By Saabira Chaudhuri And Shayndi Raice

LONDON-- SABMiller PLC's board has agreed on the key terms of a

sweetened potential takeover offer by Anheuser-Busch InBev NV,

valuing it at GBP67.9 billion ($104.2 billion) and setting the

stage for the creation of a brewing behemoth that would dominate

much of the world's beer market.

After weeks of back and forth, SABMiller's board has agreed to

unanimously recommend to its shareholders AB InBev's proposal to

pay GBP44 a share to buy the London-based brewer, marking a 50%

premium to its share price on Sept. 14, the day before media

speculation about a potential deal emerged.

For 41% of stock, AB InBev is offering a partial-share

alternative, essentially a combination of cash and unlisted stock,

with a five-year lockup period, translating into a lower per-share

price of GBP39.03. The alternative was devised for SABMiller's two

largest shareholders, Altria Group Inc. and BevCo Ltd., an

investment vehicle of Colombia's Santo Domingo family, and helps

them with taxation and potential accounting issues. Other

shareholders can elect to take the alternative as well, in which

case Altria's and BevCo's stakes in AB InBev shares would be

diluted and topped off with cash.

Altria, which owns about 27% of SABMiller, had told SABMiller's

board privately early last week it was willing to accept an offer

of GBP42 a share, people familiar with the matter said, before

publicly saying it would accept AB InBev's proposal of GBP42.15 a

share. The Santo Domingo family, which owns about 14% of SABMiller,

remained supportive of the board throughout the negotiations, said

people familiar with the matter.

The turning point for the deal came late Sunday night, when AB

InBev Chief Executive Carlos Brito sent a note to SABMiller asking

for a meeting early Monday morning, people familiar with the

negotiations said. Mr. Brito said he would bring along AB InBev

Chairman Olivier Goudet, which SABMiller took as a sign that their

rival was ready to take a more conciliatory approach, the people

said.

After AB InBev's proposal of GBP43.50 a share on Monday,

SABMiller decided it was ready to fully engage in negotiations,

said people familiar with the matter. Other than the price, the

negotiations centered on the large $3 billion breakup fee SABMiller

was requesting, said the people.

The day was spent in and out of meetings, with the two boards

agreeing to a deal around 8 p.m. Monday night, one of the people

said. Advisers huddled in investment bank Lazard's London office

well past midnight, preparing for an announcement early Tuesday

morning, the person said.

AB InBev's next challenge is to get regulatory approval for the

deal, which is expected to face antitrust scrutiny around the world

and could take as long as a year to close, according to some

antitrust experts.

The biggest regulatory hurdle is likely to be the crucial U.S.

market, where Belgium-based AB InBev already has a roughly 45%

market share and London-based SABMiller controls a further 25%

through its MillerCoors LLC joint venture with Molson Coors Brewing

Co. AB InBev was forced to dramatically restructure its $20.1

billion acquisition of Mexican brewing giant Grupo Modelo SAB in

2013 after the U.S. Justice Department sued to block the deal.

Another potential regulatory headache is China, where AB InBev

had a 14% market share last year, according to Euromonitor. Chinese

authorities could require the brewer to exit SABMiller's joint

venture with China Resources Enterprise Ltd. , which controls 23%

of the market and produces the top-selling Snow brand. Some

divestitures could also be required in Latin America.

AB InBev will be pressing for U.S. regulatory approval even as

the Justice Department is investigating the brewer's recent

acquisitions of two California distributors. The brewer confirmed

the investigation on Monday, saying it is cooperating with the

Justice Department. Regulators are looking into whether AB InBev's

acquisitions would make it harder for craft brewers and other

competitors to get their beer on shelves, according to people

familiar with the matter.

The latest proposal, unlike the prior ones, includes a provision

for SABMiller shareholders to receive dividend payments during the

period before the deal closes. Target companies often suspend

dividends after agreeing to a deal. Retaining the dividends was a

key part of recent negotiations by SABMiller's board, said a person

familiar with the talks, and increases the amount SABMiller's

shareholders get by about GBP1.3 billion.

SABMiller shares were up 9% at GBP39.50 in afternoon London

trading. If completed, the deal would be the largest acquisition of

a London-listed stock and the largest in the drinks industry,

according to Dealogic. It would easily be the largest deal agreed

on so far this year.

SABMiller has asked the U.K. Takeover Panel to extend the

so-called put-up-or-shut-up deadline, under which AB InBev needs to

make a firm offer for it or walk away, to Oct. 28. The previous

deadline was Wednesday.

The revised proposal is the latest of several AB InBev has made

for SABMiller in recent weeks and comes after the Belgian brewer on

Monday said it was prepared to offer SABMiller's shareholders

GBP43.50 a share in cash and a partial-share alternative of

GBP38.88, translating into a combined price of GBP67.4 billion.

SABMiller had rejected the proposals before Monday's, saying

they significantly undervalued it.

A tie-up between the two beer companies, if successful, would

bring AB InBev brands such as Budweiser, Corona and Stella Artois

together with SABMiller's Pilsner Urquell, Grolsch and Peroni, and

give the combined company a major presence in the U.S., China,

Europe, Africa and Latin America. Together, AB InBev and SABMiller

sell more than 30% of the world's beer.

A question mark hangs over the fate of the two brewers' bottling

arrangements with rivals Coca-Cola Co. and PepsiCo Inc. SABMiller

has disclosed in regulatory filings that a change of control at the

company would give Coke "certain rights" under their bottling

agreements. AB InBev's bottling pact with PepsiCo is set to expire

at the end of 2017. The agreement is automatically extended for

another 10 years unless either company gives written notice at

least two years before they expire.

The acquisition of SABMiller, with its big presence in Africa,

would give AB InBev a major launchpad for its beers in markets

where it has virtually no presence. Consumption in developed

markets has slowed so much that the global beer market is expected

to decline this year for the first time in 30 years, falling by

0.1%, according to industry tracker Plato Logic. The bulk of global

growth will come from Africa, which is expected to grow by 2.6%

A deal between SABMiller and AB InBev has been rumored for

years, and has been described by some analysts as the last major

piece of consolidation that remains in the beer industry. Research

firm Euromonitor has estimated that the combined company's market

share would be 29% after likely divestments, giving it a 20

percentage point lead over the next biggest brewer, Heineken

NV.

Like AB InBev, the combined brewer would be incorporated in

Belgium, the companies said.

Robey Warshaw, J.P. Morgan, Morgan Stanley, Goldman Sachs,

Linklaters and Hogan Lovells International advised SABMiller, while

Lazard, Deutsche Bank, Freshfields Bruckhaus Deringer and Cravath

Swaine & Moore advised AB InBev.

Tripp Mickle in Atlanta contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 13, 2015 10:06 ET (14:06 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

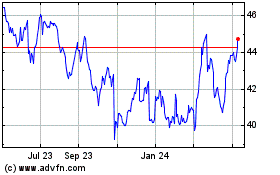

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

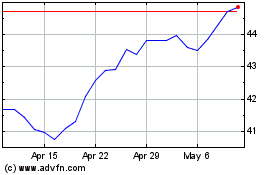

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024