UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

|

| | | |

Check the appropriate box: |

|

| Preliminary Proxy Statement |

þ | Definitive Proxy Statement | Â | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

MOLINA HEALTHCARE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1) |

Title of each class of securities to which transaction applies:

|

(2) |

Aggregate number of securities to which transaction applies:

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) |

Proposed maximum aggregate value of transaction:

|

(5) |

Total fee paid:

|

| |

¨ | Fee paid previously with preliminary materials. |

| |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

(1) |

Amount Previously Paid:

|

(2) |

Form, Schedule or Registration Statement No.:

|

(3) |

Filing Party:

|

(4) |

Date Filed:

|

|

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Wednesday, May 6, 2015

|

Dear Fellow Stockholder:

Our 2015 annual meeting of stockholders will be held at 10:00 a.m. local time on Wednesday, May 6, 2015, at 200 Oceangate, 15th Floor, Long Beach, California 90802, for the following purposes:

| |

(1) | To elect three Class I directors to hold office until the 2018 annual meeting. |

| |

(2) | To re-approve the material terms of the performance goals for Section 162(m)(1) awards under the Molina Healthcare, Inc. Incentive Compensation Plan. |

| |

(3) | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015. |

| |

(4) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice. The board of directors has fixed the close of business on March 17, 2015 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting and at any continuation, adjournment, or postponement thereof.

This notice and the accompanying proxy statement are being mailed or transmitted on or about April 6, 2015 to the Company’s stockholders of record as of March 17, 2015.

Every stockholder vote is important. Please sign, date, and promptly return the enclosed proxy card in the enclosed envelope, or vote by telephone or Internet (instructions are on your proxy card), so that your shares will be represented whether or not you attend the annual meeting.

|

|

By order of the board of directors, |

|

Joseph M. Molina, M.D. Chairman of the Board, Chief Executive Officer,

and President |

Long Beach, California

April 6, 2015

|

|

ANNUAL MEETING OF STOCKHOLDERS

To Be Held Wednesday, May 6, 2015 |

About the Annual Meeting

Who is soliciting my vote?

The board of directors of Molina Healthcare, Inc. (sometimes referred to herein as “the Company” or “Molina Healthcare”) is soliciting your vote at the 2015 annual meeting of Molina Healthcare’s stockholders.

What will I be voting on?

Stockholders will be voting on the following matters:

| |

1. | The election of three Class I directors to hold office until the 2018 annual meeting; |

| |

2. | The re-approval of the material terms of the performance goals for Section 162(m)(1) awards under the Molina Healthcare, Inc. Incentive Compensation Plan; |

| |

3. | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015; and |

| |

4. | In accordance with the best judgment of the individuals named as proxies on the proxy card, on any other matters properly brought before the meeting or any adjournment or postponement thereof. |

How many votes do I have?

You will have one vote for every share of Molina Healthcare common stock you owned on March 17, 2015, which was the record date.

How many votes can be cast by all stockholders?

49,918,906, consisting of one vote for each share of Molina Healthcare’s common stock that was outstanding on the record date. There is no cumulative voting.

How many votes must be present to hold the meeting?

A majority of the votes that can be cast, or 24,959,454 votes. We urge you to vote by proxy even if you plan to attend the annual meeting so that we will know as soon as possible whether enough votes will be present for us to hold the meeting.

How do I vote?

You can vote either in person at the annual meeting or by proxy whether or not you attend the annual meeting.

To vote by proxy, you must:

| |

• | fill out the enclosed proxy card, date and sign it, and return it in the enclosed postage-paid envelope; |

| |

• | vote by telephone (instructions are on the proxy card); or |

| |

• | vote by Internet (instructions are on the proxy card). |

To ensure that your vote is counted, please remember to submit your vote by May 5, 2015, the day before the annual meeting.

If you want to vote in person at the annual meeting and you hold your Molina Healthcare stock through a securities broker (that is, in street name), you must obtain a proxy from your broker and bring that proxy to the meeting.

Can I change my vote or revoke my proxy?

Yes. Just send in a new proxy card with a later date, or cast a new vote by telephone or Internet, or send a written notice of revocation to Molina Healthcare’s Corporate Secretary at 200 Oceangate, Suite 100, Long Beach, California 90802. If you attend the annual meeting and want to vote in person, you can request that your previously submitted proxy not be used.

What if I do not vote for the four proposals listed on my proxy card?

If you return a signed proxy card without indicating your vote, in accordance with the board’s recommendation, your shares will be voted as follows:

| |

1. | For the three director nominees listed on the card; |

| |

2. | For the re-approval of the material terms of the performance goals for Section 162(m)(1) awards under the Molina Healthcare, Inc. Incentive Compensation Plan; and |

| |

3. | For the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015. |

Can my broker vote my shares for me on each of the proposals?

Proposal 1 is not considered a routine matter under NYSE rules, and brokers will not be permitted to vote on such Proposal if the beneficial owners fail to provide voting instructions. Please vote your proxy so your vote can be counted.

Proposals 2 and 3 are considered routine matters under the NYSE rules on which brokers will be permitted to vote in their discretion even if the beneficial owners do not provide voting instructions.

Can my shares be voted if I do not return my proxy card and do not attend the annual meeting?

If you do not vote your shares held in street name, your broker can vote your shares on matters that the NYSE has ruled discretionary. As noted above, Proposal 1 is not a discretionary item. However, Proposal 2 (to re-approve the material terms of the performance goals for Section 162(m)(1) awards under the Molina Healthcare, Inc. Incentive Compensation Plan) and Proposal 3 (to ratify the appointment of Ernst & Young LLP) are discretionary items, and thus NYSE member brokers that do not receive instructions from beneficial owners may vote such shares at their discretion for such Proposals.

If you do not vote the shares registered directly in your name, not in the name of a bank or broker, your shares will not be voted.

How many votes are needed for each proposal and how are the votes counted?

In the election of directors (Item 1 on the proxy card), each of the three nominees is required to receive the affirmative vote of a majority of the votes cast with respect to such election in order to be elected, meaning that each director is required to receive more votes for the director's election than votes against the director's election. Abstentions, votes withheld, and broker non-votes will not be treated as "votes cast" and will have no effect on the voting outcome with respect to the election of directors.

The Company’s bylaws were amended in 2014 to implement a majority vote standard for an uncontested election of directors (i.e., an election where the number of nominees for director does not exceed the number of directors to be elected). This majority vote standard provides that in an uncontested election, a director nominee shall be elected by the affirmative vote of a majority of the votes cast with respect to such director. A majority of the votes cast means that the number of shares voted for a director exceeds the number of votes cast against that director.

If an incumbent director is not elected due to a failure to receive a majority of the votes cast as described above, and his or her successor is not otherwise elected and qualified, such director shall tender his or her offer of resignation promptly following the certification of the election results. Within 90 days from the certification of the vote, the corporate governance and nominating committee will make a recommendation to the board of directors with respect to any such tendered resignation, and the board of directors will act on such committee’s recommendation and publicly disclose its decision and the rationale behind it. The holdover director would not participate in either the committee’s or the board’s deliberations regarding that director’s offer to resign.

The favorable vote of a majority of the shares present in person or by proxy and entitled to vote will be required for:

| |

(i) | the re-approval of the material terms of the performance goals for Section 162(m)(1) awards under the Molina Healthcare, Inc. Incentive Compensation Plan (Item 2 on the proxy card); |

| |

(ii) | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2015 (Item 3 on the proxy card); and |

| |

(iii) | any other proposal that might properly come before the meeting. |

Abstentions will be counted toward the tabulation of votes cast on Proposals 2 and 3, and will have the effect of negative votes. Broker non-votes will have the effect of negative votes.

Could other matters be decided at the annual meeting?

We do not know of any other matters that will be considered at the annual meeting. If any other matters arise at the annual meeting, the proxies will be voted at the discretion of the proxy holders.

What happens if the meeting is postponed or adjourned?

Your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

Do I need proof of stock ownership to attend the annual meeting?

Yes, you will need proof of ownership of Molina Healthcare stock to enter the meeting.

When you arrive at the annual meeting, you may be asked to present photo identification, such as a driver’s license. If you are a stockholder of record, you will be on the list of Molina Healthcare’s registered stockholders. If your shares are held in the name of a bank, broker, or other holder of record, a recent brokerage statement or letter from a bank or broker is an example of proof of ownership. In accordance with our discretion, we may admit you only if we are able to verify that you are a Molina Healthcare stockholder.

How can I access Molina Healthcare’s proxy materials and 2014 Annual Report electronically?

This proxy statement and the 2014 Annual Report are available on Molina Healthcare’s website at www.molinahealthcare.com. From the Molina home page, click on “About Molina,” then click on “Investors,” and this proxy statement and the 2014 Annual Report can be found under the heading "Annual Meeting and Proxy Materials."

Most stockholders can elect not to receive paper copies of future proxy statements and annual reports and can instead view those documents on the Internet. If you are a stockholder of record, you can choose this option and save Molina Healthcare the cost of producing and mailing these documents by following the instructions provided when you vote over the Internet. If you hold your Molina Healthcare stock through a bank, broker, or other holder of record, please refer to the information provided by that entity for instructions on how to elect not to receive paper copies of future proxy statements and annual reports. If you choose not to receive paper copies of future proxy statements and annual reports, you will receive an e-mail message next year containing the Internet address to use to access Molina Healthcare’s proxy statement and annual report. Your choice will remain in effect until you tell us otherwise.

Where can I find the voting results?

We intend to announce preliminary voting results at the annual meeting. We will publish the final results in a current report on Form 8-K, which we expect to file within four business days after the annual meeting is held. You can obtain a copy of the Form 8-K by logging on to our website at www.molinahealthcare.com, or through the EDGAR system of the Securities and Exchange Commission (the "SEC"), at www.sec.gov. Information on our website does not constitute part of this proxy statement.

Annual Report

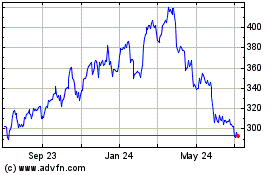

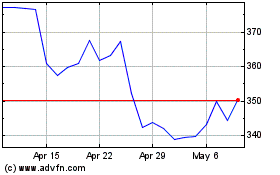

If you received these materials by mail, you should have also received with them Molina Healthcare’s Annual Report to Stockholders for 2014. The 2014 Annual Report is also available on Molina Healthcare’s website at www.molinahealthcare.com as described above. We urge you to read these documents carefully. In accordance with the rules of the SEC, the Company’s performance graph appears in Part II, Item 5, under the subheading "Stock Performance Graph," of our 2014 Annual Report.

Corporate Governance

Molina Healthcare continually strives to maintain high standards of ethical conduct, to report its results with accuracy and transparency, and to maintain full compliance with the laws, rules, and regulations that govern Molina Healthcare’s business.

The current charters of the audit committee, the corporate governance and nominating committee, the compensation committee, and the compliance and quality committee, as well as Molina Healthcare’s corporate governance guidelines, code of business conduct and ethics, and Related Person Transaction Policy are available in the “Investors” section of Molina Healthcare’s website, www.molinahealthcare.com, under the link for “Corporate Governance.” Molina Healthcare stockholders may obtain printed copies of these documents free of charge by writing to Molina Healthcare, Inc., Juan Jose Orellana, Senior Vice President of Investor Relations & Marketing, 200 Oceangate, Suite 100, Long Beach, California 90802.

Corporate Governance and Nominating Committee

The corporate governance and nominating committee’s mandate is to review and shape corporate governance policies, and to identify qualified individuals for nomination to the Company's board of directors. All of the members of the committee meet the independence standards contained in the NYSE corporate governance rules and Molina Healthcare’s Corporate Governance Guidelines.

The committee considers all qualified director candidates identified by members of the committee, by other members of the board of directors, by senior management, and by stockholders. Stockholders who would like to propose a director candidate for consideration by the committee may do so by submitting the candidate’s name, résumé, and biographical information to the attention of the Corporate Secretary as described below under “Submission of Future Stockholder Proposals.” All proposals for nominations received by the Corporate Secretary will be presented to the committee for its consideration.

The committee reviews each candidate’s biographical information and assesses each candidate’s independence, skills, and expertise based on a variety of factors, including breadth of experience reflecting that the candidate will be able to make a meaningful contribution to the board’s discussion of and decision-making regarding the array of complex issues facing the Company; understanding of the Company’s business environment; the possession of expertise that would complement the attributes of our existing directors; whether the candidate will appropriately balance the legitimate interests and concerns of all stockholders and other stakeholders in reaching decisions rather than advancing the interests of a particular constituency; and whether the candidate will be able to devote sufficient time and energy to the performance of his or her duties as a director. Application of these factors involves the exercise of judgment by the committee and the board.

Based on its assessment of each candidate’s independence, skills, and qualifications, the committee will make recommendations regarding potential director candidates to the board.

The committee follows the same process and uses the same criteria for evaluating candidates proposed by stockholders, members of the board of directors, and members of senior management.

For the 2015 annual meeting, the Company did not receive notice of any director nominations from our stockholders.

Board Diversity

Diversity is among the factors that the corporate governance and nominating committee considers when evaluating the composition of the board. Among the criteria for board membership as stated in the Company’s Corporate Governance Guidelines is a diversified membership: “The Board shall be committed to a diversified membership, in terms of the various experiences and areas of expertise of the individuals involved.” As set forth in our corporate governance guidelines, diversity may reflect age, gender, ethnicity, industry focus, and tenure on the board so as to enhance the board’s ability to manage and direct the affairs and business of the Company, including, when applicable, to enhance the ability of the committees of the board to fulfill their duties and/or to satisfy any independence requirements imposed by law, regulation, NYSE listing standards, and the Company’s Bylaws and other corporate governance documents.

Each director candidate contributes to the board’s overall diversity by providing a variety of perspectives, personal, and professional experiences and backgrounds. The board is satisfied that the current nominees reflect an appropriate diversity of gender, age, race, geographical background, and experience, and is committed to continuing to consider diversity issues in evaluating the composition of the board.

Corporate Governance Guidelines

The Company’s corporate governance guidelines embody many of our practices, policies, and procedures, which are the foundation of our commitment to sound corporate governance practices. The guidelines are reviewed annually and revised as necessary. The guidelines outline the responsibilities, operations, qualifications, and composition of the board. The guidelines provide that a majority of the members of the board shall be independent.

The guidelines require that all members of the Company’s audit, corporate governance and nominating, and compensation committees be independent. Committee members are appointed by the board upon recommendation of the corporate governance and nominating committee. Committee membership and chairs are rotated from time to time in accordance with the board’s judgment. The board and each committee have the power to hire and fire independent legal, financial, or other advisors, as they may deem necessary.

Meetings of the non-management directors are held as part of every regularly scheduled board meeting and are presided over by the lead independent director.

Directors are expected to prepare for, attend, and participate in all board meetings, meetings of the committees on which they serve, and the annual meeting of stockholders. All of the directors then in office attended Molina Healthcare’s 2014 annual meeting.

The corporate governance and nominating committee conducts an annual review of board performance. In addition, each committee conducts its own self-evaluation. The results of these evaluations are reported to the board.

Directors have full and free access to senior management and other employees of Molina Healthcare. New directors are provided with an orientation program to familiarize them with Molina Healthcare’s business, and its legal, compliance, and regulatory profile. Molina Healthcare makes available to the board educational seminars on a variety of topics. These seminars are intended to allow directors to develop a deeper understanding of relevant health care, governmental, and business issues facing the Company.

The board reviews the compensation committee’s report on the performance of Dr. Molina, the Company’s current chief executive officer, and of John Molina, the Company’s current chief financial officer, in order to ensure that they are providing effective leadership for Molina Healthcare. The board also works with the compensation committee with respect to matters of succession planning for the chief executive officer, the chief financial officer, and other senior executive officers of the Company.

Director Independence

The board of directors has determined that, except for Dr. J. Mario Molina and Mr. John Molina, each of the directors of the Company, including the three nominees identified in this proxy statement, has no material relationship with the Company that would interfere with the exercise of his or her independent judgment as a director, and is otherwise “independent” in accordance with the applicable listing requirements of the NYSE. In making that determination, the board of directors considered all relevant facts and circumstances, including the director’s commercial, consulting, legal, accounting, charitable, and familial relationships. The board of directors applied the following standards, which provide that a director will not be considered independent if he or she:

| |

• | Is, or has been within the last three years, an officer or employee of the Company or its subsidiaries, or has an immediate family member who is or has been within the last three years an officer or employee of the Company or its subsidiaries. |

| |

• | Has received, or who has an immediate family member who has received, during any 12 month period within the last three years, direct compensation from the Company in excess of $120,000 (other than director or committee fees or pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service). |

| |

• | Is or has been an executive officer of another company or is or has been an immediate family member of an executive officer of another company where any of the Company’s executive officers at the same time served on that company’s compensation committee during any of the last three years. |

| |

• | (a) Is a current partner or employee of a firm that is the Company’s internal or external auditor; (b) has an immediate family member who is a current partner of such a firm; (c) has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (d) was, or has an immediate family member who was, within the last three years, a partner or employee of such a firm and personally worked on the Company’s audit within the last three years. |

| |

• | Is a current employee, or is an immediate family member of a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues. |

In addition, a director will not be considered independent if Section 303A.02(b) of the NYSE Listed Company Manual (or any applicable successor listing standard) otherwise disqualifies such director from being considered independent. The independence of directors and the materiality of any business relationships delineated above shall be determined by the Board, and its determination shall be final.

Related Party Transactions

The board has adopted a policy regarding the review, approval, and monitoring of transactions involving the Company and related persons (directors and executive officers or their immediate family members). Such related persons are required to promptly and fully disclose to the Company’s general counsel all financial, social, ethical, personal, legal, or other potential conflicts of interest involving the Company. The general counsel shall confer as necessary with the lead independent director and/or with the Company’s corporate governance and nominating committee regarding the facts of the matter and the appropriate resolution of any conflict of interest situation in the best interests of the Company, including potential removal of the related person from a position of decision-making or operational authority with respect to the conflict situation, or other more significant steps depending upon the nature of the conflict.

6th & Pine Lease

On February 27, 2013, the Company entered into a build-to-suit office building lease (the “Lease”) with 6th & Pine Development, LLC (the “Landlord”) for office space located at 604 Pine Avenue, Long Beach, California (the “Project”). The principal members of the Landlord are John Molina, the chief financial officer and a director of the Company, and his wife. In addition, in 2013 in connection with the construction of the Project, John Molina pledged 650,000 shares of the Company’s common stock which he held as trustee of the Molina Siblings Trust. As of March 1, 2015, the number of such pledged shares was reduced to 360,000. Each of John Molina, and Dr. J. Mario Molina, the Company’s chief executive officer and chairman of the board of directors, are one-fifth beneficiaries of the Molina Siblings Trust.

The Project consisted of two office buildings. The building which comprises approximately 90,000 square feet of office and storage space (Building A) was completed in June 2013 and the second building (Building B) which comprises approximately 120,000 square feet of office space was completed in July 2014. The term of the Lease with respect to Building A commenced in June 2013, and the term of the Lease with respect to Building B commenced in July 2014. In 2014 the Company paid aggregate annual rent for Buildings A and B of approximately $4.6 million, parking expenses of $111,143, and tenant change orders of $177,955. The aggregate annual rent, including parking, for fiscal year 2015 is approximately $5.35 million for Buildings A and B.

Effective October 31, 2014, the Company and the Landlord entered into the First Amendment to Office Building Lease (the "Amended Lease"). The Amended Lease reduced the annual rent escalator under the original lease from 3.75% per year to 3.4% per year. The Amended Lease also extended the initial base term of the original lease by five years such that the Amended Lease will now expire on December 31, 2029, unless extended or earlier terminated. The Amended Lease also converted the original lease from a full service gross lease to a triple-net lease.

In addition to annual rent for the Buildings, the Company will also pay $600 per year for each on-site standard (112) and handicap (6) parking space, $1,200 per year for each on-site tandem space (29 tandem spaces for 58 automobiles), and $600 per year for each off-site parking space that the Company elects to use (up to 500). The per year, per space parking rate will increase by 3% each year for each on-site parking space and by CPI, with a cap of 3%, for each off-site space.

During the first five years of the term of the Lease, the Company has a right of first offer to purchase the Project (including any transferable off-site parking rights held by the Landlord), and from and after year five of the Lease, the Company has an option to purchase the Project (including any transferable off-site parking rights held by the Landlord) for a purchase price equal to the fair market value for the Project.

In November 2011, the Company’s board of directors organized a special committee of five independent directors and delegated to the special committee full power and authority to consider and enter into any real property transaction to meet the Company’s space needs. In connection with its work, the special committee retained Latham & Watkins LLP, as its independent legal counsel, and Duff & Phelps LLC, as its independent real estate advisor. Following the completion of its work, the committee determined that it was appropriate to negotiate and enter into the Lease with the Landlord, and accordingly approved the Company’s entry into and execution of the Lease.

The terms of the Amended Lease were negotiated, evaluated, and approved by the corporate governance and nominating committee prior to the Company's entering into such Amended Lease. In connection with such work, the corporate governance

and nominating committee retained the same advisors to the special committee who considered the Lease, Latham & Watkins LLP, as its independent legal counsel, and Duff & Phelps LLC, as its independent real estate advisor.

Joseph M. Molina, M.D., Professional Corporations

Our wholly owned subsidiary, Molina Medical Management, Inc. (formerly American Family Care, Inc.), or MMM, provides non-clinical administrative services to the Molina primary care clinics. In 2012, MMM entered into services agreements with the Joseph M. Molina, M.D. Professional Corporations, or JMMPC. JMMPC was created to further advance our direct delivery line of business. Its sole shareholder is Joseph M. Molina, M.D. (Dr. J. Mario Molina), our chairman of the board, president, and chief executive officer. Dr. Molina is paid no salary and receives no dividends in connection with his work for, or ownership of, JMMPC. Under the services agreements, MMM provides the clinic facilities, clinic administrative support staff, patient scheduling services, and medical supplies to JMMPC, and JMMPC provides routine outpatient professional medical services. Beginning in the fourth quarter of 2014, JMMPC also provided certain specialty referral services to our California health plan members through a contracted provider network. While JMMPC may provide some services to the general public, substantially all of the individuals served by JMMPC are members of our health plans. JMMPC does not have agreements to provide professional medical services with any other entities. In addition to the services agreements with MMM, JMMPC has entered into affiliation agreements with us. Under these agreements, we have agreed to fund JMMPC's operating deficits, or receive JMMPC's operating surpluses, based on a monthly reconciliation such that JMMPC will operate at break even and derive no profit.

Our California, Florida, New Mexico, Utah, and Washington health plans have entered into primary care capitation agreements with JMMPC. These agreements also direct our health plans to fund JMMPC’s operating deficits, or receive JMMPC’s operating surpluses, based on a monthly reconciliation. Because the MMM services agreements described above mitigate the likelihood of significant operating deficits or surpluses, such monthly reconciliation amounts are insignificant.

We have determined that JMMPC is a variable interest entity, or VIE, and that we are its primary beneficiary. We have reached this conclusion under the power and benefits criterion model according to U.S. generally accepted accounting principles ("GAAP"). Specifically, we have the power to direct the activities that most significantly affect JMMPC’s economic performance, and the obligation to absorb losses or right to receive benefits that are potentially significant to the VIE, under the services and affiliation agreements described above. Because we are its primary beneficiary, we have consolidated JMMPC. JMMPC’s assets may be used to settle only JMMPC’s obligations, and JMMPC’s creditors have no recourse to the general credit of the Company. As of December 31, 2014, JMMPC had total assets of $31.1 million, and total liabilities of $30.8 million. As of December 31, 2013, JMMPC had total assets of $6.9 million, and total liabilities of $6.6 million.

Our maximum exposure to loss as a result of our involvement with JMMPC is generally limited to the amounts needed to fund JMMPC’s ongoing payroll and physician employee benefits. Additionally, in connection with specialty referral services provided by JMMPC beginning in 2014, our exposure to loss includes medical care costs associated with such services. We believe that such loss exposure will be immaterial to our consolidated operating results and cash flows for the foreseeable future.

During 2014, our health plans paid $43.8 million to JMMPC under the terms of the affiliation agreement, and JMMPC paid MMM $30.0 million under the terms of the services agreements. The $13.8 million difference was expended on physician salaries, medical malpractice insurance, travel expenses, and medical care costs.

Compensation Committee Interlocks and Insider Participation

The persons listed on page 14 were the members of the compensation committee during 2014. No member of the compensation committee was a part of a “compensation committee interlock” during fiscal year 2014 as described under SEC rules. In addition, none of our executive officers served as a director or member of the compensation committee of another entity that would constitute a “compensation committee interlock.” No member of the compensation committee had any material interest in a transaction with Molina Healthcare. Except for Dr. J. Mario Molina and Mr. John C. Molina, no director is a current or former employee of Molina Healthcare or any of its subsidiaries.

Code of Business Conduct and Ethics

The board has adopted a Code of Business Conduct and Ethics governing all employees of Molina Healthcare and its subsidiaries. A copy of the Code of Business Conduct and Ethics is available on our website at www.molinahealthcare.com. From the Molina home page, click on “About Molina,” then click on “Investors,” and then click on “Corporate Governance.” There were no waivers of our Code of Business Conduct and Ethics during 2014. We intend to disclose amendments to, or waivers of, our Code of Business Conduct and Ethics, if any, on our website.

Compliance Hotline

The Company encourages employees to raise possible ethical issues. The Company offers several channels by which employees and others may report ethical concerns or incidents, including, without limitation, concerns about accounting, internal controls, or auditing matters. We provide a Compliance Hotline that is available 24 hours a day, seven days a week. Individuals may choose to remain anonymous. We prohibit retaliatory action against any individual for raising legitimate concerns or questions regarding ethical matters, or for reporting suspected violations.

Communications with the Board

Stockholders or other interested parties who wish to communicate with a member or members of the board of directors, including the lead independent director or the non-management directors as a group, may do so by addressing their correspondence to the individual board member or board members, c/o Corporate Secretary, Molina Healthcare, Inc., 200 Oceangate, Suite 100, Long Beach, California 90802. The board of directors has approved a process pursuant to which the Corporate Secretary shall review and forward correspondence to the appropriate director or group of directors for response.

PROPOSAL 1 — ELECTION OF DIRECTORS

Our eleven-member board of directors is divided into three classes — Class I, Class II, and Class III — with each Class I and Class III currently having four board seats and Class II having three board seats. The terms of the Class I directors expire at the 2015 annual meeting, while the terms of the Class II directors expire at the 2016 annual meeting, and the terms of the Class III directors expire at the 2017 annual meeting.

The four current Class I directors are Garrey E. Carruthers, Daniel Cooperman, Frank E. Murray, and John P. Szabo. The directors to be elected as Class I directors at the 2015 annual meeting will serve until the 2018 annual meeting. All directors serve until the expiration of their respective terms and until their respective successors are elected and qualified or until such director’s earlier resignation, removal from office, death, or incapacity. Each nominee receiving more votes for his election than votes against his or her election will be elected.

The board of directors, upon recommendation of the corporate governance and nominating committee, has nominated three of the incumbent Class I directors — Garrey E. Carruthers, Daniel Cooperman, and Frank E. Murray — for election as Class I directors at the 2015 annual meeting. Mr. Szabo, the fourth incumbent Class I director, has decided not to seek re-election. Therefore, in conjunction with the 2015 annual meeting, Class I of the board will be reduced to three board seats, and the overall size of the board will be reduced to ten directors. The board believes that each of the three Class I nominees have demonstrated that they possess the requisite and complementary skill sets and expertise needed to provide strategic counsel and to oversee the key risks facing the Company. More specifically, Dr. Carruthers has extensive experience and expertise in federal and state government, business, and academia; Mr. Cooperman has extensive experience and expertise in large company corporate governance, technology, and compliance issues; and Dr. Murray has extensive experience and expertise in managing medical quality programs in medical groups and hospitals, and health policy issues.

Proxies can only be voted for the three named nominees.

In the event any nominee is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who may be designated by the board of directors to fill the vacancy. As of the date of this proxy statement, the board of directors is not aware of any nominee who is unable or will decline to serve as a director.

CLASS I DIRECTOR NOMINEES

|

| | |

Name and Age at Record Date | | Position, Principal Occupation, and Business Experience |

| | |

Garrey E. Carruthers, 75 | | President of New Mexico State University |

| | |

| | • Served as Molina Healthcare director since 2012 (Class I director) • Chairman of compliance and quality committee • Member of corporate governance and nominating committee • President of New Mexico State University since 2013 • Served as Dean of the College of Business of New Mexico State University from 2003 to 2013 • Served as New Mexico State University’s Vice President for Economic Development from 2006 to 2013 • Served as the Director of the University’s Pete V. Domenici Institute since 2009 • Was the President and Chief Executive Officer of Cimarron Health Plan in New Mexico from 1993 to 2003 • From 1987 to 1990, served a term as the Governor of the state of New Mexico • From 1981 to 1984, served as Assistant Secretary of the U.S. Department of the Interior • Holds a Ph.D. in economics from Iowa State University |

| | |

Daniel Cooperman, 64 | | Of Counsel, DLA Piper LLP (US) |

| | |

| | • Served as Molina Healthcare director since 2013 (Class I director) • Chairman of corporate governance and nominating committee

• Member of audit committee • Member of technology and information security subcommittee

• Member of the Board of Directors of LegalZoom.Com, Inc. from 2012 until its change of control in 2014, an online provider of legal documents and related services to consumers and small businesses • Member of the Board of Directors of Liffey Thames Group, LLC dba Discovia, a provider of eDiscovery services to corporations and law firms • Member of the Board of Directors of Nanoscale Components Inc. since 2012, a nanoscale capacitor development and manufacturing company • Chairman of the Board of Directors of Second Harvest Food Bank of Santa Clara and San Mateo Counties; member since 2010 • Of counsel to Bingham McCutchen, LLP, a global law firm, from 2010 to 2014 • Senior Vice President, Secretary, and General Counsel of Apple Inc. from 2007 to 2009 • Senior Vice President, Secretary, and General Counsel of Oracle Corporation from 1997 to 2007 • Partner, McCutchen, Doyle, Brown & Enersen, LLP from 1977 to 1997 • Lecturer, Stanford Law School since 2010 • Fellow, Arthur and Toni Rembe Rock Center for Corporate Governance, Stanford Law School and Graduate School of Business since 2012

• Juris Doctorate, 1976 Stanford Law School • MBA, 1976 Stanford Graduate School of Business • Graduated Dartmouth College with an A.B. in Economics with highest distinction |

| | |

Frank E. Murray, M.D., 84 | | Retired Private Medical Practitioner |

| | |

| | • Served as Molina Healthcare director since 2004 (Class I director) • Member of corporate governance and nominating committee and compliance and quality committee • Has over 40 years of experience in the health care industry, including significant experience as a private practitioner in internal medicine • Previously served on the boards of directors of the Kaiser Foundation Health Plans of Kansas City, of Texas, and of North Carolina, and served for 12 years as medical director and chairman of Southern California Permanente Medical Group • Served on the board of directors of both the Group Health Association of America and the National Committee for Quality Assurance (NCQA) • Retired as medical practitioner in 1995 |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF THE THREE NOMINEES LISTED ABOVE.

DIRECTORS WHOSE TERMS ARE NOT EXPIRING

|

| | |

Name and Age at Record Date | | Position, Principal Occupation, and Business Experience |

| | |

J. Mario Molina, M.D., 56 | | President and Chief Executive Officer, Molina Healthcare |

| | |

| | • Served as president and chief executive officer of Molina Healthcare since succeeding his father and Company founder, Dr. C. David Molina, in 1996 • Served as chairman of the board since 1996 (Class III director) • Served as medical director of Molina Healthcare from 1991 through 1994 and was vice president responsible for contracting and provider relations, member services, marketing, and quality assurance from 1994 to 1996 • Earned an M.D. from the University of Southern California and performed medical internship and residency at the Johns Hopkins Hospital • Received certification from the American Board of Internal Medicine in Internal Medicine and Endocrinology and Metabolism • Brother of John C. Molina, Molina Healthcare’s chief financial officer |

| | |

Charles Z. Fedak, 63 | | Founder, Charles Z. Fedak & Co., CPAs |

| | |

| | • Served as Molina Healthcare director since 2002 (Class II director) • Member of audit committee and compensation committee; audit committee financial expert • Certified public accountant since 1975 • Founded Charles Z. Fedak & Co., Certified Public Accountants, in 1981 • Employed by KPMG from 1975 to 1980 • Employed by Ernst & Young LLP from 1973 to 1975 • Holds MBA degree from California State University, Long Beach • Molina Healthcare audit committee financial expert |

| | |

Steven G. James, 57 | | Audit Partner, Ernst & Young LLP, Retired |

| | |

| | • Served as Molina Healthcare director since 2013 (Class II director) • Member of audit committee and compliance and quality committee; audit committee financial expert • Member of technology and information security subcommittee • Has 30 years experience supervising audits of public and private healthcare companies • Partner, Ernst & Young LLP, from 1992 to 2009; previously with Ernst & Whinne(predecessor to Ernst & Young LLP) from 1979 • Leader of Ernst & Young Pacific Southwest Area Health Sciences audit and business advisory services practice from 2005 to 2009 • Bachelor of Science degree in Business Administration with an emphasis in accounting from University of Redlands • Certified Public Accountant (active and in good standing) |

| | |

|

| | |

Name and Age at Record Date | | Position, Principal Occupation, and Business Experience |

| | |

John C. Molina, 50 | | Chief Financial Officer, Molina Healthcare |

| | |

| | • Served as Molina Healthcare director since 1994 (Class II director) • Member of compliance and quality committee • Executive vice president, financial affairs, since 1995, treasurer since 2002, and chief financial officer since 2003 • Member of the Federal Reserve Bank of San Francisco board of directors, Los Angeles branch • Chairman of the Board of Directors of Aquarium of the Pacific • Past president of the California Association of Primary Care Case Management Plans • J.D. from the University of Southern California School of Law • Brother of J. Mario Molina, M.D., Molina Healthcare’s chief executive officer |

| | |

Steven J. Orlando, 63 | | Founder, Orlando Company |

| | |

| | • Served as Molina Healthcare director since 2005 (Class III director) • Chairman of audit committee; audit committee financial expert • Member of compensation committee • Has over 40 years of business and corporate finance experience • From 1988 to 1994 and from 2000 to the present, has operated his own financial management and business consulting practice, Orlando Company • Served as Greater Sacramento Bancorp director and chairman of its audit committee from January 2009 to January 2015 • Served on multiple corporate boards, including service as chairman of the audit committee for Pacific Crest Capital, Inc., a Nasdaq-listed corporation • Certified public accountant (inactive) |

| | |

Ronna E. Romney, 71 | | Director, Park-Ohio Holding Corporation |

| | |

| | • Served as Molina Healthcare director since 1999 (Class III director) • Lead independent director • Member of compensation committee and corporate governance and nominating committee • Director of Molina Healthcare of Michigan from 1999 to 2004 • Since 2001 to present, served as director for Park-Ohio Holdings Corp., a publicly traded logistics and manufacturing company • Candidate for the United States Senate for state of Michigan in 1996 • From 1989 to 1993, appointed by President George H. W. Bush to serve as Chairwoman of the President’s Commission on White House Fellowships • From 1984 to 1992, served as the Republican National Committeewoman for the state of Michigan • From 1985 to 1989, appointed by President Ronald Reagan to serve as Chairwoman of the President’s Commission on White House Presidential Scholars • From 1982 to 1985, appointed by President Ronald Reagan to serve as Commissioner of the President’s National Advisory Council on Adult Education |

|

| | |

Name and Age at Record Date | | Position, Principal Occupation, and Business Experience |

| | |

Dale B. Wolf, 60 | | President and CEO, DBW Healthcare, Inc. |

| | |

| | • Served as Molina Healthcare director since 2013 (Class III director) • Chairman of the compensation committee • Member of the corporate governance and nominating committee • Executive Chairman, Correctional Healthcare Companies, Inc., a national provider of correctional healthcare solutions that improve public safety, manage risk, reduce recidivism, and extend budgetary resources, from December 2012 to July 2014 • Chief Executive Officer of Coventry of Health Care, Inc. from 2005 to 2009 • Executive Vice President, Chief Financial Officer, and Treasurer of Coventry Health Care, Inc. from 1996 to 2004 • Member of the Board of Directors of Correctional Healthcare Companies, Inc. from December 2012 to July 2014 • Member of the Board of Directors of Coventry Healthcare, Inc. from January 2005 to April 2009

• Member of the Board of Directors of Catalyst Health Solutions, Inc. from 2003 to 2012 • Graduated Eastern Nazarene College with a Bachelor of Arts degree in Mathematics, with honors • Completed MIT Sloan School Senior Executive Program • Fellow in the Society of Actuaries since 1979

|

Meetings of the Board of Directors and Committees

During 2014, the board of directors met ten times, the audit committee met six times, the corporate governance and nominating committee met six times, the compensation committee met seven times, the compliance and quality committee met four times, and the technology and information security subcommittee of the audit committee organized in October 2014 met one time during 2014. In addition, in March 2014, the board organized a transaction committee to review and evaluate a potential strategic opportunity. During 2014, the transaction committee met six times until it completed its work at the end of June 2014.

Each director attended at least 75% of the total number of meetings of the board and board committees of which he or she was a member in 2014, and each director attended the 2014 annual meeting of stockholders held on April 30, 2014.

Meetings of Non-Management Directors

The Company’s non-management directors meet in executive session without any management directors in attendance each time the full board convenes for a regularly scheduled in-person board meeting, which is usually four times each year, and, if the board convenes a special meeting, the non-management directors may meet in executive session if the circumstances warrant. The lead independent director presides at each executive session of the non-management directors.

Board Leadership Structure

Dr. J. Mario Molina currently serves as both the Company’s chairman of the board and its chief executive officer. The board believes that Dr. Molina’s serving in these dual roles provides for productive and transparent communications between management and the board. In addition, the board strongly supports having an independent director in a board leadership position at all times. The board has appointed Ronna E. Romney, one of its independent members, as lead independent director, and has invested her with significant authority and responsibilities. Having an independent lead director enables non-management directors to raise issues and concerns for board consideration without immediately involving management. The Company’s board has determined that the current board leadership structure, with a combined chairman and chief executive officer, along with a separate lead independent director, is the most appropriate structure at this time.

The authority and responsibilities of the lead independent director are detailed in the Company’s Corporate Governance Guidelines. The independent director shall preside at all meetings of the board at which the chairman of the board is not present, assume the responsibility of chairing the regularly scheduled meetings of independent directors, and serve as the primary interface between the independent directors, the chief executive officer, and the chairman of the board, as applicable, in communicating the matters discussed during the session where the chief executive officer or the chairman of the board was not present. In addition to any other responsibilities that the independent directors as a whole might designate from time to time, the lead independent director is also responsible for approving: (i) the quality, quantity, and timeliness of the information sent to the board, (ii) the meeting agenda items for the board, and (iii) the meeting schedules of the board to assure that there is sufficient time for discussion of all agenda items. The lead independent director has the authority to call meetings of the independent directors and to set the agendas for such meetings. If requested by major stockholders of the Company, the lead independent director is responsible for ensuring that she is available, when appropriate, for consultation and direct communication in accordance with procedures developed by the Company and the lead independent director.

Board’s Role in Risk Oversight

While management is responsible for designing and implementing the Company’s risk management process, controls, and oversight, the board, both as a whole and through its committees, has overall responsibility for oversight of the Company’s risk management. The board regularly receives reports on risks from senior management with respect to the Company’s management of major risks, including efforts to identify, assess, manage, and mitigate risks that may affect the Company’s ability to execute on its corporate strategy and fulfill its business objectives. The board’s role is to oversee this effort and to consult with management on the effectiveness of risk identification, measurement, and monitoring processes, and the adequacy of staffing and action plans, as needed. The Company has also instituted a management Enterprise Risk Management Committee to assess the risks of the Company. In addition, the compensation committee reviews compensation programs to ensure that they do not encourage unnecessary or excessive risk-taking.

Committees of the Board of Directors

The four standing committees of the board of directors are: (i) the audit committee; (ii) the corporate governance and nominating committee; (iii) the compensation committee; and (iv) the compliance and quality committee. In October 2014, the board of directors approved the formation of a technology and information security subcommittee of the audit committee.

The audit committee performs a number of functions, including: (i) reviewing the adequacy of the Company’s internal system of accounting controls, (ii) meeting with the independent auditors and management to review and discuss various matters pertaining to the audit, including the Company’s financial statements, the report of the independent auditors on the results, scope, and terms of their work, and the recommendations of the independent auditors concerning the financial practices, controls, procedures, and policies employed by the Company, (iii) resolving disagreements between management and the independent auditors regarding financial reporting, (iv) reviewing the financial statements of the Company, (v) selecting, evaluating, and, when appropriate, replacing the independent auditors, (vi) reviewing and approving fees to be paid to the independent auditors, (vii) reviewing and approving all permitted non-audit services to be performed by the independent auditors, (viii) establishing procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by the Company’s employees of concerns regarding questionable accounting or auditing matters, (ix) considering other appropriate matters regarding the financial affairs of the Company, and (x) fulfilling the other responsibilities set out in its charter, as adopted by the board. The report of the audit committee required by the rules of the SEC is included in this proxy statement.

The audit committee consists of Mr. Orlando (Chair), Mr. Cooperman, Mr. Fedak, Mr. James, and Mr. Szabo. Since Mr. Szabo will not stand for re-election as a director at the annual meeting, he will no longer be a member of the audit committee as of May 6, 2015. The board has determined that each of Mr. Fedak, Mr. James, and Mr. Orlando qualify as an “audit committee financial expert” as defined by the SEC. In addition to being independent according to the board’s independence standards as set out in its Corporate Governance Guidelines, each member of the audit committee is independent within the meaning of the corporate governance rules of the NYSE. Each member of the audit committee is also financially literate. The audit committee charter is available for viewing in the “Investors” section of Molina Healthcare’s website, www.molinahealthcare.com, under the link, “Corporate Governance.”

Effective October 2014, the board of directors organized a technology and information security subcommittee of the audit committee. The subcommittee’s primary duties and responsibilities include but are not limited to the following: (i) assessing and monitoring the Company’s management of risks regarding technology, cybersecurity and data security, privacy, and disaster recovery; (ii) providing a forum to review, evaluate, monitor, and provide feedback on technology related matters, including strategies, objectives, capabilities, initiatives, and policies; and (iii) performing such other tasks related to the monitoring of the Company’s technology and information security functions as the board of directors may delegate to the subcommittee from time to time. The technology and information security subcommittee of the audit committee consists of three directors, Mr. Cooperman, Mr. Orlando, and Mr. James, as well as the Company’s chief information officer and the Company’s chief information security officer.

The corporate governance and nominating committee is responsible for identifying individuals qualified to become board members and recommending to the board the director nominees for the next annual meeting of stockholders. It leads the board in its annual review of the board’s performance and recommends to the board members for each committee of the board. The committee takes a leadership role in shaping corporate governance policies and practices, including recommending to the board the Corporate Governance Guidelines and monitoring Molina Healthcare’s compliance with these Guidelines. The committee is responsible for reviewing potential conflicts of interest involving directors, executive officers, or their immediate family members. The committee also reviews Molina Healthcare’s Code of Business Conduct and Ethics and other internal policies to help ensure that the principles contained in the Code are being incorporated into Molina Healthcare’s culture and business practices.

The corporate governance and nominating committee consists of Mr. Cooperman (Chair), Gov. Carruthers, Dr. Murray, Ms. Romney, and Mr. Wolf, each of whom is “independent” under the NYSE listing standards and the Company’s Corporate

Governance Guidelines. The corporate governance and nominating committee charter is available for viewing in the “Investors” section of Molina Healthcare’s website, www.molinahealthcare.com, under the link, “Corporate Governance.”

The compensation committee is responsible for determining the compensation for Dr. Molina, our chief executive officer and for John Molina, our chief financial officer, and also approves the compensation Dr. Molina recommends as chief executive officer for the other named executive officers. The committee reviews and discusses with management the Compensation Discussion and Analysis, and, if appropriate, recommends to the board that the Compensation Discussion and Analysis be included in Molina Healthcare’s proxy statement filing with the SEC. In addition, the committee administers Molina Healthcare’s 2002 Equity Incentive Plan and the 2011 Equity Incentive Plan. The committee also works with the board with respect to matters of succession planning for the chief executive officer, the chief financial officer, and other senior executive officers of the Company.

Each committee has the authority to retain special consultants or experts to advise the committee, as the committee may deem appropriate or necessary in its sole discretion. From time to time, the compensation committee has retained a compensation consultant to provide the committee with comparative data on executive compensation and advice on Molina Healthcare’s compensation programs for senior management.

The compensation committee consists of Mr. Wolf (Chair), Mr. Fedak, Mr. Orlando, Ms. Romney, and Mr. Szabo. Since Mr. Szabo will not stand for re-election as a director at the annual meeting, he will no longer be a member of the compensation committee as of May 6, 2015. The board has determined that in addition to being independent according to the board’s independence standards as set out in its Corporate Governance Guidelines, each of the members of the compensation committee is independent according to the corporate governance rules of the NYSE. In addition, each of the members of the committee is a “non-employee director” as defined in Section 16 of the Securities Exchange Act of 1934, as amended, and is also an “outside director” as defined by Section 162(m) of the Internal Revenue Code.

A copy of the compensation committee charter is available for viewing in the “Investors” section of Molina Healthcare’s website, www.molinahealthcare.com, under the link, “Corporate Governance.”

The compliance and quality committee consists of Gov. Carruthers (Chair), Mr. James, Dr. Murray, and John Molina. With the exception of Mr. Molina, all members of the compliance and quality committee are “independent” under the NYSE listing standards and the Company’s Corporate Governance Guidelines. The compliance and quality committee, together with the audit committee, assists the board of directors in its oversight of the Company’s compliance with applicable legal, regulatory, and quality requirements. Whereas the audit committee has oversight over matters of financial compliance (e.g., accounting, auditing, financial reporting, and investor disclosures), as to all other areas of compliance (“non-financial compliance”), the compliance and quality committee has oversight responsibility in the first instance. However, the two committees coordinate their review of major compliance matters, including the overall state of compliance, significant legal or regulatory compliance exposures, and material reports or inquiries from regulators. The compliance and quality committee also is responsible for overseeing the Company’s compliance and quality programs and monitoring their performance. Relative to quality activities, the compliance and quality committee assists the board of directors in the general oversight of the Company's quality-related activities, policies, and practices that relate to promoting member health, providing access to cost-effective quality health care, and advancing safety and efficacy for members. The compliance and quality committee charter is available for viewing in the “Investors” section of Molina Healthcare’s website, www.molinahealthcare.com, under the link, “Corporate Governance.”

The transaction committee organized in March 2014 consisted of Ronna Romney (Chair), John P. Szabo, Dale Wolf, and Daniel Cooperman.

Involvement in Certain Legal Proceedings

There are no legal proceedings to which any director, officer, nominee, or principal stockholder, or any affiliate thereof, is a party adverse to the Company or has a material interest adverse to the Company.

Non-Employee Director Compensation

2014 Director Compensation

The compensation committee makes recommendations to the board with respect to the compensation level of directors, and the board determines the directors' compensation. Effective as of the 2014 annual meeting date all meeting fees were eliminated and non-employee director cash compensation consisted of the following cash components:

| |

• | annual cash retainer of $100,000 to each director; |

| |

• | annual retainer of $30,000 to the lead independent director; |

| |

• | annual retainer of $27,500 to the chair of the audit committee; |

| |

• | annual retainer of $22,500 to the chairs of each of the corporate governance and nominating committee, the compensation committee, and the compliance and quality committee; |

| |

• | annual retainer of $15,000 for each member of the audit committee; and |

| |

• | annual retainer of $12,500 for each member of the corporate governance and nominating committee, the compensation committee, and the compliance and quality committee. |

Members of the technology and information security subcommittee of the audit committee do not receive any additional retainers or fees in connection with their membership in such subcommittee. Each member of the transaction committee received a monthly retainer of $5,000 per month for his service on the transaction committee, and the chair of the transaction committee received a monthly retainer of $6,000 per month.

The Company also reimburses its board members for travel, food, and lodging expenses incurred in attending board and committee meetings or performing other services for the Company in their capacities as directors. Directors who are employees of the Company or its subsidiaries do not receive any compensation for their services as directors. In 2014, the two directors who were employees of the Company were Dr. J. Mario Molina, our chief executive officer, and John Molina, our chief financial officer.

In addition, to link the financial interests of the non-employee directors to the interests of the stockholders, encourage support of the Company’s long-term goals, and align director compensation to the Company’s performance, the total value of the equity award to each director for 2014-15 was $250,000. One quarter of that amount, or $62,500 of restricted stock, was granted on the first day of each quarter (starting on July 1, 2014) based on the closing price of the Company’s stock on the last trading day of the preceding quarter. Such equity awards may be rounded up or down to account for fractional shares in the computation.

NON-EMPLOYEE DIRECTOR COMPENSATION

|

| | | | | | | | | | | | | | | | |

Name | Fees Earned or Paid in Cash ($) | | Stock Awards ($)(1)(2) | | Option Awards ($)(1) | | All Other Compensation ($) | | | | Total ($)(2) |

Garrey E. Carruthers, Ph.D. | 127,625 |

| | 126,113 |

| | — |

| | — |

| | | | 253,738 |

|

Daniel Cooperman | 154,375 |

| | 126,113 |

| | — |

| | — |

| | | | 280,488 |

|

Charles Z. Fedak | 135,250 |

| | 126,113 |

| | — |

| | — |

| | | | 261,363 |

|

Steven G. James | 126,875 |

| | 126,113 |

| | — |

| | — |

| | | | 252,988 |

|

Frank E. Murray | 118,250 |

| | 126,113 |

| | — |

| | 239,232 |

| | (3) | | 483,595 |

|

Steven J. Orlando | 140,250 |

| | 126,113 |

| | — |

| | — |

| | | | 266,363 |

|

Ronna E. Romney | 179,875 |

| | 126,113 |

| | — |

| | — |

| | | | 305,988 |

|

John P. Szabo, Jr. | 154,000 |

| | 126,113 |

| | — |

| | — |

| | | | 280,113 |

|

Dale B. Wolf | 147,750 |

| | 126,113 |

| | — |

| | — |

| | | | 273,863 |

|

| |

(1) | The amounts reported as Stock Awards and Option Awards reflect the fair value of grants made as of the date of grant under the Company’s 2011 Equity Incentive Plan in accordance with Accounting Standards Codification Topic 718, “Compensation — Stock Compensation.” The non-employee directors compensation program described above provides for an annual equity award valued at $250,000 for each director, or $62,500 per quarter. However, because the computation of shares to be issued each quarter is based on the closing price of the Company's stock on the last trading day of the preceding quarter, the aggregate fair value of the award on the grant date (which is the next day) will generally be different than $62,500. |

| |

(2) | The amounts shown represent the aggregate grant date fair value of the awards, using the closing price of our common stock on July 1, 2014, or $46.10 per share, and October 1, 2014, or $41.66 per share. The amounts shown do not include the grant of restricted stock awards in the targeted amount of $62,500 made to each director on January 1, 2015 and April 1, 2015. On an annual basis (from the 2014 annual shareholders’ meeting to the 2015 annual shareholders’ meeting), the total value of restricted stock granted to each non-employee director is approximately $250,000, and thus the "Total" compensation shown in the column above, if such 2015 grant amounts were included, would be $125,000 greater than the amounts shown. As discussed on the following page, such annual stock award amount will be reduced to $220,000 following the 2015 annual stockholders’ meeting. |

| |

(3) | On February 20, 2014, Dr. Murray exercised 21,000 options. The exercise price was $24.98 per share, compared with a market value of $36.37 per share. The amount shown represents the aggregate difference between the market value of the shares and the option exercise price. |

2015 Director Compensation

The compensation committee periodically reviews benchmarking assessments of director compensation at comparable companies. In early 2014, the committee determined to adjust director compensation effective as of the 2014 annual meeting date to make it better in line with market levels, with an initial transition over a two-year period commencing in 2014 towards compensation at the 75th percentile of the peer group. During the third quarter of 2014, the compensation committee retained Arthur J. Gallagher & Co. to conduct a total compensation study of the amounts paid to the directors of the Company. Arthur J. Gallagher & Co. (formerly James F. Reda & Associates, a Division of Gallagher Benefit Services, Inc.) is the same compensation consultant that the committee has used to conduct the 2015 compensation study for the named executive officers and benchmarking studies in prior years for the Company's directors and named executive officers. Other than the services provided to the Company by the consulting firm in connection with the compensation studies for the directors and named executive officers, the consulting firm does not provide any other services to the Company

The compensation committee reviewed the independence of Arthur J. Gallagher & Co. in light of SEC rules and NYSE listing standards, including the following factors: (1) other services provided to the Company by the consulting firm; (2) fees paid by the Company as a percentage of the consulting firm’s total revenue; (3) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (4) any business or personal relationships between the compensation consultant and a member of the compensation committee; (5) any company stock owned by the compensation consultant; and (6) any business or personal relationships between the Company's executive officers and the senior advisor. The compensation committee discussed these considerations and concluded that the compensation consultant’s work for the committee does not raise any conflict of interest.

Arthur J. Gallagher & Co developed a peer comparison group, which was the same group used in the executive compensation study, made up of the following 18 health care service companies:

|

| |

1. Centene Corporation | 10. Community Health Systems, Inc. |

2. WellCare Health Plans, Inc. | 11. Laboratory Corporation of America Holdings |

3. Health Net, Inc. | 12. Magellan Health Services Inc. |

4. DaVita HealthCare Partners Inc. | 13. Kindred Healthcare, Inc. |

5. Tenet Healthcare Corporation | 14. Team Health Holdings, Inc. |

6. Catamaran Corp | 15. Select Medical Holdings Corporation |

7. Universal Health Services, Inc. | 16. Brookdale Senior Living Inc. |

8. Quest Diagnostics Incorporated | 17. Omnicare, Inc. |

9. LifePoint Hospitals, Inc. | 18. Universal American Corp. |

The market study concluded that overall, the Company's design for director compensation was in line with the peer group and overall market trends, although the total compensation for our directors was above market primarily due to the equity value of the compensation component. The Company’s director compensation in 2014 was weighted slightly higher toward equity compensation than was the case with the peer group. Equity compensation of the Company's directors in 2014 accounted for 66% of total director compensation, compared with 59% of the peer group. The annual equity value of $250,000 for each director was at the 88th percentile of the equity value for director compensation for the peer group. Rather than granting directors a fixed number of shares, which could lead to spikes in value due to stock price volatility, the Company grants directors stock based on a specified dollar amount as of the end of each fiscal quarter, resulting in smoother and less unpredictable volatility in the total amount of director compensation.

Effective after the 2015 annual meeting, the board of directors has decided to further decrease the annual equity compensation paid to each director to $220,000. One quarter of that amount, or $55,000 of restricted stock, will be granted on the first day of each quarter based on the closing price of the Company's stock on the last trading day of the preceding quarter. This further reduction will bring total director compensation closer to the compensation of the 75th percentile of the peer group.

Stock Ownership Guidelines for Directors

The board of directors of the Company believes that individual directors should own and hold a reasonable number of shares of common stock of the Company to further align the director’s interests and actions with those of the Company’s stockholders, and also to demonstrate confidence in the long-term prospects of the Company.

The Company's Stock Ownership Guidelines as adopted by the board of directors in March 2013 provide that directors shall own shares of the Company’s stock equal in value to at least three (3) times the aggregate annual cash retainer amounts payable to the director. The value of a director’s holdings shall be based on the average closing price of a share of the Company’s stock for the previous calendar year. Shares that satisfy these guidelines may be those owned directly, through a trust, or by a spouse or children, and shall include shares purchased on the open market, vested or unvested shares of restricted stock, or exercised and retained option shares. Until a director’s stock ownership requirement is met, the director must retain at least 50% of all “net settled shares” received from the vesting, delivery, or exercise of equity awards granted under the Company’s equity award plans until the total value of all shares held equals or exceeds the director’s applicable ownership threshold. “Net settled shares” generally refers to those shares that remain after the payment of (i) the exercise price of stock options or purchase price of other awards, (ii) all applicable withholding taxes, and (iii) any applicable transaction costs. Shares that are pledged shall not be counted toward the director’s ownership requirements.

Non-employee directors must comply with the stock ownership guidelines within five (5) years of their election to the board of directors. Each director of the Company satisfied the stock ownership guidelines as of December 31, 2014.

Executive Officers

Two of our directors, J. Mario Molina, M.D. and John C. Molina, J.D., and the following persons were our executive officers at December 31, 2014.

Terry P. Bayer, 64, has served as our chief operating officer since November 2005. She had formerly served as our executive vice president, health plan operations since January 2005. Ms. Bayer has 33 years of healthcare management experience, including staff model clinic administration, provider contracting, managed care operations, disease management, and home care. Since March 2014, Ms. Bayer has served as a director and member of the compensation and organization committee of California Water Services Group. From 2006 – 2008 Ms. Bayer served on the board of Apria Healthcare Group Inc. Prior to joining us, her professional experience included regional responsibility at FHP, Inc. and multi-state responsibility as regional vice-president at Maxicare; Partners National Health Plan, a joint venture of Aetna Life Insurance Company and Voluntary Hospital Association (VHA); and Lincoln National. She has also served as executive vice president of managed care at Matria Healthcare, president and chief operating officer of Praxis Clinical Services, and as Western Division President of AccentCare. She holds a Juris Doctorate degree from Stanford University, a Master of Public Health degree from the University of California, Berkeley, and a Bachelor’s degree in Communications from Northwestern University.