Caterpillar Sees No End to Slump -- WSJ

July 27 2016 - 3:04AM

Dow Jones News

Quarterly profit beats expectations, but company cuts forecast,

warns of more layoffs

By Bob Tita

Caterpillar Inc. said Tuesday it doesn't anticipate a rebound

this year for its construction and mining equipment, as the company

shrunk its profit forecast and warned of additional layoffs.

Caterpillar topped second-quarter profit and sales expectations.

But the Peoria, Ill.-based company sees no end in sight to the

four-year-long slide in sales from falling prices for oil and mined

commodities and lower demand from key foreign markets.

"We're not expecting an upturn to happen this year," Chairman

and Chief Executive Doug Oberhelman said Tuesday.

Caterpillar said anemic economic growth along with geopolitical

events that undermine customer confidence such as the Brexit

referendum in Britain, the hostile rhetoric from the U.S.

presidential campaigns and the attempted coup in Turkey are holding

down global machinery demand.

"It's not any one thing. All of that contributes," said Vice

President Mike DeWalt during a conference call with analysts.

"We're a little more negative on the world economy. We have

sluggish economic growth throughout world, but not enough to drive

growth in our end markets."

Second-quarter sales of machinery and engines dropped 17% from a

year ago to $9.65 billion, with the most pronounced weakness

occurring in the mining equipment business, where sales sank 29%.

Operating profit from machinery and engines plunged 44% to $678

million.

Company executives said recent growth in U.S. housing and

infrastructure construction is helping to stabilize demand for

earth-moving equipment in North America, but added that equipment

inventories remain elevated and dealers are facing market pressure

to offer discounts on machinery that erode profits.

"It's a pretty tough pricing environment in construction," said

Mr. DeWalt.

Caterpillar has been aggressively slashing its costs in the wake

of lower sales. The company said it reduced second-quarter expenses

by $670 million from a year earlier. But the company also expects

business downsizing expenses to total about $700 million this year,

up from an earlier forecast of $550 million.

Caterpillar said it would cut an unspecified number of

additional jobs later in the year on top of the more than 10,000

jobs the company already plans to eliminate through 2018.

Caterpillar's work force has fallen by 20%, or more than 30,000

jobs, since the end of 2012. The company also intends to close or

consolidate up to 20 plants by the end of 2018.

Caterpillar trimmed its full-year profit outlook to about $2.75

a share, or $3.55, without restricting costs. The company had

previously forecast $3 a share, or $3.70 without restructuring. The

company narrowed its revenue range for this year to $40 billion to

$40.5 billion from $40 billion to $42 billion.

Over all for the quarter, the company reported a profit of $550

million, or 93 cents a share, down from $802 million, or $1.31 a

share, a year earlier. Excluding restructuring costs, earnings per

share were $1.09. Revenue slid 16% to $10.34 billion. Analysts were

expecting 96 cents a share with $10.1 billion of revenue.

--Lisa Beilfuss contributed to this article.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

July 27, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

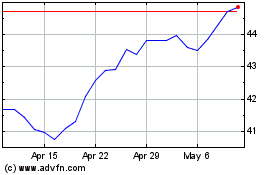

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

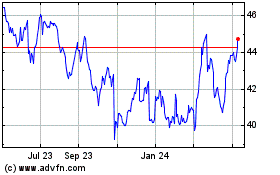

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024