UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2015

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) On March 5, 2015, the Board of Directors (the “Board”) of The Mosaic Company (the “Company”) approved the Mosaic LTI Deferral Plan (the “Plan”). The Plan is a nonqualified deferred compensation plan under which member of the Board and eligible employees (generally eligible executive officers or other highly compensated employees) may elect to defer all or a portion of certain long-term incentive awards (“LTI Awards”) granted under The Mosaic Company 2014 Stock and Incentive Plan (the “2014 Incentive Plan”).

Deferral elections generally must be made in the calendar year before the year in which the award is granted, provided that the Company may also permit deferral elections (i) with respect to performance-based awards, no later than six months before the end of the applicable performance period or an earlier date set by an authorized officer, (ii) within the first thirty days after the date of the award or grant for certain awards that are subject to a substantial risk of forfeiture that will not lapse until at least thirteen months after the date of the award or grant, or (iii) during any other period established by an authorized officer of the Company that complies with section 409A of the Internal Revenue Code (the “Code”). In each case, the deferral election must be stated as either 25%, 50%, 75%, or 100% of the LTI Award.

LTI Awards are subject to the terms of the 2014 Incentive Plan and the related award agreement, and the Plan. LTI Awards to be settled in shares of the Company’s common stock will be made under the terms and conditions of the 2014 Incentive Plan and the applicable award agreement, and subject to the terms of the Plan. LTI Awards to be settled in cash will be paid under the terms and conditions of the Plan and credited with interest as provided in the Plan.

When making a deferral election with respect to a particular award, a participant may also elect the payment schedule with respect to that award. Participants can elect to receive payments as a lump sum or in annual installments over three, five or ten years, with the lump sum or first installment paid on January 30 (or the next business day if January 30 is not a business day) of the commencement year elected by the participant. Any participant who does not make a payment election with respect to an award will receive a lump sum payment with respect to that award, and any participant who does not specify the commencement date will be deemed to have elected to begin receiving payment on the first January 30 (or the next business day if January 30 is not a business day) after the fourth anniversary of the grant date. Upon a participant’s death, the Plan provides for distribution of a participant’s benefit in a lump sum, regardless of any prior election to receive annual installments, with distribution made on the earlier of the date elected by the participant or the third anniversary of the participant’s death. Notwithstanding the Plan’s terms or the participant’s deferral election, if a participant is a “specified employee” as defined in section 409A of the Code, Plan distributions otherwise commencing upon a separation from service shall instead begin upon the six month anniversary of the separation from service, or if earlier, the participant’s death. Distribution from the Plan will also be delayed if such payment would cause the Company to lose its compensation deduction for such payment under section 162(m) of the Code or if such payment would violate Federal securities laws or other applicable law.

The deferred compensation obligations under the Plan are general unsecured obligations of the Company to pay deferred compensation in the future in accordance with the terms of the Plan. Participants will be unsecured general creditors of the Company with respect to all deferred compensation obligations owed to them under the Plan.

The Plan is administered by the Compensation Committee of the Board, which may delegate specific duties to Company employees or other individuals or entities. The Board may amend the Plan at any time, and by action of certain Board committees the Company may at any time terminate the Plan, provided generally that no amendment or termination may reduce a participant’s LTI Awards determined as of the date of the amendment or termination without the participant’s consent.

The foregoing description of the Plan does not purport to be complete and is qualified in its entirety by reference to the complete text of Plan, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibit filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: March 11, 2015 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

10.1 | | Mosaic LTI Deferral Plan |

| |

MOSAIC LTI DEFERRAL PLAN

MOSAIC LTI DEFERRAL PLAN

TABLE OF CONTENTS

Page

Section 8.7.Knowledge of Fact by Participant Imputed to Beneficiary and Others Section 9.1.No Guarantee of Employment or Retention to Perform Services

MOSAIC LTI DEFERRAL PLAN

The Mosaic Company (the “Company”) established this Mosaic LTI Deferral Plan (the “Plan”), effective March 5, 2015, for the benefit of certain employees (generally executives and highly compensated employees) and non‑employee directors of the Company.

The Plan shall apply to LTI Awards deferred on or after the Plan’s effective date. The Plan is maintained with the understanding that the Plan is not subject to ERISA with respect to: (i) non‑employee directors because they are not employees, and (ii) employees because the Plan is not intended to provide retirement income for employees or defer compensation to termination or a period after termination. The Plan is subject to section 409A of the Code. Each provision shall be interpreted and administered accordingly. Notwithstanding the foregoing, neither the Company nor any of its officers, directors, agents or affiliates shall be obligated, directly or indirectly, to any Participant or any other person for any taxes, penalties, interest or like amounts that may be imposed on the Participant or other person on account of any amounts under this Plan or on account of any failure to comply with the Code.

The obligation of the Company to make payments under the Plan constitutes an unsecured (but legally enforceable) promise of the Company to make such payments and no person, including any Participant or Beneficiary, shall have any lien, prior claim or other security interest in any property of the Company as a result of the Plan. Notwithstanding a Participant’s deferral of an LTI Award settled in shares of Common Stock, the payment of such LTI Award shall be made under and subject to the LTI Award and The Mosaic Company 2014 Stock and Incentive Plan and any shares, when issued, are issued pursuant to The Mosaic Company 2014 Stock and Incentive Plan.

ARTICLE 1

DEFINITIONS, GENDER, AND NUMBER

Section 1.1. Definitions. Whenever used in the Plan, the following words and phrases shall have the meanings set forth below unless the context plainly requires a different meaning, and when a defined meaning is intended, the term is capitalized.

| |

(a) | “Account” means all of a Participant’s LTI Awards subject to a Deferral Election Agreement that have not been paid to the Participant. |

| |

(b) | “Administratively Reasonable Period of Time” means a payment under the Plan will be made as soon as administratively practicable on or after a specified date and no later than (i) within the same calendar year as such specified date, or, if later, (ii) by the fifteenth (15th) day of the third (3rd) calendar month following such specified date. |

| |

(c) | “Affiliate” means any corporation which is a member of a controlled group of corporations (as defined in section 414(b) of the Code) which includes the Company and any trade or business (whether or not incorporated) which is under common control (as defined in section 414(c) of the Code) with the Company. |

| |

(d) | “Authorized Officer” means the Senior Vice President of Human Resources. |

| |

(e) | “Beneficiary” or “Beneficiaries” means the persons or trusts designated by a Participant in writing pursuant to Section 4.2(b) of the Plan as being entitled to receive any benefit payable under the Plan by reason of the death of a Participant, or, in the absence of such designation, the Participant’s estate. |

| |

(f) | “Board” means the Board of Directors of the Company, as constituted at the relevant time. |

| |

(g) | “Change in Control” means a change in control as defined under the award agreement to which a deferral relates; provided, however, that in all cases a change in control shall meet the definition of a change in control under section 409A of the Code or it will not be considered a change in control. |

| |

(h) | “Code” means the Internal Revenue Code of 1986, including applicable regulations for the specified section of the Code. Any reference in this Plan to a section of the Code, including the applicable regulation, shall be considered also to mean and refer to any subsequent amendment or replacement of that section or regulation. |

| |

(i) | “Commencement Date” shall mean the date that payment will commence as provided under Section 4.1(a) or as provided under a Participant’s Deferral Election Agreement. |

| |

(j) | “Committee” means the Compensation Committee of the Board, except with respect to actions and determinations involving Directors, Committee shall mean the Corporate Governance and Nominating Committee of the Board (the “Governance Committee”). |

| |

(k) | “Company” means The Mosaic Company or any successor thereto. |

| |

(l) | “Deferral Election Agreement” means an agreement by a Participant to defer all or a portion of an LTI Award under the Plan. |

| |

(m) | “Director” means a member of the Company’s Board of Directors who is not an employee of the Company. |

| |

(n) | “Disabled” or “Disability” means a condition in which either: (i) the Participant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than twelve months, or (ii) the Participant is, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than twelve months, receiving replacement benefits for a period of not less than three months under an accident and health plan covering employees of the Company and its Affiliates. |

| |

(o) | “Enrollment Period” means the period during which a Participant may elect to defer all or a portion of his or her LTI Awards that may be granted in such Plan Year (for this purpose, an LTI Award shall be considered granted when the Company takes action to approve such grant), which shall be either (i) prior to January 1 of each Plan Year, provided that such election shall be made as of the times the Authorized Officer may prescribe and shall be irrevocable as of December 31 of the year immediately preceding the Plan Year for which such elections are effective, or (ii) a period provided for under Section 3.1(a). |

| |

(p) | “LTI Award” means a long-term incentive award, payable in shares of Common Stock or cash, granted by the Company. |

| |

(q) | “Participant” means: (i) a U.S. Based employee (generally, an executive or a highly compensated employee) designated by the Authorized Officer, or (ii) a Director; in each case who has commenced participation in the Plan (by electing to defer an LTI Award). |

| |

(r) | “Plan” means the “Mosaic LTI Deferral Plan.” The Plan is set forth in a document effective as of March 5, 2015 and subsequent amendments to that plan documents. |

| |

(s) | “Plan Year” means January 1 through December 31. |

| |

(t) | “Qualified Domestic Relations Order” has the same meaning as in section 414(p) of the Code. |

| |

(u) | “Separation from Service” means a separation from service for the purposes of section 409A of the Code. |

| |

(v) | “Specified Employee” means a specified employee for the purposes of section 409A of the Code. |

Section 1.2. Gender and Number. Except as otherwise indicated by context, masculine terminology used herein also includes the feminine and neuter, and terms used in the singular may also include the plural.

ARTICLE 2

PARTICIPATION

Section 2.1. Who May Participate. Participation in the Plan is limited to Participants.

Section 2.2. Termination and Suspension of Participation. Once an individual has become a Participant in the Plan, participation shall continue until the first to occur of: (i) payment in full of all benefits to which the Participant or his or her Beneficiary is entitled under the Plan, or (ii) the occurrence of the event specified in Section 2.3 which results in loss of benefits.

Section 2.3. Missing Persons. Each Participant and Beneficiary entitled to receive benefits under the Plan shall be obligated to keep the Company informed of his or her current address until all Plan benefits that are due to be paid to the Participant or Beneficiary have been paid to him or her. If the Company is unable to locate the Participant and the Company has not received notice that the Participant has died, the Participant’s LTI Awards under the Plan will be forfeited as of the date that is five years after the date the payment was due. If the payment was to be made in installments, all unpaid installments shall be forfeited as of the date that is five years after the date the first installment payment was due. If the Company locates the Participant or receives notice of the Participant’s death after the forfeiture of the Participant’s LTI Awards, the Participant’s LTI Awards will not be reinstated and the Plan will owe no amount to the Participant or the Participant’s Beneficiaries. If payment is delayed because the Participant is missing or the Company does not receive timely notice of the Participant’s death, neither the Company nor any of its officers, directors, agents or affiliates shall be obligated, directly or indirectly, to any Participant or any other person for any taxes, penalties, interest or like amounts that may be imposed on the Participant or other person on account of any amounts paid under this Plan or on account of any failure to comply with the Code.

ARTICLE 3

DEFERRALS, CREDITING, AND VESTING

Section 3.1. Deferrals.

| |

(a) | Amount of Deferrals. Subject to the following rules and any rules adopted by the Authorized Officer, during the applicable Enrollment Period a Participant may elect to defer either twenty‑five percent (25%), fifty percent (50%), seventy‑five percent (75%), or one hundred percent (100%) of the LTI Award under a Deferral Election Agreement. The Committee, in the case of Directors, or the Authorized Officer, in the case of all other Participants, may, from time to time, change the minimum and maximum allowable elective deferrals, although such changes will take effect only with respect to LTI, if any, issued by the Company following the effectiveness of such changes. |

Notwithstanding the foregoing, to the extent allowed by the Authorized Officer, a Participant also may elect to defer all or a portion of his or her LTI Awards at the following times: (i) if the LTI Award is performance based compensation (as defined under section 409A of the Code), the election may be made no later than six months before the end of the performance period specified in the applicable award agreement or such earlier date as set by the Authorized Officer; (ii) if the LTI Award is subject to a substantial risk of forfeiture that will not lapse until at least thirteen months after the date of award or grant (or earlier upon death, Disability or a Change in Control), the election may be made no later than the first thirty days after the date of award or grant; provided that if the LTI Award actually vests within the first thirteen months by reason of death, Disability, or a Change in Control, then the deferral election shall be cancelled; and (iii) any other period established by the Authorized Officer that complies with section 409A of the Code.

| |

(b) | Separate Elections. A Participant shall make separate elections in a Deferral Election Agreement for each individual LTI Award. |

| |

(c) | Distribution Election. At the time a Participant enters into a Deferral Election Agreement, the Participant shall elect the time and form of distribution for the amount deferred under the Deferral Election Agreement, subject to the terms of Section 4 of the Plan. |

Section 3.2. Crediting.

| |

(a) | Deferral of Cash Settled LTI Awards. If a Participant elects to defer all or a portion of an LTI Award paid in cash, the administration, recordkeeping, and payment of such LTI Award shall be handled under this Plan after the |

payment date under the award agreement for such LTI Award. Once this Plan assumes the recordkeeping responsibility, the amount deferred in cash shall be credited each year effective as of December 31 with interest at the Applicable Federal Rate (“AFR”) as of that month. In addition, if the amount is paid prior to December 31, the amount shall be credited with interest at the AFR rate as of the month preceding the date of payment, pro-rated for the portion of the year preceding the date of payment.

This Section 3.2(a) shall also apply to any cash payment made under an LTI Award settled in shares of the Company’s common stock, par value $.01 per share (“Common Stock”), to the extent specified in the related award agreement.

| |

(b) | Deferral of Share Settled LTI Awards. If a Participant elects to defer all or a portion of an LTI Award to be issued in shares of Common Stock, and the payment of such LTI Award, shall be made under and subject to the LTI Award and The Mosaic Company 2014 Stock and Incentive Plan, and paid as specified in the Participant’s Deferral Election Agreement or as provided under Section 4 of this Plan. Such awards shall also be subject to the terms of this Plan. |

| |

(c) | In General. The Committee may revise the crediting rules under this Section 3.2 from time to time in the Committee’s discretion. |

Section 3.3. Vesting. Subject to forfeiture under Section 2.3, once a Participant’s LTI Award vests according to the LTI Award’s terms, the LTI Award shall be one hundred percent (100%) vested.

ARTICLE 4

DISTRIBUTION

Section 4.1. Distribution of Deferrals. Except as provided under Section 4.2, distribution to a Participant shall be made at the time and in the form specified by the Participant in his or her Deferral Election Agreement according to the following rules.

| |

(a) | Time of Distribution. A Participant may elect a Commencement Date which shall be January 30 (or the next succeeding business day if January 30 is not a business day) of the year elected by the Participant on the Participant’s Deferral Election Agreement (or within the Administratively Reasonable Period of Time thereafter). If the Participant does not specify the Commencement Date in a Deferral Election Agreement, the Participant will be deemed to have elected to have the LTI Award deferred under a Deferral Election Agreement distributed on the first January 30 (or the next succeeding business day if January 30 is not a business day) after the fourth anniversary |

of the grant date for an LTI Award (or within the Administratively Reasonable Period of Time thereafter).

| |

(b) | Form of Distribution. A Participant shall elect whether distribution of an LTI Award deferred under a Deferral Election Agreement shall be paid out on the Commencement Date: (i) in a single payment or lump sum payment; or (ii) in annual installments over a period of three, five, or ten years following the Commencement Date. If the Participant does not specify the form of distribution in a Deferral Election Agreement, the Participant will be deemed to have elected to have the LTI Award deferred under a Deferral Election Agreement distributed all in a single payment or lump sum payment. |

| |

(c) | Determination of Amount of Installment Payment. If a Participant elects to have distribution made in the form of installments pursuant to Section 4.1(b)(ii), the amount of each installment payment shall be determined by multiplying the amount of the LTI Award deferred under a Deferral Election Agreement subject to the election by a fraction, the denominator of which in the first year of payment equals the number of years over which benefits are to be paid, and the numerator of which is one. The amounts of the payments for each succeeding year shall be determined by multiplying the balance of the LTI Award deferred under a Deferral Election Agreement subject to the election as of the applicable anniversary of the payment Commencement Date by a fraction, the denominator of which equals the number of remaining years over which the LTI Award is to be paid, and the numerator of which is one. The LTI Award deferred under a Deferral Election Agreement will be credited as described in Section 3.2. If shares of Common Stock are being distributed the value of any fractional shares shall be paid in cash at the same time in lieu of a fractional share. |

| |

(d) | Disability, Qualified Change in Control Termination (Separation from Service with respect to a Change in Control), and Change in Control. Neither the time nor form of payment of a deferred LTI Award hereunder will be altered due to a Participant becoming Disabled, the Participant experiencing a qualified change in control termination, or the Company experiencing a Change in Control. |

Section 4.2. Exception to Payment Terms. Notwithstanding the Participant’s Deferral Election Agreement or anything in this Article 4 to the contrary, the following rules apply to the time and form of payment:

| |

(a) | Death. If a Participant dies, then, notwithstanding Section 4.1(a) or a Participant’s Deferral Election Agreement to the contrary, the Participant’s LTI Award subject to the Deferral Election Agreement shall be distributed to the Participant’s Beneficiary in a lump sum as of the earlier of (i) the date elected by the Participant on the Deferral Election Agreement, or (ii) on the |

date that is the third anniversary of the Participant’s death (or within the Administratively Reasonable Period of Time thereafter).

Each Participant may from time to time designate one or more persons (who may be any one or more members of such person’s family or other persons, administrators, trusts, foundations or other entities) as the Participant’s Beneficiary under the Plan. Such designation shall be made on a form prescribed by the Human Resources Department. Each Participant may, at any time, and from time to time, change any previous Beneficiary designation, without notice to or consent of any previously designated Beneficiary, by amending his or her previous designation on a form prescribed by the Human Resources Department. If the Beneficiary does not survive the Participant (or is otherwise unavailable to receive payment) or if no Beneficiary is validly designated, then the amounts payable under the Plan shall be paid to the Participant’s estate. If more than one person is the Beneficiary of a deceased Participant, each such person shall receive a pro rata share of any death benefit payable unless otherwise designated on the applicable Beneficiary designation form. If a Beneficiary who is receiving benefits dies, all benefits that were payable to such Beneficiary shall then be payable to the estate of that Beneficiary.

| |

(b) | Small Deferral Payment. If the aggregate balance of all the Participant’s amounts in all similar plans maintained by the Company (as defined under section 409A of the Code) after a Participant’s Separation from Service is less than the limit under section 402(g) of the Code, then the Company may pay out the Participant’s LTI Awards under this Plan and all other similar plans maintained by the Company, if permitted under the plans and the Code. |

| |

(c) | Delay in Distributions. |

| |

(i) | If the Participant is a Specified Employee, any Plan distributions that are otherwise to commence on the Participant’s Separation from Service shall commence within the Administratively Reasonable Period of Time after the six month anniversary of the Participant’s Separation from Service, or if earlier, the Participant’s death. |

| |

(ii) | The Company shall delay the distribution of any amount otherwise required to be distributed under the Plan if, and to the extent that, the Company reasonably anticipates that the Company’s deduction with respect to such distribution otherwise would be limited or eliminated by application of section 162(m) of the Code. In such event, the distribution will be made at the earliest date on which the Company reasonably anticipates that the deduction of the distribution will not be limited or eliminated by section 162(m) of the Code. |

| |

(iii) | The Company shall delay the distribution of any amount otherwise required to be distributed under the Plan if, and to the extent that, the Company reasonably anticipates that the making of the distribution would violate Federal securities laws or other applicable law. In such event, the distribution will be made at the earliest date on which the Company reasonably anticipates that the making of the distribution will not cause such a violation. |

| |

(d) | Acceleration of Distributions. All or a portion of a Participant’s LTI Awards may be distributed at an earlier time and in a different form than specified in this Article 4: |

| |

(i) | As may be necessary to fulfill a Qualified Domestic Relations Order or a certificate of divestiture (as defined in section 1043(b)(2) of the Code). |

| |

(ii) | The Company may deduct from an LTI Award after it has vested and other conditions related to the LTI Award are met an amount necessary to cover federal and state employment taxes to the extent permitted under 26 C.F.R. § 1.409A‑3(j)(4)(vi) and (xi) (to the extent that such taxes are due at that time). |

| |

(iii) | Due to a failure of the Plan to satisfy section 409A of the Code with respect to the Participant, but only to the extent an amount is required to be included in the Participant’s income as a result of such failure. |

Section 4.3. Distributions on Plan Termination. Notwithstanding anything in this Article 4 to the contrary, if the Plan is terminated, distributions shall be made in accordance with Section 7.2.

Section 4.4. Forfeiture for Misconduct. Notwithstanding anything in this Plan to the contrary, with respect to each LTI Award deferred under this Plan, if fraudulent or intentional misconduct contributes to the need for a material restatement of all or a portion of the Company’s financial statements filed with the Securities and Exchange Commission or otherwise contributes to the use of inaccurate metrics to determine the amount of any LTI Award granted to any Participant under The Mosaic Company 2014 Stock and Incentive Plan (including any profit from the sale of stock that was the subject of an LTI Award) or accrued by the Company in respect of any LTI Award, in addition to any other disciplinary or other action available to the Company under any agreement, Company policy including its Code of Business Conduct and Ethics, applicable law or otherwise, the Board, upon the recommendation of the Committee, may require any Participant to forfeit any LTI Award made to, and/or reimburse the Company the amount of any incentive compensation paid to, or received or earned by, such Participant or accrued by the Company in connection with any LTI Award, provided that such Participant either knowingly or grossly negligently engaged in such misconduct, or grossly negligently failed to prevent such misconduct, if in any such case the amount of such LTI Award or incentive compensation was greater than it would have been absent the misconduct.

ARTICLE 5

FUNDING

Section 5.1. Source of Benefits. All benefits under the Plan shall be paid when due by the Company out of its assets. Any amounts set aside by the Company for payment of benefits under the Plan are the property of the Company.

Section 5.2. No Claim on Specific Assets. No Participant shall be deemed to have, by virtue of being a Participant in the Plan, any claim on any specific assets of the Company such that the Participant would be subject to income taxation on his or her benefits under the Plan prior to distribution, and the rights of Participants and Beneficiaries to benefits to which they are otherwise entitled under the Plan shall be those of an unsecured general creditor of the Company.

ARTICLE 6

ADMINISTRATION AND FINANCES

Section 6.1. Administration. The Plan shall be administered by the Committee. The Company shall bear all administrative costs of the Plan other than those specifically charged to a Participant or Beneficiary.

Section 6.2. Powers of Committee. In addition to the other powers granted under the Plan, the Committee shall have all powers necessary to administer the Plan, including, without limitation, powers:

| |

(a) | to interpret the provisions of the Plan; |

| |

(b) | to establish and revise the method of tracking amounts under the Plan; and |

| |

(c) | to establish rules for the administration of the Plan and to prescribe any forms required to administer the Plan. |

The Committee delegates the day‑to‑day administration of the Plan to the Authorized Officer. In addition, the Committee may delegate any of its powers (other than the power to amend or terminate the Plan) to the Global Benefits Committee or to the Authorized Officer.

Section 6.3. Actions of the Committee. The Committee (including any person or entity to whom the Committee has delegated duties, responsibilities or authority, to the extent of such delegation) has total and complete discretionary authority to determine conclusively for all parties all questions arising in the administration of the Plan, to interpret and construe the terms of the Plan and to determine all questions of eligibility and status of employees, Participants and Beneficiaries under the Plan and their respective interests. Subject to the claims and review procedures described in Article 8, all determinations, interpretations, rules and decisions of the Committee (including those made or established by any person or entity to whom the Committee has delegated duties,

responsibilities or authority, if made or established pursuant to such delegation) are conclusive and binding upon all persons having or claiming to have any interest or right under the Plan.

Section 6.4. Delegation. The Committee, or any officer or other employee of the Company designated by the Committee, shall have the power to delegate specific duties and responsibilities to officers or other employees of the Company or other individuals or entities. Any delegation may be rescinded by the Committee at any time. Each person or entity to whom a duty or responsibility has been delegated shall be responsible for the exercise of such duty or responsibility and shall not be responsible for any act or failure to act of any other person or entity.

Section 6.5. Reports and Records. The Committee, and those to whom the Committee has delegated duties under the Plan, shall keep records of all their proceedings and actions and shall maintain books of account, records, and other data as shall be necessary for the proper administration of the Plan and for compliance with applicable law.

Section 6.6. Valuation. As of such valuation dates determined by the Company, the Company shall adjust the valuation of a Participant’s deferred LTI Awards (as applicable).

Section 6.7. Committee Member Participating in Plan. If a member of the Committee is a Participant, such Committee member shall not be a part of, and shall not participate in any way, in any determination or decision with respect to the manner or timing of benefit distributions to him or her individually or the permissibility of withdrawals by him or her individually.

ARTICLE 7

AMENDMENTS AND TERMINATION

Section 7.1. Amendments. The Company, by written action of the Board may amend the Plan, in whole or in part, at any time and from time to time. The Committee may amend the Plan, without approval or authorization of the Board, provided that any such amendment: (i) does not materially increase the cost of the Plan; or (ii) is required in order to comply with the law, in which case the Committee shall amend the Plan in such manner as the Committee deems necessary or desirable to comply with the law. To the extent an amendment approved by the Committee affects Directors, the amendment must also be approved by the Governance Committee. An amendment shall not reduce a Participant’s deferred LTI Awards determined as of the date of such amendment without such Participant’s or Beneficiary’s consent.

Section 7.2. Termination. The Company, by action of the Committee and Governance Committee, may at any time terminate the Plan, and reduce, suspend or discontinue future contributions to the Plan. The termination of the Plan shall not reduce a Participant’s deferred LTI Awards determined as of the date of such amendment without such Participant’s or Beneficiary’s consent. If the Plan is terminated, the Company shall terminate the Plan in accordance with the provisions permitting plan termination under section 409A of the Code.

ARTICLE 8

CLAIM PROCEDURES

Section 8.1. Determinations. The benefits under the Plan will be paid only if the Committee decides in its discretion that the applicant is entitled to them. The Committee has discretionary authority to grant or deny benefits under the Plan. The Committee shall have the sole discretion, authority and responsibility to interpret and construe this Plan and all relevant documents and information, and to determine all factual and legal questions under the Plan, including but not limited to, the entitlement of all persons to benefits and the amounts of their benefits. The Committee shall make such determinations as may be required from time to time in the administration of the Plan. This discretionary authority shall include all matters arising under the Plan. An application for a distribution shall be considered as a claim.

Section 8.2. Claims and Review Procedures. The claim and review procedures set forth in this section shall be the mandatory claims and review procedures for the resolution of disputes and disposition of claims filed under the Plan to be reviewed by the Committee.

| |

(a) | Initial Claim. An individual may, subject to any applicable deadline, file with the Authorized Officer a written claim for benefits under the Plan in a form and manner prescribed by such Authorized Officer. |

| |

(i) | If the claim is denied in whole or in part, the Authorized Officer shall notify the claimant of the adverse benefit determination within ninety days after receipt of the claim. |

| |

(ii) | The ninety-day period for making the claim determination may be extended for ninety days if the Authorized Officer determines that special circumstances require an extension of time for determination of the claim, provided that the Authorized Officer notifies the claimant, prior to the expiration of the initial ninety-day period, of the special circumstances requiring an extension and the date by which a claim determination is expected to be made. |

| |

(b) | Notice of Initial Adverse Determination. A notice of an adverse determination shall be set forth in a manner calculated to be understood by the claimant: |

| |

(i) | the specific reasons for the adverse determination; |

| |

(ii) | references to the specific provisions of this Plan (or other applicable Plan document) on which the adverse determination is based; |

| |

(iii) | a description of any additional material or information necessary to perfect the claim and an explanation of why such material or information is necessary; and |

| |

(iv) | a description of the claims and review procedures, including the time limits applicable to such procedure. |

| |

(c) | Request for Review. Within sixty days after receipt of an initial adverse benefit determination notice, the claimant may file with the Authorized Officer a written request for a review of the adverse determination and may, in connection therewith, submit written comments, documents, records and other information relating to the claim benefits. Any request for review of the initial adverse determination not filed within sixty days after receipt of the initial adverse determination notice shall be untimely. The Authorized Officer shall provide the request for review to the Committee. |

| |

(d) | Claim on Review. If the claim, upon review, is denied in whole or in part, the Committee shall notify the claimant of the adverse benefit determination within sixty (60) days after receipt of such a request for review. |

| |

(i) | The sixty-day period for deciding the claim on review may be extended for sixty days if the Committee determines that special circumstances require an extension of time for determination of the claim, provided the Committee notifies the claimant, prior to the expiration of the initial sixty-day period, of the special circumstances requiring an extension and the date by which a claim determination is expected to be made. |

| |

(ii) | In the event that the time period is extended due to a claimant’s failure to submit information necessary to decide a claim on review, the claimant shall have sixty days within which to provide the necessary information and the period for making the claim determination on review shall be tolled from the date on which the notification of the extension is sent to the claimant until the date on which the claimant responds to the request for additional information or, if earlier, the expiration of sixty days. |

| |

(iii) | The Committee’s review of a denied claim shall take into account all comments, documents, records, and other information submitted by the claimant relating to the claim, without regard to whether such information was submitted or considered in the initial benefit determination. |

| |

(e) | Notice of Adverse Determination for Claim on Review. A notice of an adverse determination for a claim on review shall be set forth in a manner calculated to be understood by the claimant: |

| |

(i) | the specific reasons for the denial; |

| |

(ii) | references to the specific provisions of this Plan (or other applicable Plan document) on which the adverse determination is based; |

| |

(iii) | a statement that the claimant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, all documents, records, and other information relevant to the claimant’s claim for benefits; and |

| |

(iv) | a statement describing any voluntary appeal procedures offered by the Plan and the claimant’s right to obtain information about such procedures. |

Section 8.3. Rules and Regulations.

| |

(a) | Adoption of Rules. Any rule not in conflict or at variance with the provisions hereof may be adopted by the Authorized Officer or the Committee. |

| |

(i) | No inquiry or question shall be deemed to be a claim or a request for a review of a denied claim unless made in accordance with the established claims and review procedures. The Committee may require that any claim for benefits and any request for a review of a denied claim be filed on forms to be furnished by the Committee upon request. |

| |

(ii) | All decisions on claims shall be made by the Committee, unless delegated as provided for in the Plan, in which case references in this section shall be treated as references to the delegate of the Committee. |

| |

(iii) | Claimants may be represented by a lawyer or other representative at their own expense, but the Committee reserves the right to require the claimant to furnish written authorization and establish reasonable procedures for determining whether an individual has been authorized to act on behalf of a claimant. A claimant’s representative shall be entitled to copies of all notices given to the claimant. |

| |

(iv) | The decision on a claim and on a request for a review of a denied claim may be provided to the claimant in electronic form instead of in writing. |

| |

(v) | In connection with the review of a denied claim, the claimant or the claimant’s representative shall be provided, upon request and free of charge, reasonable access to, and copies of, all documents, records, and other information relevant to the claimant’s claim for benefits. |

| |

(vi) | The time period within which a benefit determination will be made shall begin to run at the time a claim or request for review is filed in accordance with the claims and review procedures, without regard to whether all the information necessary to make a benefit determination accompanies the filing. |

| |

(vii) | The claims and review procedures shall be administered with appropriate safeguards so that benefit claim determinations are made in accordance with governing plan documents and, where appropriate, the plan provisions have been applied consistently with respect to similarly situated claimants. |

| |

(viii) | For the purpose of this section, a document, record, or other information shall be considered “relevant” if such document, record, or other information: (i) was relied upon in making the benefit determination; (ii) was submitted, considered, or generated in the course of making the benefit determination, without regard to whether such document, record, or other information was relied upon in making the benefit determination; (iii) demonstrates compliance with the administration processes and safeguards designed to ensure that the benefit claim determination was made in accordance with governing plan documents and that, where appropriate, the Plan provisions have been applied consistently with respect to similarly situated claimants; and (iv) constitutes a statement of policy or guidance with respect to the Plan concerning the denied treatment option or benefit for the claimant’s diagnosis, without regard to whether such advice or statement was relied upon in making the benefit determination. |

| |

(ix) | The Committee may, in its discretion, rely on any applicable statute of limitation or deadline as a basis for denial of any claim. |

Section 8.4. Deadline to File Claim. To be considered timely under the Plan’s claim and review procedures, a claim must be filed with the Authorized Officer within one (1) year after the claimant knew or reasonably should have known of the principal facts upon which the claim is based. If or to the extent that the claim relates to a failure to effect a Participant’s or Beneficiary’s investment directions or a Participant’s election regarding contributions, a claim must be filed with the Authorized Officer within thirty (30) days after the claimant knew or reasonably should have known of the principal facts upon which the claim is based.

Section 8.5. Exhaustion of Administrative Remedies. Notwithstanding any provision in this Plan, the exhaustion of the claims and review procedures is mandatory for resolving every claim and dispute arising under the Plan. As to such claims and disputes: (i) no legal action to recover Plan benefits or to enforce or clarify rights under the Plan under any provision of law, whether or not statutory, may be commenced until the claims and review procedures set forth herein have been exhausted in the entirety; and (ii) in any such legal action all explicit and all implicit determinations

by the Committee (including, but not limited to, determinations as to whether the initial request for benefits or request for review was timely filed) shall be afforded the maximum deference permitted by law.

Section 8.6. Deadline to File Legal Action. No legal action to recover Plan benefits or to enforce or clarify rights under the Plan under any provision of law, whether or not statutory, may be brought by any claimant on any matter pertaining to the Plan unless the legal action is commenced in the proper forum before the earlier of: (i) thirty months after the date the claimant knew or reasonably should have known of the principal facts on which the claim is based, or (ii) six months after the date the claimant has exhausted the claims and review procedures.

Section 8.7. Knowledge of Fact by Participant Imputed to Beneficiary and Others. Knowledge of all facts that a Participant knew or reasonably should have known shall be imputed to every claimant who is or claims to be a Beneficiary of the Participant or otherwise claims to derive an entitlement by reference to the Participant for the purpose of applying the previously specified periods.

ARTICLE 9

MISCELLANEOUS

Section 9.1. No Guarantee of Employment or Retention to Perform Services. Neither the adoption and maintenance of the Plan nor the execution by the Company of a Deferral Election Agreement with any Participant shall be deemed to be a contract of employment or for the performance of services between the Company and any Participant. Nothing contained herein shall give any Participant the right to be retained in the employ of the Company or to perform services for the Company, or to interfere with the right of the Company to discharge any Participant at any time, nor shall it give the Company the right to require any Participant to remain in its employ or to perform services for it or to interfere with the Participant’s right to terminate his or her employment or performance of services at any time.

Section 9.2. Release. Any payment of benefits to or for the benefit of a Participant or a Participant’s Beneficiaries that is made in good faith by the Company in accordance with the Company’s interpretation of its obligations hereunder, shall be in full satisfaction of all claims against the Company for benefits under the Plan to the extent of such payment.

Section 9.3. Notices. Any notice permitted or required under the Plan shall be in writing and shall be hand‑delivered or sent, postage prepaid, by first class mail, or by certified or registered mail with return receipt requested, to the Committee, if to the Company, or to the address last shown on the records of the Company, if to a Participant or Beneficiary. If a form or document must be filed with or received by the Company, the Committee, the Authorized Officer, the Human Resources Department or other entity (the “Appropriate Entity”), it must be actually received by the Appropriate Entity to be effective. The determination of whether or when a form or document has been received by the Appropriate Entity shall be made by the Committee on the basis of what documents are

acknowledged by the Appropriate Entity to be in its actual possession without regard to the “mailbox rule” or similar rule of evidence. The absence of a document in the Appropriate Entity’s records and files shall be conclusive and binding proof that the document was not received by the Appropriate Entity.

Section 9.4. Nonalienation. No benefit payable at any time under the Plan will be subject in any manner to alienation, sale, transfer, assignment, pledge, levy, attachment, or encumbrance of any kind, except with respect to a domestic relations order that the Committee determines to be a Qualified Domestic Relations Order.

Section 9.5. Withholding. The Company may withhold from any payment of benefits or other compensation payable to a Participant or Beneficiary, or the Committee may direct the Trustee to withhold from any payment of benefits to a Participant or Beneficiary, such amounts as the Committee determines are reasonably necessary to pay any taxes or other amounts required to be withheld under applicable law.

Section 9.6. Captions. Article and section headings and captions are provided for purposes of reference and convenience only and shall not be relied upon in any way to construe, define, modify, limit, or extend the scope of any provision of the Plan.

Section 9.7. Binding Agreement. This Plan shall be binding on the parties hereto, their heirs, executors, administrators, and successors in interest.

Section 9.8. Invalidity of Certain Provisions. If any provision of the Plan is held invalid or unenforceable, such invalidity or unenforceability shall not affect any other provision of the Plan and the Plan shall be construed and enforced as if such provision had not been included. The Plan is subject to section 409A of the Code. Each provision shall be interpreted and administered accordingly. If any provision of the Plan does not conform to the requirements of section 409A of the Code, such that the inclusion of the provision would result in loss of the Plan’s intended tax deferral, the Plan shall be construed and enforced as if such provision had not been included.

Section 9.9. No Other Agreements. The terms and conditions set forth herein, together with the Deferral Election Agreements entered into between the Company and Participants, constitute the entire understanding of the Company and the Participants with respect to the matters addressed herein.

Section 9.10. Incapacity. In the event that any Participant is unable to care for his or her affairs because of illness or accident, any payment due may be paid to the Participant’s spouse, parent, brother, sister or other person deemed by the Committee to have incurred expenses for the care of such Participant, unless a duly qualified guardian or other legal representative has been appointed.

Section 9.11. Counterparts. This Plan may be executed in any number of counterparts, each of which when duly executed by the Company shall be deemed to be an original, but all of which shall together constitute but one instrument, which may be evidenced by any counterpart.

Section 9.12. Participating Affiliates. Any Affiliate of the Company may adopt the Plan with the permission of the Company and according to such rules as may be established from time to time by the Company in its discretion, and thereby become a “Participating Affiliate” in the Plan.

Section 9.13. Sole Source of Benefits. Neither the Company nor any of its officers nor any member of its Board of Directors nor any members of the Committee in any way guarantee a Participant’s Account against loss or depreciation, nor do they guarantee the payment of any benefit or amount which may become due and payable hereunder to any Participant, Beneficiary, or other person. Each Participant, Beneficiary, or other person entitled at any time to payments hereunder shall look solely to the assets of the Company for such payments. If an Account shall have been distributed to a Participant, Beneficiary, or any other person entitled to the receipt thereof, such Participant, Beneficiary, or other person, as the case may be, shall have no further right or interest in the other assets.

Section 9.14 Electronic Media. Notwithstanding anything in the Plan to the contrary, but subject to the requirements of the Code or other applicable law, any action or communication otherwise required to be taken or made in writing by a Participant or Beneficiary or by the Company or Committee shall be effective if accomplished by another method or methods required or made available by the Company or Committee, or their agent, with respect to that action or communication, including e‑mail, telephone response systems, intranet systems, or the Internet.

Section 9.15. ERISA Status. The Plan is maintained with the understanding that the Plan is not subject to ERISA with respect to: (i) non‑employee Directors because they are not employees, and (ii) employees because the Plan is not intended to provide retirement income for employees or defer compensation to termination or a period after termination.

Section 9.16. Internal Revenue Code Status. The Plan is maintained as a nonqualified deferred compensation arrangement under section 409A of the Code. Notwithstanding the foregoing, neither the Company nor any of its officers, directors, agents or affiliates shall be obligated, directly or indirectly, to any Participant or any other person for any taxes, penalties, interest or like amounts that may be imposed on the Participant or other person on account of any amounts under this Plan or on account of any failure to comply with the Code.

Section 9.17. Choice of Law. This instrument has been executed and delivered in the State of Minnesota and, except to the extent that federal law is controlling, shall be construed and enforced in accordance with the laws of the State of Minnesota (except that the state law will be applied without regard to any choice of law provisions).

Section 9.18. Choice of Venue. Any claim or action brought with respect to this Plan shall be brought in the Federal courts of Hennepin County of the State of Minnesota.

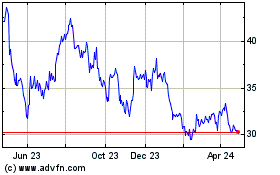

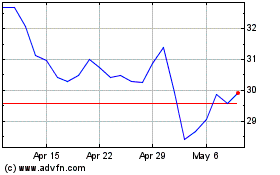

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024