UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2016

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

On February 11, 2016, The Mosaic Company hosted a conference call discussing its financial results for the quarter and year ended December 31, 2015. Furnished herewith as Exhibits 99.1 and 99.2 and incorporated by reference herein are copies of the transcript of the conference call and slides that were shown during the webcast of the conference call.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: February 12, 2016 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Senior Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Transcript of conference call of The Mosaic Company held on February 11, 2016 |

| |

99.2 | | Slides shown during the webcast of the conference call of The Mosaic Company held on February 11, 2016 |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, ladies and gentlemen, and welcome to The Mosaic Company’s Fourth Quarter 2015 Earnings Conference Call. At this time, all participants have been placed in a listen-only mode. After the company completes their prepared remarks, the lines will be opened to take your questions.

Your host for today’s call is Laura Gagnon, Vice President, Investor Relations of The Mosaic Company. Ms. Gagnon, you may begin.

Laura C. Gagnon, Vice President - Investor Relations

Thank you and welcome to our fourth quarter and full year 2015 earnings call. Presenting today will be Joc O’Rourke, President and Chief Executive Officer; and Rich Mack, Executive Vice President and Chief Financial Officer. We also have other members of the senior leadership team available to answer your questions after our prepared remarks. The presentation slides we are using during the call are available on our website at mosaicco.com.

We will be making forward-looking statements during this conference call. The statements include but are not limited to statements about future financial and operating results. They are based on management’s beliefs and expectations as of today’s date, and are subject to significant risks and uncertainties. Actual results may differ materially from projected results. And factors that could cause actual results to differ materially from those in the forward-looking statements are included in our press release issued this morning and in our reports filed with the Securities and Exchange Commission.

In addition, we will be presenting non-GAAP financial information that we believe will provide insight into the company’s results. Reconciliations to the nearest GAAP numbers are found in the presentation slide and in today’s press release.

Now I’d like to turn the call over to Joc.

James Calvin O’Rourke, President and Chief Executive Officer

Good morning. Thank you for joining us for our fourth quarter and full year 2015 earnings call. It seems clear to us that you all understand the market related challenges we face. To summarize, we’re experiencing a major decline in the broader commodities markets, as well as global economic uncertainty and unprecedented strength of the U.S. dollar.

Agriculture, the grain and oilseed supply and demand situation remains relatively balanced. Even after three consecutive huge harvests and despite the severe price decline across other commodities, crop prices have been relatively stable. Unlike hard commodities, we do not see a structural imbalance in agriculture, so we have a positive outlook for the 2016 global shipments in both potash and phosphates.

We believe recent price declines in potash and phosphates have been driven more by macroeconomic trends than by the current supply and demand balance, weak currency valuations against the U.S. dollar, our lowering production cost for exporting nations and raising prices for importing nations. Normal seasonal pressures are exacerbating the fertilizer price trend. As a result,

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

our realized prices were down in the fourth quarter and have been under increasing pressure since the beginning of this year.

We see several factors that are giving farmers around the globe incentives to use fertilizer to maximize yield and revenue per acre. The price declines in fertilizer have led to high crop nutrient affordability. Farmers are experiencing lower energy costs. Currency valuations are providing tailwinds for non-U.S. growers selling U.S. dollar-priced crops and the reason big harvests have withdrawn large amounts of nutrients from the soil which must be replenished.

As a result, demand is expected to remain strong. With that operating environment as a backdrop, we have three important concepts to discuss today. First, we expect Mosaic to emerge a stronger company from this difficult period. Second, the resilience we built into our business is real, as demonstrated by the strength of our balance sheet, our cost control and our strong execution. We believe it will yield compelling opportunities for growth as this cycle plays out.

And third, agricultural commodities bear different dynamics than any other commodities. And that’s a fact that we believe has been overlooked amid the general commodity market [indiscernible] (04:15). Cycles can turn more quickly in agriculture because of unpredictable weather and the consistent underlying global demand for food.

We understand that cycles are inevitable and that they are neither tidy nor predictable. We have always managed Mosaic for the long-term for success across the business cycle. That is a lot easier to say than it is to do. So, let’s explore the characteristics of our franchise that we believe will allow us to emerge ahead of our competition as the business improves.

First, the earnings we reported today show our resilience. We reported $0.44 per share or $0.53 per share excluding notable items and the catch-up in our tax accruals. This catch-up was the result of higher accruals through the first three quarters of the year and a true-up in this quarter, which resulted in a low effective tax rate in the quarter.

For the full year, we earned $1 billion, and our earnings per share of $2.78 were higher than the $2.68 per share Mosaic earned in 2014, reflecting both our execution and our capital allocation. It is important to note that Mosaic remains solidly profitable and free cash flow positive despite the very tough markets.

We’ve taken the actions necessary to ensure stability. We’ve made tremendous progress on costs. We are well ahead of schedule on our initiative to generate $500 million of cost savings by 2018. It’s important to note that we began that work with Mosaic already occupying a competitive cost position on a global potash and phosphate cost curves. We’ve made tough decisions, including difficult moves to stop our MOP production at Carlsbad, New Mexico, and decommission our potash mine in Hersey, Michigan. We’ve also saved significant costs through innovate decision and by investing the necessary capital to improve processes for the long term. We’ve made major progress towards a strong and efficient balance sheet. We’ve reached our leverage targets while maintaining enough cash to provide a buffer. That seem conservative to some, no doubt, but it will prove prudent and provide flexibility others do not have in this environment.

In 2012, when potash prices were close to $450 per tonne, we indefinitely postponed a $3 billion potash expansion. Two years ago, we had the opportunity to contract for ammonia with natural gas based prices, and decided to [ph] forego (07:06) building a $1.2 billion ammonia plant. We took that capital and returned it to shareholders, retiring nearly a quarter of our outstanding shares since we were split off from Cargill.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And we’re executing at a very high level. Our plants and mines are efficient. We’ve had very little unplanned downtime. And as an indicator of our effectiveness, we delivered another year of record-low reportable injury frequency.

To put it simply, we have not built the company just to weather storms. We have built it to succeed across the cycles that we all know will come. We’ve also created a great deal of potential, and that’s why we believe so strongly that Mosaic will emerge a winner. We expect to realize the value of our many growth initiatives across the cycle. And we believe we have created a tremendous amount of leverage for when better conditions arise. We’ve covered our many growth initiatives in the past. So, I’ll provide you with a short update.

The Esterhazy K3 potash mine remains on schedule and on budget. When the project is completed, the mine will be amongst the lowest cost, most efficient mine in the world. It will give us important operating flexibility including the ability at some point to fully eliminate material brine management cost. The CF phosphate acquisition has exceeded our expectations. Those facilities generated excellent margins for the first 18 months we owned them.

The ADM acquisition in Brazil and Paraguay continues to hold significant promise. The current difficult economic and political situation is Brazil is temporarily muting the benefit we expect. Our work to ensure stable, cost-effective access to our phosphate raw materials is nearing completion. We have finished the sulfur melter project in our New Wales facility in Florida and our ammonia supply agreement with CF begins next year.

While the economics in the near term are less attractive with $310 per tonne ammonia, long-term economics remained highly positive. Also at New Wales, our project to increase MicroEssentials capacity is nearing completion. We will have the ability to make 3.5 million tonnes of MicroEssentials, which provides significant value to the farmers, the retailers and Mosaic. The Wa’ad Al Shamal phosphates project in Saudi Arabia is also progressing and we expect initial production of ammonia later this year.

Taken together, all this work is Mosaic resilience and potential, which in turn gives us the opportunity to emerge from the weak part of the cycle in the lead. Now, I will turn the call over to Rich Mack for insights into our financial results and our guidance. Rich.

Richard L. Mack, Chief Financial Officer & Executive Vice President

Thank you, Joc and good morning to you all. To briefly reiterate Joc’s commentary on the markets, our financial results are being impacted by a confluence of challenging factors. Global macroeconomic uncertainty, ongoing currency volatility and weakness in key currencies against the U.S. dollar, the lack of sufficient credit in Brazil, and in potash, a recently completed Canpotex proving run that added supply in the seasonally slow part of the year.

Over the longer term, though, we see cause for optimism including a balanced supply and demand picture in phosphates, a manageable supply and demand picture in potash, and good conditions for agriculture in Brazil where the weak reais leads to high prices in local currency for grains and oil seeds.

Now, I’ll provide an overview of results in each of our three operating segments. In phosphates, our margins were lower in the fourth quarter primarily because of timing. We were selling fertilizer manufactured when raw material prices were higher than they are today. At the same time, prices dropped quickly as traders anticipated the impact of lower raw material costs and buyers delayed purchasing.

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

So, for the near term, we are seeing seasonally limited sales volumes and softer prices before we can realize our lower raw material costs. These trends are expected to continue into the first quarter. If we look longer term, however, our stripping margin is expected to remain healthy with much lower raw material prices offsetting lower fertilizer prices. We expect continued declines in sulfur, reflecting a number of curtailment announcements in China as well as our own. These low raw material costs combined with a firming of phosphate prices in the spring leads us to expect margin rates to rebound to normal levels after the first quarter.

In the first quarter, we expect the seasonally slow sales to continue and raw material costs to fall further. Last week, we announced that we are once again curtailing production to avoid the building of high-cost inventory. As a result, we expect our phosphate operating rates to be in the range of 70% to 80%. These factors are all embedded assumptions in our phosphate’s guidance. It is noteworthy that sales volumes picked up after we announced our decision to reduce production.

For the full year, we expect margins to be similar to last year, underpinned by our constructive view of the industry. We expect to ship between 9 million and 10 million tonnes of phosphates, with global market shipments increasing yet again this year to a range of 65 million to 67 million tonnes. In the Potash segment, we remained solidly profitable despite the drop in prices. Our work to reduce costs as well as the tailwinds provided by the weak Canadian dollar have enabled us to maintain reasonable margins.

Looking back at potash supply and demand, in the latter of 2014, customers built significant inventories with the expectation of a drawdown in 2015. That inventory reduction occurred to some extent but it was less pronounced than we had expected. Heading into the 2016 planting season in North America, we expect a strong demand in good shipment levels, tempered by the fact that retailers continue to hold higher inventories. As a result of these factors, we have lowered our estimate of global potash shipments by 3 million tonnes to a range of 58 million to 60 million tonnes, consistent with 2015, which was the second highest year of shipments ever.

We do not believe the potash supply and demand scenario is grossly out of balance. Many producers including Mosaic have cut back volumes in response to the seasonal lack of demand. Per our earlier production curtailment announcements, we reduced our operating rate in the fourth quarter by about 20 percentage points compared to last year.

In the first quarter, we plan to operate our potash lines at approximately 70% to 80% of capacity. In order to meet global demand, we expect to emerge during the second quarter. We expect pent-up demand to come from most of our major markets, China, Brazil, India, Southeast Asia, and North America as well as from Europe, all at roughly the same time this year which should provide a solid foundation for crisis.

In the meantime, we will maintain our disciplined approach meeting our customers’ demands. We have operational flexibility, a low cost structure including the benefit of low natural gas prices at our Belle Plaine solution mine and the benefit of a weak Canadian dollar which in 2015 was down as much as the Russian ruble against the U.S. dollar.

Our first quarter potash volume guidance anticipates demand emerging around the world towards the end of this quarter. And as a result, our expected operating rate is well below the same period last year. Margins are expected to be in the low to mid 20% range, reflecting both lower realized prices and our decision to produce only to expected market demand.

We expect our shipments to North America to be about flat with last year’s levels with the reduction in volumes primarily a function of delayed demand in the export markets. Our full-year volume guidance of 7.5 million to 8.5 million tonnes reflects an expected increase in Canpotex potash exports.

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

In our International Distribution segment, we continue to be impacted by the difficult political and economic situation in Brazil. Fertilizer demand remains slower than usual primarily because farmers are having difficulty finding appropriate access to credit. The credit situation is giving farmers incentive to acquire their inputs through barter, a system that can benefit Mosaic because of our strong relationships with key players in the Brazilian barter market. These arrangements also allow us to take a conservative approach to granting credit which lowers overall credit losses.

Farmers in Brazil continue to plant for big crops. In fact, a high percentage of second crop corn already has been sold in advance because of the favorable currency dynamics. So, farmers need to plant their acres and maximize yields. We believe that will facilitate additional fertilizer demand.

Brazilian credit availability is the swing factor in our volume guidance assumptions for the first quarter and full year. Because of the relatively high proportion of fixed costs, higher volumes positively impact margins per tonne as does a higher proportion of MicroEssentials in our sales.

Finally, I should note that our forecasted margins anticipate relative stability in the real. For 2016, we expect our distribution volumes to range from 6 million to 7 million tonnes. For calendar 2016, our annual guidance ranges are as follows: Canadian resource taxes and royalties are expected to be in the range of $180 million to $220 million, down from $281 million in 2015. Brine management costs are expected to be consistent with 2015 in the range of $160 million to $180 million.

Our SG&A expense is estimated to be $350 million to $370 million. We will continue to look for opportunities to take additional costs out of the system to increase cash flow and to manage the company for the inevitable cyclical upturn.

Our effective tax rate is expected to be in the high-teen percentage range. Capital expenditures are expected to range from $900 million to $1.1 billion, plus around $300 million for our interest in the modern Wa’ad Al Shamal phosphate company.

As we have previously guided, approximately $600 million of our capital expenditures is sustaining capital. And the majority of the remainder is for projects already well underway. We are prepared to calibrate capital spending further to reflect current market conditions. Given the current attractiveness of Mosaic share price, new capital commitments must meet a very high risk-adjusted hurdle rate.

And one more note on capital. Today we announced an accelerated share repurchase program of $75 million. As you know, cycles bring opportunities. And during the fourth quarter we were evaluating some unique opportunities and did not affect additional share repurchases. We are pleased to be in a position to make today’s announcement, and we will continue to embrace the capital management philosophy we have often articulated in the past.

To conclude, I would like to reiterate Joc’s main points. There is no doubt that markets are challenging on several fronts, but Mosaic has made and will continue to make notable progress. We have the financial and operational resilience and discipline to succeed in weak markets. And we have significant leverage to outperform as conditions improve, which they always do in this sector.

With that, I’ll return the call back to Joc for his closing comments. Joc?

James Calvin O’Rourke, President and Chief Executive Officer

Thank you, Rich. To summarize, we’re operating in a challenging environment with volatility and headwinds coming from many fronts. But at Mosaic, we have learned to embrace the cyclicality of our

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

business. Our philosophy to produce to demand in both potash and phosphates has not changed. We are also managing costs, remaining flexible on our capital spending, and looking for opportunities to create long-term value for our shareholders.

We have been profitable through the trough. We have created the potential to accelerate quickly in better markets, and we believe the agricultural markets will prove more resilient than current sentiment expects. Mosaic is in excellent position for now and for the years to come.

Now, we would be happy to take your question. Thank you.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: [Operator Instructions] Your first question comes from the line of Ben Isaacson of Scotia Bank. Go ahead. Your line is open.

<Q – Ben Isaacson>: Much. Just wanted to dig a little bit deeper on Rich’s comment on the phosphate market. Can you start by talking about how finished phosphate fertilizer inventory levels looked worldwide right now?

And then secondly, what changes to global supply do you see occurring in 2016 with the particular focus on China’s export capability? Thank you.

<A – James O’Rourke>: Thanks, Ben. Joc here. I’m going to hand that straight to Mike. I think this is really an area, where he can give us the best answer. Mike, do you want to just take that?

<A – Michael Rahm>: Sure. Let me start with the second question first, in terms of Chinese exports. I’m sure you’re all aware that exports spiked in 2015 to, I believe the kind of customs numbers in that 11.6 million tonne range. As I think was noted earlier, there have been some shutdowns in China. Those tonnes we think we’d be lost. Our projection that we’re using right now in our S&D is somewhere in that 10 million tonne range. We think it will be off a bit from the record last year.

In terms of the first question, phosphate inventories, and Rick, you should comment as well. I think it varies from region to region, certainly continuing in China. We know that inventories have built up at the plant level, we think they’re high there. Distributors in China are the same as distributors around the world in terms of when prices – when prices are trending down, they tend not to take position. So, we’re seeing the backup of inventories at the plant. But overall, we don’t think inventories in China are excessive.

The situation – India may be a little bit different, they had a 2.5 million tonne increase in imports last year. And we think that inventories are certainly greater than what they have in the last couple of years when they were pulled down to very low levels. North America, I think, is in good shape. And in terms of Brazil, inventories ended the year maybe a little bit above the average, but I think we’re seeing some positive signs there that things are beginning to move.

So, I’ll let Rick provide his color – commentary as well.

<A – Richard Mack>: Yeah. Good morning, Ben. I’ve just spent some time going through with our Brazilian team, some things that are happening in the marketplace there. And we’ve seen over the last – since the start of the year some pretty significant moves of volumes that had waited to come to market. So, these are [indiscernible] (23:03) volumes that are going out. And we see the phosphate inventories, frankly, being drawn down. Mike described them as about even year-over-year. But the sales that are going right now for the first quarter reflect farmers coming back into that marketplace. So, I think those inventories get drawn down.

And we just finished spending time this week with some of our larger North American customers. And I would say their buying is probably lower than it has been for the last three years. They’re going to wait and we’ll hand them out and so they’re not sitting on a lot of inventories. There’s not a lot of inventory sitting in North America. And so, we expect when the season hits, this bodes very well, and volumes will move through the system.

Operator: Your next question comes from the line of Vincent Andrews with Morgan Stanley. Go ahead. Your line is open.

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Neel Kumar>: Hi. Good morning. This is Neel Kumar calling in for Vincent. I had a couple of questions regarding MicroEssentials. Would you characterize the demand is still an excess supply in the current operating environment? And can you also talk about how you’ve been managing the price premium versus DAP and whether or not prices has been stickier than DAP?

<A – James O’Rourke>: Hi, Neel. Joc O’Rourke. We’ll start – I’ll start off with just a quick comment. As you’re probably well aware, our production capacity for MicroEssentials was reaching its limit in the last year or so, and we’re just in the process of expanding that capacity at our New Wales plant, up to 3.5 million tonnes so that as the future goes by, we will actually have sufficient capacity. So, in the timeframe, volumes have not necessarily increased, but we’ve really focused on the value add that we can achieve through that.

I’m going to let Rick just talk about this for a little while, and maybe come back with some [indiscernible] (25:05).

<A – Richard Mack>: Yeah. Good morning. Joc’s right. We saw volumes stay relatively flat year-over-year. But we saw the increases in the premiums we’ve been able to capture for on MicroEssentials. We really are looking forward to the fact that we will have this increase production sometime in 2016, and our focus is really on expanding significantly into Brazil. Last year, we did grow, but it stayed relatively flat. Our plans were for it to grow further but we – I think a lot of activity in Brazil, a lot of uncertainty and so we felt real good that we stayed flat.

We really are looking for opportunities for it to grow in the Caribbean basin as this new production comes on, fill in the holes in North America where our customers and people that have not been able to get access are asking for it and still worry. I think I mentioned it before, we’re doing research in Europe because the crop cycle there is very similar to what we see in Canada which is one of our fastest growth markets.

<A>: We continue to have a very good view on the future of micro essentials and its ability to have real value to Mosaic on the long term. So I’ll close with that.

Operator: Our next question comes from the line of Don Carson with Susquehanna Financial. Go ahead. Your line is open.

<Q – Don Carson>: Yeah. A couple of questions on potash. Given your more conservative view on shipments this year despite the benefit of falling prices, do you have any plans to idle Colonsay indefinitely or do you think others should be doing more to idle production as well in Saskatchewan? And then just from a market perspective, can you talk about your FPD program in potash given falling prices? Are you finding that you’re shipping more potash with the price to be determined post shipment?

<A>: Let me start off with the – we have said and we continue to say we will operate to the demand in the market and, of course, as we look at that, we will make sure that the production that we curtail gives us the most long-term benefit. So, whether that’s because of a higher cost of operations or whether we need maintenance or our deferring maintenance of certain plans, I think that decision gets made based on the value it adds to Mosaic. So, we’re certainly not going to specify how we plan to do that, but we expect to make sure that our production meets the expected demand. And that’s why our guidance this year is 70% to 80% in the first quarter and it was about 70% in the fourth quarter against last year. We have operated 91% in the fourth quarter and 90% in the third quarter. So, we’re looking at controlling that to meet the market. I’m going to give the FPD questions straight over to Rick.

<A>: Good morning, Don, and it’s a very apropos question. We are seeing people take advantage for us and them of using our FPD program. And I think we saw the impact of that showing up in our

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

fourth quarter. There was questions about our third quarter volumes in the North America, and, frankly, we saw those volumes come back in the fourth quarter. I think the one thing that people don’t understand is our program separates price from shipment. And so, it allows the dealer to put product in the place but the pricing mechanism is they can buy up to the moment they sell to the farmer. And at that point, they have to price at the current price.

And so, their revenue recognition and ours match up. We think it creates a competitive advantage for us and it certainly does for our customer base.

<A – James O’Rourke>: I think just to reemphasize Rick’s other point there, which is we believe the FPD program allows a much smoother logistics for supply chain for our products. In other words, we can get the products to market on our convenience and allow them to be where they need to be when the markets really start moving.

Operator: Your next question comes from the line of Andrew Wong with RBC Capital Markets. Go ahead. Your line is open.

<Q – Andrew Wong>: Thank you and good morning. In Richard’s prepared comment, I think he mentioned that Mosaic was evaluating some unique opportunities in the fourth quarter. Can you talk about which parts of your business you would like to see maybe the footprint expanded, would it be distribution or production? And, geographically, what sort of regions you might be interested in? Thank you.

<A – James O’Rourke>: Andrew, thank you. And, obviously, we’re not going to comment on specifics with any M&A-type activities we might be involved in. But I would say, just – and I’ll give it back to Rich for some more color, but I would say, look, we’re interested in both of our sectors. We’re certainly interested in anything that gives us a long-term risk-adjusted superior return above our cost of capital.

Now, having said that, as per Richard’s comments, the hurdle rate has to be adjusted for what we believe is a low-stock price right now. So, we’re measuring any investment we make against the benefits of buying back our own stock. Rich, do you want to add something to that?

<A – Richard Mack>: Sure. Andrew, what I would say is it goes to in parts of capital management, it goes into the cyclicality of the industry. And if you take a look at Mosaic historically going way back to the Cargill years, the down parts of the cycle do present opportunities. And if you take a look at our track record, Cargill got into the phosphate business at the down part of cycle. We, years later, ended up by consolidating with IMC Global. That was a great opportunity for us. And just a couple of years ago, I would argue that we rolled up the CF phosphates business at very attractive valuation. So, as Joc noted, anything that we would do would go through a very strong filter, but the fact that we have a strong balance sheet, which I would argue would be the envy of many in the mining sector and ag sector today, is of great benefit to us. So, we’ll continue to balance between repurchasing our shares and looking for opportunities out there. And if there’s something that is extraordinarily compelling, it’s something that we could act on.

Operator: Your next question comes from the line of Jeff Zekauskas from JPMorgan. Go ahead. Your line is open.

<Q – Jeffrey Zekauskas>: Hi. Good morning. Two-part question. When do you expect the Ma’aden phosphate plant to come on stream? And how much more do you have to spend on it?

And then secondly, your corporate cost this quarter, I think, was an income benefit of $29 million. I was wondering why that was the case. And your other current assets year-over-year are up about $260 million, and I was wondering what that was too.

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – James O’Rourke>: Okay. I’m going to hand the more technical finance questions over to Rich in a second here. Let me just quickly touch on Ma’aden. Actually, over there a couple of weeks on its – it’s really come a long well. I think we’re pretty pleased with where we sit with Ma’aden. They were just adding gas and starting to commission the boilers for the ammonia plant and recognize a big piece of the value of the modern joint venture will be that ammonia plant. And that’ll come on mid-year this year and probably finish commissioning somewhere around the third quarter. The rest of the plant should be ready by, let’s call it late 2016 or early 2017, and then start commissioning at that stage. So, that’s kind of a timing. And I believe we have about $300 million left to spend on it. But again, I’ll get Rich to give you a little more background and then give you answers on our corporate spending. Thanks.

<A – Richard Mack>: Sure. Thanks, Joc. Hey, Jeff, your two part question had five questions in it. So, I’ll try to address that. This year, we’re at the tailwind of Ma’aden, as what I would say. 2016 will represent the vast majority of our remaining expenditures there. I think we’re suggesting about $300 million in 2016. There could be some spillover effect that goes into 2017. And that’s yet to be determined based on a variety of factors in terms of how the construction is progressing today.

Joc noted ammonia production comes online later this year. Phosphate production will come online sometime during 2017. But there will be a ramp-up period. And we’re progressing, I would say, very quickly right now in terms of the construction process. And those time horizons are still generally consistent with what we thought about a couple of years ago.

Your question about the positive contribution in the corporate segment really relates to intercompany eliminations between our phosphates segment and our international distribution segment. So, when we sell phosphates to international distribution primarily Brazil. We do not take – we back off the profit – or the profit is recognized, I should say, in the phosphate segment and then it’s eliminated in the corporate segment until that product is sold by international distribution. And so, what you’re seeing here is product that moved in the fourth quarter out of international distribution and therefore, the profit has fully been recognized by Mosaic.

And then, I think, your third question was an increase in other current assets. And I think the answer to that is primarily additional FPDs this year compared to the last relevant period. So I hope that’s a response to your question.

Operator: Your next question comes from the line of Adam Samuelson with Goldman Sachs. Go ahead. Your line is open.

<Q – Adam Samuelson>: Yes. Thanks. Good morning, everyone. So maybe – we’d love to hear your thoughts on India. And particularly both on P&K near term, it seems the inventories there have built up pretty sharply and demand has weakened. Can you help me think about kind of how the back half of the year could progress, actually get that import demand back up is probably a pretty important swing factor in the seaborne P&K markets? Thanks.

<A>: Sure, Adam. Thanks for the question. I’m going to hand that straight over to Rick McLellan’s answer. I think that’s...

<A – Richard McLellan>: Yeah. Good morning, Adam. I think it is a swing factor. I’ll ask Mike to add in after I’m done. But late in January, the Indian government stopped allowing shipments to be moved from ports in country.

So, inventory buildup, it will get cleaned out quicker. How long that lasts, and we’ve seen it before where it allows inventory to be cleaned up in-country, and it allows them to reset the subsidy. We have no idea what the subsidy will be for P&K in India, but it will be lower. And I think the other piece

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

that the inventory builds up for a couple of reasons and I think the biggest one was that the expectations for demand last year were a little higher than what ended up happening.

The impact of the drought in India impacted both P&K usage, and right now what we’re seeing in-country with our own in-country business is product is moving from the distributors’ shelf to the farmers. And so, we have to separate what happens on the import side from what happens on the distributors’ shelf, and frankly, this move of theirs will help clean up some of that inventory, and we look forward to the back half of the year, will be very good going in India, but it won’t be at a level we experienced last year.

Mike, you want to add something there?

<A – Michael Rahm>: Yes, a couple of notes. Obviously, there are a lot of uncertainties there with respect to how good or bad the monsoon will be this year, what happens to exchange rates, what if any changes to subsidies. So, a lot of moving parts there, but bottom line, our best guess at this point is in terms of MOP imports, we think they’ll be off a little bit. Recall that in calendar year 2005, India imported 4 million tonnes of potash, off a little bit from 4 million tonnes, 3 million tonnes to previous year, but up from 3 million tonnes in 2013. We think we’ll be in that 3.7 million tonnes to 3.9 million tonnes range this year. So, off a little bit.

I’d say maybe a little bit different story as we noted earlier, import surged to 2.5 million tonnes last year from very low levels. Yeah, we think those are probably off maybe 0.5 million tonnes to 750,000 tonnes this year, and how much depends on all of those factors we noted earlier.

Operator: Your next question comes from the line of Jonas Oxgaard with Bernstein. Go ahead. Your line is open.

<Q – Jonas Oxgaard>: Hi. Morning. So, a bit curious about those timing effects in the phosphates. So, I understand most of that is ammonia moving down quite dramatically. Now, you’ve guided for Q1 about 10% gross margin. But can you talk a little bit about what we expect Q2, Q3 when it starts to [ph] cool already (40:07) both in the percentage and absolute terms?

<A>: Sure. Thanks, Jonas, for your question. Certainly in Q1, we are faced with the impact of declining ammonia prices. Now that takes about a quarter to just work through our systems. So, whenever the price is declining, the inventory value of your product tends to be higher for about that quarter until we work that – the higher cost materials through system.

As we said in our guidance, by about the second, third quarter, we expect our gross margins in phosphate to be returning to more or less what I would say as our normal range of high teens. And so we would expect the last three quarters to be in that high-teens area.

Rick, did you – or Mike, did you want to add anything on those – movement of those products?

<A>: No. I think it’s – you hit it, Jonas, the change year-over-year in raw material and even quarter-over-quarter. If you look at our sulfur cost Q1 of 2015, it’s $147 a tonne. Q1 of 2016 is $95. Our ammonia costs in January of 2015 were $545. We bought ammonia in 2016 for $350. In February 2015, we bought ammonia for $495. At February of 2016, it’s $310. So, those are significant drops. And so, as that stabilizes and we move through Q2, Q3, and Q4, those are going to drive improved gross margins.

Operator: Your next question comes from the line of Joel Jackson with BMO Capital Markets. Go ahead. Your line is open.

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Joel Jackson>: Thanks. On the potash guidance you’ve given for volume, you’re giving guidance that Mosaic will have roughly flat shipments on its own but that global demand for potash will be down about 1.5 million tonnes. So, can you talk about how you see Mosaic gaining share? I know there’s some flips going on in Canpotex allocation between Vanscoy and New Brunswick being taken out of and potash getting more allocation here. I mean in your base case, do you see that the Belarusians and the Russians cut capacity? Thanks.

<A>: Thanks, Joel. Good to hear from you. Our base case actually is pretty darn flat for both world shipments – and I’ll let Mike expand on that – but also on our shipments. We go down slightly in Canpotex, but with the inclusion of the New Brunswick tonnage into Canpotex, I think our overall Canpotex tonnage goes up slightly. And then North America is quite flat for us. So, we’re expecting with sort of normal ranges a very similar year to what we have this year. And Rick or Mike, do you want to expand on the global?

<A>: The only think I would point out in terms of our global shipments, we revised up our 2015 estimate to 60.7, largely based on a big surge of imports by China and our point estimate for 2016 is 59.7. So, we’re looking only at about a million tonne drop. So, I don’t think there’s a great inconsistency there between what we’re projecting internally and what we’re projecting for the market.

Operator: Your next question comes from the line of Chris Parkinson with Credit Suisse. Go ahead. Your line is open.

<Q – Graeme Welds>: Morning, everyone. This is Graeme Welds on for Chris. I’m just wondering if you could process a little bit about where we stand on the CapEx spend for Esterhazy like percentage-wise versus your total target?

And then also wondering, longer term, what’s the potential there to improve your cost per tonne. I know you mentioned that eventually, there will be the opportunity to potentially eliminate the brand cost. But just wondering ex that, like how much could you potentially [indiscernible] (44:30) cost per tonne? Thanks.

<A>: Thanks, Graeme. Let me just highlight with Esterhazy. It’s a little difficult to give an absolute CapEx number because much of it will be going forward, will be development money that we spend developing the [indiscernible] (44:51) and the mining area in underground at Esterhazy. And that is money we will not be spending at K2 or K1. So, there’s a trade-off there. We have probably about $300 million to $600 million to spend over the next three years at Esterhazy for the other equipment like the conveyors, the shaft, and development around the shaft. So, I would say those are the expected. And then there’s a net tax effect.

So, overall, the net money we’re spending, I’m not sure of the exact number, but it isn’t – the gross number is about $600 million. The thing I’d point out is once we do have that completed, once we have ramped up Esterhazy, if we can remove our total brine cost at some point, that is today costing us about $18 a tonne across the whole business. So, we see the Esterhazy cost as being extremely competitive, probably some of the best in – certainly, some of the best in North America once we get this done. Rich, do you want to continue to that?

<A – Richard Mack>: Yeah. The only thing that I would add is just maybe in terms of the total CapEx program at Esterhazy on a percentage basis. We’re somewhere probably in the low- to mid-30% range in terms of completion. And then in terms of overall cost, I think as we’ve commented previously, once K3 is completed, not only will it eliminate obviously the brine [ph] inflow (46:28), as Joc has noted, but the distances to the main shafts and so forth are going to be significantly closer, and the overall operating cost environment for that mine will be extremely good.

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Operator: Your next question comes from the line of P.J. Juvekar with Citi. Go ahead. Your line is open.

<Q – P.J. Juvekar>: Yes. Hi. Good morning. I think Mike mentioned that North American inventories have [indiscernible] (46:55) care and good shape. One of the retailers’ complaint about to wet fall season that prevented some application was you talked about your FPD program. Given all that, one would think that retail inventories are slightly higher than normal, but maybe you can just talk about how do you see inventories currently?

<A>: Thanks for the question, P.J. I’m going to hand this to Rick pretty quick here. But I think the inventory buildup is more on the nitrogen suite than it is in the P&K suite. We did not see the same – although, we didn’t see a big fall season because of the weather issues that were mentioned we see probably a lot of pent-up demand and not a lot of inventory moved out to the retailers yet. And Rick, you want to just expand on that?

<A – Richard McLellan>: Yeah. Good morning, P.J. What you’re saying on weather conditions, frankly, is very regional. But there is big chunks of the U.S. market that you need to get product out this spring. And all of them are hoping for an early spring so that they can get at some of that work. I think the biggest thing that will be a challenge in 2016 spring is the fact that dealers have held up, placing the inventory into [ph] bins (48:17). So, there’s [ph] bins (48:17) out there that are empty. And when everyone starts, it will be, where is the inventory? How close is it to them? And frankly, if everyone comes to the trough at the same time, it’s just – the inventory is not going to be there. And I think that’s a good place for us to be.

The other thing is, is that it will help pricing because inventory in place is going to be worth what people want to pay for at that day as they go to the field. Mike?

<A – Michael Rahm>: Sure. Just to add a couple of comments. One, I think we’ve characterized the fall application season as being generally average but we didn’t see a major drop-off. There may have been pockets here or there, but there are also pockets where it was very good. Case in point, in talking with one of our larger customers in the eastern Corn Belt. They actually sold more tonnes this fall than what their average was. So, I wouldn’t characterize it as necessarily a poor fall application season.

The other factor is with the expectation corn acres being north of 90 million this year, we think that overall usage in the United States for P&K likely will be up 1% to 2%. And given that, coupled with the fact that there was good pull this fall, we’re thinking it bodes well for spring movement.

Operator: Your next question comes from the line of Jacob Bout with CIBC. Go ahead. Your line is open.

<Q – Jacob Bout>: Good morning. Wouldn’t mind getting your thoughts on the dividend, specifically as it pertains to your capital allocation [ph] decisions (50:02) in the context of CapEx share buyback [indiscernible] (50:05).

<A>: Thanks, Jacob. Good to hear your voice. I’ll hand this over to Rich pretty quickly, but I mean suffice to say from my perspective, our capital planning, our capital strategy is unchanged. So, with that, I’m just going to hand to Rich to just reiterate our [indiscernible] (50:27).

<A – Richard Mack>: Sure. And, Jacob, our stated philosophy on dividends is we’re going to grow the dividend as our business and our earnings grow. Obviously in the last 12 to 18 months it’s been much challenging environment out there. But in terms of our overall capital management philosophy, I think the dividend is a very important component of it. I think that it is something obviously that is

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

entirely sustainable going forward. And as the cycle turns, we will continue to evaluate that against what our current share price is, and make decisions accordingly.

<A>: And we believe we have strong enough cash flow capabilities through the whole cycle that we cannot only pay a reasonable and fair dividend, but we can also balance that with our growth opportunities and returning money to shareholders through share buybacks as we’ve demonstrated through our accelerated share repurchase plan that we’ve announced today.

Operator: Your next question comes from the line of Steve Byrne with Bank of America. Go ahead. Your line is open.

<Q – Stephen Byrne>: Yes. Thank you. I have a couple of government actions that I would like you to comment on. First being Brazil’s action last week to release some farmer credit. And would those moneys impact fertilizer demand in the near term? Are you seeing any activity as a result of that? And then the other one being China’s decision to terminate the crop support price there, are you expecting any impact from that action on fertilizer demand in China? How much of that 60 million tonne shipment of yours, Mike, worldwide for potash is China versus a year ago level?

<A – James Calvin O’Rourke>: I’m going to hand that straight to Mike. I think he really has a good handle on our world supply and demand balance. Let me hand that straight to Mike.

<A – Michael Rahm>: Once you have – Rich you want to talk about Brazil?

<A – Richard Mack>: I’ll talk about the Brazil credit. Yeah. Good morning, Steve. I think that I expressed earlier that our team in Brazil is reporting for the corn and second crop period that we’ve seen demand increases from the 1st of January. And that credit being freed up by the government is very good to see. It’s not new credit. It’s credit that had been announced in last year’s budget. But the fact that they freed it up is really quite significant. And we see that as positive. Farmers are still having issues with access to credit. But from our own business, we’re doing a nice job of managing the credit, helping farmers connect themselves with either banks or with barter opportunities. Mike, do you want to take the China question?

<A – Michael Rahm>: Sure. I guess in terms of what we know, obviously, last year the Chinese dropped their corn support price, 10%. But that basically took their support price down from big, round numbers, $10 to $9. We expect that there will be further cuts in that, but it still keeps Chinese support prices for corn at relatively high levels compared to the rest of the world.

So, just in terms of farm economics, we think farm economics remained healthy in China. The drops that we’re showing, for example, in potash shipments relates more to the build-up of inventories than any drop in demand. I think the bigger concern there is making Chinese corns, for example, more competitive. We’ll cut into their imports of corn substitutes whether it’s [ph] DDGs (54:23), sorghum, barley or whatever. But, by and large, we think Chinese farm economics and the demand drivers there are still okay.

<A>: And, Mike, just one thing I’d add is our local team in China, it made a point of saying farmers are seeing their support coming from the government, not in the support of corn prices, but in other subsidies that are replacing that. And so, as Mike said and just to add on to it, the farmer economics in China are really very good today.

<A>: Okay. So, we have time for probably one more question before we close.

Operator: Your next question comes from the line of John Roberts with UBS. Go ahead. Your line is open.

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – John Roberts>: Thank you. A buzzer beater. I think you gave guidance for 70% to 80% mine operating rates in Potash for the first quarter. That would seem like a pretty wide range given we’ve only got six weeks left in the quarter.

<A – James O’Rourke>: Thanks, John. Yeah. It probably is a wider range. We, in general, give about a 10% range or an estimate on that. But due to the high level of uncertainty in this first quarter, we thought it was prudent to make maybe a little higher range than we would normally give. Rick, do you have any comments on that that we need to add?

<A – Richard Mack>: No, Joc. Just this is Q1 with – it’s interesting we could run at higher rates if we see both the Chinese and the Brazilians come back into the marketplace. But we’re putting the range in. So there are presumptions on the lower end of the range reflect the little movement into either of those markets.

James Calvin O’Rourke, President and Chief Executive Officer

Okay. Thank you, everyone. Let me conclude. Before I even start my concluding remarks, I just want to point out maybe a bit of a – Graham reminded me of a point that we haven’t made my job lately, which is we are now at 2,600 feet deep in our two potash shafts on our way to 3,100 feet. So, those projects are getting very near to completion in terms of the two shafts. It’s been a very well executed project from our perspective, continues to run right on budget and right on schedule. So, just a call out to our Potash team that has really done an extraordinary job of a very complicated big project.

So, let me give my conclusions. To conclude our call, I just want to reiterate our key themes. First, we expect Mosaic to emerge as a stronger company from this challenging part of the cycle, because we’ve built a resilient business. And second, demand for agricultural commodities remain strong because of global demand for food continues to grow. And I know we harp on that, but the reality is the whole thing is based on the food story, and it continues to grow.

So, we have created significant potential to accelerate when business conditions improve. And we know that business conditions will improve. So, thank you very much for joining us today. Have a great and safe day. Thank you.

Operator: This concludes today’s conference. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q4 2015 Earnings Call | Feb. 11, 2016 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2016. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2016 CallStreet |

The Mosaic Company Earnings Conference Call – Fourth Quarter 2015 February 11, 2016 Joc O’Rourke, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations

Safe Harbor Statement This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture) and other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing ammonia supply agreement with CF, including the risk that the cost savings from the agreement may not be realized or that the price of natural gas or ammonia during the agreement’s term are at levels at which the pricing becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. 2

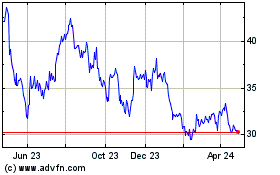

Challenging Environment; Agricultural Commodities Less Impacted 3 30 40 50 60 70 80 90 100 110 120 2014 2015 2016 Index Source: CRB Market Commodity Prices 2014 Q1=100 Oil WTI Iron Ore Corn Based on actual market prices

Potash: Currency Swings Exacerbating Price Movement Source: Factset Bringing costs of production down …… …… and costs for customers up. 4 1/1/15 12/31/15 1/1/15 12/31/15 0.70 0.75 0.80 0.85 0.90 Canada 0.04 0.05 0.06 0.07 0.08 0.09 0.10 Belarussia 0.012 0.014 0.016 0.018 0.020 0.022 Russia 2.0 2.5 3.0 3.5 4.0 4.5 Brazil 6.1 6.2 6.3 6.4 6.5 6.6 China 60.0 62.0 64.0 66.0 68.0 India ‐17% +49% ‐18% +5% ‐41% +5%

Crop Nutrient Affordability a Significant Tailwind for Farmers 5 0.50 0.75 1.00 1.25 1.50 1.75 05 06 07 08 09 10 11 12 13 14 15 16 Plant Nutrient Affordability Plant Nutrient Price Index / Crop Price Index Affordability Metric Average (2010‐present) Source: Weekly Price Publications, CME, USDA, AAPFCO, Mosaic Based on actual market prices

Challenges Lead to Strength 6 Positive Secular Trend Underpins Long‐Term Demand Growth Impact on Mosaic: Cyclicality presents opportunities Resilient business: • Effective cost control • Prudent balance sheet management Agriculture different from hard commodities

2015 Highlights 7 2015 EPS up 4 percent over last year $1.1 billion in share repurchases and dividends Lowest SG&A in six years Esterhazy K3 shaft on time, on budget CF and ADM acquisitions fully integrated Sulfur melter commissioned MicroEssentials® expansion on track Ma’aden JV expected to begin ammonia production in 2016

Financial Results Review

0% 5% 10% 15% 20% 25% $‐ $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016F Q2‐Q4 2016F Avg. GM % GM % Range Realized DAP Price DAP Stripping Margin Phosphates: Unchanged Positive Outlook 9 Impact of seasonal weakness and raw materials lag Source: Mosaic Stripping Margin: the difference between the fob plant price of DAP and the cost of sulphur and ammonia in one tonne of DAP

Phosphates Guidance Phosphates 2016 Q1 Sales Volumes 1.8 to 2.2 million tonnes Q1 DAP Selling Price $350 to $370 per tonne Q1 Gross Margin Rate Around 10 percent Q1 Operating Rate 70 to 80 percent Full Year Sales Volumes 9 to 10 million tonnes Global Shipments 65 to 67 million tonnes 10

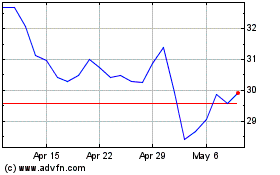

Potash: Optimizing Value 11 $‐ $20 $40 $60 $80 $100 $120 $140 $160 $230 $240 $250 $260 $270 $280 $290 $300 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 G r os s M a r g i n / M T A v e r a g e M O P P r i c e / M T GM/mt Average MOP Price/mt Maintaining profitability despite declining prices Includes impact of production shutdowns Source: Mosaic

Potash Guidance Potash 2016 Q1 Sales Volumes 1.5 to 1.9 million tonnes Q1 MOP Selling Price $200 to $230 per tonne Q1 Gross Margin Rate Low to mid 20 percent Q1 Operating Rate 70 to 80 percent range Full Year Sales Volumes 7.5 to 8.5 million tonnes Global Shipments 58 to 60 million tonnes 12

International Distribution: Weak Real a Positive for Brazil Agriculture Brazil: Credit + Stable Soybean Prices = Strong H2 Soybean Prices Soybean Prices Monthly Average of CBOT Daily Nearby Close Main concern: ongoing credit issues Source: Mosaic 13 4 8 12 16 20 24 28 32 36 2 4 6 8 10 12 14 16 18 09 10 11 12 13 14 15 Reais$ BuUS$ Bu USD Bu Brazilian Reais Bu

International Distribution Guidance International Distribution 2016 Q1 Sales Volumes 1.0 to 1.2 million tonnes Q1 Gross Margin per Tonne Approximately $10 per tonne Full Year Sales Volumes 6 to 7 million tonnes 14

Full-Year Guidance Summary Consolidated Full-Year 2016 Total SG&A $350 to $370 million Capital Expenditures and Equity Investments $1.2 to $1.4 billion Effective Tax Rate Upper teens 15 Potash 2016 Full-Year Canadian Resources Taxes and Royalties $180 to $220 million Full-Year Brine Management Costs $160 to $180 million

Closing Commentary

Strong Cash Generation Through Cycle O p e r a t i n g C a s h / W e i g h t e d A v e r a g e D i l u t e d S h a r e A v e r a g e M O P p r i c e 17 $0 $75 $150 $225 $300 $375 $450 $525 $4.40 $4.60 $4.80 $5.00 $5.20 $5.40 $5.60 $5.80 2012 2013 2014 2015 Net cash provided by operating activities per weighted average diluted share Average MOP price

Thank You The Mosaic Company Earnings Conference Call – Fourth Quarter 2015 February 11, 2016

Appendix

Phosphates Segment Highlights Key Drivers: • The year‐over‐year decrease in net sales is driven by lower sales volumes and lower average selling prices. • The year‐over‐year decrease in operating earnings reflects lower finished product selling prices and lower operating rates, partially offset by lower ammonia and sulfur costs. $ In millions, except DAP price Q4 2015 Q3 2015 Q4 2014 Net sales $1,031 $1,032 $1,212 Gross margin $121 $199 $231 Percent of net sales 12% 19% 19% Operating earnings $47 $157 $157 Sales volumes 2.2 2.1 2.4 Production volume(a) 2.2 2.4 2.4 Finished product operating rate 76% 83% 81% Avg DAP selling price $410 $451 $447 (a) Includes crop nutrient dry concentrates and animal feed ingredients 0 50 100 150 200 250 300 Q4 2014 OE Sales price Sales volumes Raw materials Other Q4 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 20

Potash Segment Highlights Key Drivers: • The decrease in net sales compared to last year was driven by lower sales volumes and lower average selling prices. • The year‐over‐year decrease in gross margin rate was primarily driven by lower realized prices and lower operating rates, partially offset by the weak Canadian dollar and expense management initiatives. 21 $ In millions, except MOP price Q4 2015 Q3 2015 Q4 2014 Net sales $572 $492 $763 Gross margin $155 $97 $327 Percent of net sales 27% 20% 43% Gross margin (excluding CRT)* $211 $156 $375 Percent of net sales* 37% 32% 49% Operating earnings $113 $66 $229 Sales volumes 1.9 1.6 2.3 Production volume 1.9 1.8 2.6 Production operating rate 70% 67% 91% Avg MOP selling price $254 $265 $295 0 50 100 150 200 250 Q4 2014 OE Sales price Sales volumes Production and other Resource taxes & royalties Q4 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS *reconciliation in the appendix

International Distribution Segment Highlights Key Drivers: • The increase in net sales was driven by higher sales volumes, partially offset by lower average realized prices. • Operating earnings declined by $8 million from last year, reflecting lower margins on existing inventory, partially offset by the weak Brazilian Real. 22 $ In millions, except Blends price Q4 2015 Q3 2015 Q4 2014 Net sales $605 $825 $516 Gross margin $38 $61 $41 Percent of net sales 6% 7% 8% Operating earnings $14 $44 $22 Sales volumes 1.5 2.0 1.1 Margin per tonne $26 $30 $37 Average realized price (FOB destination) $407 $400 $456 0 50 100 150 Q4 2014 OE Sales volumes & mix Product cost Sales price Other Q4 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS

Q4 2015 Percent Ammonia ($/tonnes) Realized in COGS $404 Average Purchase Price $413 Sulfur ($/ton) Realized in COGS $146 Average Purchase Price $133 Phosphate rock (realized in COGS) ('000 tonnes) U.S. mined rock 3,572 91% Purchased Miski Mayo Rock 340 9% Other Purchased Rock 9 0% Total 3,921 100% Average cost / tonne consumed rock $60 Raw Material Cost Detail 23

(a) These factors do not change in isolation; actual results could vary from the above estimates (b) Assumes no change to KMAG pricing Earnings Sensitivity to Key Drivers(a) 24 2015 Q4 Actual Change 2015 Q4 Margin % Actual % Impact on Segment Margin Pre-Tax Impact EPS Impact Marketing MOP Price ($/tonne)(b) $254 $50 27% 13% $74 $0.18 Potash Volume (thousand tonnes) 1,931 500 27% 16% $89 $0.22 DAP Price ($/tonne) $410 $50 12% 11% $111 $0.27 Phosphate Volume (thousand tonnes) 2,212 500 12% 5% $50 $0.12 Raw Materials Sulfur ($/lt) $146 $50 12% 5% $49 $0.12 Ammonia ($/tonne) $404 $50 12% 2% $25 $0.06

Phosphate Raw Material Trends Ammonia Sulfur ($/tonne) ($/tonne) 1. Market ammonia prices are average prices based upon Tampa C&F as reported by Fertecon 2. Market sulfur prices are average prices based upon Tampa C&F as reported by Green Markets 3. Realized raw material costs include: ~$20/tonne of transportation, transformation and storage costs for sulfur ~$30/tonne of transportation and storage costs for ammonia 25 0 100 200 300 400 500 600 700 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016F Realized Costs Market Prices 0 25 50 75 100 125 150 175 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016F Realized Costs Market Prices 1 2

Global Phosphate Shipment Forecasts by Region (February 11, 2016) Million Tonnes DAP/MAP/NPS*/TSP 2014R 2015E Nov Low 2016F Nov High 2016F Feb Low 2016F Feb High 2016F Comments China 21.4 19.6 20.8 21.2 20.6 20.9 Shipments of high analysis products declined last year due to moderate demand growth, delays in the winter stockpiling program, and competition from lower analysis products. We project a rebound this year based on continued profitable farm economics ‐‐ despite lower corn support prices and the VAT tax. India 7.7 9.2 9.1 9.4 8.5 8.8 Shipments and imports popped 1.5 and 2.5 mmt, respectively, last year with importers entering the market for large tonnage early in 2015/16. A below average monsoon hindered on‐farm demand and led to a buildup of channel stocks. Our 2016 forecast has been cut to reflect a pulldown of inventories. Other Asia/Oceania 7.6 8.5 7.8 8.1 8.1 8.3 Shipments last year exceeded our earlier forecast despite weaker and volatile currencies and weather issues in some regions. Our 2016 forecast is up slightly from the November forecast as a result of profitable farm economics, average to below‐average channel inventories and more stable foreign exchange rates. Europe and FSU 4.8 4.7 5.8 5.9 5.3 5.5 Shipments were about flat in 2015 (from a re‐based level of ~4.8 mmt). Shipments in 2016 are projected to rebound due to steady to modestly higher shipments in Europe and stronger gains in the FSU. Weak currencies such as the ruble are expected to boost agricultural exports and phosphate use. Brazil 7.5 6.9 7.1 7.5 7.0 7.3 The collapse of the real and lack of credit resulted in a drop in shipments in 2015. The decline was about in line with the drop in phosphate use so channel inventories remained above‐average. A modest rebound is expected due to lower phosphate prices, strong farm economics, and improved credit availability. Other Latin America 3.2 3.0 3.2 3.4 3.2 3.4 Shipments held up a bit better than expected in 2015, but still showed a modest year‐ over‐year decline. Shipments are forecast to rebound this year as a result of steady agricultural commodity prices, more stable currencies and potentially much higher imports by Argentina. North America 8.9 9.0 8.8 9.0 8.8 9.0 Shipments exceeded our prior forecast for 2015 following a solid fall application season. Our 2016 forecast is unchanged from last November and assumes that markets will bid for, and farmers will plant, 90‐91 million acres of corn, 82‐83 million acres of soybeans, and 52‐53 million acres of wheat this year. Other 4.0 3.5 3.4 3.6 3.6 3.8 Continued moderate growth is expected in Africa and parts of the Mideast. Total 64.9 64.4 66.0 68.0 65.0 67.0 Shipments last year were revised down 1.0 million tonnes from our prior point estimate largely due to much lower‐than‐expected Chinese shipments. We have lowered 2016 guidance 1.0 million tonnes to 65‐67 million with a point estimate of 65.5 million mostly as a result of lower Indian shipments. Source: CRU and Mosaic. Numbers may not sum to total due to rounding. * NPS products included in this analysis are those with a combined N and P2O5 nutrient content of 45 units or greater.