Altria Group Statement on the Joint Announcement by Anheuser-Busch InBev and SABMiller

October 13 2015 - 7:00AM

Business Wire

Altria Group, Inc. (Altria), the largest shareholder of

SABMiller plc (SABMiller), notes the joint announcement earlier

this morning by Anheuser-Busch InBev (AB InBev) and SABMiller of

their agreement in principle on key terms regarding a possible

recommended offer for AB InBev to acquire SABMiller. At SABMiller’s

request, the U.K. Takeover Panel has extended until October 28,

2015 the relevant Takeover Code deadline to enable the parties to

continue their talks.

Altria is pleased that ABI and SABMiller have taken these steps,

and looks forward to working constructively with both parties.

Altria’s Profile

Altria currently owns approximately 27% percent of SABMiller’s

ordinary shares and has been a SABMiller shareholder since 2002.

Altria’s wholly-owned subsidiaries include Philip Morris USA Inc.,

U.S. Smokeless Tobacco Company LLC, John Middleton Co., Nu Mark

LLC, Ste. Michelle Wine Estates Ltd. and Philip Morris Capital

Corporation.

The brand portfolios of Altria’s tobacco operating companies

include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, MarkTen®

and Green Smoke®. Ste. Michelle produces and markets premium wines

sold under various labels, including Chateau Ste. Michelle®,

Columbia Crest®, 14 Hands® and Stag’s Leap Wine Cellars™, and it

imports and markets Antinori®, Champagne Nicolas

Feuillatte™, Torres® and Villa Maria Estate™

products in the United States. Trademarks and service marks related

to Altria referenced in this release are the property of Altria or

its subsidiaries or are used with permission. More information

about Altria is available at altria.com and on the Altria Investor

app.

Forward-Looking and Cautionary

Statements

This press release contains forward-looking statements that

involve a number of risks and uncertainties and are made pursuant

to the Safe Harbor Provisions of the Private Securities Litigation

Reform Act of 1995. Important factors that may cause actual results

and outcomes to differ materially from those contained in the

forward-looking statements included in this press release are

described in Altria’s publicly filed reports, including its Annual

Report on Form 10-K for the year ended December 31, 2014 and its

quarterly report on Form 10-Q for the period ended June 30, 2015.

In addition, AB InBev has not announced a firm intention to make an

offer in accordance with the U.K. City Code on Takeovers and

Mergers; accordingly, there can be no certainty either that an

offer will be made or as to the terms on which any offer will be

made. Altria does not undertake to update any forward-looking

statements that it may make except as required by applicable law.

All subsequent written and oral forward-looking statements

attributable to Altria or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

referenced above. This press release is non-binding and does not

impose or give rise to any legally binding obligation on Altria

Group, Inc. in relation to any offer.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151013005954/en/

Altria Client ServicesInvestor Relations, 804-484-8222orMedia

Relations, 804-484-8897

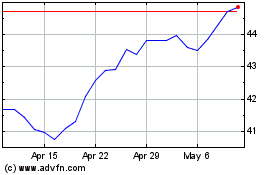

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

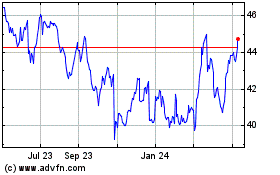

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024