UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2016

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-31719 |

|

13-4204626 |

| (State of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

200 Oceangate, Suite 100,

Long Beach, California 90802

(Address of principal executive offices)

Registrant’s telephone number, including area code: (562) 435-3666

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

On Monday, January 11, 2016, at 9:30 a.m. Pacific time, the Company’s management gave a presentation followed by a question and answer session at the

34th Annual J.P. Morgan Healthcare Conference in San Francisco, California. During the presentation, the Company presented and webcast certain slides, and addressed such issues as

revenue and membership growth and opportunities for further expansion.

A copy of the Company’s complete slide presentation is included as Exhibit

99.1 to this report. An audio and slide replay of the Company’s presentation will also be available for 30 days from the date of the presentation on the Company’s website.

The information in this Form 8-K current report and the exhibits attached hereto shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as

expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Slide presentation in connection with the Company’s presentation at the 34th Annual J.P. Morgan Healthcare Conference on January 11, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MOLINA HEALTHCARE, INC. |

|

|

|

|

| Date: January 11, 2016 |

|

|

|

By: |

|

/s/ Jeff D. Barlow |

|

|

|

|

Jeff D. Barlow |

|

|

|

|

Chief Legal Officer and Secretary |

EXHIBIT INDEX

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Slide presentation in connection with the Company’s presentation at the 34th Annual J.P. Morgan Healthcare Conference on January 11, 2016. |

Exhibit 99.1

34th Annual JP Morgan Healthcare Conference

J.

Mario Molina, MD

President & Chief Executive Officer

January 11-15, 2016 / San Francisco, California

Cautionary Statement

Safe Harbor Statement under

the Private Securities Litigation Reform Act of 1995:This slide presentation and our accompanying oral remarks contain “forward -looking statements” regarding, without limitation: our growth and acquisition expectations and strategies; the

projected growth of the Medicaid program; our Companies growth and acquisition strategy; our projected 2016 revenues from the in-market acquisitions we announced in 2015; the headwinds and tailwinds we anticipate in fiscal year 2016; and various

other matters. All of our forward -looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to differ materially. Anyone viewing or listening to this presentation is urged to read the

risk factors and cautionary statements found under Item 1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements in our quarterly reports and in our other reports and filings with the Securities and Exchange

Commission and available for viewing gov . on its website at sec. Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward -looking statements in future filings or communications regarding

our business or operating results.

2

© 2016 MOLINA HEALTHCARE, INC.

Our mission

To provide quality health care to

people receiving government assistance

3

© 2016 MOLINA HEALTHCARE, INC.

Our footprint today

Health plan footprint

includes 4 of 5 largest Medicaid markets

USVI

Puerto Rico

Molina Health plans

Molina Medicaid Solutions

Pathways2

Primary Care Direct delivery

1. Total enrollment

relates to estimated membership as of January, 2016.

2. Pathways was previously know as Providence Human

Services and was acquired from The Providence Services Corporation in a transaction that closed on November 1, 2015.

© 2016 MOLINA HEALTHCARE, INC.

1

3.9M

Members

1% Duals

1% Medicare

10% Marketplace

9% ABD

13% Expansion

65% TANF & CHIP

Member Mix

4

Our membership growth

Significant historical

enrollment growth over the last 10 years1

4.0M

136k

3.9M

3.0M 53k 66k 21k

2.0M 135k

64k

1.0M 0.9M

0.0M

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Jan -16

1. Total enrollment as of December 31 for each year from 2005 “2014 plus January 2016 preliminary enrollment from Company estimates.

5

© 2016 MOLINA HEALTHCARE, INC.

Our revenue growth

Historical revenue has

outpaced historical membership growth over the last 10 years1

16.0B 136k

14.3B

12.0B 53k 66k 21k

8.0B 135k

64k

4.0B

1.7B

0.0B

2

2005 2006 2007 2008 2009 2010 2011 2012 2013

2014 2015O

1. Total revenue as reported in the Company“s 10Ks as of December 31 for each year from

2005 “2014.

2. 2015 Outlook as provided by the Company in the June 2015 estimate.

6

© 2016 MOLINA HEALTHCARE, INC.

Medicaid growth

Growth in the Medicaid program

accelerated between 2013-2015 due to the Affordable

Care Act, steady organic growth is expected to continue

over the next five years. Year to Date Enrollment

Growth

136k

85M

Medicaid/CHIP Growth Projections 1

81.5M 82.2M December 31, 2014

80.8M

53k 79.8M 2.6M 80M

77.9M 66k members

21k

76.3M

135k

75M

72.1M 64k

January 2016

70M 3.9M

members

65M

2013 2014 2015 2016 2017 2018 2019 2020

1. CMS, Office of the Actuary, National Health Expenditure Projections 2014 -2024, Table 17 Health Insurance Enrollment and Enrollment Growth Rates https://www. cms.gov/Research

-Statistics -Data-and-Systems/Statistics -Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected. htm.l

7

© 2016 MOLINA HEALTHCARE, INC.

Medicaid spending on managed care vs. fee for service

$500 Medicaid Benefit Spending

2010-2014 $468B

$283 Expenditures on Medicaid Long Term Services and Supports $286 (LTSS) represent ~50% of Medicaid Fee For

Service spend.

$400

$295 $282 $284 6%

3%

People with Other / $300

Serious Multiple Mental Populations Medicaid Fee For Service Illness $200

$184 30% $145 61%

$100 $125 People with $111

Older People & $98 Developmental People with Disabilities Physical Disabilities

Medicaid Managed Care

Source: Truven Health Analytics. “Medicaid Expenditures for Long-Term Services and Supports in FFY 2012;

$0 published April 28, 2014.

2010 2011 2012 2013 2014

Sources:

1. 2011 “2014 March Medicaid and CHIP Program Statistics MACStats

2. MACStats: Medicaid and CHIP Data Book, December 2015

Total spend includes FFS plus managed care and premium assistance only and excludes Medicare premiums and coinsurance and collections. 8

© 2016 MOLINA HEALTHCARE, INC.

Increasing complexity drives higher spend

Complex

members continue to transition into managed care

$$$$$

Long Term Care

Dual Eligible $$$$

Seniors & Persons $$$

with Disabilities

Medicaid

Expansion $$

Temporary

Assistance to $ Needy Families

Number of potential enrollees

9

© 2016 MOLINA HEALTHCARE, INC.

How will we continue to grow?

Organic growth in

existing markets and RFPs

In-market acquisitions

Marketplace

Transition of members and benefits from FFS to managed care Capability -based provider acquisitions

10

© 2016 MOLINA HEALTHCARE, INC.

Executing on our strategy: RFPs

§ Successful

re-procurement

Region 1

§ Won all 9 regions bid on

1

§ Expands current geographic footprint by 18 counties

§ HealthPlus and HAP Midwest acquisitions add an additional 170K

Regions 2 -10 members

§ New Medicaid contract became effective January 1, 2016

§ Successful re-procurement for one region

§ Combines physical health and behavioral health services into one contract§ CUP acquisition adds an additional

55K members§ New Medicaid contract will become effective April 1, 2016

1. Molina did not bid on

Region 1 in Michigan

© 2016 MOLINA HEALTHCARE, INC.

Michigan

§ Awarded contracts will serve more than 1.7M

beneficiaries across the

state

Washington

“ Molina is one of two awardees in the region

that will serve more than 120,000 beneficiaries

11

Acquisition strategy

How do the pieces fit

together?

New Managed Care State Existing Managed Care State Provider / Capability

Rationale

Diversification “ revenue, risk, contracts Fortify competitive position Enhance provider alignment

Administrative cost leverage “long term Administrative leverage “short term Medical cost improvement “ medium term

Criteria

Increased member care oversite / Competitive provider environment Competitive provider environment management

Sizeable Medicaid population Attractive price Complementary to Molina care model

Difficult /expensive / timely to develop Favorable regulatory environment Favorable regulatory environment internally

Valuable talent

12

© 2016 MOLINA HEALTHCARE, INC.

Executing on our growth strategy: acquisitions

9

acquisitions announced in 2015

May August October

In-market acquisitions:

§ generally asset purchases§ provide greater scale§ entry to new service areas§ accretive

Michigan Florida Illinois status: closed status: closed status: closed

Washington

Status: closed Florida status: closed

* Michigan Status: closed 23 states + DC

Status: closed Illinois status: closed

2015 Illinois status: pending

July September November

* Capability based

provider acquisition

In-market acquisitions expected to add approximately $1.4 billion in total revenue in

2016

Note:

Estimated revenue based on annualized Company estimates. Please refer to the Company“s cautionary statement. 13 © 2016 MOLINA HEALTHCARE, INC.

Diagnoses of behavioral and mental health conditions are increasing

Mental and substance use disorders are expected to surpass all physical diseases as a major cause of worldwide disability by 2020

68% 49%

68% of adults with 49% of Medicaid mental illness also enrollees with have at least 1 chronic disabilities have a physical illness . psychiatric illness.

Source: Annals of Internal Medicine: Crowley RA, Kirschner N, for the Health and Public Policy Committee of the American

College of Physicians. The Integration of Care for Mental Health, Substance Abuse, and Other Behavioral Health Conditions into Primary Care: Executive Summary of an American College of Physicians Position Paper. Ann Intern Med. 2015;163:298 -299.

doi:10.7326/M15 -0510.

© 2016 MOLINA HEALTHCARE, INC.

2X

Prevalence of mental illness among the Medicaid population is twice that of the general population

2X-3X

Treatment of chronic physical health issues

for patients with behavioral health needs is 2 to 3 times more expensive than patients with physical health only needs.

14

Introducing Pathways

A capability -based provider

acquisition

Pathways provides a growing number behavioral health programs and social services to Medicaid

beneficiaries throughout the nation.

Mental Other 1 Health Child 10% 44%

Autism &

Intellectual and Mental Developmental Health Adult Disabilities 26% 9%

Child Welfare 11%

1. Other includes Educational,

Probational, and Substance Abuse

© 2016 MOLINA HEALTHCARE, INC.

15

Medicaid and social services on the horizon

CMS

has announced a 5-year, $157M program to test up to 44 separate pilot projects that will better link Medicare and Medicaid patients to social services.

CMS will focus on:

§ Housing Social service

needs inhibit many lower income § Food insecurity individuals from getting better or maintaining § Utilities good health

§ Interpersonal safety, and§ Transportation

Social health issues become a more significant driver of health care costs as care complexity increases

Sources:

1. Kaiser Health News Feds Funding

Effort To Tie Medical Services To Social Needs, Julie Rovner, January 5, 2016; http://khn. org/news/feds -funding -effort-to-tie-medical -services -to-social-needs

2. New England Journal of Medicine: Accountable Health Communities “ Addressing Social Needs through Medicare and Medicaid; Dawn E. Alley, Ph.D., Chisara N. Asomugha, M.D., Patrick H.

Conway, M.D., and Darshak M. Sanghavi, M.D.; January 5, 2016 DOI: 10.1056/NEJMp1512532; http://www.

nejm.org/doi/full/10.1056/NEJMp1512532 16

© 2016 MOLINA HEALTHCARE, INC.

Home and Community Based Services

Behavioral and

mental health services are significant drivers of cost

Medicaid HCBS Expenditures

Prevocational services FY 20101 Day habilitation Education services Day treatment/partial hospitalization Other2 Adult day

health 14%

Adult day services Group living, mental health services Community integration Round-the-clock

services, unspecified Medical day care for children Group living, other Day Services Round-the-clock Shared living, other 15% In-home residential habilitation

In-home round-the-clock services, other Group living, residential habilitation Home-based habilitation 46% Home-Based Shared living, residential habilitation Home health aide In-home

round-the-clock mental health services Personal care 18% Companion Homemaker Chores

Mental Health Case

Management

3% 4%

Medicaid HCBS total spend in 2012: $69B

1.

Mathematica Policy Research. “The HCBS Taxonomy: A New Language for Classifying Home-and Community -Based Services”, August 2013

2. Other includes expenses related to goods and services, interpreters, housing consultation, and claims where the procedure code could not be interpreted

17

© 2016 MOLINA HEALTHCARE, INC.

Continued organic growth in Medicare-Medicaid Plans (MMP)

Dual eligible markets

1. CMS enrollment data as

of December, 2015

2. South Carolina is currently enrolling voluntary members only

© 2016 MOLINA HEALTHCARE, INC.

Enrollment

December December 2014 20151

California 11K 14K Illinois 5K 4K

USVI Michigan—9K Ohio 2K 10K

South Carolina 2—<1K

Puerto Rico Texas—14K

Total 18K 51K

MMP Markets

18

Marketplace

15M

Penalty for not having coverage in 2016 is 2.5% of yearly household income or $695 per adult (half for those under 18)

[Graphic Appears Here]

§ Leverages existing Medicaid network§ Continuity for Medicaid members§ No platinum, limited gold

§ Low MCR not sustainable in the long term

USVI

Puerto Rico Molina 325K1

Marketplace 226K

Enrollment

Marketplace operations

3Q2015 Jan 2016

93% of Molina marketplace members

receive government subsidies

1. Company“s enrollment as of January 2016

19

© 2016 MOLINA HEALTHCARE, INC.

One of a kind

Flexible health services portfolio

(health plans, direct delivery, MMIS) Focused on people receiving government assistance Scalable administrative infrastructure Consistent Medicaid national brand Seasoned management team Unique culture

20

© 2016 MOLINA HEALTHCARE, INC.

The year ahead

Tailwinds

Headwinds

§ Top line revenue/membership from § Premium rates existing managed care state acquisitions§ Pent-up demand new § Dual eligible experience in all 6

contracts/populations demonstration states§ Provider settlements and retroactive§ Marketplace growth state recoveries§ Marketplace MCR convergence

21

© 2016 MOLINA HEALTHCARE, INC.

Q&A

22

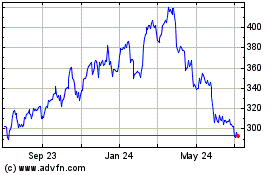

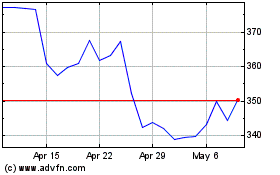

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024