Current Report Filing (8-k)

June 01 2015 - 8:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2015

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-31719 |

|

13-4204626 |

| (State of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

200 Oceangate, Suite 100, Long Beach, California 90802

(Address of principal executive offices)

Registrant’s telephone number, including area code: (562) 435-3666

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

On June 1, 2015, Molina Healthcare, Inc. issued a press release updating

its outlook for fiscal year 2015 provided on February 12, 2015 to include the impact of improvements in its medical margin, the recently announced expansion in the State of Michigan, a proposed offering of common stock, and increased accounting

dilution from its convertible notes due to the Company’s stock trading price. The full text of the press release is included as Exhibit 99.1 to this report. The information contained in the websites cited in the press release is not

part of this report.

The information in this Form 8-K and the exhibits attached hereto shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934,

except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release of Molina Healthcare, Inc. issued June 1, 2015, updating outlook for fiscal year 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MOLINA HEALTHCARE, INC. |

|

|

|

|

| Date: June 1, 2015 |

|

|

|

By: |

|

/s/ Jeff D. Barlow |

|

|

|

|

Jeff D. Barlow |

|

|

|

|

Chief Legal Officer and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release of Molina Healthcare, Inc. issued June 1, 2015, updating outlook for fiscal year 2015. |

Exhibit 99.1

News Release

Contact:

Juan José Orellana

Investor Relations

562-435-3666, ext. 111143

MOLINA HEALTHCARE

PROVIDES UPDATE

TO FISCAL YEAR 2015 OUTLOOK

LONG BEACH, California (June 1, 2015) – Molina Healthcare, Inc. (NYSE:MOH) today announced that it is updating its outlook for fiscal year 2015

provided on February 12, 2015 to include the impact of improvements in its medical margin, the recently announced expansion in the State of Michigan, a proposed offering of common stock, and increased accounting dilution from its convertible

notes due to the Company’s stock trading price.

The following table presents the Company’s updated outlook for fiscal year 2015 (all amounts

are approximate): (1)

|

|

|

|

|

| Premium Revenue |

|

$ |

13.5 billion |

|

| Health Insurer Fee Revenue (2) |

|

$ |

260 million |

|

| Premium Tax Revenue |

|

$ |

400 million |

|

| Service Revenue |

|

$ |

180 million |

|

| Investment Income and Other Revenue |

|

$ |

17 million |

|

|

|

|

|

|

| Total Revenue |

|

$ |

14.3 billion |

|

|

|

|

|

|

| Total Medical Care Costs |

|

$ |

12.1 billion |

|

| Medical Care Ratio (3) |

|

|

89.5 |

% |

| Total Cost of Service Revenue |

|

$ |

145 million |

|

|

|

|

|

|

| General and Administrative Expenses |

|

$ |

1.1 billion |

|

| G&A Ratio (4) |

|

|

7.6 |

% |

| Premium Tax Expenses |

|

$ |

400 million |

|

| Health Insurer Fee Expenses |

|

$ |

165 million |

|

| Depreciation and Amortization |

|

$ |

105 million |

|

| Interest and Other Expenses |

|

$ |

60 million |

|

| Income Before Income Tax Expense |

|

$ |

300 million |

|

|

|

|

|

|

| Net Income |

|

$ |

132 million |

|

|

|

|

|

|

| EBITDA(5) |

|

$ |

485 million |

|

| Effective Tax Rate |

|

|

56 |

% |

| Diluted Weighted Average Shares Outstanding(6) |

|

|

56 million |

|

| Diluted net income per share |

|

$ |

2.35 |

|

| Adjusted net income per share(5) |

|

$ |

2.90 |

|

-MORE-

| (1) |

All amounts are estimates; actual results may differ materially. See our risk factors as discussed in our Form 10-K and other filings as well as the cautionary statements below. 2015 outlook assumes the closing by

September 2015 of our recently announced expansion in Michigan. |

| (2) |

2015 outlook assumes full reimbursement of the Health Insurer Fee and related tax effects for 2015, and includes the recognition of $18 million in revenue relating to the 2014 HIF. |

| (3) |

Medical care ratio represents medical care costs as a percentage of premium revenue. |

| (4) |

G&A Ratio represents general and administrative expenses as a percentage of total revenue. |

| (5) |

See reconciliation of non-GAAP financial measures. |

| (6) |

Estimate of weighted average shares outstanding for full year 2015 includes impact of existing convertible notes and the assumed issuance of 5.75 million shares in June 2015. Estimate assumes an average daily

weighted average share price of $70 for the period June 1, 2015 through December 31, 2015. |

-MORE-

Non-GAAP Financial Measures

EBITDA and adjusted net income per diluted share are non-GAAP financial measures used by management as supplemental metrics in evaluating financial

performance, financing and business decisions, and in forecasting and planning for future periods. These measures are not determined in accordance with accounting principles generally accepted in the United States of America (GAAP) and should not be

viewed as a substitute for the most directly comparable GAAP measures.

The following table reconciles net income, which the Company believes to be the

most comparable GAAP measure, to EBITDA:

|

|

|

|

|

| |

|

2015

Outlook(1) |

|

| Net income |

|

$ |

132 million |

|

| Adjustments: |

|

|

|

|

| Depreciation, and amortization of intangible assets and capitalized software |

|

|

125 million |

|

| Interest expense |

|

|

60 million |

|

| Income tax expense |

|

|

168 million |

|

|

|

|

|

|

| EBITDA |

|

$ |

485 million |

|

|

|

|

|

|

The following table reconciles net income per diluted share, which the Company believes to be the most comparable GAAP

measure, to adjusted net income per diluted share:

|

|

|

|

|

| |

|

2015

Outlook(1) |

|

| Net income per diluted share |

|

$ |

2.35 |

|

| Adjustments, net of tax: |

|

|

|

|

| Amortization of convertible senior notes and lease financing obligations |

|

|

0.35 |

|

| Amortization of intangible assets |

|

|

0.20 |

|

|

|

|

|

|

| Adjusted net income per diluted share |

|

$ |

2.90 |

|

|

|

|

|

|

| (1) |

All amounts are estimates and subject to change. Computation assumes 56 million diluted weighted average shares outstanding. |

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed health care services under the Medicaid and Medicare programs and through the state insurance

marketplaces. Through our locally operated health plans in 11 states across the nation, Molina currently serves over 3 million members. Dr. C. David Molina founded our company in 1980 as a provider organization serving low-income families

in Southern California. Today, we continue his mission of providing high quality and cost-effective health care to those who need it most.

Cautionary Statement under the Private Securities Litigation Reform Act of 1995: This earnings release contains “forward-looking

statements” regarding the Company’s plans, expectations, and anticipated future events. Actual results could differ materially due to numerous known and unknown risks and uncertainties, including, without limitation, risk factors related

to the following:

| • |

|

continuing uncertainties associated with the implementation of the Affordable Care Act, including the full grossed up reimbursement by states of the non-deductible ACA health insurer fee, the Medicaid expansion, the

insurance marketplaces, the effect of various implementing regulations, the King v. Burwell case now pending before the Supreme Court, and uncertainties regarding the Medicare-Medicaid dual eligible demonstration programs in California, Illinois,

Michigan, Ohio, and South Carolina; |

| • |

|

management of our medical costs, including seasonal flu patterns and rates of utilization that are consistent with our expectations, and our ability to reduce over time the high medical costs commonly associated with

new patient populations; |

| • |

|

federal or state medical cost expenditure floors, administrative cost and profit ceilings, and profit sharing arrangements; |

| • |

|

the interpretation and implementation of at-risk premium revenue recognition rules regarding the achievement of certain quality measures; |

| • |

|

cyber-attacks or other privacy or data security incidents resulting in an inadvertent unauthorized disclosure of protected health information; |

| • |

|

the timely closing and successful integration of our recently announced expansion in Michigan; |

| • |

|

the success of our new health plan in Puerto Rico, and the ability of ASES, the Puerto Rico Medicaid agency, to pay our Puerto Rico health plan throughout 2015 under the terms of its Medicaid contract;

|

| • |

|

newly FDA-approved specialty drugs such as Sovaldi, Olysio, Harvoni, and other specialty drugs or generic drugs that are exorbitantly priced but not factored into the calculation of our capitated rates;

|

| • |

|

significant budget pressures on state governments and their potential inability to maintain current rates, to implement expected rate increases, or to maintain existing benefit packages or membership eligibility

thresholds or criteria; |

| • |

|

the accurate estimation of incurred but not paid medical costs across our health plans; |

| • |

|

retroactive adjustments to premium revenue or accounting estimates which require adjustment based upon subsequent developments, including Medicaid pharmaceutical rebates or retroactive premium rate increases;

|

| • |

|

efforts by states to recoup previously paid amounts; |

| • |

|

the success of our efforts to retain existing government contracts and to obtain new government contracts in connection with state requests for proposals (RFPs) in both existing and new states, including the success

of the proposal of Molina Medicaid Solutions in New Jersey; |

| • |

|

the continuation and renewal of the government contracts of both our health plans and Molina Medicaid Solutions and the terms under which such contracts are renewed; |

| • |

|

complications, member confusion, or enrollment backlogs related to the annual renewal of Medicaid coverage; |

| • |

|

government audits and reviews, and any fine, enrollment freeze, or monitoring program that may result therefrom; |

| • |

|

changes with respect to our provider contracts and the loss of providers; |

| • |

|

approval by state regulators of dividends and distributions by our health plan subsidiaries; |

| • |

|

changes in funding under our contracts as a result of regulatory changes, programmatic adjustments, or other reforms; |

| • |

|

high dollar claims related to catastrophic illness; |

| • |

|

the favorable or unfavorable resolution of litigation, arbitration, or administrative proceedings, including pending qui tam actions in Florida and California, and the litigation commenced against us by the state of

Louisiana alleging that Molina Medicaid Solutions and its predecessors used an incorrect reimbursement formula for the payment of pharmaceutical claims; |

| • |

|

the relatively small number of states in which we operate health plans; |

| • |

|

our management of a portion of College Health Enterprises’ hospital in Long Beach, California; |

| • |

|

the availability of adequate financing on acceptable terms to fund and capitalize our expansion and growth, repay our outstanding indebtedness in accordance with its terms and meet our liquidity needs, including the

interest expense and other costs associated with such financing; |

| • |

|

the failure of a state in which we operate to renew its federal Medicaid waiver; |

| • |

|

changes generally affecting the managed care or Medicaid management information systems industries; |

| • |

|

increases in government surcharges, taxes, and assessments; |

| • |

|

public alarm associated with the Ebola virus, measles, or any actual widespread epidemic; |

| • |

|

changes in general economic conditions, including unemployment rates; |

| • |

|

increasing competition and consolidation in the Medicaid industry; |

and numerous other risk

factors, including those discussed in the Company’s periodic reports and filings with the Securities and Exchange Commission. These reports can be accessed under the investor relations tab of the Company’s website or on the SEC’s

website at www.sec.gov. Given these risks and uncertainties, we can give no assurances that the Company’s forward-looking statements will prove to be accurate, or that any other results or events projected or

contemplated by the Company’s forward-looking statements will in fact occur, and we caution investors not to place undue reliance on these statements. All forward-looking statements in this

release represent the Company’s judgment as of June 1, 2015, and we disclaim any obligation to update any forward-looking statements to conform the statement to actual results or changes in the Company’s expectations.

-END-

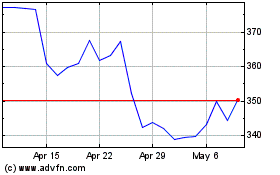

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

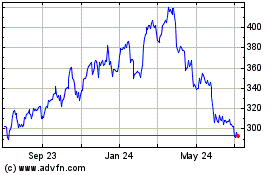

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024