As filed with the Securities and Exchange Commission on February 25, 2016

Registration No. 333-

======================================================================================================

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Altria Group,

Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Virginia |

|

|

|

13-3260245 |

| (State or other jurisdiction of

incorporation or organization) |

|

|

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 6601 West Broad Street

Richmond, Virginia |

|

|

|

23230 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Deferred Profit-Sharing Plan for Salaried Employees

Deferred Profit-Sharing Plan for Hourly Employees

(Full titles of the plans)

W. Hildebrandt

Surgner, Jr.

Corporate Secretary and

Senior Assistant General Counsel

ALTRIA GROUP, INC.

6601 West Broad

Street

Richmond, Virginia 23230

(Name and address of agent for service)

(804) 274-2200

(Telephone number,

including area code, of agent for service)

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. |

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

|

|

|

|

|

|

|

|

|

|

|

|

| CALCULATION OF REGISTRATION FEE |

|

|

|

|

|

|

|

|

|

|

|

| |

| Title of each

class of securities to be

registered |

|

Title of Plan |

|

Amount to be

registered |

|

Proposed

maximum

offering price

per share(1) |

|

Proposed

maximum

aggregate

offering price(1) |

|

Amount of

registration fee |

| Common Stock, $0.33 1/3 par value per share |

|

Deferred Profit-Sharing

Plan for Salaried Employees |

|

35,000,000 shs. (2) |

|

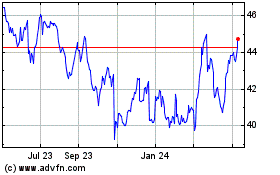

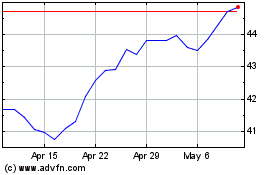

$60.465 |

|

$2,116,275,000 |

|

$213,108.89 |

| Common Stock, $0.33 1/3 par value per share |

|

Deferred Profit-Sharing

Plan for Hourly Employees |

|

35,000,000 shs. (2) |

|

$60.465 |

|

$2,116,275,000 |

|

$213,108.89 |

| Total |

|

|

|

70,000,000 shs. (2) |

|

|

|

$4,232,550,000 |

|

$426,217.78 |

| |

| |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and

457(h) under the Securities Act of 1933, as amended, based upon the average of the high and low prices for the common stock of Altria Group, Inc. reported in the consolidated reporting system on February 18, 2016.

In addition, pursuant to Rule 416(c) under the Securities Act of 1933, as amended, this registration statement also covers an indeterminate

amount of interests to be offered or sold pursuant to the employee benefit plans described herein.

(2) Plus such additional shares as may

be issued by reason of stock splits, stock dividends or similar transactions.

Part I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. |

Plan Information. |

Not required to be filed with the Securities and Exchange Commission

(the “Commission”).

| Item 2. |

Registrant Information and Employee Plan Annual Information. |

Not required to be filed

with the Commission.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The following documents filed by Altria

Group, Inc. (the “Company”) with the Commission (File No. 001-08940) are incorporated by reference in, and made a part of, this Registration Statement (other than documents or information included in such documents deemed to have been

furnished and not filed in accordance with Commission rules):

| |

(i) |

the Company’s Annual Report on Form 10-K for the year ended December 31, 2015; |

| |

(ii) |

the Company’s Deferred Profit-Sharing Plan for Salaried Employees Annual Report on Form 11-K for the fiscal year ended December 31, 2014; |

| |

(iii) |

the Company’s Deferred Profit-Sharing Plan for Hourly Employees Annual Report on Form 11-K for the fiscal year ended December 31, 2014; |

| |

(iv) |

the Company’s Current Reports on Form 8-K, filed with the Commission on January 28, 2016 (Item 2.05 and Item 8.01) and January 28, 2016 (Item 5.02); and |

| |

(v) |

the description of the Company’s Common Stock contained in the Company’s Registration Statement on Form 8-B, dated July 1, 1985, as amended by Amendment No. 1 on Form 8, dated April 27, 1989,

including any subsequent amendment or any report subsequently filed for the purpose of updating such description. |

All

documents filed by the Company under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date of this Registration Statement and before the filing of a post-effective

amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in, and to be a part of, this Registration Statement from the date of

filing of such documents (other than documents or information included in such documents deemed to have been furnished and not filed in accordance with Commission rules). Any statement contained in a document incorporated by reference in this

Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in this Registration Statement or in any other subsequently filed document that is incorporated

by reference in this Registration Statement modifies or supersedes such earlier statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not applicable.

| Item 5. |

Interests of Named Experts and Counsel. |

Not applicable.

| Item 6. |

Indemnification of Directors and Officers. |

The Virginia Stock Corporation Act (the

“VSCA”) permits the Company to indemnify its officers and directors in connection with certain actions, suits and proceedings brought against them if they acted in good faith and believed their conduct to be in the best interests of the

Company and, in the case of criminal actions, had no reasonable cause to believe that the conduct was unlawful. The VSCA requires such indemnification when a director entirely prevails in the defense of any proceeding to which he or she was a party

because he or she is or was a director of the Company, and further provides that the Company may make any other or further indemnity (including indemnity with respect to a proceeding by or in the right of the Company), and may make additional

provision for advances and reimbursement of expenses, if authorized by its articles of incorporation or shareholder-adopted by-laws, except an indemnity against willful misconduct or a knowing violation of the criminal law.

The VSCA establishes a statutory limit on liability of officers and directors of the Company for damages assessed against them in a suit

brought by or in the right of the Company or brought by or on behalf of shareholders of the Company and authorizes the Company, with shareholder approval, to specify a lower monetary limit on liability in the Company’s articles of incorporation

or by-laws; however, the liability of an officer or director shall not be limited if such officer or director engaged in willful misconduct or a knowing violation of the criminal law or of any federal or state securities law. The Company’s

articles of incorporation provide that an officer or director or former officer or director of the Company shall be indemnified to the full extent permitted by the VSCA as currently in effect or as later amended in connection with any action, suit

or proceeding brought by or in the right of the Company or brought by or on behalf of shareholders of the Company. The Company’s articles of incorporation further provide for the limitation or elimination of the liability of an officer or

director or former officer or director of the Company for monetary damages to the Company or its shareholders in any action, suit or proceeding, to the full extent permitted by the VSCA as currently in effect or as later amended. The Company carries

insurance on behalf of its directors and officers.

The distribution agreement among the Company, the Company’s wholly-owned

subsidiary, Philip Morris USA Inc., and Philip Morris International Inc. (“PMI”) provides for indemnification by PMI of the Company’s directors, officers and employees for certain liabilities, including liabilities under the

Securities Act of 1933, as amended (the “Securities Act”), and the Exchange Act related to information provided to the Company by PMI or incorporated into filings by the Company from PMI’s filings with the Commission.

The Company has entered into an indemnity agreement with each of the members of its Board of Directors. The agreement provides for the

mandatory advancement and reimbursement of reasonable expenses (subject to limited exceptions) incurred by members of the Board of Directors in various legal proceedings in which they may be involved by reason of their service as directors, as

permitted by Virginia law and the Company’s articles of incorporation.

| Item 7. |

Exemption from Registration Claimed. |

Not applicable.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Hunton & Williams LLP as to the legality of the securities being registered. |

|

|

| 5.2 |

|

In lieu of the opinion of counsel or determination letter contemplated by Item 601(b)(5) of Regulation S-K, the Company confirms that it has submitted the Deferred Profit-Sharing Plan for Salaried Employees and Deferred

Profit-Sharing Plan for Hourly Employees and any amendments thereto (collectively, the “401(k) Plans”) to the Internal Revenue Service (the “IRS”) in a timely manner, and that it has made or will make all changes required by the

IRS in order to qualify the 401(k) Plans under Section 401 of the Internal Revenue Code. |

|

|

| 23.1 |

|

Consent of Hunton & Williams LLP (included in Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm. |

|

|

| 24 |

|

Powers of Attorney executed by Gerald L. Baliles, John T. Casteen III, Dinyar S. Devitre, Thomas F. Farrell II, Thomas W. Jones, Debra J. Kelly-Ennis, W. Leo Kiely III, Kathryn B. McQuade, George Muñoz and Nabil Y.

Sakkab. |

|

|

| 99.1 |

|

Deferred Profit-Sharing Plan for Salaried Employees. |

|

|

| 99.2 |

|

Deferred Profit-Sharing Plan for Hourly Employees. |

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change in such information in the registration statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the

information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are

incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities

Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities

being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant hereby undertakes that, for

purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to provisions described in Item 6 above, or otherwise, the registrant has been advised that in the opinion of the

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of

expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Henrico, Commonwealth of Virginia, on February 25, 2016.

|

|

|

|

|

| ALTRIA GROUP, INC. |

|

|

| By: |

|

/s/ WILLIAM F. GIFFORD, JR. |

|

|

Name: |

|

William F. Gifford, Jr. |

|

|

Title: |

|

Executive Vice President and Chief Financial

Officer |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed

by the following persons in the capacities and on February 25, 2016.

|

|

|

| Signature |

|

Title |

|

|

| /s/ MARTIN J. BARRINGTON

(Martin J. Barrington) |

|

Director, Chairman, Chief Executive

Officer and President

(Principal Executive Officer) |

|

|

| /s/ WILLIAM F. GIFFORD, JR.

(William F. Gifford, Jr.) |

|

Executive Vice President and Chief

Financial Officer

(Principal Financial Officer) |

|

|

| /s/ IVAN S. FELDMAN

(Ivan S. Feldman) |

|

Vice President and Controller

(Principal Accounting Officer) |

|

|

| * Gerald L. Baliles,

John T. Casteen III,

Dinyar S. Devitre,

Thomas F. Farrell II,

Thomas W. Jones,

Debra J. Kelly-Ennis,

W. Leo Kiely III,

Kathryn B. McQuade,

George Muñoz,

Nabil Y. Sakkab |

|

Directors |

|

|

| *By: /s/ MARTIN J. BARRINGTON

(Martin J. Barrington,

Attorney-in-Fact) |

|

|

Pursuant to the requirements of the Securities Act of 1933, Rodger W. Rolland, having

administrative responsibility of the Deferred Profit-Sharing Plan for Salaried Employees, has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Henrico, Commonwealth of

Virginia, on February 25, 2016.

|

|

|

|

|

| Deferred Profit-Sharing Plan for Salaried Employees |

|

|

| By: |

|

/s/ RODGER W. ROLLAND |

|

|

Name: |

|

Rodger W. Rolland |

|

|

Title: |

|

Vice President, Compensation, Benefits & HR Services |

Pursuant to the requirements of the Securities Act of 1933, Rodger W. Rolland, having administrative

responsibility of the Deferred Profit-Sharing Plan for Hourly Employees, has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Henrico, Commonwealth of Virginia, on

February 25, 2016.

|

|

|

|

|

| Deferred Profit-Sharing Plan for Hourly Employees |

|

|

| By: |

|

/s/ RODGER W. ROLLAND |

|

|

Name: |

|

Rodger W. Rolland |

|

|

Title: |

|

Vice President, Compensation, Benefits & HR Services |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Hunton & Williams LLP as to the legality of the securities being registered. |

|

|

| 5.2 |

|

In lieu of the opinion of counsel or determination letter contemplated by Item 601(b)(5) of Regulation S-K, the Company confirms that it has submitted the Deferred Profit-Sharing Plan for Salaried Employees and Deferred

Profit-Sharing Plan for Hourly Employees and any amendments thereto (collectively, the “401(k) Plans”) to the Internal Revenue Service (the “IRS”) in a timely manner, and that it has made or will make all changes required by the

IRS in order to qualify the 401(k) Plans under Section 401 of the Internal Revenue Code. |

|

|

| 23.1 |

|

Consent of Hunton & Williams LLP (included in Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm. |

|

|

| 24 |

|

Powers of Attorney executed by Gerald L. Baliles, John T. Casteen III, Dinyar S. Devitre, Thomas F. Farrell II, Thomas W. Jones, Debra J. Kelly-Ennis, W. Leo Kiely III, Kathryn B. McQuade, George Muñoz and Nabil Y.

Sakkab. |

|

|

| 99.1 |

|

Deferred Profit-Sharing Plan for Salaried Employees. |

|

|

| 99.2 |

|

Deferred Profit-Sharing Plan for Hourly Employees. |

Exhibit 5.1

|

|

|

|

|

HUNTON & WILLIAMS LLP RIVERFRONT

PLAZA, EAST TOWER 951 EAST BYRD STREET RICHMOND, VIRGINIA

23219-4074 TEL 804 • 788 • 8200

FAX 804 • 788 • 8218 |

|

|

FILE NO: 54587.000148 |

|

|

February 25, 2016

Altria

Group, Inc.

6601 West Broad Street

Richmond, Virginia 23230

Altria Group, Inc.

Registration Statement on Form S-8

Deferred Profit-Sharing Plan for Salaried Employees

Deferred Profit-Sharing Plan for Hourly Employees

Ladies and Gentlemen:

We have acted as special

counsel to Altria Group, Inc., a Virginia corporation (the “Company”), in connection with the Registration Statement on Form S-8 (the “Registration Statement”), as filed by the Company with the Securities and Exchange Commission

(the “Commission”) on the date hereof pursuant to the Securities Act of 1933, as amended (the “Securities Act”), to register an aggregate of 70,000,000 shares of the Company’s common stock, par value $0.33 1/3 per share

(the “Shares”), (1) 35,000,000 of which are issuable pursuant to the Deferred Profit-Sharing Plan for Salaried Employees (the “DPS Salaried Employees Plan”) and (2) 35,000,000 of which are issuable pursuant to the

Deferred Profit-Sharing Plan for Hourly Employees (the “DPS Hourly Employees Plan”). The DPS Salaried Employees Plan and the DPS Hourly Employees Plan are collectively referred to herein as the “Plans.”

This opinion is being furnished in accordance with the requirements of Item 8(a) of Form S-8 and Item 601(b)(5)(i) of Regulation

S-K.

We have examined originals or reproductions or certified copies of such records of the Company, certificates of officers of the

Company and of public officials and such other documents as we have deemed relevant and necessary for the purpose of rendering this opinion, including, among other things, (i) the Company’s Amended and Restated Articles of Incorporation,

(ii) the Company’s Amended and Restated Bylaws, (iii) the resolutions of the Company’s Board of Directors approving the Plans and authorizing registration and the issuance of the Shares, (v) the Plans and (vi) the

Registration Statement.

For purposes of the opinions expressed below, we have assumed (i) the authenticity of all documents

submitted to us as originals, (ii) the conformity to the originals of all documents submitted to us as certified, photostatic or electronic copies and the authenticity of

ATLANTA AUSTIN BANGKOK

BEIJING BRUSSELS CHARLOTTE DALLAS HOUSTON LONDON LOS ANGELES

McLEAN MIAMI NEW YORK NORFOLK RALEIGH RICHMOND SAN FRANCISCO TOKYO WASHINGTON

www.hunton.com

Altria Group, Inc.

February

25, 2016

Page 2

the originals of such documents, (iii) the legal capacity of natural persons, (iv) the genuineness

of all signatures and (v) the due authorization, execution and delivery of all documents by all parties and the validity, binding effect and enforceability thereof (other than the due authorization, execution and delivery of documents by the

Company and the validity, binding effect and enforceability thereof upon the Company).

We do not purport to express an opinion on any

laws other than the laws of the Commonwealth of Virginia.

Based upon the foregoing and the further qualifications stated below, we are of

the opinion that:

1. The Company is a corporation

validly existing and in good standing under the laws of the Commonwealth of Virginia.

2.

The Shares have been duly authorized and, when and to the extent issued in accordance with the terms of the applicable Plan and any award agreement entered into thereunder, the

Shares will be validly issued, fully paid and nonassessable.

We hereby consent to the filing of this opinion with the Commission as

Exhibit 5.1 to the Registration Statement. By giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the

Commission promulgated thereunder.

This opinion is limited to the matters stated in this letter, and no opinions may be implied or

inferred beyond the matters expressly stated in this letter. This opinion is given as of the date hereof and we assume no obligation to advise you after the date hereof of facts or circumstances that come to our attention or changes in the law,

including judicial or administrative interpretations thereof, that occur which could affect the opinions contained herein.

Very truly yours,

/s/ Hunton & Williams LLP

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated January 28, 2016 relating to the

consolidated financial statements and the effectiveness of internal control over financial reporting, which appears in Altria Group, Inc.’s Annual Report on Form 10-K for the year ended December 31,

2015. We also consent to the incorporation by reference in this Registration Statement of our reports dated June 11, 2015 relating to the financial statements and supplemental schedules, which appear in the Annual Reports of the Deferred

Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees on Form 11-K for the year ended December 31, 2014.

/s/PricewaterhouseCoopers LLP

Richmond, Virginia

February 25, 2016

Exhibit 24

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ GERALD L. BALILES |

| Gerald L. Baliles |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ JOHN T. CASTEEN III |

| John T. Casteen III |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ DINYAR S. DEVITRE |

| Dinyar S. Devitre |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ THOMAS F. FARRELL II |

| Thomas F. Farrell II |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ THOMAS W. JONES |

| Thomas W. Jones |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ DEBRA J. KELLY-ENNIS |

| Debra J. Kelly-Ennis |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ W. LEO KIELY III |

| W. Leo Kiely III |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ KATHRYN B. MCQUADE |

| Kathryn B. McQuade |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ GEORGE MUÑOZ |

| George Muñoz |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS THAT the undersigned, a Director of Altria Group, Inc., a Virginia corporation (the

“Company”), does hereby constitute and appoint Martin J. Barrington, Denise F. Keane, William F. Gifford, Jr. and W. Hildebrandt Surgner, Jr., or any one or more of them, his or her true and lawful attorney, for him or her and in his

or her name, place and stead, to execute, by manual or facsimile signature, electronic transmission or otherwise, one or more Registration Statements on Form S-8 and any amendments (including post-effective amendments thereto) for the registration

of shares of the Company’s common stock $.33 1/3 par value, issuable by the Company in connection with the Deferred Profit-Sharing Plan for Salaried Employees and the Deferred Profit-Sharing Plan for Hourly Employees, and to cause the same to

be filed with the Securities and Exchange Commission, together with any exhibits, financial statements and prospectuses included or to be incorporated by reference therein, hereby granting to said attorneys, and each of them, full power and

authority to do and perform each and every act and thing whatsoever requisite or desirable to be done in and about the premises as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all

acts and things which said attorneys may do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, the undersigned

has hereunto set his or her hand and seal this 25th day of February, 2016.

|

| /s/ NABIL Y. SAKKAB |

| Nabil Y. Sakkab |

Exhibit 99.1

DEFERRED PROFIT-SHARING PLAN

FOR SALARIED

EMPLOYEES

Effective January 1, 1956

(as

amended and restated as of January 1, 2016)

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| PREAMBLE |

|

1 |

|

|

|

|

|

|

| ARTICLE I DEFINITIONS |

|

|

3 |

|

| 1.01 |

|

Accounts |

|

|

3 |

|

| 1.02 |

|

Accredited Service |

|

|

3 |

|

| 1.03 |

|

Actual Dividend Per Share Growth Rate |

|

|

5 |

|

| 1.04 |

|

Actual Adjusted Earnings Per Share Growth Rate |

|

|

5 |

|

| 1.05 |

|

Administrator |

|

|

5 |

|

| 1.06 |

|

After-Tax Contribution |

|

|

5 |

|

| 1.07 |

|

After-Tax Rollover Contribution |

|

|

6 |

|

| 1.08 |

|

Alternate Payee |

|

|

6 |

|

| 1.09 |

|

Altria |

|

|

6 |

|

| 1.10 |

|

Altria Stock |

|

|

6 |

|

| 1.11 |

|

Altria Stock Independent Named Fiduciary |

|

|

6 |

|

| 1.12 |

|

Beneficiary |

|

|

6 |

|

| 1.13 |

|

Board |

|

|

7 |

|

| 1.14 |

|

Business Day |

|

|

7 |

|

| 1.15 |

|

Cash or Deferred Arrangement |

|

|

7 |

|

| 1.16 |

|

Catch-Up Contributions |

|

|

8 |

|

| 1.17 |

|

Claimant |

|

|

8 |

|

| 1.18 |

|

Code |

|

|

8 |

|

| 1.19 |

|

Committee |

|

|

8 |

|

| 1.20 |

|

Company |

|

|

9 |

|

| 1.21 |

|

Company Account |

|

|

9 |

|

| 1.22 |

|

Company Match Account |

|

|

9 |

|

| 1.23 |

|

Company Match Contributions |

|

|

9 |

|

| 1.24 |

|

Compensation |

|

|

9 |

|

| 1.25 |

|

Compensation Committee |

|

|

11 |

|

| 1.26 |

|

Consolidated Earnings |

|

|

11 |

|

| 1.27 |

|

Contribution |

|

|

11 |

|

| 1.28 |

|

Controlled Group |

|

|

11 |

|

| 1.29 |

|

Current Value |

|

|

12 |

|

| 1.30 |

|

Dividend Payment Date |

|

|

12 |

|

| 1.31 |

|

Elective Contributions |

|

|

12 |

|

| 1.32 |

|

Eligible Retirement Plan |

|

|

12 |

|

| 1.33 |

|

Eligible Rollover Contribution |

|

|

12 |

|

| 1.34 |

|

Eligible Rollover Distribution |

|

|

13 |

|

| 1.35 |

|

Employee |

|

|

13 |

|

| 1.36 |

|

ERISA |

|

|

16 |

|

| 1.37 |

|

ESOP Fund |

|

|

16 |

|

| 1.38 |

|

Exchange |

|

|

16 |

|

| 1.39 |

|

Ex-Dividend Date |

|

|

17 |

|

| 1.40 |

|

Fiduciary |

|

|

17 |

|

| 1.41 |

|

Fund |

|

|

17 |

|

| 1.42 |

|

General Purpose Loan |

|

|

17 |

|

| 1.43 |

|

Highly Compensated Employee |

|

|

17 |

|

| 1.44 |

|

Home Purchase Loan |

|

|

17 |

|

i

TABLE OF CONTENTS (cont’d)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| 1.45 |

|

Hour of Service |

|

|

18 |

|

| 1.46 |

|

Hourly Plan |

|

|

18 |

|

| 1.47 |

|

Inactive Participant |

|

|

18 |

|

| 1.48 |

|

Investment Committee |

|

|

18 |

|

| 1.49 |

|

Investment Manager |

|

|

19 |

|

| 1.50 |

|

Kraft Heinz Company Stock |

|

|

19 |

|

| 1.51 |

|

Kraft Heinz Company Stock Independent Named Fiduciary |

|

|

20 |

|

| 1.52 |

|

Leased Employee |

|

|

20 |

|

| 1.53 |

|

Loan or Loans |

|

|

20 |

|

| 1.54 |

|

Loan Account |

|

|

20 |

|

| 1.55 |

|

Management Committee |

|

|

20 |

|

| 1.56 |

|

Match-Eligible Employee |

|

|

21 |

|

| 1.57 |

|

Mondelēz Stock |

|

|

22 |

|

| 1.58 |

|

Mondelēz Stock Independent Named Fiduciary |

|

|

22 |

|

| 1.59 |

|

Monitoring Committee |

|

|

22 |

|

| 1.60 |

|

Named Fiduciary |

|

|

22 |

|

| 1.61 |

|

Non-Altria Stock |

|

|

22 |

|

| 1.62 |

|

Non-Altria Stock Independent Named Fiduciary |

|

|

22 |

|

| 1.63 |

|

Non-Altria Stock Investment Option |

|

|

22 |

|

| 1.64 |

|

Operating Company Contribution |

|

|

23 |

|

| 1.65 |

|

Participant |

|

|

23 |

|

| 1.66 |

|

Participating Company |

|

|

25 |

|

| 1.67 |

|

PAYSOP |

|

|

25 |

|

| 1.68 |

|

Paysop Rollover Account |

|

|

25 |

|

| 1.69 |

|

Personal After-Tax Account |

|

|

26 |

|

| 1.70 |

|

Personal After-Tax Rollover Account |

|

|

26 |

|

| 1.71 |

|

Personal Before-Tax Account |

|

|

26 |

|

| 1.72 |

|

Personal Before-Tax Catch-Up Account |

|

|

26 |

|

| 1.73 |

|

Plan |

|

|

26 |

|

| 1.74 |

|

Plan Year |

|

|

26 |

|

| 1.75 |

|

PMI Stock |

|

|

26 |

|

| 1.76 |

|

PMI Stock Independent Named Fiduciary |

|

|

26 |

|

| 1.77 |

|

Profit-Sharing Fund |

|

|

27 |

|

| 1.78 |

|

Qualified Domestic Relations Order |

|

|

27 |

|

| 1.79 |

|

Qualified Nonelective Contributions |

|

|

28 |

|

| 1.80 |

|

Real-Time Trade or Real-Time Trading |

|

|

28 |

|

| 1.81 |

|

Rebalance or Rebalancing |

|

|

28 |

|

| 1.82 |

|

Record Date |

|

|

28 |

|

| 1.83 |

|

Required Benefit Commencement Date |

|

|

29 |

|

| 1.84 |

|

Rollover Account |

|

|

29 |

|

| 1.85 |

|

Roth Account |

|

|

29 |

|

| 1.86 |

|

Roth Catch-Up Account |

|

|

29 |

|

| 1.87 |

|

Salary Reduction Contribution |

|

|

29 |

|

| 1.88 |

|

Service in the Uniformed Services of the United States |

|

|

30 |

|

| 1.89 |

|

SMWE |

|

|

30 |

|

| 1.90 |

|

SMWE Employee |

|

|

30 |

|

| 1.91 |

|

Spouse |

|

|

30 |

|

ii

TABLE OF CONTENTS (cont’d)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| 1.92 |

|

Supplemental Company Contribution |

|

|

31 |

|

| 1.93 |

|

Supplemental Company Contribution Account |

|

|

31 |

|

| 1.94 |

|

Target Adjusted Earnings Per Share Growth Rate |

|

|

31 |

|

| 1.95 |

|

Third-Party Recordkeeper |

|

|

31 |

|

| 1.96 |

|

Trust Agreement |

|

|

31 |

|

| 1.97 |

|

Trustee |

|

|

31 |

|

| 1.98 |

|

UST |

|

|

31 |

|

| 1.99 |

|

UST Pre-2010 Match Account |

|

|

31 |

|

| 1.100 |

|

UST Savings Plan |

|

|

32 |

|

| 1.101 |

|

Valuation Date |

|

|

32 |

|

|

|

| ARTICLE II COMPANY CONTRIBUTIONS |

|

|

33 |

|

| 2.01 |

|

The Contribution |

|

|

33 |

|

| 2.02 |

|

Amount of the Contribution |

|

|

33 |

|

| 2.03 |

|

Company Match Contributions for Match-Eligible Employees who are not SMWE Employees |

|

|

34 |

|

| 2.04 |

|

Company Match Contributions for SMWE Employees |

|

|

34 |

|

| 2.05 |

|

Forfeiture of Company Match Contributions |

|

|

35 |

|

| 2.06 |

|

Supplemental Company Contribution for Match-Eligible Employees who are not SMWE Employees |

|

|

35 |

|

| 2.07 |

|

Limits on Amount of Contribution and Supplemental Company Contribution to the Plan and the Contribution to the Hourly Plan. |

|

|

35 |

|

| 2.08 |

|

Annual Addition Limitation |

|

|

36 |

|

| 2.09 |

|

Timing of Contributions |

|

|

36 |

|

| 2.10 |

|

Deductibility of Contributions |

|

|

36 |

|

| 2.11 |

|

Mistaken or Surplus Contribution |

|

|

37 |

|

| 2.12 |

|

Qualified Nonelective Contributions |

|

|

37 |

|

|

|

| ARTICLE III ALLOCATION OF COMPANY CONTRIBUTION AND SUPPLEMENTAL COMPANY |

|

|

|

|

|

|

CONTRIBUTION |

|

|

38 |

|

| 3.01 |

|

Method of Allocation of Contribution |

|

|

38 |

|

| 3.02 |

|

Method of Allocation of Supplemental Company Contribution |

|

|

38 |

|

|

|

| ARTICLE IV PARTICIPANT CONTRIBUTIONS |

|

|

39 |

|

| 4.01 |

|

Salary Reduction Contributions |

|

|

39 |

|

| 4.02 |

|

Catch-Up Contributions |

|

|

40 |

|

| 4.03 |

|

After-Tax Contributions |

|

|

41 |

|

| 4.04 |

|

Suspension of Personal Contributions For Hardship Withdrawal |

|

|

42 |

|

| 4.05 |

|

Aggregate Limit on Participant Contributions |

|

|

42 |

|

| 4.06 |

|

Eligible Rollover Contributions |

|

|

42 |

|

|

|

| ARTICLE V VALUATION |

|

|

44 |

|

| 5.01 |

|

Participant Accounts |

|

|

44 |

|

| 5.02 |

|

Valuation of Participant Accounts |

|

|

45 |

|

| 5.03 |

|

Transfer to Hourly Plan |

|

|

45 |

|

| 5.04 |

|

Accounts For Individuals Ineligible to Participate |

|

|

45 |

|

| 5.05 |

|

Account Statements |

|

|

46 |

|

iii

TABLE OF CONTENTS (cont’d)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE VI DISTRIBUTION |

|

|

47 |

|

| 6.01 |

|

In General |

|

|

47 |

|

| 6.02 |

|

Form and Timing of Distributions |

|

|

47 |

|

| 6.03 |

|

Form of Distribution |

|

|

50 |

|

| 6.04 |

|

Maintenance of Accounts |

|

|

51 |

|

| 6.05 |

|

Designation of Beneficiary |

|

|

51 |

|

| 6.06 |

|

Eligible Rollover Distributions |

|

|

52 |

|

| 6.07 |

|

Alternate Payee |

|

|

52 |

|

| 6.08 |

|

Section 16 of Securities Exchange Act of 1934 |

|

|

52 |

|

|

|

| ARTICLE VII WITHDRAWALS |

|

|

53 |

|

| 7.01 |

|

In General |

|

|

53 |

|

| 7.02 |

|

Hardship Withdrawals |

|

|

53 |

|

| 7.03 |

|

Withdrawal of UST Pre-2010 Matching Contributions |

|

|

56 |

|

| 7.04 |

|

Age 59 1⁄2 Withdrawal |

|

|

56 |

|

| 7.05 |

|

Form of Withdrawal |

|

|

56 |

|

| 7.06 |

|

Withdrawal of Altria Stock Cash Dividends |

|

|

57 |

|

| 7.07 |

|

Withdrawal Fees |

|

|

57 |

|

| 7.08 |

|

Section 16 of Securities Exchange Act of 1934 |

|

|

57 |

|

| 7.09 |

|

Distributions Upon a Deemed Severance from Employment While Performing Service in the Uniformed Service of the United States |

|

|

57 |

|

| 7.10 |

|

Qualified Reservist Withdrawals |

|

|

58 |

|

|

|

| ARTICLE VIII THE FUND |

|

|

59 |

|

| 8.01 |

|

The Fund |

|

|

59 |

|

| 8.02 |

|

Investments |

|

|

59 |

|

| 8.03 |

|

Participant Direction of Investments |

|

|

64 |

|

| 8.04 |

|

Investment Rules |

|

|

65 |

|

| 8.05 |

|

Beneficiaries and Alternate Payees |

|

|

66 |

|

| 8.06 |

|

Common, Collective or Pooled Funds |

|

|

66 |

|

| 8.07 |

|

Investments in Trustee Deposits |

|

|

66 |

|

|

|

| ARTICLE IX LOANS TO PARTICIPANTS |

|

|

67 |

|

| 9.01 |

|

Participant Loans |

|

|

67 |

|

| 9.02 |

|

Period of Repayment |

|

|

68 |

|

| 9.03 |

|

Loan Repayments |

|

|

68 |

|

| 9.04 |

|

Loan Default |

|

|

68 |

|

| 9.05 |

|

Investigations; Possible Implications of Misrepresentation |

|

|

69 |

|

| 9.06 |

|

Loan Fees |

|

|

69 |

|

| 9.07 |

|

Section 16 of Securities Exchange Act of 1934 |

|

|

69 |

|

|

|

| ARTICLE X PLAN ADMINISTRATION |

|

|

70 |

|

| 10.01 |

|

The Administrator |

|

|

70 |

|

| 10.02 |

|

Investment Committee |

|

|

70 |

|

| 10.03 |

|

Monitoring Committee |

|

|

71 |

|

| 10.04 |

|

Management Committee |

|

|

71 |

|

| 10.05 |

|

Altria Stock Independent Named Fiduciary |

|

|

72 |

|

iv

TABLE OF CONTENTS (cont’d)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| 10.06 |

|

Non-Altria Stock Independent Named Fiduciary |

|

|

73 |

|

| 10.07 |

|

The Fiduciaries |

|

|

74 |

|

|

|

| ARTICLE XI AMENDMENT OR TERMINATION |

|

|

77 |

|

| 11.01 |

|

Amendment of the Plan |

|

|

77 |

|

| 11.02 |

|

Termination of the Plan |

|

|

77 |

|

|

|

| ARTICLE XII RESTRICTIONS ON ALIENATION AND ASSIGNMENT |

|

|

79 |

|

| 12.01 |

|

Nonalienation of Accounts |

|

|

79 |

|

|

|

| ARTICLE XIII GENERAL PROVISIONS |

|

|

80 |

|

| 13.01 |

|

No Contract of Employment |

|

|

80 |

|

| 13.02 |

|

Altria Stock Voting |

|

|

80 |

|

| 13.03 |

|

Non-Altria Stock Voting |

|

|

80 |

|

| 13.04 |

|

Determination of Beneficiary Pursuant to Section 6.05 of the Plan |

|

|

81 |

|

| 13.05 |

|

Denial of Claims for Benefits |

|

|

82 |

|

| 13.06 |

|

Qualified Domestic Relations Orders |

|

|

83 |

|

| 13.07 |

|

Offset for Indebtedness to Participating Company |

|

|

84 |

|

| 13.08 |

|

Payments to Infants or Incompetents |

|

|

84 |

|

| 13.09 |

|

Uncashed Checks |

|

|

84 |

|

| 13.10 |

|

Administrative Restrictions |

|

|

85 |

|

| 13.11 |

|

Fiduciary Discretion |

|

|

86 |

|

| 13.12 |

|

Applicable Law |

|

|

86 |

|

| 13.13 |

|

USERRA |

|

|

86 |

|

| 13.14 |

|

Participating Company Leaves Controlled Group |

|

|

87 |

|

|

|

| ARTICLE XIV FORMS; COMMUNICATIONS; RULES AND PROCEDURES |

|

|

88 |

|

| 14.01 |

|

Administrative Forms; Use of Electronic Media |

|

|

88 |

|

| 14.02 |

|

Administrative Communications |

|

|

88 |

|

| 14.03 |

|

Rules and Procedures |

|

|

88 |

|

|

|

| ARTICLE XV MERGER, ETC. |

|

|

89 |

|

| 15.01 |

|

Merger or Consolidation |

|

|

89 |

|

|

|

| ARTICLE XVI CHANGE OF CONTROL PROVISIONS |

|

|

90 |

|

| 16.01 |

|

Contributions Upon Change of Control |

|

|

90 |

|

| 16.02 |

|

Change of Control |

|

|

90 |

|

| 16.03 |

|

Miscellaneous |

|

|

92 |

|

|

|

| ARTICLE XVII LIMITATION ON ALLOCATIONS |

|

|

94 |

|

| 17.01 |

|

General Rule |

|

|

94 |

|

| 17.02 |

|

Limit on Allocations for Defined Contribution Plan |

|

|

94 |

|

| 17.03 |

|

Annual Additions |

|

|

94 |

|

| 17.04 |

|

Compensation |

|

|

95 |

|

|

|

| ARTICLE XVIII RULES IN THE EVENT PLAN BECOMES A TOP-HEAVY PLAN |

|

|

96 |

|

| 18.01 |

|

Top-Heavy Contribution |

|

|

96 |

|

v

TABLE OF CONTENTS (cont’d)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| 18.02 |

|

Top-Heavy Plan |

|

|

96 |

|

|

|

| EXHIBIT A PARTICIPATING COMPANIES |

|

|

98 |

|

vi

PREAMBLE

The Plan was originally adopted, effective January 1, 1956, as a profit sharing plan for the benefit of eligible Employees of the

Participating Companies. The Plan is a defined contribution plan intended to be qualified under Section 401(a) of the Code. Since 1983, the Plan includes a cash or deferred arrangement qualified under Section 401(k) of the Code. Effective

December 15, 2001, the Plan is also a stock bonus plan that permits Participants to elect to receive in cash their share of cash dividends paid on shares of Altria Stock held in Part D of the Fund (the investment option for Altria Stock).

Effective January 1, 2007, the Plan included (1) Company Match Contributions on behalf of Match-Eligible Employees who make

Salary Reduction Contributions and/or After-Tax Contributions to the Profit-Sharing Fund, (2) a Company Contribution on behalf of each Match-Eligible Employee after the completion of twelve (12) months of Accredited Service, and (3) a

Make-Up Contribution so that the aggregate Company Contribution and Make-Up Contribution equaled no less than ten percent (10%) of the Compensation of a Match-Eligible Employee who is eligible for an allocation of the Company Contribution.

Effective as of March 30, 2007, Kraft Foods Inc. and its subsidiary companies ceased to be members of the Controlled Group.

Effective as of March 30, 2007, Part I (the investment option for Kraft Stock (now Mondelēz Stock)) was added as an investment option under the Plan. No exchanges or rebalancings into Part I are permitted and no contributions may be

invested in Part I.

Effective as of March 28, 2008, PMI and its subsidiary companies ceased to be members of the Controlled

Group. Effective as of March 28, 2008, Part K (the investment option for PMI Stock) was added as an investment option under the Plan. No exchanges or rebalancings into Part K are permitted and no contributions may be invested in Part K.

Effective after the close of business on December 30, 2009, the assets and liabilities of the UST Savings Plan allocable to

non-union employees of UST and SMWE were merged with and into the assets and liabilities of the Plan. The Plan was amended and restated as of December 31, 2009 to reflect the transfer of these assets and liabilities into the Plan although

Employees who were participants in the UST Plan were not eligible to participate in the Plan with respect to the making of contributions pursuant to Article IV of the Plan and in the sharing or allocation of any contributions pursuant to Articles II

and III of the Plan until January 1, 2010.

The Plan was amended and restated as of January 1, 2010: (1) to include

non-union employees of UST and SMWE, (2) to include salaried employees employed by John Middleton Co. and (3) to change the benefit formula in the Plan set forth in Article II of the Plan applicable to all Employees, except SMWE Employees,

effective for Plan Years beginning January 1, 2010. Effective for Plan Years beginning in 2010, the Contribution was based on Consolidated Earnings, rather than Operating Profit. A Contribution based on Consolidated Earnings was the original

formula under the Plan. It was changed for Plan Years beginning in 1994 and ending December 31, 2009.

The Plan was amended and

restated as of January 1, 2011 to reflect: (1) additional duties of the independent named fiduciary for the Altria, Kraft and PMI Stock Investment Options, (2) to clarify the members of the Committee, (3) to provide for the

actions of the Altria,

1

Kraft and PMI Stock Independent Named Fiduciaries when there is a tender offer for less than 5% of the outstanding shares.

The Plan was amended and restated as of January 1, 2012 to (1) change the benefit formula set forth in Article II of the Plan

applicable to all employees, except SMWE Employees, and (2) include the participation of hourly non-agricultural employees of SMWE who are not represented by a collective bargaining agreement.

The Plan was amended and restated as of October 1, 2012 (with certain amendments effective earlier) to reflect: (1) changes to

the investment options offered under the Plan, (2) the separation of Kraft Foods Inc. into two separate public companies, (3) the change in the name of Kraft Foods Inc. to Mondelēz International, Inc., (4) the receipt of the

shares of KFG Stock distributed to the shareholders of Mondelēz International and the establishment of the KFG Stock investment option and (5) the appointment of Fiduciary Counselors, Inc. as the KFG Stock Independent Named Fiduciary.

The Plan was amended and restated as of July 1, 2014 (with certain earlier effective dates). Effective for Plan Years beginning on

and after January 1, 2014, the Plan was amended to provide for the allocation of the Contribution and the Supplemental Contribution to the Plan and the contribution to the Hourly Plan if 3% of Consolidated Earnings is insufficient to fund the

Plan and the Hourly Plan in accordance with their respective benefit formulas. The Plan was further amended effective July 1, 2014, to provide an increase in the percentage of Compensation that can be contributed to the Plan pursuant to Article

IV per payroll period, to place further limits on hardship withdrawals, and to make a number of other changes in the administration of the Plan. The Plan was also amended effective June 26, 2013 to revise the definition of “Spouse.”

The Plan has been amended and restated as of January 1, 2016 (with certain amendments effective earlier) to reflect the merger

of Kraft Foods Group, Inc. and H. J. Heinz Company, resulting in the formation of The Kraft Heinz Company, and certain other administrative changes. The Plan has also been amended effective January 1, 2016 to eliminate Part J of the Fund, the

Conduit Fund, as an investment option.

2

ARTICLE I

DEFINITIONS

The following

terms as used herein or in the Trust Agreement shall have the meanings set forth below:

1.01

ACCOUNTS

Accounts, means the aggregate of the

following Accounts that may be maintained on behalf of any Participant or Inactive Participant (or Beneficiary or Alternate Payee):

(a) Company Account, consisting of:

(1) a sub-account that is considered part of a Cash or Deferred

Arrangement; and

(2) a sub-account that is not considered part of a

Cash or Deferred Arrangement;

(b) Company Match Account;

(c) UST Pre-2010 Match Account;

(d) Supplemental Company Contribution Account;

(e) Personal After-Tax Account;

(f) Personal After-Tax Rollover Account;

(g) Personal Before-Tax Account;

(h) Personal Before-Tax Catch-Up Account;

(i) Rollover Account;

(j) Paysop Rollover Account;

(k) Qualified Nonelective Contributions Account;

(l) Roth Account; and

(m) Roth Catch-Up Account.

1.02 ACCREDITED SERVICE

(a) Accredited Service means the accumulated periods of service taken into account in

determining an Employee’s eligibility for benefits under the Plan. Each twelve (12) months of Accredited Service shall constitute one (1) year of Accredited Service.

3

(b) Full-Time Employees. The

Accredited Service of a Full-Time Employee shall include the following periods of service:

(1) all periods of service commencing on the Employee’s date of

employment with any member of the Controlled Group and ending on the earlier of:

(A) the date on which the Employee resigns, is discharged, dies or

retires; or

(B) the first anniversary of the date the Employee

remains absent from service for any other reason;

(2) all periods

of service during which the Employee is deemed employed by any member of the Controlled Group;

(3) all periods during which the Employee has been severed from the

service of any member of the Controlled Group if such severance is by reason of:

(A) his resignation, discharge or retirement and he then performs an

Hour of Service within twelve (12) months of his severance from service date; or

(B) his resignation, discharge or retirement during an absence from

service of twelve (12) months or less for any reason other than his resignation, discharge or retirement, and he then performs an Hour of Service within twelve (12) months of the date on which he was first absent from service;

(4) all periods of service with General Foods Corporation, a Delaware

corporation, or any of its subsidiaries with respect to an Employee who was employed by General Foods Corporation or any of its subsidiaries on November 1, 1985;

(5) all periods of service with Kraft, Inc., a Delaware corporation, or

any of its subsidiaries with respect to an Employee who was employed by Kraft, Inc. or any of its subsidiaries on October 30, 1988;

(6) all periods of service with Nabisco Holdings Corp., a Delaware

corporation, or any of its subsidiaries with respect to an Employee who was employed by Nabisco Holdings Corp. or any of its subsidiaries on December 11, 2000; and

(7) all periods of service with UST Inc., a Delaware corporation, or any

of its subsidiaries with respect to an Employee who was employed by UST Inc. or any of its subsidiaries on January 6, 2009.

(c) Part-Time Employees. A Part-Time Employee shall be credited with a year of

Accredited Service for the initial twelve (12) month period commencing on the Employee’s date of employment with any member of the Controlled Group and ending on the anniversary date thereof if he completes one thousand (1,000) Hours

of Service; thereafter, a Part-Time Employee shall be credited with a year of Accredited Service for each Plan Year (beginning with the Plan Year that includes the first anniversary of the date of employment) he completes one thousand

(1,000) Hours of Service.

4

(d) Severance Pay. No period after

an Employee has separated from employment (including any period during which an Employee is receiving a severance pay allowance from the Severance Pay Plan for Salaried Employees) shall be taken into account as Accredited Service, except as

specifically permitted pursuant to the preceding provisions of this Section 1.02 of the Plan.

1.03 ACTUAL

DIVIDEND PER SHARE GROWTH RATE

Actual Dividend Per Share Growth Rate means the percentage growth in the dollar amount of the cash dividend per share declared by the

Board in December of the fiscal year of Altria that coincides with the Plan Year for which the Contribution is to be made pursuant to Section 2.02 (which dividend is ordinarily payable in January of the immediately succeeding fiscal year of

Altria) from the dollar amount of cash dividend per share declared by the Board in December of the immediately preceding fiscal year of Altria (which dividend was paid in January of the fiscal year of Altria that coincides with the Plan Year for

which the Contribution is to be made pursuant to Section 2.02).

1.04 ACTUAL ADJUSTED

EARNINGS PER SHARE GROWTH RATE

Actual Adjusted Earnings Per Share Growth Rate means the percentage growth in adjusted diluted earnings per share of Altria Stock for

Altria’s fiscal year coinciding with the Plan Year for which the Contribution is calculated pursuant to Section 2.02 from the adjusted diluted earnings per share of Altria Stock for the immediately preceding fiscal year, as determined by

Altria in its sole discretion. For purposes of this Plan, Actual Adjusted Earnings Per Share Growth Rate shall be determined by adjusting the percentage growth rate disclosed in a fiscal year-end earnings press release issued by Altria (which

earnings press release is furnished to the Securities and Exchange Commission on Form 8-K), for unforeseen or unusual events as determined in the sole discretion of Altria, including but not limited to, excessive unanticipated excise taxes,

legislation, or litigation as well as to correct any errors included in the original announcement or change the methodology for the calculation of adjusted diluted earnings per share attributable to Altria.

1.05 ADMINISTRATOR

Administrator means the Vice President, Compensation, Benefits and HR Services of the Company designated pursuant to the terms of the

Plan to carry out certain responsibilities in connection with the management of the Plan solely as it relates to the administration of the Plan, which Administrator shall be the Plan administrator and the Named Fiduciary with respect to such

management and administrative duties within the meaning of ERISA. The Administrator may be authorized to act in a “settlor” capacity or as a fiduciary. The Administrator has assigned certain duties to the Third-Party Recordkeeper and the

Participating Companies. Any reference in the Plan to the administrative duties of the Administrator shall include the carrying out of such duties by one or more delegates or assignees appointed by the Administrator.

1.06 AFTER-TAX CONTRIBUTION

After-Tax Contribution means a contribution made by periodic payroll deduction by a Participant to the Profit-Sharing Fund pursuant to

Section 4.03 of the Plan that does not reduce the Participant’s Compensation for the year contributed to the Profit-Sharing Fund, but that will

5

not be includible in the gross income of the Employee in the year withdrawn or distributed from the Fund.

1.07 AFTER-TAX ROLLOVER

CONTRIBUTION

After-Tax Rollover Contribution means that portion