UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2016

MOOG INC.

(Exact name of registrant as specified in its charter)

|

| | |

New York | 1-5129 | 16-0757636 |

(State or Other Jurisdiction | (Commission | (I.R.S. Employer |

of Incorporation) | File Number) | Identification No.) |

|

| |

East Aurora, New York | 14052-0018 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (716) 652-2000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition |

On January 29, 2016, Moog Inc. (the “Company”) issued a press release discussing results of operations for the quarter ended January 2, 2016. A copy of the press release is included as exhibit 99.1 of this report.

The information in this report is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) or otherwise be subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, except as expressly stated by specific reference in such a filing.

|

| |

Item 9.01 | Financial Statements and Exhibits |

|

| |

99.1 | Press release dated January 29, 2016, announcing Moog Inc.’s results of operations for the quarter ended January 2, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | MOOG INC. | |

| | | |

Dated: January 29, 2016 | By: | /s/ Jennifer Walter | |

| Name: | Jennifer Walter | |

| | Controller | |

EXHIBIT INDEX

|

| |

99.1 | Press release dated January 29, 2016, announcing Moog Inc.’s results of operations for the quarter ended January 2, 2016. |

press information

MOOGINC., EAST AURORA, NEW YORK 14052 TEL-716/652-2000 FAX -716/687-4457

|

| | | |

release date | Immediate | contact | Ann Marie Luhr |

| January 29, 2016 | | 716-687-4225 |

MOOG REPORTS FIRST QUARTER RESULTS

East Aurora, NY - Moog Inc. (NYSE: MOG.A and MOG.B) today announced first quarter sales of $568 million, down 10% from a year ago on weaker industrial and energy markets. Net earnings of $26 million decreased by 26% and earnings per share of $.71 were 17% lower.

Aircraft Controls segment sales in the quarter were $255 million, down 4% year over year. Commercial aircraft revenues were off 4%, to $135 million. Lower OEM sales to Boeing were offset by higher OEM sales to Airbus. Commercial aftermarket sales were down marginally to $28 million, the result of lower 787 initial provisioning.

Military aircraft sales were down 5%, to $120 million. Lower F-18 and V-22 OEM sales were partly offset by a 31% increase in F-35 sales. Military aftermarket sales were nominally lower at $49 million, as the C-5 modernization program winds down.

Space and Defense Controls segment sales of $83 million were 17% lower than a year ago. Space market sales of $40 million were down 24%, mostly the result of a cyclical decrease in demand for satellite components. Defense sales were $43 million, down 10%, all on lower security sales.

Industrial Systems segment sales of $125 million were down 6%, all due to the stronger U.S. dollar. Energy sales were down 17% due to lower sales of oil and gas exploration equipment. Sales of industrial automation products were off by 11% but offset by a 19% increase in sales of simulation and test systems.

Components segment sales, at $80 million, were 26% lower than a year ago. Decreases were seen across all markets as the segment was impacted by weaker oil prices, the slowing economy in China and the strong U.S. dollar.

Medical Devices segment sales of $26 million were 13% higher than last year on very strong sales of IV and enteral pumps and associated administration sets.

Twelve month consolidated backlog was $1.2 billion.

Projections for fiscal 2016 were also updated based on a weakening outlook for the industrial and energy businesses. The company is reducing its sales forecast for the year by $100 million which will result in sales of $2.47 billion, net earnings of $124 million and earnings per share of $3.35, plus or minus $0.15 per share.

“We expected a slow start to the year and we came in at the low end of our guidance for the quarter,” said John Scannell, Chairman and CEO. “Over the last 90 days, our outlook for A&D markets has held fairly firm, but our view on our non-A&D markets has changed based on evolving global economics. We’re still investing in the long-term future across all of our markets and we’re promoting more efficient processes in our operations. Over the past couple of years we’ve seen improvements in several operating segments and our team will continue to work very hard to deliver the best results possible for our shareholders.”

In conjunction with today’s release, Moog will host a conference call beginning at 10:00 a.m. ET, which will be broadcast live over the Internet. John Scannell and Don Fishback, CFO, will host the call. Listeners can access the call live or in replay mode at www.moog.com/investors/communications. Supplemental financial data will be available on the webcast link prior to the conference call.

Moog Inc. is a worldwide designer, manufacturer, and integrator of precision control components and systems. Moog’s high-performance systems control military and commercial aircraft, satellites and space vehicles, launch vehicles, missiles, automated industrial machinery, wind energy, marine and medical equipment. Additional information about the company can be found at www.moog.com.

Cautionary Statement

Information included or incorporated by reference in this report that does not consist of historical facts, including statements accompanied by or containing words such as “may,” “will,” “should,” “believes,” “expects,” “expected,” “intends,” “plans,” “projects,” “approximate,” “estimates,” “predicts,” “potential,” “outlook,” “forecast,” “anticipates,” “presume” and “assume,” are forward-looking statements. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and are subject to several factors, risks and uncertainties, the impact or occurrence of which could cause actual results to differ materially from the expected results described in the forward-looking statements. These important factors, risks and uncertainties include:

| |

• | the markets we serve are cyclical and sensitive to domestic and foreign economic conditions and events, which may cause our operating results to fluctuate; |

| |

• | we operate in highly competitive markets with competitors who may have greater resources than we possess; |

| |

• | we depend heavily on government contracts that may not be fully funded or may be terminated, and the failure to receive funding or the termination of one or more of these contracts could reduce our sales and increase our costs; |

| |

• | we make estimates in accounting for long-term contracts, and changes in these estimates may have significant impacts on our earnings; |

| |

• | we enter into fixed-price contracts, which could subject us to losses if we have cost overruns; |

| |

• | we may not realize the full amounts reflected in our backlog as revenue, which could adversely affect our future revenue and growth prospects; |

| |

• | if our subcontractors or suppliers fail to perform their contractual obligations, our prime contract performance and our ability to obtain future business could be materially and adversely impacted; |

| |

• | contracting on government programs is subject to significant regulation, including rules related to bidding, billing and accounting kickbacks and false claims, and any non-compliance could subject us to fines and penalties or possible debarment; |

| |

• | the loss of The Boeing Company as a customer or a significant reduction in sales to The Boeing Company could adversely impact our operating results; |

| |

• | our new product research and development efforts may not be successful which could reduce our sales and earnings; |

| |

• | our inability to adequately enforce and protect our intellectual property or defend against assertions of infringement could prevent or restrict our ability to compete; |

| |

• | our business operations may be adversely affected by information systems interruptions, intrusions or new software implementations; |

| |

• | our indebtedness and restrictive covenants under our credit facilities could limit our operational and financial flexibility; |

| |

• | significant changes in discount rates, rates of return on pension assets, mortality tables and other factors could adversely affect our earnings and equity and increase our pension funding requirements; |

| |

• | a write-off of all or part of our goodwill or other intangible assets could adversely affect our operating results and net worth; |

| |

• | our sales and earnings may be affected if we cannot identify, acquire or integrate strategic acquisitions, or if we engage in divesting activities; |

| |

• | our operations in foreign countries expose us to political and currency risks and adverse changes in local legal and regulatory environments; |

| |

• | unforeseen exposure to additional income tax liabilities may affect our operating results; |

| |

• | government regulations could limit our ability to sell our products outside the United States and otherwise adversely affect our business; |

| |

• | governmental regulations and customer demands related to conflict minerals may adversely impact our operating results; |

| |

• | the failure or misuse of our products may damage our reputation, necessitate a product recall or result in claims against us that exceed our insurance coverage, thereby requiring us to pay significant damages; |

| |

• | future terror attacks, war, natural disasters or other catastrophic events beyond our control could negatively impact our business; |

| |

• | our operations are subject to environmental laws, and complying with those laws may cause us to incur significant costs; and |

| |

• | we are involved in various legal proceedings, the outcome of which may be unfavorable to us. |

These factors are not exhaustive. New factors, risks and uncertainties may emerge from time to time that may affect the forward-looking statements made herein. Given these factors, risks and uncertainties, investors should not place undue reliance on forward-looking statements as predictive of future results. We disclaim any obligation to update the forward-looking statements made in this report.

|

|

Moog Inc. |

CONSOLIDATED STATEMENTS OF EARNINGS |

(dollars in thousands, except per share data) |

|

| | | | | | | | |

| | Three Months Ended |

| | January 2, 2016 | | January 3, 2015 |

Net sales | | $ | 568,457 |

| | $ | 630,523 |

|

Cost of sales | | 406,997 |

| | 446,605 |

|

Gross profit | | 161,460 |

| | 183,918 |

|

Research and development | | 34,798 |

| | 31,321 |

|

Selling, general and administrative | | 82,994 |

| | 97,827 |

|

Interest | | 8,322 |

| | 5,368 |

|

Restructuring | | 273 |

| | — |

|

Other | | (582 | ) | | (36 | ) |

Earnings before income taxes | | 35,655 |

| | 49,438 |

|

Income taxes | | 9,495 |

| | 14,173 |

|

Net earnings attributable to common shareholders and noncontrolling interest | | $ | 26,160 |

| | $ | 35,265 |

|

| | | | |

Net earnings (loss) attributable to noncontrolling interest | | (81 | ) | | — |

|

| | | | |

Net earnings attributable to common shareholders | | $ | 26,241 |

| | $ | 35,265 |

|

| | | | |

Net earnings per share attributable to common shareholders | | | | |

|

Basic | | $ | 0.71 |

| | $ | 0.87 |

|

Diluted | | $ | 0.71 |

| | $ | 0.86 |

|

| | | | |

| | | | |

Average common shares outstanding | | | | |

|

Basic | | 36,713,949 |

| | 40,594,886 |

|

Diluted | | 37,028,331 |

| | 41,080,179 |

|

|

|

Moog Inc. |

CONSOLIDATED SALES AND OPERATING PROFIT |

(dollars in thousands) |

|

| | | | | | | | |

| | Three Months Ended |

| | January 2,

2016 | | January 3,

2015 |

Net sales: | | | | |

Aircraft Controls | | $ | 254,835 |

| | $ | 266,368 |

|

Space and Defense Controls | | 82,640 |

| | 99,955 |

|

Industrial Systems | | 125,179 |

| | 133,366 |

|

Components | | 79,575 |

| | 107,704 |

|

Medical Devices | | 26,228 |

| | 23,130 |

|

Net sales | | $ | 568,457 |

| | $ | 630,523 |

|

Operating profit: | | | | |

Aircraft Controls | | $ | 18,131 |

| | $ | 24,458 |

|

| | 7.1 | % | | 9.2 | % |

Space and Defense Controls | | 11,816 |

| | 8,726 |

|

| | 14.3 | % | | 8.7 | % |

Industrial Systems | | 13,633 |

| | 13,219 |

|

| | 10.9 | % | | 9.9 | % |

Components | | 4,700 |

| | 16,962 |

|

| | 5.9 | % | | 15.7 | % |

Medical Devices | | 3,279 |

| | 2,336 |

|

| | 12.5 | % | | 10.1 | % |

Total operating profit | | 51,559 |

| | 65,701 |

|

| | 9.1 | % | | 10.4 | % |

Deductions from operating profit: | | | | |

Interest expense | | 8,322 |

| | 5,368 |

|

Equity-based compensation expense | | 936 |

| | 3,398 |

|

Corporate and other expenses, net | | 6,646 |

| | 7,497 |

|

Earnings before income taxes | | $ | 35,655 |

| | $ | 49,438 |

|

|

|

Moog Inc. |

CONSOLIDATED BALANCE SHEETS |

(dollars in thousands) |

|

| | | | | | | | |

| | January 2,

2016 | | October 3,

2015 |

ASSETS | | | | |

Current assets | | | | |

Cash and cash equivalents | | $ | 323,318 |

| | $ | 309,853 |

|

Receivables | | 690,876 |

| | 698,419 |

|

Inventories | | 501,653 |

| | 493,360 |

|

Deferred income taxes | | 91,225 |

| | 91,210 |

|

Prepaid expenses and other current assets | | 37,933 |

| | 34,653 |

|

Total current assets | | 1,645,005 |

| | 1,627,495 |

|

Property, plant and equipment, net | | 535,393 |

| | 536,756 |

|

Goodwill | | 752,791 |

| | 737,212 |

|

Intangible assets, net | | 143,048 |

| | 143,723 |

|

Other assets | | 40,603 |

| | 41,285 |

|

Total assets | | $ | 3,116,840 |

| | $ | 3,086,471 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

Current liabilities | | | | |

Short-term borrowings | | $ | 1,363 |

| | $ | 83 |

|

Current installments of long-term debt | | 443 |

| | 34 |

|

Accounts payable | | 147,971 |

| | 165,973 |

|

Accrued salaries, wages and commissions | | 115,457 |

| | 125,270 |

|

Customer advances | | 166,491 |

| | 167,423 |

|

Contract loss reserves | | 29,724 |

| | 30,422 |

|

Other accrued liabilities | | 106,740 |

| | 116,300 |

|

Total current liabilities | | 568,189 |

| | 605,505 |

|

Long-term debt, excluding current installments | | 1,130,569 |

| | 1,075,067 |

|

Long-term pension and retirement obligations | | 333,441 |

| | 348,239 |

|

Deferred income taxes | | 69,136 |

| | 60,209 |

|

Other long-term liabilities | | 3,363 |

| | 2,919 |

|

Total liabilities | | 2,104,698 |

| | 2,091,939 |

|

Commitment and contingencies | | — |

| | — |

|

Redeemable noncontrolling interest | | 9,106 |

| | — |

|

Shareholders’ equity | | | | |

Common stock | | 51,280 |

| | 51,280 |

|

Other shareholders' equity | | 951,756 |

| | 943,252 |

|

Total shareholders’ equity | | 1,003,036 |

| | 994,532 |

|

Total liabilities and shareholders’ equity | | $ | 3,116,840 |

| | $ | 3,086,471 |

|

|

|

Moog Inc. |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

(dollars in thousands) |

|

| | | | | | | | |

| | Three Months Ended |

| | January 2,

2016 | | January 3,

2015 |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net earnings attributable to common shareholders and noncontrolling interest | | $ | 26,160 |

| | $ | 35,265 |

|

Adjustments to reconcile net earnings to net cash provided (used) by operating activities: | | | | |

Depreciation | | 19,208 |

| | 19,833 |

|

Amortization | | 5,877 |

| | 6,741 |

|

Deferred income taxes | | 3,532 |

| | 6,713 |

|

Equity-based compensation expense | | 936 |

| | 3,398 |

|

Other | | 804 |

| | 1,111 |

|

Changes in assets and liabilities providing (using) cash: | | | | |

Receivables | | 5,221 |

| | 62,772 |

|

Inventories | | (11,131 | ) | | (15,381 | ) |

Accounts payable | | (22,522 | ) | | (6,528 | ) |

Customer advances | | (498 | ) | | (1,019 | ) |

Accrued expenses | | (17,114 | ) | | (35,922 | ) |

Accrued income taxes | | (2,685 | ) | | (3,060 | ) |

Net pension and post retirement liabilities | | (5,709 | ) | | 970 |

|

Other assets and liabilities | | (2,534 | ) | | 3,580 |

|

Net cash provided (used) by operating activities | | (455 | ) | | 78,473 |

|

CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

Acquisitions of businesses, net of cash acquired | | (11,016 | ) | | — |

|

Purchase of property, plant and equipment | | (12,305 | ) | | (20,160 | ) |

Other investing transactions | | 1,021 |

| | 71 |

|

Net cash used by investing activities | | (22,300 | ) | | (20,089 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Net short-term repayments | | — |

| | (3,236 | ) |

Proceeds from revolving lines of credit | | 148,605 |

| | 123,170 |

|

Payments on revolving lines of credit | | (93,605 | ) | | (337,170 | ) |

Payments on long-term debt | | (9,540 | ) | | (5,234 | ) |

Proceeds from senior notes, net of issuance costs | | — |

| | 294,718 |

|

Proceeds from sale of treasury stock | | 2,230 |

| | 9,951 |

|

Purchase of outstanding shares for treasury | | (3,034 | ) | | (122,443 | ) |

Purchase of stock held by SECT | | (1,020 | ) | | (4,460 | ) |

Excess tax benefits from equity-based payment arrangements | | 580 |

| | 4,855 |

|

Net cash provided (used) by financing activities | | 44,216 |

| | (39,849 | ) |

Effect of exchange rate changes on cash | | (7,996 | ) | | (9,587 | ) |

Increase in cash and cash equivalents | | 13,465 |

| | 8,948 |

|

Cash and cash equivalents at beginning of period | | 309,853 |

| | 231,292 |

|

Cash and cash equivalents at end of period | | $ | 323,318 |

| | $ | 240,240 |

|

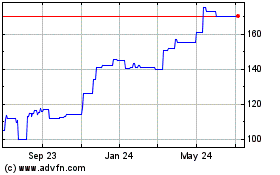

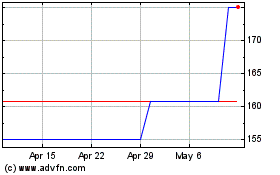

Moog (NYSE:MOG.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moog (NYSE:MOG.B)

Historical Stock Chart

From Apr 2023 to Apr 2024