Altria Group to Lay Off Workers to Cut Costs -- 2nd Update

January 28 2016 - 3:02PM

Dow Jones News

By Tripp Mickle and Chelsey Dulaney

U.S. tobacco giant Altria Group Inc. on Thursday said it would

cut roughly 5% of its workforce in an effort to reduce costs by

$300 million annually as industry volumes decline.

The Marlboro maker announced the layoffs on the same day it

reported profit and revenue for the fourth quarter that missed Wall

Street expectations as cigarette shipments slipped and earnings

declined from its stake in SABMiller PLC's beer business.

Altria's earnings rose slightly to $1.25 billion, or 64 cents a

share, from $1.24 billion, or 63 cents a share, a year earlier.

The results foreshadowed some of the challenges facing the

U.S.'s largest tobacco company, which commits to deliver 7% to 9%

annual earnings growth.

Altria reported adjusted earnings growth of 8.9% for 2015 in

part because it saved an estimated $300 million in costs because of

the expiration of a federal program that required the company pay

subsidies for tobacco farmers. The company also benefited from the

first increase in cigarette volumes in years as lower gas prices

put more money in consumers' pockets.

But the benefits of lower costs from tobacco subsidies ended in

the second half of last year, and the company anticipates industry

cigarette volumes eventually will return to historic levels of

decline in the 3% to 4% range. The company's 27% stake in SABMiller

also is expected to affect results as the London-based brewer

struggles with volatile currencies in South America and Africa.

"That's what makes this year a tough act to follow," said CLSA

analyst Michael Lavery.

Altria said it would eliminate 490 salaried jobs. The Richmond,

Va.-based company employs about 9,000 people. It is the second

round of cuts in the past five years. In 2011, the company

announced it would eliminate 15% of its salaried workforce as part

of a $400 million cost-savings plan.

When asked during a call with analysts to explain what triggered

this year's cuts, Chief Executive Marty Barrington said, "You

always have to be mindful of costs over time. If you have

opportunities to improve in your infrastructure or to improve your

organization and to invest those savings in your brands or in your

products for the future...you should do that."

Mr. Barrington said the company would reinvest some of the cost

savings into "reduced harm products" such as electronic cigarettes

and in its brands.

In its latest quarter, Altria said higher pricing helped offset

a 2.6% decline in cigarette-shipment volume. The company is facing

stronger competition from No. 2 player Reynolds American Inc.,

which in June closed a $25 billion acquisition of rival Lorillard

Inc. Despite that, Altria's cigarette market share rose to 51.4%

from 50.9% a year earlier.

Net revenue after excise taxes was $4.73 billion, up from $4.61

billion a year earlier. Analysts had been expecting revenue of

$4.75 billion.

The company reported earnings from its SABMiller interest

declined 17% to $211 million from $253 million. Excluding

litigation costs and other special items, per-share earnings were

67 cents, while analysts polled by Thomson Reuters forecast

earnings of 68 cents.

For 2016, Altria is expecting earnings of $3 to $3.05 a share,

excluding restructuring charges. The guidance doesn't include any

impact from the proposed combination of Anheuser-Busch InBev NV and

SABMiller, which is expected to close in the second half of the

year.

Write to Tripp Mickle at Tripp.Mickle@wsj.com and Chelsey

Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 28, 2016 14:47 ET (19:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

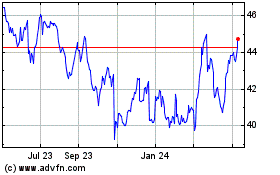

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

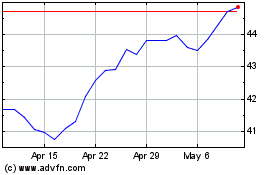

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024