UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2016

______________

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 1-31719 | 13-4204626 |

(State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

______________

|

|

200 Oceangate, Suite 100, Long Beach, California 90802 |

(Address of principal executive offices) |

Registrant’s telephone number, including area code: (562) 435-3666

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 8, 2016, Molina Healthcare, Inc. issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2015. The full text of the press release is included as Exhibit 99.1 to this report. The information contained in the websites cited in the press release is not part of this report.

The information in this Form 8-K and the exhibit attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

Exhibit

No. Description

99.1 Press release of Molina Healthcare, Inc. issued February 8, 2016, as to financial results for the fourth quarter and year ended December 31, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | MOLINA HEALTHCARE, INC. |

| | |

Date: | February 8, 2016 | By: | /s/ Jeff D. Barlow |

| | Jeff D. Barlow |

| | Chief Legal Officer and Secretary |

EXHIBIT INDEX

|

| |

Exhibit | |

No. | Description |

| |

99.1 | Press release of Molina Healthcare, Inc. issued February 8, 2016, as to financial results for the fourth quarter and year ended December 31, 2015. |

News Release

Contact:

Juan José Orellana

Investor Relations

562-435-3666, ext. 111143

MOLINA HEALTHCARE REPORTS

FOURTH QUARTER AND YEAR-END 2015 RESULTS

| |

• | Full year 2015 net income per diluted share of $2.57, up nearly 100% over 2014. |

| |

• | Full year 2015 total revenue of $14.1 billion, up 46% over 2014. |

| |

• | Aggregate membership up 35% over 2014. |

| |

• | Excluding a contract settlement charge of $0.16 per diluted share, diluted net income per share for the fourth quarter of 2015 would have been $0.67 compared with $0.69 for the fourth quarter of 2014. |

Long Beach, California (February 8, 2016) - Molina Healthcare, Inc. (NYSE: MOH) today reported its financial results for the fourth quarter of 2015.

“The fourth quarter of 2015 capped off a very strong year for Molina Healthcare. Net income more than doubled compared with 2014, and we are making progress toward our goal of a 1.5% to 2% net income margin by the end of 2017,” said J. Mario Molina M.D., chief executive officer of Molina Healthcare, Inc. “The in-market ‘tuck-in’ acquisitions already announced give us strong momentum going into 2016 and complement the already strong revenue growth we experienced over the past two years. I want to thank all of our employees for a great year.”

2016 Business Outlook and Investor Meeting

As has been the Company’s past practice, it will discuss its 2016 business outlook and strategy at its Investor Day Conference webcast and presentation to be held on February 11, 2016, at the Le Parker Meridien Hotel in New York City from 12:30 p.m. to 4:30 p.m. Eastern Time. The Company will webcast the presentations offered by its management team, which will be followed by question-and-answer sessions. A 30-day online replay of the Investor Day meeting will be available approximately one hour following the conclusion of the live webcast. A link to this webcast can be found on the Company’s website at molinahealthcare.com.

Overview of 2015 Financial Results, Continuing Operations

Earnings per diluted share nearly doubled in 2015 when compared with 2014, while net income more than doubled. Substantial increases in revenue, along with improved operating efficiency, were responsible for

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 2

February 8, 2016

the Company’s improved performance. The Company’s after-tax margin increased to 1.0% in 2015 from 0.6% in 2014.

Strong enrollment growth combined with a 4% increase in premium revenue per member generated over $4 billion, or 46% more premium revenue in 2015 compared with 2014.

Enrollment growth was primarily due to increased Medicaid Expansion, Marketplace and integrated Medicare-Medicaid Plan (MMP) enrollment, and the start-up of the Puerto Rico health plan in April 2015.

Medical care costs as a percent of premium revenue (the “medical care ratio”) decreased to 89.0% in 2015, from 89.5% in 2014.

General and administrative expenses as a percentage of total revenue (the “general and administrative expense ratio”) increased slightly to 8.2% in 2015, from 7.9% in 2014, primarily as a result of dramatic growth in the Company’s Marketplace membership. Excluding Marketplace broker and exchange fees from both years, the general and administrative expense ratio decreased to 7.5% in 2015 from 7.8% in 2014.

Other items affecting premium revenue in 2015 included the Affordable Care Act health insurer fee (HIF). During 2015, the Company secured full reimbursement for its expenses under the HIF. Additionally, as the Company has previously disclosed, it has been unable to recognize certain quality related revenue at its Texas health plan because it does not have historical information, clear definitions, and clarity around minimum standards. The Company recognized no such revenue in either the fourth quarter of 2015, or the year as a whole.

Fourth Quarter Developments

Fourth quarter results were favorable for the reasons explained above. The following items are included in results for the fourth quarter of 2015:

| |

• | During the quarter, the Company recorded a contract settlement charge of approximately $15 million ($0.16 per diluted share) as a result of its termination of a hospital management agreement. |

| |

• | During the fourth quarter of 2015, the Company recognized approximately $6 million ($0.07 per diluted share) of interest expense related to $700 million of senior notes due 2022 issued in November. |

| |

• | General and administrative expense for the fourth quarter 2015 includes approximately $3 million ($0.03 per diluted share) in transaction costs for business acquisitions. |

Conference Call

The Company’s management will host a conference call and webcast to discuss its fourth quarter and year-end results at 5:00 p.m. Eastern time on Monday, February 8, 2016. The number to call for the interactive teleconference is (212) 271-4657. A telephonic replay of the conference call will be available from 7:00 p.m. Eastern time on Monday, February 8, 2016, through 6:00 p.m. on Tuesday, February 9, 2016, by dialing (800) 633-8284 and entering confirmation number 21802135. A live audio broadcast of Molina Healthcare’s conference call will be available on the Company’s website, molinahealthcare.com. A 30-day online replay will be available approximately an hour following the conclusion of the live broadcast.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed health care services under the Medicaid and Medicare programs and through the state insurance marketplaces. Through our locally operated health plans in 11 states across the nation and in the Commonwealth of Puerto Rico, Molina currently serves approximately 3.5 million members. Dr. C. David Molina founded our company in 1980 as a provider organization serving low-income families in Southern California. Today, we continue his mission of providing high quality and cost-effective health care to those who need it most. For more information about Molina Healthcare, please visit our website at molinahealthcare.com.

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 3

February 8, 2016

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This earnings release contains “forward-looking statements” regarding the Company’s plans, expectations, and anticipated future events. Actual results could differ materially due to numerous known and unknown risks and uncertainties. Those known risks and uncertainties include, but are not limited, to the following:

| |

• | uncertainties and evolving market and provider economics associated with the implementation of the Affordable Care Act, the Medicaid expansion, the insurance marketplaces, the effect of various implementing regulations, and uncertainties regarding the Medicare-Medicaid dual eligible demonstration programs in California, Illinois, Michigan, Ohio, South Carolina, and Texas; |

| |

• | management of our medical costs, including seasonal flu patterns and rates of utilization that are consistent with our expectations, and our ability to reduce over time the high medical costs commonly associated with new patient populations; |

| |

• | federal or state medical cost expenditure floors, administrative cost and profit ceilings, premium stabilization programs, profit sharing arrangements, and conflicting interpretations thereof; |

| |

• | the interpretation and implementation of at-risk premium rules regarding the achievement of certain quality measures; |

| |

• | cyber-attacks or other privacy or data security incidents resulting in an inadvertent unauthorized disclosure of protected health information; |

| |

• | the success of our new health plan in Puerto Rico, including the successful resolution of the Puerto Rico debt crisis and the payment of all amounts due under our Medicaid contract; |

| |

• | specialty drugs or generic drugs that are exorbitantly priced but not factored into the calculation of our capitated rates; |

| |

• | significant budget pressures on state governments and their potential inability to maintain current rates, to implement expected rate increases, or to maintain existing benefit packages or membership eligibility thresholds or criteria, including the resolution of the Illinois budget impasse and continued payment of our Illinois health plan; |

| |

• | the accurate estimation of incurred but not reported or paid medical costs across our health plans; |

| |

• | retroactive adjustments to premium revenue or accounting estimates which require adjustment based upon subsequent developments; |

| |

• | efforts by states to recoup previously paid amounts; |

| |

• | the success of our efforts to retain existing government contracts and to obtain new government contracts in connection with state requests for proposals (RFPs) in both existing and new states; |

| |

• | the continuation and renewal of the government contracts of both our health plans and Molina Medicaid Solutions and the terms under which such contracts are renewed; |

| |

• | complications, member confusion, or enrollment backlogs related to the annual renewal of Medicaid coverage; |

| |

• | government audits and reviews, and any fine, enrollment freeze, or monitoring program that may result therefrom; |

| |

• | changes with respect to our provider contracts and the loss of providers; |

| |

• | approval by state regulators of dividends and distributions by our health plan subsidiaries; |

| |

• | changes in funding under our contracts as a result of regulatory changes, programmatic adjustments, or other reforms; |

| |

• | high dollar claims related to catastrophic illness; |

| |

• | the favorable resolution of litigation, arbitration, or administrative proceedings; |

| |

• | the relatively small number of states in which we operate health plans; |

| |

• | the effect on our Los Angeles County subcontract of Centene’s acquisition of Health Net; |

| |

• | the availability of adequate financing on acceptable terms to fund and capitalize our expansion and growth, repay our outstanding indebtedness at maturity and meet our liquidity needs, including the interest expense and other costs associated with such financing; |

| |

• | the failure of a state in which we operate to renew its federal Medicaid waiver; |

| |

• | changes generally affecting the managed care or Medicaid management information systems industries; |

| |

• | increases in government surcharges, taxes, and assessments; |

| |

• | newly emergent viruses or widespread epidemics, including the Zika virus, and associated public alarm; |

| |

• | changes in general economic conditions, including unemployment rates; |

| |

• | the sufficiency of our funds, on hand to pay the amounts due upon conversion of our outstanding notes; |

| |

• | increasing competition and consolidation in the Medicaid industry; |

and numerous other risk factors, including those discussed in the Company’s periodic reports and filings with the Securities and Exchange Commission. These reports can be accessed under the investor relations tab of the Company’s website or on the SEC’s website at sec.gov. Given these risks and uncertainties, we can give no assurances that the Company’s forward-looking statements will prove to be accurate, or that any other results or events projected or contemplated by the Company’s forward-looking statements will in fact occur, and we caution investors not to place undue reliance on these statements. All forward-looking statements in this release represent the Company’s judgment as of February 8, 2016, and we disclaim any obligation to update any forward-looking statements to conform the statement to actual results or changes in the Company’s expectations.

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 4

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Dollar amounts in millions, except net income per share) |

Revenue: | | | | | | | |

Premium revenue | $ | 3,488 |

| | $ | 2,599 |

| | $ | 13,140 |

| | $ | 9,023 |

|

Service revenue | 106 |

| | 54 |

| | 252 |

| | 210 |

|

Premium tax revenue | 104 |

| | 91 |

| | 393 |

| | 294 |

|

Health insurer fee revenue | 61 |

| | 52 |

| | 264 |

| | 120 |

|

Investment income | 6 |

| | 2 |

| | 18 |

| | 8 |

|

Other revenue | — |

| | 4 |

| | 5 |

| | 12 |

|

Total revenue | 3,765 |

| | 2,802 |

| | 14,072 |

| | 9,667 |

|

Operating expenses: | | | | | | | |

Medical care costs | 3,110 |

| | 2,322 |

| | 11,691 |

| | 8,076 |

|

Cost of service revenue | 90 |

| | 39 |

| | 193 |

| | 157 |

|

General and administrative expenses | 317 |

| | 205 |

| | 1,147 |

| | 765 |

|

Premium tax expenses | 104 |

| | 91 |

| | 393 |

| | 294 |

|

Health insurer fee expenses | 40 |

| | 23 |

| | 157 |

| | 89 |

|

Depreciation and amortization | 28 |

| | 25 |

| | 104 |

| | 93 |

|

Total operating expenses | 3,689 |

| | 2,705 |

| | 13,685 |

| | 9,474 |

|

Operating income | 76 |

| | 97 |

| | 387 |

| | 193 |

|

Other expenses, net: | | | | | | | |

Interest expense | 22 |

| | 15 |

| | 67 |

| | 57 |

|

Other (income) expense, net | (2 | ) | | — |

| | (2 | ) | | 1 |

|

Total other expenses, net | 20 |

| | 15 |

| | 65 |

| | 58 |

|

Income from continuing operations before income tax expense | 56 |

| | 82 |

| | 322 |

| | 135 |

|

Income tax expense | 26 |

| | 48 |

| | 179 |

| | 73 |

|

Income from continuing operations | 30 |

| | 34 |

| | 143 |

| | 62 |

|

Net income | $ | 30 |

| | $ | 34 |

| | $ | 143 |

| | $ | 62 |

|

| | | | | | | |

Diluted net income per share: (1) | | | | | | | |

Income from continuing operations | $ | 0.51 |

| | $ | 0.69 |

| | $ | 2.57 |

| | $ | 1.30 |

|

Loss from discontinued operations | — |

| | — |

| | — |

| | (0.01 | ) |

Diluted net income per share | $ | 0.51 |

| | $ | 0.69 |

| | $ | 2.57 |

| | $ | 1.29 |

|

| | | | | | | |

Diluted weighted average shares outstanding | 57.7 |

| | 48.9 |

| | 55.6 |

| | 48.3 |

|

| | | | | | | |

Operating Statistics, Continuing Operations: (1) | | | | | | | |

Medical care ratio (2) | 89.2 | % | | 89.4 | % | | 89.0 | % | | 89.5 | % |

Service revenue ratio (3) | 84.7 | % | | 72.6 | % | | 76.4 | % | | 74.6 | % |

General and administrative expense ratio (4) | 8.4 | % | | 7.3 | % | | 8.2 | % | | 7.9 | % |

Premium tax ratio (2) | 2.9 | % | | 3.4 | % | | 2.9 | % | | 3.2 | % |

Effective tax rate | 47.0 | % | | 58.6 | % | | 55.5 | % | | 53.8 | % |

Net profit margin, continuing operations (4) | 0.8 | % | | 1.2 | % | | 1.0 | % | | 0.6 | % |

| |

(1) | Source data for calculations in thousands. |

| |

(2) | Medical care ratio represents medical care costs as a percentage of premium revenue; premium tax ratio represents premium tax expenses as a percentage of premium revenue plus premium tax revenue. Medical care costs include costs incurred for providing long term services and supports (LTSS). |

(3) Service revenue ratio represents cost of service revenue as a percentage of service revenue.

| |

(4) | Computed as a percentage of total revenue. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 5

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED BALANCE SHEETS

|

| | | | | | | |

| December 31, |

| 2015 | | 2014 |

| (Amounts in millions,

except per-share data) |

ASSETS |

Current assets: | | | |

Cash and cash equivalents | $ | 2,329 |

| | $ | 1,539 |

|

Investments | 1,801 |

| | 1,019 |

|

Receivables | 597 |

| | 596 |

|

Income taxes refundable | 13 |

| | — |

|

Prepaid expenses and other current assets | 192 |

| | 49 |

|

Derivative asset | 374 |

| | — |

|

Total current assets | 5,306 |

| | 3,203 |

|

Property, equipment, and capitalized software, net | 393 |

| | 341 |

|

Deferred contract costs | 81 |

| | 54 |

|

Intangible assets, net | 122 |

| | 89 |

|

Goodwill | 519 |

| | 272 |

|

Restricted investments | 109 |

| | 102 |

|

Derivative asset | — |

| | 329 |

|

Deferred income taxes | 18 |

| | 15 |

|

Other assets | 28 |

| | 30 |

|

| $ | 6,576 |

| | $ | 4,435 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY |

Current liabilities: | | | |

Medical claims and benefits payable | $ | 1,582 |

| | $ | 1,201 |

|

Amounts due government agencies | 834 |

| | 527 |

|

Accounts payable and accrued liabilities | 360 |

| | 242 |

|

Deferred revenue | 223 |

| | 196 |

|

Income taxes payable | — |

| | 9 |

|

Current portion of long-term debt | 449 |

| | — |

|

Derivative liability | 374 |

| | — |

|

Total current liabilities | 3,822 |

| | 2,175 |

|

Senior notes | 962 |

| | 690 |

|

Lease financing obligations | 198 |

| | 157 |

|

Lease financing obligations - related party | — |

| | 40 |

|

Derivative liability | — |

| | 329 |

|

Other long-term liabilities | 37 |

| | 34 |

|

Total liabilities | 5,019 |

| | 3,425 |

|

Stockholders’ equity: | | | |

Common stock, $0.001 par value; 150 shares authorized; outstanding: 56 shares at December 31, 2015 and 50 shares at December 31, 2014 | — |

| | — |

|

Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

|

Additional paid-in capital | 803 |

| | 396 |

|

Accumulated other comprehensive loss | (4 | ) | | (1 | ) |

Retained earnings | 758 |

| | 615 |

|

Total stockholders’ equity | 1,557 |

| | 1,010 |

|

| $ | 6,576 |

| | $ | 4,435 |

|

____________

Note: Certain 2014 amounts have been reclassified to conform to the 2015 presentation. Specifically, current and non-current deferred issuance costs are now reported as direct deductions from “Current portion of long-term debt,” and “Senior notes,” respectively. Additionally, the aggregate amount of deferred income taxes are now reported as non-current. Both reclassifications are a result of recently adopted accounting pronouncements.

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 6

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS,

CONTINUING AND DISCONTINUED OPERATIONS

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Amounts in millions) |

Operating activities: | | | | | | | |

Net income | $ | 30 |

| | $ | 34 |

| | $ | 143 |

| | $ | 62 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

Depreciation and amortization | 33 |

| | 35 |

| | 126 |

| | 134 |

|

Deferred income taxes | 5 |

| | 9 |

| | (7 | ) | | (2 | ) |

Share-based compensation | 7 |

| | 6 |

| | 23 |

| | 22 |

|

Amortization of convertible senior notes and lease financing obligations | 8 |

| | 7 |

| | 30 |

| | 27 |

|

Other, net | 6 |

| | 3 |

| | 19 |

| | 7 |

|

Changes in operating assets and liabilities: | | | | | | | |

Receivables | 79 |

| | (171 | ) | | 56 |

| | (298 | ) |

Prepaid expenses and other current assets | 28 |

| | 32 |

| | (35 | ) | | (20 | ) |

Medical claims and benefits payable | 20 |

| | 77 |

| | 379 |

| | 531 |

|

Amounts due government agencies | (146 | ) | | 129 |

| | 307 |

| | 470 |

|

Accounts payable and accrued liabilities | 48 |

| | 37 |

| | 82 |

| | 11 |

|

Deferred revenue | 153 |

| | 5 |

| | 24 |

| | 74 |

|

Income taxes | (52 | ) | | 17 |

| | (22 | ) | | 42 |

|

Net cash provided by operating activities | 219 |

| | 220 |

| | 1,125 |

| | 1,060 |

|

| | | | | | | |

Investing activities: | | | | | | | |

Purchases of investments | (612 | ) | | (337 | ) | | (1,923 | ) | | (953 | ) |

Proceeds from sales and maturities of investments | 263 |

| | 159 |

| | 1,126 |

| | 633 |

|

Purchases of property, equipment, and capitalized software | (31 | ) | | (43 | ) | | (132 | ) | | (115 | ) |

Increase in restricted investments | (1 | ) | | (10 | ) | | (6 | ) | | (34 | ) |

Net cash paid in business combinations | (373 | ) | | (36 | ) | | (450 | ) | | (44 | ) |

Other, net | (1 | ) | | (8 | ) | | (35 | ) | | (23 | ) |

Net cash used in investing activities | (755 | ) | | (275 | ) | | (1,420 | ) | | (536 | ) |

| | | | | | | |

Financing activities: | | | | | | | |

Proceeds from senior notes offerings, net of issuance costs | 689 |

| | — |

| | 689 |

| | 123 |

|

Proceeds from common stock offering, net of issuance costs | — |

| | — |

| | 373 |

| | — |

|

Contingent consideration liabilities settled | — |

| | — |

| | — |

| | (50 | ) |

Proceeds from employee stock plans | 10 |

| | 6 |

| | 18 |

| | 14 |

|

Principal payments on convertible senior notes | — |

| | (10 | ) | | — |

| | (10 | ) |

Other, net | 2 |

| | — |

| | 5 |

| | 2 |

|

Net cash provided by (used in) financing activities | 701 |

| | (4 | ) | | 1,085 |

| | 79 |

|

Net increase (decrease) in cash and cash equivalents | 165 |

| | (59 | ) | | 790 |

| | 603 |

|

Cash and cash equivalents at beginning of period | 2,164 |

| | 1,598 |

| | 1,539 |

| | 936 |

|

Cash and cash equivalents at end of period | $ | 2,329 |

| | $ | 1,539 |

| | $ | 2,329 |

| | $ | 1,539 |

|

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 7

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED NON-GAAP FINANCIAL MEASURES

The Company uses two non-GAAP financial measures as supplemental metrics in evaluating its financial performance, making financing and business decisions, and forecasting and planning for future periods. For these reasons, management believes such measures are useful supplemental measures to investors in comparing the Company’s performance to the performance of other public companies in the health care industry. These non-GAAP financial measures should be considered as supplements to, and not as substitutes for or superior to, GAAP measures.

The first of these non-GAAP measures is earnings before interest, taxes, depreciation and amortization (EBITDA). The following table reconciles net income, which the Company believes to be the most comparable GAAP measure, to EBITDA.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (Amounts in millions) |

Net income | $ | 30 |

| | $ | 34 |

| | $ | 143 |

| | $ | 62 |

|

Adjustments: | | | | | | | |

Depreciation, and amortization of intangible assets and capitalized software | 33 |

| | 30 |

| | 120 |

| | 114 |

|

Interest expense | 22 |

| | 15 |

| | 67 |

| | 57 |

|

Income tax expense | 26 |

| | 48 |

| | 179 |

| | 72 |

|

EBITDA | $ | 111 |

| | $ | 127 |

| | $ | 509 |

| | $ | 305 |

|

The second of these non-GAAP measures is adjusted net income, continuing operations (including adjusted net income per diluted share). The following table reconciles net income from continuing operations, which the Company believes to be the most comparable GAAP measure, to adjusted net income, continuing operations. The source data for per diluted share calculations below is in thousands.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

2015 | | 2014 | | 2015 | | 2014 |

| (In millions, except per diluted share amounts) |

| Amount | | Per share | | Amount | | Per share | | Amount | | Per share | | Amount | | Per share |

Net income, continuing operations | $ | 30 |

| | $ | 0.51 |

| | $ | 34 |

| | $ | 0.69 |

| | $ | 143 |

| | $ | 2.57 |

| | $ | 62 |

| | $ | 1.30 |

|

Adjustments, net of tax: | | | | | | | | | | | | | | | |

Amortization of convertible senior notes and lease financing obligations | 5 |

| | 0.08 |

| | 4 |

| | 0.09 |

| | 19 |

| | 0.34 |

| | 17 |

| | 0.36 |

|

Amortization of intangible assets | 3 |

| | 0.06 |

| | 3 |

| | 0.06 |

| | 11 |

| | 0.20 |

| | 13 |

| | 0.27 |

|

Adjusted net income, continuing operations (1) | $ | 38 |

| | $ | 0.65 |

| | $ | 41 |

| | $ | 0.84 |

| | $ | 173 |

| | $ | 3.11 |

| | $ | 92 |

| | $ | 1.93 |

|

________________________

| |

(1) | Beginning in the first quarter of 2015, the Company revised its calculation of adjusted net income, continuing operations. The Company no longer subtracts “depreciation, and amortization of capitalized software” and “share-based compensation” from net income, continuing operations to arrive at adjusted net income, continuing operations. The Company made this change to better reflect the way in which it evaluates its financial performance, makes financing and business decisions, and forecasts and plans for future periods. All periods presented conform to this presentation. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 8

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED HEALTH PLANS SEGMENT MEMBERSHIP, CONTINUING OPERATIONS

|

| | | | | | | | |

| As of December 31, |

| 2015 | | 2014 | | 2013 |

Ending Membership by Health Plan: | | | | | |

California | 620,000 |

| | 531,000 |

| | 368,000 |

|

Florida | 440,000 |

| | 164,000 |

| | 89,000 |

|

Illinois | 98,000 |

| | 100,000 |

| | 4,000 |

|

Michigan | 328,000 |

| | 242,000 |

| | 213,000 |

|

New Mexico | 231,000 |

| | 212,000 |

| | 168,000 |

|

Ohio | 327,000 |

| | 347,000 |

| | 255,000 |

|

Puerto Rico (1) | 348,000 |

| | — |

| | — |

|

South Carolina | 99,000 |

| | 118,000 |

| | — |

|

Texas | 260,000 |

| | 245,000 |

| | 252,000 |

|

Utah | 102,000 |

| | 83,000 |

| | 86,000 |

|

Washington | 582,000 |

| | 497,000 |

| | 403,000 |

|

Wisconsin | 98,000 |

| | 84,000 |

| | 93,000 |

|

| 3,533,000 |

| | 2,623,000 |

| | 1,931,000 |

|

Ending Membership by Program: | | | | | |

Temporary Assistance for Needy Families (TANF), CHIP(2) | 2,312,000 |

| | 1,809,000 |

| | 1,603,000 |

|

Medicaid Expansion(3) | 557,000 |

| | 385,000 |

| | — |

|

Aged, Blind or Disabled (ABD) | 366,000 |

| | 347,000 |

| | 289,000 |

|

Marketplace(3) | 205,000 |

| | 15,000 |

| | — |

|

Medicare-Medicaid Plan (MMP) - Integrated(4) | 51,000 |

| | 18,000 |

| | — |

|

Medicare Special Needs Plans | 42,000 |

| | 49,000 |

| | 39,000 |

|

| 3,533,000 |

| | 2,623,000 |

| | 1,931,000 |

|

_______________________

| |

(1) | The Puerto Rico health plan began serving members effective April 1, 2015. |

| |

(2) | CHIP stands for Children’s Health Insurance Program. |

| |

(3) | Medicaid Expansion membership phased in, and Marketplace became available for consumers to access coverage, beginning January 1, 2014. |

| |

(4) | MMP members who receive both Medicaid and Medicare coverage from the Company. The Company began serving members under this program in the second quarter of 2014. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 9

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT FINANCIAL DATA,

CONTINUING OPERATIONS

(In millions, except percentages and per-member per-month amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2015 |

| Member Months(1) | | Premium Revenue | | Medical Care Costs | | MCR(2) | | Medical Margin |

| | Total | | PMPM | | Total | | PMPM | | |

California | 1.8 |

| | $ | 563 |

| | $ | 309.31 |

| | $ | 474 |

| | $ | 260.44 |

| | 84.2 | % | | $ | 89 |

|

Florida | 1.2 |

| | 329 |

| | 277.71 |

| | 318 |

| | 268.98 |

| | 96.9 |

| | 11 |

|

Illinois | 0.3 |

| | 85 |

| | 287.88 |

| | 79 |

| | 266.91 |

| | 92.7 |

| | 6 |

|

Michigan | 1.0 |

| | 329 |

| | 334.44 |

| | 282 |

| | 287.00 |

| | 85.8 |

| | 47 |

|

New Mexico | 0.7 |

| | 304 |

| | 438.82 |

| | 263 |

| | 379.10 |

| | 86.4 |

| | 41 |

|

Ohio | 1.0 |

| | 500 |

| | 501.11 |

| | 437 |

| | 436.77 |

| | 87.2 |

| | 63 |

|

Puerto Rico | 1.1 |

| | 192 |

| | 184.79 |

| | 159 |

| | 153.04 |

| | 82.8 |

| | 33 |

|

South Carolina | 0.3 |

| | 78 |

| | 261.07 |

| | 69 |

| | 229.48 |

| | 87.9 |

| | 9 |

|

Texas | 0.7 |

| | 543 |

| | 693.06 |

| | 496 |

| | 633.77 |

| | 91.4 |

| | 47 |

|

Utah | 0.4 |

| | 89 |

| | 290.05 |

| | 77 |

| | 251.55 |

| | 86.7 |

| | 12 |

|

Washington | 1.7 |

| | 416 |

| | 241.28 |

| | 376 |

| | 217.77 |

| | 90.3 |

| | 40 |

|

Wisconsin | 0.3 |

| | 55 |

| | 186.57 |

| | 53 |

| | 182.41 |

| | 97.8 |

| | 2 |

|

Other(3) | — |

| | 5 |

| | — |

| | 27 |

| | — |

| | — |

| | (22 | ) |

| 10.5 |

| | $ | 3,488 |

| | $ | 334.62 |

| | $ | 3,110 |

| | $ | 298.43 |

| | 89.2 | % | | $ | 378 |

|

| | | | | | | | | | | | | |

| Three Months Ended December 31, 2014 |

| Member Months(1) | | Premium Revenue | | Medical Care Costs | | MCR(2) | | Medical Margin |

| Total | | PMPM | | Total | | PMPM | | |

California | 1.6 |

| | $ | 463 |

| | $ | 291.27 |

| | $ | 379 |

| | $ | 238.49 |

| | 81.9 | % | | $ | 84 |

|

Florida | 0.4 |

| | 126 |

| | 348.60 |

| | 129 |

| | 356.76 |

| | 102.3 |

| | (3 | ) |

Illinois | 0.2 |

| | 84 |

| | 353.71 |

| | 78 |

| | 323.76 |

| | 91.5 |

| | 6 |

|

Michigan | 0.7 |

| | 213 |

| | 294.14 |

| | 185 |

| | 254.41 |

| | 86.5 |

| | 28 |

|

New Mexico | 0.7 |

| | 299 |

| | 456.40 |

| | 294 |

| | 448.99 |

| | 98.4 |

| | 5 |

|

Ohio | 1.1 |

| | 492 |

| | 475.15 |

| | 426 |

| | 412.02 |

| | 86.7 |

| | 66 |

|

Puerto Rico | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

South Carolina | 0.4 |

| | 93 |

| | 263.97 |

| | 73 |

| | 208.10 |

| | 78.8 |

| | 20 |

|

Texas | 0.8 |

| | 339 |

| | 458.42 |

| | 299 |

| | 404.88 |

| | 88.3 |

| | 40 |

|

Utah | 0.2 |

| | 76 |

| | 300.28 |

| | 69 |

| | 277.44 |

| | 92.4 |

| | 7 |

|

Washington | 1.4 |

| | 364 |

| | 246.91 |

| | 342 |

| | 232.08 |

| | 94.0 |

| | 22 |

|

Wisconsin | 0.2 |

| | 38 |

| | 148.99 |

| | 36 |

| | 139.75 |

| | 93.8 |

| | 2 |

|

Other(3) | — |

| | 12 |

| | — |

| | 12 |

| | — |

| | — |

| | — |

|

| 7.7 |

| | $ | 2,599 |

| | $ | 338.52 |

| | $ | 2,322 |

| | $ | 302.60 |

| | 89.4 | % | | $ | 277 |

|

____________

| |

(1) | A member month is defined as the aggregate of each month’s ending membership for the period presented. |

| |

(2) | The MCR represents medical costs as a percentage of premium revenue. Source data in thousands. |

| |

(3) | “Other” medical care costs include primarily medically related administrative costs at the parent company, and direct delivery costs. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 10

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT FINANCIAL DATA,

CONTINUING OPERATIONS

(In millions, except percentages and per-member per-month amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2015 |

| Member Months(1) | | Premium Revenue | | Medical Care Costs | | MCR(2) | | Medical Margin |

| | Total | | PMPM | | Total | | PMPM | | |

California | 7.1 |

| | $ | 2,101 |

| | $ | 296.93 |

| | $ | 1,823 |

| | $ | 257.67 |

| | 86.8 | % | | $ | 278 |

|

Florida | 4.1 |

| | 1,197 |

| | 289.38 |

| | 1,081 |

| | 261.49 |

| | 90.4 |

| | 116 |

|

Illinois | 1.2 |

| | 397 |

| | 328.93 |

| | 367 |

| | 303.72 |

| | 92.3 |

| | 30 |

|

Michigan | 3.4 |

| | 1,067 |

| | 317.15 |

| | 903 |

| | 268.27 |

| | 84.6 |

| | 164 |

|

New Mexico | 2.8 |

| | 1,237 |

| | 446.27 |

| | 1,106 |

| | 398.98 |

| | 89.4 |

| | 131 |

|

Ohio | 4.1 |

| | 2,034 |

| | 499.34 |

| | 1,718 |

| | 421.61 |

| | 84.4 |

| | 316 |

|

Puerto Rico | 3.2 |

| | 567 |

| | 178.31 |

| | 505 |

| | 158.80 |

| | 89.1 |

| | 62 |

|

South Carolina | 1.3 |

| | 348 |

| | 267.25 |

| | 278 |

| | 213.30 |

| | 79.8 |

| | 70 |

|

Texas | 3.1 |

| | 1,961 |

| | 621.25 |

| | 1,809 |

| | 573.32 |

| | 92.3 |

| | 152 |

|

Utah | 1.2 |

| | 331 |

| | 286.22 |

| | 300 |

| | 259.32 |

| | 90.6 |

| | 31 |

|

Washington | 6.6 |

| | 1,602 |

| | 242.36 |

| | 1,470 |

| | 222.36 |

| | 91.7 |

| | 132 |

|

Wisconsin | 1.2 |

| | 261 |

| | 213.48 |

| | 215 |

| | 176.01 |

| | 82.4 |

| | 46 |

|

Other(3) | — |

| | 37 |

| | — |

| | 116 |

| | — |

| | — |

| | (79 | ) |

| 39.3 |

| | $ | 13,140 |

| | $ | 334.71 |

| | $ | 11,691 |

| | $ | 297.81 |

| | 89.0 | % | | $ | 1,449 |

|

| | | | | | | | | | | | | |

| Year Ended December 31, 2014 |

| Member Months(1) | | Premium Revenue | | Medical Care Costs | | MCR(2) | | Medical Margin |

| Total | | PMPM | | Total | | PMPM | | |

California | 5.6 |

| | $ | 1,523 |

| | $ | 270.51 |

| | $ | 1,269 |

| | $ | 225.37 |

| | 83.3 | % | | $ | 254 |

|

Florida | 1.1 |

| | 439 |

| | 397.79 |

| | 419 |

| | 379.95 |

| | 95.5 |

| | 20 |

|

Illinois | 0.3 |

| | 153 |

| | 498.48 |

| | 141 |

| | 456.88 |

| | 91.7 |

| | 12 |

|

Michigan | 2.8 |

| | 781 |

| | 278.68 |

| | 661 |

| | 235.81 |

| | 84.6 |

| | 120 |

|

New Mexico | 2.5 |

| | 1,076 |

| | 435.17 |

| | 996 |

| | 402.92 |

| | 92.6 |

| | 80 |

|

Ohio | 3.7 |

| | 1,553 |

| | 425.47 |

| | 1,335 |

| | 365.87 |

| | 86.0 |

| | 218 |

|

Puerto Rico | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

South Carolina | 1.5 |

| | 381 |

| | 260.72 |

| | 323 |

| | 220.89 |

| | 84.7 |

| | 58 |

|

Texas | 3.0 |

| | 1,318 |

| | 442.32 |

| | 1,197 |

| | 401.81 |

| | 90.8 |

| | 121 |

|

Utah | 1.0 |

| | 310 |

| | 310.64 |

| | 285 |

| | 286.43 |

| | 92.2 |

| | 25 |

|

Washington | 5.5 |

| | 1,305 |

| | 236.27 |

| | 1,219 |

| | 220.75 |

| | 93.4 |

| | 86 |

|

Wisconsin | 1.0 |

| | 156 |

| | 150.87 |

| | 136 |

| | 130.91 |

| | 86.8 |

| | 20 |

|

Other(3) | — |

| | 28 |

| | — |

| | 95 |

| | — |

| | — |

| | (67 | ) |

| 28.0 |

| | $ | 9,023 |

| | $ | 322.68 |

| | $ | 8,076 |

| | $ | 288.84 |

| | 89.5 | % | | $ | 947 |

|

____________

| |

(1) | A member month is defined as the aggregate of each month’s ending membership for the period presented. |

| |

(2) | The MCR represents medical costs as a percentage of premium revenue. Source data in thousands. |

| |

(3) | “Other” medical care costs include primarily medically related administrative costs at the parent company, and direct delivery costs. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 11

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT FINANCIAL DATA,

CONTINUING OPERATIONS

(In millions, except percentages and per-member per-month amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2015 (1) |

| Member Months(2) | | Premium Revenue | | Medical Care Costs | | MCR(3) | | Medical Margin |

| | Total | | PMPM | | Total | | PMPM | | |

TANF and CHIP | 6.9 |

| | $ | 1,203 |

| | $ | 175.96 |

| | $ | 1,092 |

| | $ | 159.83 |

| | 90.8 | % | | $ | 111 |

|

Medicaid Expansion | 1.7 |

| | 637 |

| | 386.27 |

| | 503 |

| | 305.28 |

| | 79.0 |

| | 134 |

|

ABD | 1.1 |

| | 1,059 |

| | 967.72 |

| | 995 |

| | 910.11 |

| | 94.0 |

| | 64 |

|

Marketplace | 0.6 |

| | 126 |

| | 223.57 |

| | 111 |

| | 194.80 |

| | 87.1 |

| | 15 |

|

MMP | 0.1 |

| | 330 |

| | 2,160.91 |

| | 290 |

| | 1,905.00 |

| | 88.2 |

| | 40 |

|

Medicare | 0.1 |

| | 133 |

| | 1,076.00 |

| | 119 |

| | 954.40 |

| | 88.7 |

| | 14 |

|

| 10.5 |

| | $ | 3,488 |

| | $ | 334.62 |

| | $ | 3,110 |

| | $ | 298.43 |

| | 89.2 | % | | $ | 378 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2015 (1) |

| Member Months(2) | | Premium Revenue | | Medical Care Costs | | MCR(3) | | Medical Margin |

| | Total | | PMPM | | Total | | PMPM | | |

TANF and CHIP | 25.5 |

| | $ | 4,483 |

| | $ | 175.64 |

| | $ | 4,122 |

| | $ | 161.50 |

| | 92.0 | % | | $ | 361 |

|

Medicaid Expansion | 5.9 |

| | 2,291 |

| | 391.62 |

| | 1,828 |

| | 312.58 |

| | 79.8 |

| | 463 |

|

ABD | 4.3 |

| | 4,122 |

| | 966.37 |

| | 3,784 |

| | 887.27 |

| | 91.8 |

| | 338 |

|

Marketplace | 2.6 |

| | 651 |

| | 251.96 |

| | 481 |

| | 185.85 |

| | 73.8 |

| | 170 |

|

MMP | 0.5 |

| | 1,063 |

| | 2,033.76 |

| | 974 |

| | 1,863.93 |

| | 91.6 |

| | 89 |

|

Medicare | 0.5 |

| | 530 |

| | 1,038.15 |

| | 502 |

| | 982.50 |

| | 94.6 |

| | 28 |

|

| 39.3 |

| | $ | 13,140 |

| | $ | 334.71 |

| | $ | 11,691 |

| | $ | 297.81 |

| | 89.0 | % | | $ | 1,449 |

|

_______________________

| |

(1) | Three and twelve months ended December 31, 2014 data not presented due to lack of comparability. |

| |

(2) | A member month is defined as the aggregate of each month’s ending membership for the period presented. |

| |

(3) | The MCR represents medical costs as a percentage of premium revenue. Source data in thousands. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 12

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT FINANCIAL DATA,

CONTINUING OPERATIONS

(In millions, except percentages and per-member per-month amounts)

The following tables provide the details of the Company’s medical care costs from continuing operations for the periods indicated:

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2015 | | 2014 |

| Amount | | PMPM | | % of Total | | Amount | | PMPM | | % of Total |

Fee for service | $ | 2,297 |

| | $ | 220.34 |

| | 73.9 | % | | $ | 1,644 |

| | $ | 214.14 |

| | 70.8 | % |

Pharmacy | 449 |

| | 43.08 |

| | 14.4 |

| | 354 |

| | 46.12 |

| | 15.3 |

|

Capitation | 257 |

| | 24.69 |

| | 8.3 |

| | 211 |

| | 27.60 |

| | 9.1 |

|

Direct delivery | 43 |

| | 4.14 |

| | 1.4 |

| | 26 |

| | 3.42 |

| | 1.1 |

|

Other | 64 |

| | 6.18 |

| | 2.0 |

| | 87 |

| | 11.32 |

| | 3.7 |

|

| $ | 3,110 |

| | $ | 298.43 |

| | 100.0 | % | | $ | 2,322 |

| | $ | 302.60 |

| | 100.0 | % |

|

| | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2015 | | 2014 |

| Amount | | PMPM | | % of Total | | Amount | | PMPM | | % of Total |

Fee for service | $ | 8,572 |

| | $ | 218.35 |

| | 73.3 | % | | $ | 5,673 |

| | $ | 202.87 |

| | 70.2 | % |

Pharmacy | 1,610 |

| | 41.01 |

| | 13.8 |

| | 1,273 |

| | 45.54 |

| | 15.8 |

|

Capitation | 982 |

| | 25.02 |

| | 8.4 |

| | 748 |

| | 26.77 |

| | 9.3 |

|

Direct delivery | 128 |

| | 3.26 |

| | 1.1 |

| | 96 |

| | 3.44 |

| | 1.2 |

|

Other | 399 |

| | 10.17 |

| | 3.4 |

| | 286 |

| | 10.22 |

| | 3.5 |

|

| $ | 11,691 |

| | $ | 297.81 |

| | 100.0 | % | | $ | 8,076 |

| | $ | 288.84 |

| | 100.0 | % |

The following table provides the details of the Company’s medical claims and benefits payable as of the dates indicated:

|

| | | | | | | |

| December 31, |

| 2015 | | 2014 |

Fee-for-service claims incurred but not paid (IBNP) | $ | 1,191 |

| | $ | 871 |

|

Pharmacy payable | 88 |

| | 71 |

|

Capitation payable | 37 |

| | 28 |

|

Other (1) | 266 |

| | 231 |

|

| $ | 1,582 |

| | $ | 1,201 |

|

______________________

| |

(1) | “Other” medical claims and benefits payable include amounts payable to certain providers for which the Company acts as an intermediary on behalf of various state agencies without assuming financial risk. Such receipts and payments do not impact the Company’s consolidated statements of income. As of December 31, 2015 and 2014, the Company had recorded non-risk provider payables of approximately $167 million and $119 million, respectively. |

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 13

February 8, 2016

MOLINA HEALTHCARE, INC.

UNAUDITED CHANGE IN MEDICAL CLAIMS AND BENEFITS PAYABLE

(Dollars in millions, except per-member amounts)

The Company’s claims liability includes a provision for adverse claims deviation based on historical experience and other factors including, but not limited to, variations in claims payment patterns, changes in utilization and cost trends, known outbreaks of disease, and large claims. The Company’s reserving methodology is consistently applied across all periods presented. The amounts displayed for “Components of medical care costs related to: Prior period” represent the amount by which the Company’s original estimate of claims and benefits payable at the beginning of the period were more than the actual amount of the liability based on information (principally the payment of claims) developed since that liability was first reported. The following table presents the components of the change in medical claims and benefits payable from continuing and discontinued operations combined for the periods indicated:

|

| | | | | | | |

| Year Ended |

| December 31, |

| 2015 | | 2014 |

| |

Medical claims and benefits payable, beginning balance | $ | 1,201 |

| | $ | 670 |

|

Components of medical care costs related to: | | | |

Current period | 11,832 |

| | 8,123 |

|

Prior period | (141 | ) | | (46 | ) |

Total medical care costs | 11,691 |

| | 8,077 |

|

| | | |

Change in non-risk provider payables | 48 |

| | (32 | ) |

Payments for medical care costs related to: | | | |

Current period | 10,448 |

| | 7,064 |

|

Prior period | 910 |

| | 450 |

|

Total paid | 11,358 |

| | 7,514 |

|

Medical claims and benefits payable, ending balance | $ | 1,582 |

| | $ | 1,201 |

|

| | | |

Benefit from prior period as a percentage of: | | | |

Balance at beginning of period | 11.8 | % | | 6.9 | % |

Premium revenue, trailing twelve months | 1.1 | % | | 0.5 | % |

Medical care costs, trailing twelve months | 1.2 | % | | 0.6 | % |

| | | |

Fee-For-Service Claims Data: | | | |

Days in claims payable, fee for service | 48 |

| | 49 |

|

Number of members at end of year | 3,533,000 |

| | 2,623,000 |

|

Number of claims in inventory at end of year | 380,800 |

| | 307,700 |

|

Billed charges of claims in inventory at end of year | $ | 816 |

| | $ | 719 |

|

Claims in inventory per member at end of year | 0.11 |

| | 0.12 |

|

Billed charges of claims in inventory per member at end of year | $ | 230.91 |

| | $ | 273.92 |

|

Number of claims received during the year | 40,173,300 |

| | 27,597,000 |

|

Billed charges of claims received during the year | $ | 46,211 |

| | $ | 30,316 |

|

MOH Reports Fourth Quarter and Year-End 2015 Results

Page 14

February 8, 2016

MOLINA HEALTHCARE, INC.

HEALTH INSURER FEE DETAILS BY HEALTH PLAN

(In millions)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| HIF Reimbursement Revenue, Gross(1) |

| Year Ended December 31, 2015 |

| Recognized | | Necessary for Full Reimbursement |

| Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | Total | |

2015 HIF: | |

California | $ | — |

| | $ | 17 |

| | $ | 6 |

| | $ | 8 |

| | $ | 31 |

| | $ | 31 |

|

Florida | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 8 |

| | 8 |

|

Illinois | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 4 |

| | 4 |

|

Michigan | — |

| | — |

| | 21 |

| | 7 |

| | 28 |

| | 28 |

|

New Mexico | 7 |

| | 8 |

| | 8 |

| | 7 |

| | 30 |

| | 30 |

|

Ohio | 12 |

| | 12 |

| | 12 |

| | 12 |

| | 48 |

| | 48 |

|

South Carolina | 3 |

| | 3 |

| | 3 |

| | 3 |

| | 12 |

| | 12 |

|

Texas | 6 |

| | 6 |

| | 6 |

| | 5 |

| | 23 |

| | 23 |

|

Utah | — |

| | — |

| | 4 |

| | 2 |

| | 6 |

| | 6 |

|

Washington | 11 |

| | 11 |

| | 6 |

| | 9 |

| | 37 |

| | 37 |

|

Wisconsin | 1 |

| | 1 |

| | 1 |

| | 2 |

| | 5 |

| | 5 |

|

Subtotal, Medicaid | 43 |

| | 61 |

| | 70 |

| | 58 |

| | 232 |

| | 232 |

|

Marketplace | — |

| | — |

| | 1 |

| | 1 |

| | 2 |

| | 2 |

|

Medicare | 6 |

| | 4 |

| | 4 |

| | 5 |

| | 19 |

| | 19 |

|

| 49 |

| | 65 |

| | 75 |

| | 64 |

| | 253 |

| | $ | 253 |

|

2014 HIF: | | | | | | | | | | | |

California | — |

| | 12 |

| | — |

| | — |

| | 12 |

| | |

Michigan | — |

| | — |

| | 7 |

| | — |

| | 7 |

| | |

Utah | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | |

| $ | 49 |

| | $ | 77 |

| | $ | 83 |

| | $ | 64 |

| | $ | 273 |

| | |

| | | | | | | | | | | |

Recognized in: | | | | | | | | | | | |

Health insurer fee revenue | $ | 48 |

| | $ | 74 |

| | $ | 81 |

| | $ | 61 |

| | $ | 264 |

| | |

Premium tax revenue | 1 |

| | 3 |

| | 2 |

| | 3 |

| | 9 |

| | |

| $ | 49 |

| | $ | 77 |

| | $ | 83 |

| | $ | 64 |

| | $ | 273 |

| | |

_____________

| |

(1) | Amounts in the table include the Company’s estimate of the full economic impact of the excise tax including premium tax and the income tax effect. |

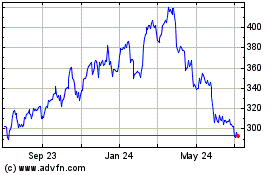

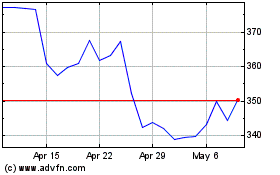

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024