Aetna Tops Views, Stops ACA Expansion Plans

August 02 2016 - 7:40AM

Dow Jones News

Aetna Inc. posted better-than-expected profit and revenue growth

in the most recent quarter but said it dropped plans to further

expand its Affordable Care Act business next year and will review

how it will continue—if at all—in existing states.

"While we are pleased with our overall results, in light of

updated 2016 projections for our individual products and the

significant structural challenges facing the public exchanges, we

intend to withdraw all of our 2017 public exchange expansion plans,

and are undertaking a complete evaluation of future participation

in our current 15-state footprint," said Chief Executive Mark

Bertolini.

Chief Financial Officer Shawn Guertin said Aetna delivered solid

top-line and bottom-line results in the second quarter, "despite

the challenges in our ACA compliant products."

"Our financial position, capital structure, and liquidity are

all strong, and bolstered by core businesses that continue to

produce bottom-line growth," he said.

In the June quarter, Aetna's overall medical membership fell

2.9% to 22.98 million. Medicaid membership popped 12% to 2.4

million, while Medicare Advantage membership grew 9% to 1.3

million.

Aetna's medical-benefit ratio, a key measure of the amount of

premiums used to pay patient medical costs, rose to 82.4% from

81.1%. The ratio rose more for its commercial members, to 83.4%

from 81.8%, than its government-based business, 81.4% from

80.3%.

In all for the quarter, Aetna reported earnings of $790.8

million, or $2.23 a share, up from $731.8 million, or $2.08 a

share, a year earlier.

Operating earnings rose to $2.21 a share from $2.05 a share.

Operating revenue, which excludes net realized capital gains and

losses, grew 5.1% to $15.9 billion. Analysts had forecast $2.12 a

share on $15.69 billion in revenue.

Aetna reaffirmed its 2016 operating earnings guidance for $7.90

to $8.10 a share.

Aetna in early July agreed to buy Humana Inc., part of a

rapid-fire reconfiguration of the U.S. health-insurance industry's

top ranks. The consolidation momentum is being fed by a desire to

diversify and cut costs following changes brought by the Affordable

Care Act. The deal to buy Humana would boost Hartford, Conn.-based

Aetna's Medicare business and give it scale to thrive as the

industry consolidates.

But late last month, the Justice Department filed a pair of

lawsuits in a Washington, D.C., federal court challenging Anthem

Inc.'s proposed acquisition of Cigna Corp. and Aetna's planned

combination with Humana, alleging the mergers would harm consumers,

employers and health-care providers with an unacceptable reduction

in competition.

On Tuesday, Aetna and Humana together announced they agreed to

sell separate Medicare Advantage assets to Molina Healthcare Inc.

for about $117 million in cash. The pair of transactions are

subject to the completion of the merger.

The deals give Molina about 290,000 Medicare Advantage members

in 21 states, "preserving robust competition for seniors choosing

to receive Medicare coverage through Medicare Advantage plans and

addressing a key concern of the U.S. Department of Justice in its

challenge to the Aetna-Humana transaction," the companies said in a

statement.

Mr. Bertolini said they believe these divestitures taken

together would address the Justice Department's "perceived

competitive concerns."

Humana is set to report second-quarter results tomorrow.

Shares of Aetna, inactive premarket, have risen 5.9% so far this

year.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

August 02, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

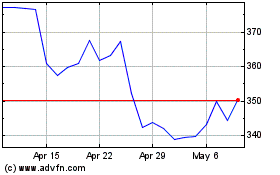

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

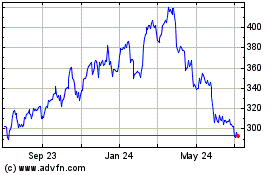

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024