnings per share in 2015 in spite of challenging global economic conditions and weak near-term market conditions by focusing on cost control and executing share repurchases. We also made progress on our strategic initiatives, to position Mosaic to outperform in better markets.

|

| | | |

| w | | For 2015, net earnings attributable to Mosaic were $1.0 billion, or $2.78 per diluted share, compared to $1.0 billion, or $2.68 per diluted share, for the year ended December 31, 2014. |

| w | | We generated $1.8 billion in cash flows from operations during 2015, and maintained cash and cash equivalents of $1.3 billion as of December 31, 2015. |

|

| | | |

| w | | We continued the expansion of capacity in our Esterhazy K3 potash segment. When fully operational, Esterhazy K3 is expected to further reduce our ongoing costs of production and provide the ability to eliminate brine inflow management costs and risk. |

| w | | We completed the integration of the Archer Daniels Midland Company’s fertilizer distribution business in Brazil and Paraguay, acquired in December 2014 (the “ADM Acquisition”). Over time, we expect this acquisition to increase our annual distribution in the region from approximately four million metric tonnes to about six million metric tonnes of crop nutrients in key agricultural regions. |

| w | | MicroEssentials® expansion continued to progress on time and on budget and is expected to add an incremental 1.2 million tonnes, and bring total capacity to 3.5 million tonnes by the end of 2016. |

| w | | We made equity contributions of $225 million to the Ma’aden joint venture to develop, own and operate integrated phosphate production facilities in the Kingdom of Saudi Arabia. The joint venture is expected to be the lowest cost producer of finished phosphates globally. |

| w | | We reduced our potash cash costs, including realized mark-to-market gains and losses, per production tonne by approximately 10% compared to 2014. |

| w | | Phosphate rock cash production costs were near a five-year low, as we effectively mitigated the effects of inflation. |

| w | | Selling, general and administrative (“SG&A”) expenses declined six percent from the prior year to a six-year low, despite a larger business footprint. |

| w | | We reached agreements with federal and state regulators that, when effective, will resolve claims relating to our management of certain waste materials onsite at fertilizer manufacturing facilities in Florida and Louisiana. A key element of the settlements is our provision of financial assurance for balance sheet liabilities associated with our phosphogypsum stacks. When effective, this settlement will resolve all prior related claims. |

| w | | We ended 2015 with a record low annual recordable injury frequency rate for the second consecutive year. |

| w | | We repurchased approximately 15.6 million shares for an aggregate amount of $698 million during the year. |

| w | | In March 2015, our Board of Directors approved an increase in our annual dividend to $1.10 from $1.00 per share. During 2015, we paid $385 million in dividends. |

Compensation Highlights

|

| | |

w | | 2015 “Say-on-Pay” advisory proposal approved by approximately 95% of votes cast. |

| |

• | 2015 Executive Compensation: |

|

| | |

w | | Short-term incentive plan payouts for 2015 performance were above target, largely reflecting achievements against incentive operating earnings/return on invested capital, capital efficiency and cost management objectives, with a payout percentage of 137% for our executive officers. |

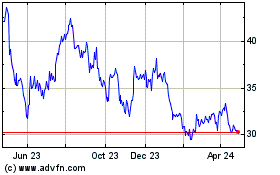

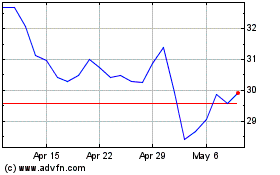

w | | Despite earnings per share growth over the past one- and three calendar-year periods, our stock price has declined over the same periods, influenced by a number of factors outside our control. Our negative total shareholder return is reflected in all options granted during the past three years being underwater as of December 31, 2015, and the restricted stock units (“RSUs”) and total shareholder return (“TSR”) performance units that vested during 2015 paying out at a value significantly below their grant date values (-21% and -36%, respectively). |

w | | We changed the mix of long-term incentives for 2015 grants to executive officers by replacing time-based RSUs with performance units with vesting linked to our three-year return on invested capital, adjusted as described on Appendix C (“Incentive ROIC”). We refer to these performance units as “ROIC performance units.” |

•Compensation Governance: highlights of our 2015 compensation practices are presented below. |

| |

What We Do |

ü | 100% performance-based long-term incentive grants: stock appreciation, TSR and ROIC |

ü | Significant percentage of target direct compensation tied to performance |

ü

| Stock and incentive plan designed to permit awards that meet performance-based criteria of Section 162(m) |

ü | Clawback policy applicable to annual and long-term incentives |

ü

| Executive change-in-control agreements and long-term incentive awards: double trigger in a change in control |

ü | Stock ownership guidelines: 5x annual salary for CEO; 3x annual salary for other executive officers |

ü | Independent executive compensation consultant |

ü | Compensation Committee access to other independent advisors |

ü | Annual say-on-pay vote |

|

| |

What We Don’t Do |

û | No executive employment agreements |

û | No tax gross-ups under our executive change-in-control agreements |

û | No hedging or pledging of Mosaic stock |

û | No repricing of options under our stock plan |

û | No company cars, no country clubs, no supplemental defined benefit executive retirement plans; no tax gross-ups on spousal travel effective in 2016 |

Corporate Governance Highlights

|

| | |

Ÿ | Completion of Transition to Declassified Board of Directors. With the elections of directors at the 2016 Annual Meeting, the transition from a classified board to a fully declassified board will be completed. At the 2016 Annual Meeting, and each annual meeting of stockholders of Mosaic thereafter, all directors will be elected to hold office for a one-year term expiring at the next annual meeting of stockholders of Mosaic. |

Ÿ | Proxy Access. In March 2016, we adopted a proxy access bylaw effective for our 2017 annual meeting of stockholders, which permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials nominees for director constituting up to 20% of the Board of Directors or two directors, whichever is greater, subject to the requirements set forth in our Bylaws. |

Ÿ | Independent Directors. All of our directors except our CEO and former CEO, and all of the members of our Audit, Compensation and Corporate Governance and Nominating Committees are independent. |

Ÿ | Audit Committee Financial Experts. Our Board has determined that three of our directors qualify as “audit committee financial experts” within the meaning of applicable Securities and Exchange Commission rules. |

Ÿ | Majority Vote Standard. Our Bylaws provide for the election of directors by a majority of votes cast in uncontested elections. |

Ÿ | Independent Non-Executive Chairman. Our Board is led by an independent non-executive Chairman. |

Ÿ | Director Stock Ownership. Minimum guideline equal to five times the base cash retainer for non-employee directors with five years of service. |

Ÿ | Succession Planning. Rigorous framework for Corporate Governance and Nominating Committee annual review of succession planning for our CEO and for Compensation Committee annual review of succession planning for other executive officers and key executives. |

Ÿ | Environmental, Health, Safety and Sustainable Development. |

| w | Dedication to protecting our employees and the communities in which we operate, and to being a good steward of natural resources. |

| w | Separate standing Board committee to oversee environmental, health, safety, security and sustainable development. |

Ÿ | Annual Board and Committee Evaluations. |

| w | Annual self-evaluation by Board and each standing committee, including individual peer review. |

| w | Annual review of each standing committee’s charter. |

Risk Oversight

Standing management Enterprise Risk Management, or ERM, Committee assists in achieving business objectives through systematic approach to anticipate, analyze and review material risks. Consists of cross-functional team of executives and senior leaders. |

| |

Ÿ | Board oversees management’s actions, with assistance from each of its standing committees. Management reports on enterprise risks to the full Board on a regular basis. |

Completion of Declassification of our Board of Directors

Because the transition from a classified board to a fully declassified board, for which all Board members stand for annual elections, will be completed with the elections of directors at the 2016 Annual Meeting, our Board is proposing an amendment to our Restated Certificate of Incorporation to delete references to the transition process from a classified Board to a fully declassified board. Since the Delaware General Corporation Law, as applicable to corporations without a classified board of directors such as Mosaic, as of the 2016 Annual Meeting, requires that stockholders be afforded the right to remove directors from office with or without cause, our Board is also proposing an amendment to our Restated Certificate of Incorporation to permit stockholders to remove any director with or without cause.

Elimination of authorized Class A and Class B Common Stock and decreasing the total number of shares of capital stock that Mosaic has authority to issue from 1,279,036,543 to 1,015,000,000

Our Board is proposing an amendment to our Restated Certificate of Incorporation to eliminate authorized Class A and Class B Common Stock and to decrease the total number of shares of capital stock that Mosaic has authority to issue from 1,279,036,543 to 1,015,000,000. No shares of our Class A and Class B Common Stock are currently outstanding and the provisions relating to our Class A and Class B Common Stock are no longer operative and serve no continuing purpose. The proposed amendment to our Restated Certificate of Incorporation would eliminate all references to Class A and Class B Common Stock, and eliminate provisions related specifically to the designation and attributes of Class A and Class B Common Stock. The proposed amendments would also decrease the number of authorized shares of capital stock from 1,279,036,543 by the combined amount of previously authorized shares of Class A and B Common Stock, 264,036,543, to 1,015,000,000 shares of capital stock.

Director Nominees

The table below shows summary information about each nominee for election as a director. Each director nominee is elected by a majority of the votes cast and will be elected for a term that expires in 2016. Each incumbent director, including the director nominees identified in the table below, together with our directors retiring at the 2016 Annual Meeting, was present for at least 94% of the aggregate number of meetings of the Board and committees of the Board of which such director was a member that occurred during 2015. Two directors, William R. Graber and James T. Prokopanko, will be retiring from our Board upon conclusion of the 2016 Annual Meeting.

|

| | | | | | | | | | |

Name | Age | Director Since | Occupation | Experience/ Qualifications | | Committee Memberships | Other Company Boards |

Independent | AC | Comp | Gov | EHSS |

Nominees for Election as Directors |

Nancy E. Cooper | 62 | 2011 | Retired, former Executive Vice President and CFO, CA, Inc. (“CA Technologies”) | • Financial Expertise and Leadership • Audit Committee Financial Expert • Software Technology • Ethics and Compliance • Risk Management | X | £ | | ¤ | | Teradata Corporation Brunswick Corporation |

Gregory L. Ebel | 52 | 2012 | Chairman, President and CEO, Spectra Energy Corp | • Executive Leadership • Financial Expertise and Leadership • Audit Committee Financial Expert • Business Development • Risk Management | X | ¤ | ¤ | | | Spectra Energy Corp Spectra Energy Partners, LP |

Timothy S. Gitzel | 53 | 2013 | President and CEO, Cameco Corporation | • Executive Leadership • Business, Government and Regulatory Affairs in Canada • Mining • Risk Management | X | ¤ | | ¤ | | Cameco Corporation |

|

| | | | | | | | | | |

Name | Age | Director Since | Occupation | Experience/ Qualifications | | Committee Memberships | Other Company Boards |

Independent | AC | Comp | Gov | EHSS |

Denise C. Johnson | 49 | 2014 | Group President, Resources Industries Group, Caterpillar, Incorporated | • Global Operational Leadership • Operational Excellence • Strategic Business Planning | X | | ¤ | | ¤ | |

Emery N. Koenig | 60 | 2010 | Retired, former Vice Chairman and Chief Risk Officer, Cargill | • Executive Leadership • Financial Expertise and Leadership • Risk Management • Agricultural Business | X | | | ¤ | ¤ | |

Robert L. Lumpkins | 72 | 2004 | Retired, former Vice Chairman and CFO, Cargill | • Executive Leadership • Financial Expertise and Leadership • Agricultural/ Fertilizer Business • Formation of Mosaic | X | | | £ | | Ecolab, Inc. |

William T. Monahan | 68 | 2004 | Retired, former Chairman, President and CEO, Imation Corp. | • Executive and Operational Leadership • Marketing • Executive Compensation • Risk Management | X | ¤ | £ | | | Pentair Ltd. |

James (“Joc”) C. O’Rourke | 55 | 2015 | President and CEO, Mosaic | • Management Interface with Board • Global Operational Leadership • Mining Experience • Agriculture/Fertilizer Business | | | | | | The Toro Company |

James L. Popowich | 71 | 2007 | Retired, former President and CEO, Elk Valley Coal Corporation | • Executive and Operational Leadership • Mining • Environment, Health, Safety and Sustainability | X | | ¤ | | ¤ | |

David T. Seaton | 54 | 2009 | Chairman and CEO, Fluor Corporation | • Project Management • Executive Leadership • Global Operations • Energy and Chemical Markets | X | | ¤ | | ¤ | Fluor Corporation |

Steven M. Seibert | 60 | 2004 | Attorney, The Seibert Law Firm | • Government and Public Policy • Statewide and Local Issues in Florida • Environment and Land Use | X | | | ¤ | £ | |

|

| | |

AC: | | Audit Committee |

Comp: | | Compensation Committee |

Gov: | | Corporate Governance and Nominating Committee |

EHSS: | | Environmental, Health, Safety and Sustainable Development Committee |

| |

£: | | Committee Chair |

¤: | | Committee Member |

Auditors

As a matter of good corporate governance, we are requesting our stockholders to ratify our selection of KPMG LLP as our independent registered public accounting firm. The table below shows information about KPMG LLP’s fees for services in 2015 and 2014:

|

| | | | |

| 2015

($) | 2014 ($) |

Audit Fees | 4,765,000 |

| 4,692,000 |

|

Audit-Related Fees | 302,000 |

| 328,000 |

|

Tax Fees | 446,000 |

| 221,000 |

|

All Other Fees | — |

| — |

|

Frequently Asked Questions

We provide answers to many frequently asked questions about the 2016 Annual Meeting of Stockholders (“2016 Annual Meeting”) and voting, including how to vote shares held in employee benefit plans, in the Questions and Answers section beginning on page 79.

TABLE OF CONTENTS

PROXY STATEMENT

The Board of Directors (the “Board”) of The Mosaic Company is soliciting proxies for use at the 2016 Annual Meeting to be held on May 19, 2016, and at any adjournment or postponement of the meeting. The proxy materials are first being mailed or available to stockholders on or about April 6, 2016.

References in this Proxy Statement to “Mosaic” refer to The Mosaic Company and references to the “Company,” “we,” “us,” or “our” refer to Mosaic and its direct and indirect subsidiaries, individually or in any combination.

Through May 31, 2013, our fiscal year ended on May 31, and references in this Proxy Statement to fiscal 2013 or any prior fiscal year are to the twelve months ended May 31 of that year. As previously reported, we have changed our fiscal year end to December 31 from May 31 and references in this Proxy Statement to the “2013 Stub Period” are to the seven month transition period from June 1, 2013 through December 31, 2013. We have filed an annual report on Form 10-K with the U.S. Securities and Exchange Commission (“SEC”) for the year ended December 31, 2015 (the “2015 10-K Report”).

PROPOSAL NO. 1 – APPROVAL OF AN AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO DELETE REFERENCES TO THE TRANSITION PROCESS FROM A CLASSIFIED BOARD TO A FULLY DECLASSIFIED BOARD AND TO PERMIT MOSAIC’S STOCKHOLDERS TO REMOVE ANY DIRECTOR WITH OR WITHOUT CAUSE

Because the transition from a classified board to a fully declassified board, for which all Board members stand for annual elections will be completed with the elections of directors at the 2016 Annual Meeting, our Board is proposing an amendment to Article VIII of our Restated Certificate of Incorporation to delete references to the transition process. Our Board believes the proposed amendment removes provisions that are no longer necessary.

Our Board is also proposing an amendment to our Restated Certificate of Incorporation to provide that Mosaic’s stockholders may remove any director from office, with or without cause. Article VIII of our Restated Certificate of Incorporation currently provides that Mosaic’s stockholders may remove directors from office only for cause. The Delaware General Corporation Law, as applicable to corporations without a classified board of directors such as Mosaic, as of the 2016 Annual Meeting, requires that stockholders be afforded the right to remove directors from office with or without cause. The proposed amendment to Mosaic’s Restated Certificate of Incorporation is intended to conform the certificate of incorporation to the requirements of Delaware law as applicable to Mosaic following the complete declassification of the Board as of the 2016 Annual Meeting.

Accordingly, upon the recommendation of our Corporate Governance and Nominating Committee, our Board unanimously approved an amendment to Article VIII of our Restated Certificate of Incorporation (the “Article VIII Amendment”), subject to stockholder approval at the 2016 Annual Meeting, and declared the Article VIII Amendment to be advisable. A copy of Article VIII of the Restated Certificate of Incorporation, as it would be implemented upon stockholder approval of this Proposal No. 1, is attached as Appendix A to this Proxy Statement, with deletions to the Restated Certificate of Incorporation indicated by strikeouts and additions indicated by double underlining.

In addition, our Board has provisionally approved an amendment to our Amended and Restated Bylaws to provide that Mosaic’s stockholders may remove any director from office, with or without cause. The amendment to our Amended and Restated Bylaws has been approved by our Board but is conditioned upon stockholder approval of the Article VIII Amendment pursuant to this proposal.

The proposed Article VIII Amendment, if approved by the stockholders, will be filed with the Secretary of State of the State of Delaware shortly after the 2016 Annual Meeting and the Article VIII Amendment will become effective upon such filing. This description of the effect of the proposed Amendment is a summary and is qualified by the full text of the proposed Article VIII Amendment, attached as Appendix A to this Proxy Statement.

The Board of Directors recommends a vote FOR approval of the amendment to the Restated Certificate of Incorporation to delete references to the transition process from a classified board to a fully declassified board and to provide that Mosaic’s stockholders may remove any director from office, with or without cause.

PROPOSAL NO. 2 – APPROVAL OF AN AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE AUTHORIZED CLASS A AND CLASS B COMMON STOCK AND TO DECREASE THE TOTAL NUMBER OF AUTHORIZED SHARES OF CAPITAL STOCK

Our Restated Certificate of Incorporation currently allows Mosaic to issue up to 177,027,941 shares of Class A Common Stock and 87,008,602 shares of Class B Common Stock. Following the conversion of 17,176,046 Class A Shares, Series A-3, which were held by certain Exchanging Cargill Stockholders into regular Common Stock on November 26, 2015, no shares of our Class A or Class B Common Stock are currently outstanding and we have no plans to issue any of the authorized shares of our Class A or Class B Common Stock. As a result, our Board has concluded that the continuing authorization of share of Class A and Class B Common Stock is unnecessary and that the provisions relating to our Class A and Class B Common Stock are no longer operative and serve no continuing purpose. Our Board also believes it may be confusing to the capital markets and undesirable from a corporate governance perspective.

The proposed amendments to our Restated Certificate of Incorporation would eliminate all references to Class A and Class B Common Stock, and eliminate provisions related specifically to the designation and attributes of Class A and Class B Common Stock. The proposed amendments would also decrease the number of authorized shares of capital stock from 1,279,036,543 by the combined amount of previously authorized shares of Class A and B Common Stock, 264,036,543, to 1,015,000,000 shares of capital stock.

Upon the recommendation of our Corporate Governance and Nominating Committee, our Board unanimously approved an amendment to our Restated Certificate of Incorporation (the “Amendment”), subject to stockholder approval at the 2016 Annual Meeting, and declared the Amendment to be advisable. A copy of the amendment, as it would be implemented upon stockholder approval of this Proposal No. 2, is attached as Appendix B to this Proxy Statement, with deletions to the Restated Certificate of Incorporation indicated by strikeouts and additions indicated by double underlining.

The proposed Amendment, if approved by the stockholders, will be filed with the Secretary of State of the State of Delaware shortly after the 2016 Annual Meeting and the Amendment will become effective upon such filing. This description of the effect of the proposed Amendment is a summary and is qualified by the full text of the proposed Amendment, attached as Appendix B to this Proxy Statement.

The Board of Directors recommends a vote FOR approval of the amendment to the Restated Certificate of Incorporation to eliminate Class A and Class B Common Stock and to decrease the total number of authorized shares of capital stock from 1,279,036,543 to 1,015,000,000.

PROPOSAL NO. 3 – ELECTION OF DIRECTORS

Our Restated Certificate of Incorporation and Bylaws provide that each member of our Board is elected annually by a majority of votes cast if the election is uncontested. Our Board has nominated eleven directors for election at the 2016 Annual Meeting. The director nominees, if elected, will serve until the 2017 Annual Meeting or until their successors are elected and qualified.

Prior to the 2014 Annual Meeting, the Board was divided into three classes and members of each class were elected to serve three-year terms, with the term of office for each class ending in consecutive years. In accordance with our Bylaws and our Restated Certificate of Incorporation, as amended by the stockholders at the 2014 Annual Meeting, our Board will be fully declassified as of the 2016 Annual Meeting. Each director is being nominated for election for a one-year term at the 2016 Annual Meeting.

Our Board currently consists of 13 members. Our Board has nominated Nancy E. Cooper, Gregory L. Ebel, Timothy S. Gitzel, Denise C. Johnson, Emery N. Koenig, Robert L. Lumpkins, William T. Monahan, James (“Joc”) C. O’Rourke, James L. Popowich, David S. Seaton and Steven M. Seibert, each of whom is currently serving as a director, to stand for re-election at the 2016 Annual Meeting for one-year terms expiring in 2017. Messrs. Graber and Prokopanko will be retiring from our Board upon conclusion of the 2016 Annual Meeting.

If one or more nominees should become unavailable to serve as a director, it is intended that shares represented by the proxies will be voted for such substitute nominee or nominees as may be selected by the Board.

The Board of Directors recommends that you vote FOR the election of each of the nominees. Executed proxies will be voted FOR the election of each nominee unless you specify otherwise.

Nomination and Selection of Directors

The Corporate Governance and Nominating Committee identifies and evaluates potential director candidates in a variety of ways:

| |

• | Periodic solicitation of input from Board members. |

| |

• | Consultations with senior management and director search firms. |

| |

• | Candidates nominated by stockholders who have complied with the advance notice procedures set forth in our Bylaws. |

The Corporate Governance and Nominating Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines its nominees after considering the recommendation of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee evaluates all candidates on the same basis regardless of the source of the referral.

Our Bylaws provide that a stockholder entitled to vote at an annual meeting who wishes to nominate a candidate for election to the Board is required to give written notice to our Corporate Secretary of his or her intention to make such a nomination. In accordance with the advance notice procedures in our Bylaws, a notice of nomination is required to be received within the prescribed time and must contain certain information about both the nominee and the stockholder making the nomination as described in our Policy Regarding Identification and Evaluation of Potential Director Nominees. The full text of this policy is available on our website www.mosaicco.com under the “Investors – Corporate Overview – Governance Documents” caption. The Corporate Governance and Nominating Committee may require that the proposed nominee furnish other information to determine that person’s eligibility to serve as a director. Additionally, the notice of nomination must include a statement whether each such nominee, if elected, intends to tender, promptly following such person’s failure to receive the required vote for election, an irrevocable resignation letter to be effective upon acceptance by the Board, in accordance with our Corporate Governance Guidelines. The remainder of the requirements of the advance notice procedures are described in this Proxy Statement under the caption “Stockholder Proposals and Nominations for the 2017 Annual Meeting of Stockholders.” A nomination that does not comply with the advance notice procedures may be disregarded.

Director Qualifications

In order to be nominated by the Board as a director, director nominees should possess, in the judgment of the Corporate Governance and Nominating Committee, the qualifications set forth in our Corporate Governance Guidelines, including:

| |

• | Personal characteristics: |

|

| | |

w | | highest personal and professional ethics, integrity and values; |

w | | an inquisitive and objective perspective; and |

w | | practical wisdom and mature judgment; |

| |

• | Broad experience at the policy-making level in international business, trade, agriculture, government, academia or technology; |

| |

• | Expertise that is useful to us and complementary to the background and experience of other directors, so that an appropriate balance of skills and experience of the membership of the Board can be achieved and maintained; |

| |

• | Willingness to represent the best interests of all stockholders and objectively appraise management performance; |

| |

• | Involvement only in activities or interests that do not create a material conflict with the director’s responsibilities to us and our stockholders; |

| |

• | Commitment in advance of necessary time for Board and committee meetings; and |

| |

• | A personality reasonably compatible with the existing Board members. |

In evaluating director nominees, the Board and the Corporate Governance and Nominating Committee believe that diversity in the broadest sense, as stated in our Corporate Governance Guidelines, including background, experience, geographic location, gender and ethnicity, is an important consideration in the composition of the Board as a whole. The committee discusses diversity considerations in connection with each director candidate. When seeking the assistance of a director search firm to identify candidates, the Corporate Governance and Nominating Committee requests that the search firm consider diversity, in addition to other factors, in its search criteria.

Our Corporate Governance and Nominating Committee annually reviews our Corporate Governance Guidelines, including the provisions relating to diversity, and recommends to the Board any changes it believes appropriate to reflect best practices. In addition, our Board assesses annually its overall effectiveness by means of a self-evaluation process. This evaluation includes, among other things, a peer review of individual directors and an assessment of the overall composition of the Board, including a discussion as to whether the Board has adequately considered diversity, among other factors, in identifying and discussing director candidates.

The full text of our Corporate Governance Guidelines is available on our website at www.mosaicco.com under the “Investors – Corporate Overview – Governance Documents” caption.

Nominees for Election as Directors whose Terms Expire in 2017

|

| | | | |

Nancy E. Cooper Retired, former Executive Vice President and Chief Financial Officer CA Technologies | | Ms. Cooper served as Executive Vice President and Chief Financial Officer of CA Technologies, an IT management software provider, from August 2006 until she retired in May 2011. Ms. Cooper joined CA Technologies with nearly 30 years of finance experience, including as Chief Financial Officer for IMS Health Incorporated, a leading provider of market intelligence to the healthcare industry, from 2001 to August 2006, and, prior to that, Reciprocal, Inc., a leading digital rights management and consulting firm. In 1998, she served as a partner responsible for finance and administration at General Atlantic Partners, a private equity firm focused on software and services investments. Ms. Cooper began her career at IBM Corporation where she held increasingly important roles over a 22-year period that focused on technology strategy and financial management. |

| | |

Age: | 62 | |

| | | |

Director Since: October 2011 | |

| | | |

2015 | Meeting Attendance: | 100% | |

Independent: Yes | | Skills and Qualifications: |

| | Financial Expertise and Leadership and Audit Committee Experience – Extensive experience as a Chief Financial Officer and in other financial leadership roles at several public companies, as well as service on the audit committee of two other public companies, allows her to serve as an “audit committee financial expert” within the meaning of SEC rules. Software Technology Experience – Experience in technology matters. Ethics and Compliance – Ethics and compliance focus. Risk Management – Executive experience in risk management. |

Mosaic Committee Membership: • Audit (Chair) • Corporate Governance and Nominating | |

| Other Board Service: |

| • Teradata Corporation (Audit Committee) • Brunswick Corporation (Audit Committee) |

|

| | | | |

Gregory L. Ebel Chairman, President and Chief Executive Officer Spectra Energy Corp | | Mr. Ebel has served as Chairman, President and Chief Executive Officer of Spectra Energy Corp which, through its subsidiaries and equity affiliates, owns and operates a large and diversified portfolio of complementary natural gas-related energy assets, since April 2014. From January 2009 to April 2014, Mr. Ebel served as President as Chief Executive Officer of Spectra Energy. From January 2007 to January 2009, Mr. Ebel served as Group Executive and Chief Financial Officer of Spectra Energy and as President of Union Gas Limited, a subsidiary of Spectra Energy, from January 2005 until January 2007, and Vice President, Investor & Shareholder Relations of Duke Energy Corporation from November 2002 until January 2005. Mr. Ebel joined Duke Energy in March 2002 as Managing Director of Mergers and Acquisitions in connection with Duke Energy’s acquisition of Westcoast Energy Inc. |

| | | |

Age: | 52 | | |

| | | |

Director Since: October 2012 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | | Skills and Qualifications: |

| | Executive Leadership – Breadth of senior executive and policy-making roles at Spectra Energy and Duke Energy, and in a number of leadership positions in the areas of finance, operations and strategic development. Financial Expertise and Leadership – Experience in financial matters and as a financial executive, including Chief Financial Officer of Spectra Energy and Vice President, Investor and Shareholder Relations of Duke Energy, allows him to serve as an “audit committee financial expert” within the meaning of SEC rules. Business Development – Experience in leading organization in the areas of strategic development and mergers and acquisitions at Spectra Energy and Duke Energy. Risk Management – Executive experience in risk management. |

Mosaic Committee Membership: • Audit • Compensation

| |

|

|

|

|

| Other Board Service: |

| • Spectra Energy Corp • Spectra Energy Partners |

|

| | | | |

Timothy S. Gitzel President and Chief Executive Officer Cameco Corporation | | Mr. Gitzel has been President and Chief Executive Officer of Cameco Corporation, a uranium producer and provider of processing services required to produce fuel for nuclear power plants, since July 2011. From May 2010 to July 2011, Mr. Gitzel served as President of Cameco and from January 2007 to May 2010, as its Senior Vice President and Chief Operating Officer. Prior to joining Cameco, Mr. Gitzel was Executive Vice President, mining business unit for Areva SA in Paris, France from 2004 to January 2007 with responsibility for global uranium, gold, exploration and decommissioning operations in eleven countries, and served as President and Chief Executive Officer of Cogema Resources Inc., now known as Areva Resources Canada, from 2001 to 2004. |

| | | |

Age: | 53 | | |

| | | |

Director Since: October 2013 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | | Skills and Qualifications: |

| | | | Executive Leadership – Executive leadership experience in multi-national companies. Experience in Business, Government and Regulatory Affairs in Canada – Extensive experience in business, governmental and regulatory affairs in Canada and the Province of Saskatchewan, where most of our Potash business’ mines are located. Mining Experience – Over 20 years of senior management experience in Canadian and international uranium and mining activities including global exploration and decommissioning operations. Risk Management – Executive experience in risk management. |

Mosaic Committee Membership: • Audit • Corporate Governance and Nominating

| |

| Other Board Service: |

| • Cameco Corporation |

|

| | | | |

Denise C. Johnson Group President, Resources Industries Caterpillar, Incorporated | | Ms. Johnson is the Group President of Resources Industries of Caterpillar, Incorporated (“Caterpillar”), a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Ms. Johnson has held this position since February 2016 when she was promoted from Vice President of Material Handling and Underground Division, which position she had held since January 2015. Prior to becoming Vice President of Material Handling and Underground Division, Ms. Johnson served as Vice President and Officer – Integrated Manufacturing Operations from May 2013 to January 2015, as Vice President and Officer – Diversified Products Division from January 2013 to May 2013 and as General Manager – Specialty Products from May 2011 to January 2013 of Caterpillar. Ms. Johnson began her career at General Motors Corporation and continued at General Motors Company, an automobile and truck manufacturer, where she held increasingly important roles from 1989 through 2011, including President and Managing Director of General Motors do Brasil Ltda. from June 2010 to March 2011; Vice President and Officer, General Motors Labor Relations, from December 2009 to June 2010; Vehicle Line Director and Vehicle Chief Engineer, Global Small Cars, from April 2009 to December 2009; and Plant Manager, Flint Truck Assembly & Flint Metal Center Plants, from November 2008 to April 2009. |

| | | |

Age: | 49 | | |

| | | |

Director Since: May 2014 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | |

| | | |

Mosaic Committee Membership: • Compensation • Environmental, Health, Safety and Sustainable Development | |

| Skills and Qualifications: |

| Global Operational Leadership – Significant experience in leading complex global operations, labor negotiations and product development, improvement and launches. Operational Excellence – Experience in lean manufacturing and supply chain management. Strategic Business Planning – Experience in developing global leadership strategies to optimize core business value. |

|

| | | | |

Emery N. Koenig Retired Vice Chairman, Chief Risk Officer and member of Corporate Leadership Team Cargill, Incorporated | | Mr. Koenig is the retired Vice Chairman and Chief Risk Officer of Cargill. Mr. Koenig held this position since September 2013 and also served as a member of its Corporate Leadership Team and board of directors since December 2009 until his retirement in February 2016. Previously, Mr. Koenig served as leader of Cargill Agricultural Supply Chain Platform from April 2006 to May 2014; as Executive Vice President and Chief Risk Officer of Cargill from June 2011 to September 2013; as Senior Vice President at Cargill from June 2010 to June 2011; and as leader of the Cargill Energy, Transportation and Industrial Platform from June 2007 to July 2011. Since joining Cargill in 1978, Mr. Koenig has had 14 years of agricultural commodity trading and managerial experience in various locations in the United States and 15 years in Geneva, Switzerland leading Cargill’s global trading and risk management activities. Mr. Koenig currently serves as a trustee for Minnesota Public Radio and a director of CARE USA and the Catholic Community Foundation. |

| | | |

Age: | 60 | | |

| | | |

Director Since: October 2010 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | |

| | | | Skills and Qualifications: |

Mosaic Committee Membership: • Corporate Governance and Nominating • Environmental, Health, Safety and Sustainable Development

| |

| Executive Leadership – Experience in various senior executive and policy-making roles at Cargill, including broad experience in management of a global business. Financial Expertise and Leadership – Experience as executive and leader in commodity trading, international trading and asset management businesses. Risk Management – Executive experience in risk management functions of a large, multinational business. Agricultural Business Expertise – Extensive experience in agricultural commodity trading and management. |

|

| | | | |

Robert L. Lumpkins Retired, former Vice Chairman and Chief Financial Officer Cargill, Incorporated | | Mr. Lumpkins served as Vice Chairman of Cargill from August 1995 to October 2006 and as its Chief Financial Officer from 1989 to 2005. As Vice Chairman of Cargill, Mr. Lumpkins played a key role in the formation of Mosaic through the combination of IMC and Cargill’s fertilizer businesses. |

Non-Executive Chairman of Mosaic’s Board | | Skills and Qualifications: |

| Executive Leadership – Experience in various senior executive and policy-making roles at Cargill, including as Vice Chairman for over a decade; international management; strong and effective Board leadership and governance. Financial Expertise and Leadership – Served in various financial leadership roles at Cargill, including Chief Financial Officer for over ten years. Agricultural and Fertilizer Business Expertise; Formation of Mosaic – Experience in Cargill’s agricultural and fertilizer businesses and service as one of Cargill’s key leaders in the conception and formation of Mosaic; possesses unique strategic and business insights into our business. |

| | | |

Age: | 72 | | |

| | | |

Director Since: 2004 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | |

| | | | Other Board Service: |

Mosaic Committee Membership: • Corporate Governance and Nominating (Chair)

| |

| • Ecolab, Inc. (Chair, Safety, Health and Environment Committee; Audit Committee) • Howard University • Educational Testing Service • Airgas, Inc. (2010 – August 2013) • Webdigs, Inc. (2007 – 2010) |

|

|

| | | | |

William T. Monahan Retired, former Chairman of the Board, President and Chief Executive Officer Imation Corp. | | Mr. Monahan served as Chairman of the Board, President and Chief Executive Officer of Imation Corp., a developer, manufacturer, marketer and distributor of removable data storage media products and accessories, from 1996 to 2004. Previously, he served as Group Vice President of 3M Company responsible for its Electro and Communications Group, Senior Managing Director of 3M’s Italy business and Vice President of 3M’s Data Storage Products Division. |

| | | |

Age: | 68 | | | Skills and Qualifications |

| | | | Executive and Operational Leadership – Broad experience as CEO, Chairman, and lead director of other public companies. Experienced in international management, financial management, mergers and acquisitions and corporate structure development. Marketing – Experienced in worldwide marketing and distribution, and business to business sales development. Executive Compensation Background – Strong background in executive compensation matters as a former CEO and in other executive roles, as well as his service as a member and chairman of compensation committees for other public companies, facilitates his leadership of our Compensation Committee. Risk Management – Executive experience in risk management. |

Director Since: 2004 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | |

| | | |

Mosaic Committee Membership: • Audit • Compensation (Chair) | |

| Other Board Service: |

| • Pentair Ltd. (Lead Director; Compensation Committee; Governance Committee) • Hutchinson Technology, Inc. (2000 – December 2012; Chair, Compensation Committee) • Solutia Inc. (2008 – July 2012; Lead Director) |

|

| | | | |

James (“Joc”) C. O’Rourke President and Chief Executive Officer The Mosaic Company | | Mr. O’Rourke was appointed our President and Chief Executive Officer in August 2015. He previously served as our Executive Vice President - Operations and Chief Operating Officer from August 2012 to August 2015 and as our Executive Vice President - Operations from January 2009 to August 2012. Prior to joining Mosaic, Mr. O’Rourke was President, Australia Pacific for Barrick Gold Corporation, the largest gold producer in Australia, since May 2006, where he was responsible for the Australia Pacific Business Unit consisting of ten gold and copper mines in Australia and Papua New Guinea. Before that, Mr. O’Rourke was Executive General Manager in Australia and Managing Director of Placer Dome Asia Pacific Ltd., the second largest gold producer in Australia, from December 2004, where he was responsible for the Australia Business Unit consisting of five gold and copper mines; and General Manager of Western Australia Operations for Iluka Resources Ltd., the world’s largest zircon and second largest titanium producer, from September 2003, where he was responsible for six mining and concentrating operations and two mineral separation/synthetic rutile refineries. Mr. O’Rourke had previously held various management, engineering and other roles in the mining industry in Canada and Australia since 1984. |

| | | |

Age: | 55 | | |

| | | |

Director Since: May 2015 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: No | |

| | | |

| |

| Skills and Qualifications: |

| Management Interface with Board - Principal interface between management and our Board; facilitates our Board’s performance of its oversight function by communicating the Board’s and management’s perspectives to each other. Mining Experience - More than 30 years of experience in U.S., Canadian and international mining activities, including both shaft and open-pit mining. Global Operational Leadership - extensive experience in leading complex global operations. Agriculture/Fertilizer Business - Longstanding experience in the agriculture and fertilizer industry through executive and operational roles for Mosaic. |

| Other Board Service: |

| • The Toro Company (Audit Committee; Finance Committee) |

|

| | | | |

James L. Popowich Retired, former President and Chief Executive Officer Elk Valley Coal Corporation | | Mr. Popowich served as President and Chief Executive Officer of Elk Valley Coal Corporation (“EVCC”), a producer of metallurgical hard coking coal, in Calgary, Alberta, from January 2004 to August 2006, and as President of the Fording Canadian Coal Trust, (“Fording Coal”) a mutual fund trust that held a majority ownership interest in EVCC, from January 2004 until his retirement in December 2006. Mr. Popowich was Executive Vice President of EVCC from February 2003 to January 2004, and from March 1990 to June 2001 served as Vice President – Operations at Fording Coal. He was Past President of Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), an industry technical association dedicated to education and identifying best practices in the mineral industry from May 2008 through May 2009, and President of CIM from May 2007 to May 2008. |

| | | |

Age: | 71 | | |

| | | |

Director Since: 2007 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | | Skills and Qualifications: |

| | | | Executive and Operational Leadership Experience – Significant executive and operational experience. Mining Experience – Extensive experience in the mining business, including both shaft and open-pit; member of the Association of Professional Engineers, Geologist and Geophysicists of Alberta; received the CIM Fellowship award for contributions to the coal industry in Canada; and serves as an advisor to the mining industry with a focus on operational excellence. Environment, Health, Safety, and Sustainability – Familiarity with addressing environmental, health, safety, corporate social responsibility and greenhouse gas matters in Canada. |

Mosaic Committee Membership: • Compensation • Environmental,Health, Safety and Sustainable Development

| |

|

| Other Board Service: |

| • CIM (2007-2015) • ClimateChange Central (an organization established by the Alberta government dedicated to the reduction of greenhouse gasses, 2002 – 2010) |

|

| | | | |

David T. Seaton Chairman and Chief Executive Officer Fluor Corporation | | Mr. Seaton is the Chairman and Chief Executive Officer of Fluor Corporation, a professional services firm. He was elected chairman in February 2012 and became a member of Fluor’s board of directors and Chief Executive Officer in February 2011. Prior to his appointment as Chief Executive Officer, Mr. Seaton was Chief Operating Officer of Fluor from November 2009 to February 2011. Mr. Seaton served as Senior Group President of the Energy and Chemicals, Power and Government business groups for Fluor from March 2009 to November 2009 and as Group President of Energy and Chemicals for Fluor from February 2007 to March 2009. Since joining Fluor in 1984, Mr. Seaton has held numerous positions in both operations and sales globally. |

| | | |

Age: | 54 | | |

| | | |

Director Since: April 2009 | |

| | | |

2015 | Meeting Attendance: | 94% | | Skills and Qualifications: |

| | | | Project Management – Extensive experience in leading major projects. Executive Leadership – Experience as a CEO and in other executive leadership and policy-making roles in a public company. Leadership of Global Operations – Experience in leadership of a large, global business. Energy and Chemicals Markets Experience – Experience in energy and chemicals markets. |

Independent: Yes | |

| | | |

Mosaic Committee Membership: • Compensation • Environmental, Health, Safety and Sustainable Development

| |

| Other Board Service: |

| • Fluor Corporation (Chairman; Chair, Executive Committee) |

|

| | | | |

Steven M. Seibert Attorney The Seibert Law Firm | | Mr. Seibert is a land use and environmental attorney and has been a Florida Supreme Court-certified mediator for over 20 years. He has operated The Seibert Law Firm in Tallahassee, Florida since January 2003, and in early 2013 co-founded a strategy consulting firm, triSect, LLC. From July 2008 until September 2011, Mr. Seibert was Senior Vice President and Director of Strategic Visioning for the Collins Center for Public Policy, a non-partisan, non-profit policy research organization. He also served as the Executive Director of the Century Commission for a Sustainable Florida from 2005 until July 2008. Prior to re-starting his law practice in 2003, Mr. Seibert served as the Secretary of Florida’s Department of Community Affairs from 1999 to 2003, following his appointment by Governor Jeb Bush, and, before that, Mr. Seibert was an elected County Commissioner representing Pinellas County, Florida from 1992 to 1999. |

| | | |

Age: | 60 | | |

| | | |

Director Since: October 2004 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: Yes | |

| | | | Skills and Qualifications: |

Mosaic Committee Membership: • Corporate Governance and Nominating • Environmental, Health, Safety and Sustainable Development (Chair) | |

| Government and Public Policy; Statewide and Local Issues in Florida – Service in various public policy and governmental roles in Florida, as well as his law practice, contribute to our Board’s understanding of public policy and other statewide and local issues in Florida, where most of our phosphate operations are located. Environment and Land Use Experience – Insights gained through his experience in environmental, land and water use and emergency management in Florida enhance our Board’s perspective on these matters. Facilitates his leadership of our Environmental, Health, Safety and Sustainable Development Committee. |

|

Directors Departing the Board at the 2016 Annual Meeting

|

| | | | |

William R. Graber Retired, former Senior Vice President and Chief Financial Officer

McKesson Corporation | | Mr. Graber is the retired Senior Vice President and Chief Financial Officer of McKesson Corporation, a healthcare services company. Mr. Graber held this position since joining McKesson in February 2000 through his retirement in May 2004. From 1991 to 1999, Mr. Graber was with Mead Corporation where, prior to becoming Vice President and Chief Financial Officer, he served as Controller and Treasurer. From 1965 to 1991, Mr. Graber held a variety of financial management positions at General Electric Company. |

| | | |

Age: | 72 | | |

| | | |

Director Since: 2004 | | Skills and Qualifications: |

| | | | Financial Expertise and Leadership – Experience as Chief Financial Officer and other financial and accounting leadership roles for several other companies, facilitates his service on our Audit Committee and allows him to serve as an “audit committee financial expert” within the meaning of SEC rules.

Executive Leadership – Extensive experience as both a senior executive and a director of other public companies in a wide variety of businesses, including cyclical businesses, short-cycle, long-cycle, manufacturing and service businesses.

Risk Management – Executive experience in risk management. |

2015 | Meeting Attendance: | 95% | |

| | | |

Independent: Yes | |

| | | |

Mosaic Committee Membership:• Audit

• Corporate Governance and

Nominating | |

| Other Board Service: |

| • Kaiser Permanente (2004 – 2015)

• Archimedes, Inc. (2005 – 2013)

• Solectron Corporation (2004 – 2007) |

|

| | | | |

James T. Prokopanko Retired President and Chief Executive Officer

The Mosaic Company | | Mr. Prokopanko is the retired President and Chief Executive Officer of Mosaic. Mr. Prokopanko held this position from January 2007 until his resignation effective August 5, 2015, when he became Mosaic’s Senior Advisor until his planned retirement in January 2016. He joined us as our Executive Vice President and Chief Operating Officer in July 2006, serving in such offices until he was elected President and Chief Executive Officer. Previously, he was a Corporate Vice President of Cargill from 2004 to 2006. He was Cargill’s Corporate Vice President with executive responsibility for procurement from 2002 to 2006 and a leader of Cargill’s Ag Producer Services Platform from 1999 to 2006. After joining Cargill in 1978, he served in a wide range of leadership positions, including being named Vice President of the North American crop inputs business in 1995. During his Cargill career, Mr. Prokopanko was engaged in retail agriculture businesses in Canada, the United States, Brazil, Argentina and the United Kingdom. Mr. Prokopanko is the sole director who is a member of management. |

| | | |

Age: | 62 | | |

| | | |

Director Since: October 2004 | |

| | | |

2015 | Meeting Attendance: | 100% | |

| | | |

Independent: No | |

| | | |

Mosaic Committee Membership:• Environmental,Health, Safety and Sustainable Development | | Skills and Qualifications: |

| Executive Leadership – As former President and Chief Executive Officer, he provides the Board his leadership experience and his knowledge of Mosaic and the fertilizer industry developed over his years of service with Mosaic. Agriculture/Fertilizer Business – Longstanding experience in the agriculture and fertilizer industry through executive and operational roles for Cargill. |

| Other Board Service: |

| • Vulcan Materials Company (Compensation Committee; Governance Committee)

• Xcel Energy Inc. (Audit Committee; Operations, Nuclear, Environmental and Safety Committee) |

DIRECTOR STOCK OWNERSHIP GUIDELINES

We have stock ownership guidelines for non-employee directors. These guidelines call for each director to acquire shares with a value of at least five times the annual base cash retainer within five years of becoming a director which, based on our current director compensation program, would be $900,000 for our non-executive Chairman of the Board and $450,000 for each other non-emloyee director. For purposes of computing a director’s holdings under our stock ownership guidelines, restricted stock units (“RSUs”) (whether vested or unvested) owned by a director are included. The following table shows information about each non-employee director’s status with respect to the ownership guidelines at February 29, 2016:

|

| | | |

Director | Shares Included Under Guidelines | Value (1) in Excess of Guidelines |

# | Value (1) |

Nancy E. Cooper (2) | 12,361 | $606,889 | $156,889 |

Gregory E. Ebel (2) | 12,986 | $633,475 | $183,475 |

Timothy S. Gitzel (2) | 18,543 | $633,918 | $183,918 |

William R. Graber | 23,559 | $912,261 | $462,261 |

Denise C. Johnson | 7,321 | $327,857 | (2) |

Emery N. Koenig | 20,155 | $1,023,428 | $573,428 |

Robert L. Lumpkins | 39,127 | $1,256,801 | $356,801 |

William T. Monahan | 37,866 | $1,134,886 | $684,886 |

James T. Prokopanko (3) | | | |

James L. Popowich | 23,120 | $778,330 | $328,330 |

David T. Seaton | 15,637 | $776,543 | $351,543 |

Steven M. Seibert | 23,443 | $902,913 | $477,913 |

(1) Under our stock ownership guidelines for non-employee directors, RSUs are valued at the date of grant and other shares are valued at their date of purchase.

(2) Director has not yet completed five years of service. Ms. Cooper, Mr. Ebel, Mr. Gitzel and Ms. Johnson will complete five years of service on October 6, 2016, October 4, 2017, October 3, 2018 and May 15, 2019, respectively, if they remain as directors of Mosaic.

(3) Mr. Prokopanko was our President and Chief Executive officer from January 1, 2015 until August 5, 2015 and then served as our Senior Advisor until his planned retirement in January 2016. His stock ownership is reflected under “Executive Stock Ownership Guidelines” on page 51 in our Compensation Discussion and Analysis.

Our stock ownership guidelines for executive officers, including executive officers who are directors, are described under “Executive Stock Ownership Guidelines” on page 51 in our Compensation Discussion and Analysis.

CORPORATE GOVERNANCE

Our Board oversees the management of our business and determines overall corporate policies. The Board’s primary responsibilities are directing our fundamental operating, financial and other corporate strategies and evaluating the overall effectiveness of our management.

We review our corporate governance principles and practices on a regular basis. As one example of our Board’s ongoing consideration of potential changes to our corporate governance practices and engagement with our stockholders on these matters, consistent with our own philosophical beliefs about shareholders’ rights, we recently adopted a proxy access bylaw which will be effective beginning with our 2017 annual meeting of stockholders.

Set forth below is a detailed description of our key governance policies and practices.

Board Independence

The New York Stock Exchange (“NYSE”) listing standards require our Board to formally determine each year which directors of Mosaic are independent. In addition to meeting the minimum standards of independence adopted by the NYSE, we do not consider a director “independent” unless our Board affirmatively determines that the director has no material relationship with us that would prevent the director from being considered independent.

Our Board has adopted Director Independence Standards setting forth specific criteria by which the independence of our directors will be determined. These criteria include restrictions on the nature and extent of any affiliations directors and their immediate family members may have with us, our independent accountants, or any commercial or non-profit entity with which we have a relationship. A copy of our Director Independence Standards is available on our website at www.mosaicco.com under the “Investors – Corporate Overview – Governance Documents” caption.

Our Board, as recommended by the Corporate Governance and Nominating Committee, has determined that our directors, Nancy E. Cooper, Gregory L. Ebel, Timothy S. Gitzel, William R. Graber, Denise C. Johnson, Emery N. Koenig, Robert L. Lumpkins, William T. Monahan, James L. Popowich, David T. Seaton and Steven M. Seibert, are each “independent” under the NYSE rules and our Director Independence Standards and have no material relationships with us that would prevent the directors from being considered independent. In making its independence recommendations, our Corporate Governance and Nominating Committee reviewed all of our directors’ relationships with us based primarily on a review of each director’s response to questions regarding employment, business, familial, compensation and other relationships with us and our management. James (“Joc”) C. O’Rourke is not independent because he is our current President and Chief Executive Officer. James T. Prokopanko is not independent because he is our former President and Chief Executive Officer.

Board Oversight of Risk

It is the role of management to operate the business, including managing the risks arising from our business, and the role of our Board to oversee management’s actions.

Management’s ERM Committee assists us in achieving our business objectives by creating a systematic approach to anticipate, analyze and review material risks. The ERM Committee consists of a cross-functional team of our executives and senior leaders. The ERM Committee has the responsibility for establishing the context of our ERM process, as well as identifying, analyzing, evaluating and ensuring that appropriate protocols are in place to mitigate the risks.

Our Board is responsible for oversight of our management of enterprise risk. Our Board provides guidance with regard to our enterprise risk management practices; our strategy and related risks; and significant operating, financial, legal, regulatory, legislative and other risk-related matters relating to our business. As an integral part of the Board’s oversight of enterprise risk management, the Board has directed the ERM Committee to review its activities with the full Board on a periodic basis, and the Board monitors management’s processes, reviews management’s risk analyses and evaluates our ERM performance. In addition, regularly-scheduled meetings of our Board from time to time include an in-depth review of one or more significant enterprise risk focus topics.

Pursuant to their respective charters, committees of our Board assist in the Board’s oversight of risk:

| |

• | In accordance with its charter and NYSE governance requirements, our Audit Committee regularly reviews with management, our Vice President – Risk Advisory and Assurance Services, and our independent registered public accounting firm, the quality and adequacy of our system of internal accounting, financial, disclosure and operational |

controls, including policies, procedures and systems to assess, monitor and manage business risks, as well as compliance with the applicable provisions of the Sarbanes-Oxley Act of 2002, and discusses with management and our Vice President – Risk Advisory and Assurance Services policies regarding risk assessment and risk management.

| |

• | Our Environmental, Health, Safety and Sustainable Development (“EHSS”) Committee oversees management’s plans, programs and processes to evaluate and manage EHSS risks to our business, operations and products; the quality of management’s processes for identifying, assessing, monitoring and managing the principal EHSS risks in our businesses; and management’s objectives and plans (including means for measuring performance) for implementing our EHSS risk management programs. |

| |

• | Our Corporate Governance and Nominating Committee oversees succession planning for our CEO and oversees from a corporate governance perspective the manner in which the Board and its committees review and assess enterprise risk. |

| |

• | Our Compensation Committee oversees risks related to our executive and employee compensation policies and practices, as well as succession planning for senior management other than our CEO. |

Each of these Committees reports to the full Board on significant matters discussed at their respective meetings, including matters relating to risk oversight.

Committees of the Board of Directors

Our Board has four standing committees:

| |

• | Corporate Governance and Nominating; and |

| |

• | Environmental, Health, Safety and Sustainable Development. |

Each of these Committees plays a significant role in the discharge of our Board’s duties and obligations. Each of the committees routinely meets in private session without the CEO or other members of management in attendance. Each of the four committees operates under a written charter. The charters are available on our website at www.mosaicco.com under the “Investors – Corporate Overview – Governance Documents” caption.

|

| | | | | | |

Audit Committee |

| Five Members: | | | | |

| Ÿ | Nancy E. Cooper, Chair | | The Board has determined that all of the Audit Committee’s members meet the independence and experience requirements of the NYSE and the SEC. The Board has further determined that each of Nancy E. Cooper, Gregory L. Ebel and William R. Graber qualifies as an “audit committee financial expert” within the meaning of Item 407(d) of Regulation S-K promulgated by the SEC. | |

| Ÿ | Gregory L. Ebel | | | |

| Ÿ | Timothy S. Gitzel | | | |

| Ÿ | William R. Graber | | | |

| Ÿ | William T. Monahan | | |

| | | | | |

| | | | | | |

| Meetings During 2015: | Eight | | | |

| Key Responsibilities: | | | | |

| Ÿ | appointment, retention, compensation and oversight of the work of our independent registered public accounting firm; |

| Ÿ | reviewing the scope and results of the annual independent audit and quarterly reviews of our financial statements with the independent registered public accounting firm, management and internal auditor; |

| Ÿ | reviewing the internal audit plan and audit results; |

| Ÿ | reviewing the quality and adequacy of internal control systems with management, the internal auditor and the independent registered public accounting firm; |

| Ÿ | reviewing with the independent registered public accounting firm and management the application and impact of new and proposed accounting rules, regulations, disclosure requirements and reporting practices on our financial statements and reports; and |

| Ÿ | reviewing the Audit Committee Report included in this Proxy Statement. |

|

| | | | | | | | |

Compensation Committee |

| Five Members: | | | | | |

| Ÿ | William T. Monahan, Chair | | None of our Compensation Committee’s members are officers or employees of ours, and all of its members, including its Chair, meet the independence requirements of the NYSE and the SEC. | | |

| Ÿ | Gregory L. Ebel | | | | |

| Ÿ | Denise C. Johnson | | | | |

| Ÿ | James L. Popowich | | | | |

| Ÿ | David T. Seaton | | | | |

| | | | | | | | |

| Meetings During 2015: Five | | | | | |

| Key Responsibilities: | | | | | |

| Assists the Board in oversight of compensation of our executives and employees and other significant human resource strategies and policies. This includes, among other matters, the principles, elements and proportions of total compensation to our CEO as well as other executive officers, the evaluation of our CEO’s performance and broad-based compensation, benefits and rewards and their alignment with our business and human resource strategies. The responsibilities of our Compensation Committee include, among others: |

| Ÿ | Chief Executive Officer Compensation: |

| | w | reviewing and recommending to our independent directors the amount and mix of direct compensation paid to our CEO; and |

| | w | establishing the amount and mix of executive benefits and perquisites for our CEO. |