Beer megamerger's revised terms follow fall in value of British

pound after Brexit

By Saabira Chaudhuri

LONDON -- Anheuser-Busch InBev NV on Tuesday raised its offer

for SABMiller PLC in their proposed $100 billion-plus beer

megamerger, trying to assuage concerns over the valuation of the

deal after the British pound's steep descent.

The Belgian-based beer giant lifted its cash offer to GBP45

($59.10) a share, from GBP44 a share, to appease shareholders of

London-based SABMiller who have watched the value of the offer fall

along with sterling. The pound sank sharply after the June 23 vote

by Britain to leave the European Union.

That fall has deflated the value of AB InBev's cash-only offer,

intended for most shareholders, compared with a separate

cash-and-share offer aimed at SABMiller's two biggest shareholders,

U.S. cigarette maker Altria Group Inc. and Colombia's Santo Domingo

family.

That partial-share alternative has soared in value, because AB

InBev shares are priced in euros.

AB InBev, the world's largest brewer, also raised the cash

component of the alternative offer by 88 pence a share. It said the

sweetened offer was its final one, a turn of phrase that under U.K.

takeover rules prevents it from making another offer for six

months.

After Tuesday's sweetened terms and the rise in the euro against

the pound, the partial-share offer is now worth GBP51.14 based on

Monday's closing prices, compared with GBP41.85 in November, when

both sides formally agreed on the deal. The partial-share deal is

technically open to all shareholders, but it comes with a five-year

lockup that is unattractive for many investors.

AB InBev's ability to sweeten the deal was limited by its

decision to hedge its exposure to the British pound in December.

With the currency falling by more than 10% against the dollar since

Britain's vote to leave the EU, the hedge has cost AB InBev an

estimated $10 billion, according to Susquehanna International Group

LLP. The beer giant has "no room to increase the offer" as a

result, wrote Susquehanna analyst Pablo Zuanic.

An AB InBev spokeswoman said the currency hedges were made to

ensure that the proposed deal would be delivered to SABMiller

shareholders regardless of currency movements.

The fresh offer comes after both companies spent months pursuing

regulatory approval for the megamerger around the world. They have

agreed to sell big chunks of their business in the process.

The deal still needs to be approved by shareholders of AB InBev

and SABMiller. Shareholder votes won't be scheduled until after

Chinese regulators have weighed in on the deal. China remains the

last big antitrust hurdle to the combination, which has already

been approved by competition authorities in the U.S., the European

Union, South Africa and several other jurisdictions.

Hedge funds including Elliott Management Corp. and TCI Fund

Management Ltd. have built stakes in SABMiller in recent days and

have been agitating for a higher offer, according to a person

familiar with the matter. Elliott and TCI declined to comment.

Some big SABMiller shareholders were digging in their heels.

Aberdeen Asset Management PLC, one of SABMiller's major investors,

said the new offer still undervalues the company.

"The revised deal remains unacceptable," the investment firm

said, "as it both undervalues the company and continues to favor

SABMiller's two major shareholders." It said that in the absence of

a better offer, it was content to stay a shareholder in SABMiller

as a stand-alone firm. Aberdeen owns 1.2% of SABMiller.

A long-term SABMiller shareholder with a roughly 1% stake in the

company -- who declined to be identified -- said his firm also

opposes the deal, saying it fails to account for the full value of

SABMiller's assets.

For 41.6% of stock, AB InBev created the partial-share

alternative as a combination of cash and unlisted stock, designed

to let Altria and the Santo Domingo family's BevCo Ltd. investment

vehicle retain their relative holdings in the combined firm and

their board seats. The alternative also protects them against some

tax and accounting disadvantages related to a deal.

Combined, Altria and BevCo control about 41% of SABMiller's

stock.

Altria declined to comment. Representatives for the Santo

Domingo family weren't available.

SABMiller said in a statement that it has hired Centerview

Partners Holdings LLC to give it financial advice following the

recent currency volatility, and that its board would consult with

shareholders and meet to formally review the offer. It said the

chairmen of both brewers held talks on Friday, but they didn't

discuss the terms of a new deal.

The new offer raises the total value of the deal to about GBP79

billion, or $103.81 billion, from its previous offer of about GBP71

billion. The new terms show the deep decline in the pound: The

original offer was worth about $108 billion at November's exchange

rates.

Bernstein Research estimates that the increased offer represents

an 8% premium to the "fair value" of SABMiller. That is up from 6%

before the increased offer but is still sharply below the roughly

33% premium when AB InBev's approach was first announced in

October, the firm noted.

RBC analyst James Edwardes Jones said he had "already felt that

ABI was paying a full price."

SABMiller shares closed 0.7% lower at GBP44.10 in London. AB

InBev shares were up 0.8% in Brussels.

The two brewing giants had expected to close their merger in the

second half of this year. The deal is critical to AB InBev's

growth. Buying SABMiller allows AB InBev to reduce its reliance on

the U.S., where it has had trouble getting younger people to drink

more Budweiser, and gives it access to the growing African market,

which is expected to drive beer-industry sales.

--Tripp Mickle contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 27, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

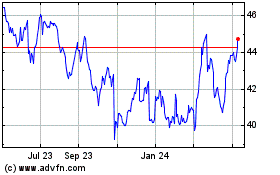

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

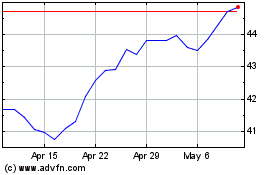

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024