Aetna Executives Defend Pulling Out of Some ACA Exchanges

December 12 2016 - 6:20PM

Dow Jones News

WASHINGTON—Aetna Inc. executives on Monday jousted with Justice

Department lawyers over the health insurer's reasons for sharply

cutting its participation in Affordable Care Act exchanges, a

potentially important issue in the antitrust trial over Aetna's

proposed merger with Humana Inc.

The Justice Department, which sued in July to block the $34

billion Aetna-Humana combination, argues the deal would suppress

competition for private Medicare plans, as well as the sale of

individual insurance policies on ACA exchanges in 17 counties

covering three states: Florida, Georgia and Missouri.

Aetna in August pulled out of exchanges in 11 states, including

the areas covered by the Justice Department lawsuit. The government

argues Aetna withdrew in an attempt to avoid those antitrust

claims, but the insurer says its decision wasn't

litigation-driven.

Aetna Chief Executive Mark T. Bertolini, in testimony that began

late Friday and resumed Monday, said the company pulled back from

its exchange presence for business reasons, namely accelerating

financial losses that could reach $350 million for 2016.

Three other high-ranking Aetna executives took the witness stand

and said that if the decision had been up to them they would have

withdrawn Aetna from the exchange business entirely. That business

"has continued to deteriorate as the year has progressed," said

Jonathan Mayhew, who heads Aetna's exchange business.

The Justice Department introduced as evidence internal company

communications in which Aetna officials specifically discussed what

the insurer should do about its exchange business in the 17

counties identified in the lawsuit. And at least one email exchange

appeared to show Aetna officials troubled by the move to pull out

of Florida because they weren't sure it was a good business

decision.

Mr. Mayhew at one point acknowledged on the witness stand that

he had been told to keep strategy discussions about the 17 counties

verbal so there wouldn't be written communication that could be

shared with the Justice Department during discovery for the

litigation.

In addition to questions about the exchanges, Aetna's Mr.

Bertolini touched on a variety of topics during his second day of

testimony Monday.

The Aetna CEO said Molina Healthcare Inc., which is line to buy

Medicare assets from Aetna and Humana for $117 million if the

merger is approved, had the capability to be successful with those

assets and be a competitor in that market. Aetna has argued the

Molina deal would address any antitrust concerns with the

merger.

The Justice Department has argued that Molina, which is much

smaller than Aetna or Humana, would be unable to replace the

competition lost from the merger.

Mr. Bertolini also said he had "high expectations" that he would

be able to deliver on Aetna's vision that the merger with Humana

would produce more than $3 billion in cost savings and

efficiencies.

Justice Department lawyer Craig Conrath in response asked a

series of questions designed to show that Mr. Bertolini and Aetna

didn't need the merger to move forward with cost-savings

initiatives that could make the insurer more efficient.

The case is one of two currently unfolding in Washington, D.C.'s

federal courthouse in which the Justice Department in challenging

major health insurance mergers. The department also is suing to

block Anthem Inc.'s $48 billion deal to acquire Cigna Corp.

Write to Brent Kendall at brent.kendall@wsj.com and Aruna

Viswanatha at Aruna.Viswanatha@wsj.com

(END) Dow Jones Newswires

December 12, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

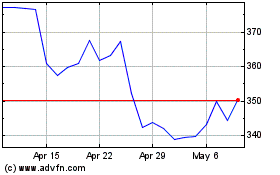

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

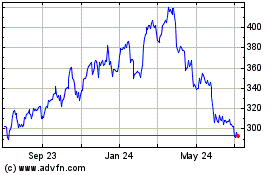

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024