Molina Healthcare Announces Pricing of Common Stock Offering

June 04 2015 - 6:00AM

Business Wire

Molina Healthcare, Inc. (NYSE:MOH) (the “Company”) announced

today the pricing of its previously announced underwritten public

offering by the Company of 5,000,000 shares of its common stock at

a public offering price of $67.75 per share.

The Company intends to use the net proceeds of the offering for

general corporate purposes, which may include the repayment of

indebtedness, funding for acquisitions such as our recently

announced expansion in the State of Michigan, capital expenditures,

additions to working capital and to meet statutory capital

requirements in new or existing states.

In connection with the offering, the Company has granted the

underwriters a 30-day option to purchase at the public offering

price an additional 750,000 shares to cover overallotments, if

any.

UBS Securities LLC, BofA Merrill Lynch and Wells Fargo

Securities, LLC are acting as lead book-running managers for the

offering. SunTrust Robinson Humphrey, Inc. is acting as a joint

book-running manager of the offering.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

The offering is being made by means of a prospectus and the related

prospectus supplement only. Before investing, investors should read

the prospectus in the registration statement, the related

prospectus supplement and other documents Molina Healthcare has

filed with the Securities and Exchange Commission (the “SEC”) for

more complete information about Molina Healthcare and the offering.

Copies of the prospectus and the related prospectus supplement can

be obtained from UBS Securities LLC, Attn: Prospectus Dept., 1285

Avenue of the Americas, New York, NY 10019, tel.: (888) 827-7275;

BofA Merrill Lynch, 222 Broadway, New York, NY 10038, Attn:

Prospectus Department or via email at

dg.prospectus_requests@baml.com; Wells Fargo Securities, LLC,

Attention: Equity Syndicate Department, 375 Park Avenue, New York,

NY 10152, via telephone at 800-326-5897 or email at

cmclientsupport@wellsfargo.com. A prospectus supplement related to

the offering will also be available free of charge on the SEC’s

website at http://www.sec.gov.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed

health care services under the Medicaid and Medicare programs and

through the state insurance marketplaces. Through our locally

operated health plans in 11 states across the nation, Molina

currently serves over 3 million members. Dr. C. David Molina

founded our company in 1980 as a provider organization serving

low-income families in Southern California. Today, we continue his

mission of providing high quality and cost-effective health care to

those who need it most.

Cautionary Statement under the Private Securities Litigation

Reform Act: This press release contains “forward-looking

statements” that are subject to risks and uncertainties that may

cause actual results to differ materially. A discussion of the risk

factors facing the Company can be found in its annual report on

Form 10-K for the year ended December 31, 2014, in its quarterly

report on Form 10-Q for the quarter ended March 31, 2015, in its

Form 8-K current reports, and in its other reports and filings with

the SEC. These reports can be accessed on the SEC’s website at

www.sec.gov. The Company undertakes no obligation to release any

revisions to any forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150604005205/en/

Molina Healthcare, Inc.Juan José Orellana, 562-435-3666Investor

Relations

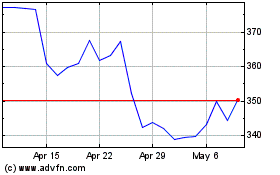

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

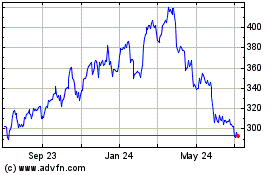

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024