AB InBev, SABMiller Formalize $105 Billion Deal

November 11 2015 - 4:10AM

Dow Jones News

LONDON—Anheuser-Busch InBev NV on Wednesday said it had formally

agreed to buy SABMiller PLC for £ 69.78 billion ($105.5 billion), a

deal that creates a brewing behemoth that will dominate much of the

global beer market.

As part of the deal, SABMiller has agreed to sell its 58% stake

in the MillerCoors LLC joint venture to its partner Molson Coors

Brewing Co., which holds the remaining 42%, for $12 billion. It is

also selling the Miller international business. The transaction

catapults Molson into the position of the No.2 brewer in the U.S.

with a 25% market share that is second only to AB InBev's 45%

share.

The sale of MillerCoors—which sells brands including Miller

Lite, Miller High Life and Blue Moon—is necessary for AB InBev to

gain U.S. regulatory approval to buy SABMiller.

The formal offer by AB InBev comes after weeks of back and forth

between the two companies. SABMiller's board announced on Oct. 13

that it had agreed in principle to unanimously recommend to its

shareholders AB InBev's proposal to pay £ 44 a share to buy the

London-based brewer, marking a 50% premium to its share price on

Sept. 14, the day before media speculation about a potential deal

emerged.

For 41.6% of stock, AB InBev is offering a partial-share

alternative, essentially a combination of cash and unlisted stock,

translating into a lower per-share price of £ 41.85. The

alternative was designed to appeal to SABMiller's largest

shareholders, cigarette giant Altria Group Inc. and the BevCo Ltd.

investment vehicle of Colombia's Santo Domingo family.

The enlarged company's ordinary shares will be listed in

Brussels, Johannesburg and Mexico. The American Depositary Shares

will be listed in New York.

AB InBev expects to achieve at least $1.4 billion in run-rate

synergies a year by the end of the fourth year once the deal is

completed.

A tie-up between the two beer companies, if it gets the green

light from regulators, would bring AB InBev brands such as

Budweiser, Corona and Stella Artois together with SABMiller's

Grolsch and Peroni, and give the combined company a major presence

in the U.S., China, Europe, Africa and Latin America. Together, AB

InBev and SABMiller sell more than 30% of the world's beer.

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=BE0003793107

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US03524A1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 03:55 ET (08:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

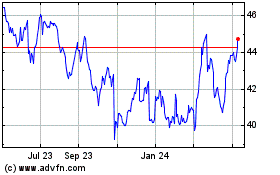

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

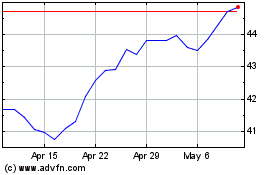

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024