Altria's Raises Earnings Outlook for the Year

July 27 2016 - 1:47PM

Dow Jones News

By Tripp Mickle

U.S. tobacco company Altria Group Inc. said it expects to get

another $500 million from its stake in brewer SABMiller PLC, which

received a sweetened offer from rival Anheuser-Busch InBev NV

earlier this week.

Belgian-based AB InBev raised its offer for SABMiller PLC in

their proposed $100 billion-plus beer megamerger amid a brewing

revolt among London-based SABMiller shareholders over the valuation

of the deal after the British pound's steep fall. Altria has a 27%

stake in SABMiller.

As it reported quarterly earnings on Wednesday, Altria expressed

optimism the deal would close and said that it already is preparing

for how to account for revenue from its future stake in a combined

mega beer company.

AB InBev raised its offer for SABMiller to GBP45 ($59.10) a

share, from GBP44 a share. It also boosted a separate

cash-and-stock offer by 88 pence a share.

Altria, which plans to opt for the cash-and-stock option, said

it now expects to receive $3 billion in cash, up from $2.5 billion,

plus a 10.5% stake in the combined brewer.

The company declined to say what it would do with the extra cash

but signaled it would consider putting it toward dividends or share

repurchases.

The Richmond, Va.-based company remains committed to keeping a

stake in the beer business because it has become a critical

contributor to its bottom line.

At a time when cigarette volumes are falling in the U.S., Altria

reports its share of profits from SABMiller using equity accounting

practices. The company said SABMiller added $199 million in

earnings in the second quarter, helping it deliver a 13.5% increase

in profit from a year earlier despite declining cigarette

volumes.

Earnings rose in the second quarter to $1.65 billion, or 84

cents a share, from $1.45 billion, or 74 cents a share, a year

prior. Revenue was flat at roughly $4.9 billion.

Volumes of the company's signature Marlboro brand fell 5.5% in

the quarter as a result of trade inventory movements and industry

declines. The brand also lost 0.1 percentage point of market share.

The company's overall market share was flat at 54.1% as enough

smokers opted for its discount brands like L&M to offset

Marlboro's slight decline.

However, Altria said industry cigarette volumes fell 3% in the

third quarter, indicating a return to historic levels of decline in

the 2%-to-4% range after declining just 0.5% last year.

"It is competitive out there, it always has been, but we haven't

seen any material changes," Chief Executive Marty Barrington said.

He said that Marlboro "continues to perform terrifically."

The company raised its outlook for the year, saying it expects

adjusted earnings of $3.01 to $3.07, up from $3 to $3.05 a

share.

The U.S.'s largest tobacco company is facing stronger

competition from No. 2 player Reynolds American Inc., which last

June closed a $25 billion acquisition of rival Lorillard Inc.

Reynolds American said Tuesday that it gained 0.4 percentage

point of market share in the second quarter, pushing overall share

to 34.5% behind brands like Newport and Natural American

Spirit.

--Austen Hufford contributed to this article.

Corrections & Amplifications

A previous version of this article misstated Altria's revenue

after excise taxes.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

July 27, 2016 13:32 ET (17:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

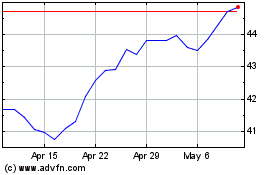

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

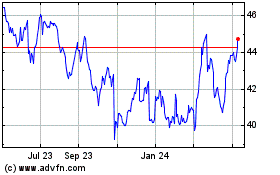

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024