Molina Healthcare Announces Commencement of Offer to Exchange Its Privately Placed 5.375% Senior Notes Due 2022 for Registere...

August 17 2016 - 4:46PM

Business Wire

Molina Healthcare, Inc. (NYSE: MOH) (the “Company”) today

announced that it has commenced an offer to exchange up to $700

million aggregate principal amount of its 5.375% Senior Notes due

2022 (the “Original Notes”) and the note guarantees associated

therewith issued on November 10, 2015, in a private placement

exempt from the registration requirements of the Securities Act of

1933, as amended (the “Securities Act”), for up to an equal

aggregate principal amount of its 5.375% Senior Notes due 2022 (the

“Exchange Notes”) and the note guarantees associated therewith

registered under the Securities Act. The exchange offer is

registered under the Securities Act pursuant to an effective

registration statement on Form S-4 filed with the Securities and

Exchange Commission (the “SEC”) on August 15, 2016.

In connection with the issuance of the Original Notes, the

Company entered into a registration rights agreement with certain

initial purchasers (the “Registration Rights Agreement”) wherein

the Company agreed, for the benefit of the holders of the Original

Notes, to file with the SEC, and cause to become effective, a

registration statement relating to an offer to exchange the

Original Notes for notes registered under the Securities Act with

terms substantially identical in all material respects to the

Original Notes. In accordance with the Registration Rights

Agreement, the terms of the Exchange Notes are substantially

identical to the terms of the Original Notes, except that the

Exchange Notes are not subject to the transfer restrictions, and do

not contain the additional interest provisions, applicable to the

Original Notes.

Original Notes not tendered for exchange in the exchange offer

will remain outstanding and continue to accrue interest, but will

not retain any rights under the Registration Rights Agreement,

except in limited circumstances. The terms of the exchange offer

are contained in the exchange offer prospectus and related letter

of transmittal.

The exchange offer will expire at 5:00 p.m., New York City time,

on September 15, 2016, unless extended. Tenders of Original Notes

must be properly made before the expiration date. Original Notes

tendered in the exchange offer may be withdrawn at any time before

the expiration date by following the procedures set forth in the

exchange offer prospectus.

Documents describing the terms of the exchange offer, including

the prospectus, letter of transmittal and notice of guaranteed

delivery, can be obtained from the exchange agent, U.S. Bank

National Association, 111 Fillmore Avenue, St. Paul, Minnesota

55107-1402, Attention: Corporate Actions.

This press release does not constitute an offer to sell any

securities or a solicitation of an offer to buy any securities. The

exchange offer is being made only by means of the written exchange

offer prospectus and the related letter of transmittal.

About Molina Healthcare, Inc.

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed

health care services under the Medicaid and Medicare programs and

through the state insurance marketplaces. Through our locally

operated health plans in 12 states and in the Commonwealth of

Puerto Rico, Molina serves approximately 4.3 million members. Dr.

C. David Molina founded our company in 1980 as a provider

organization serving low-income families in Southern California.

Today, we continue his mission of providing high quality and

cost-effective health care to those who need it most. For more

information about Molina Healthcare, please visit our website at

molinahealthcare.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160817006231/en/

Molina Healthcare, Inc.Juan José Orellana, 562-435-3666, ext.

111143Investor Relations

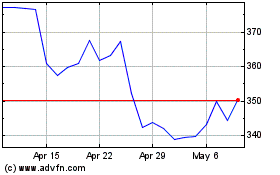

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

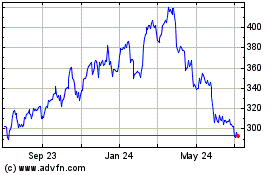

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024