SABMiller, AB InBev Agree on Key Terms of Possible Deal -- 4th Update

October 13 2015 - 5:01AM

Dow Jones News

By Saabira Chaudhuri

LONDON-- SABMiller PLC's board has agreed on the key terms of a

sweetened potential takeover offer by Anheuser-Busch InBev NV

valuing it at GBP67.9 billion ($104.2 billion), setting the stage

for the creation of a brewing behemoth that would dominate much of

the world's beer market.

After weeks of back and forth, SAB Miller's board has agreed to

unanimously recommend to its shareholders AB InBev's proposal to

pay GBP44 a share to buy the London-based brewer, marking a 50%

premium to its share price on Sept 14, the day before media

speculation about a potential deal emerged. For 41% of stock AB

InBev is offering a partial-share alternative, essentially a

combination of cash and stock translating into a lower per-share

price of GBP39.03. The alternative was devised for SABMiller's two

largest shareholders, Altria Group Inc. and the Santo Domingo

family's investment vehicle BevCo, and helps them with taxation and

potential accounting issues.

The latest proposal also includes a provision for SABMiller

shareholders to get dividend payments, something the prior

proposals didn't. SABMiller's shareholders are entitled to get up

to 28 cents a share in dividends paid by the London-based brewer

for the six months to Sept. 30 and a further 94 cents a share for

the six month period ended March 31 next year before a possible

deal is completed. That amounts to $1.22 a share and raises the

total value of the deal by about GBP1.3 billion ($2 billion). It

increases the amount SABMiller's shareholders get by about GBP1.3

billion ($2 billion.)

Dividends are ordinarily suspended once a deal is agreed on and

including these was a key part of recent negotiations by

SABMiller's board, according to a person familiar with the matter.

AB InBev's Chief Executive Carlos Brito and Chairman Olivier Goudet

met with SABMiller's Chairman Jan du Plessis in London on Monday to

negotiate final terms of the proposal while SABMiller's board also

met to discuss the deal according to this person.

SABMiller' shares jumped 9.1% when the market opened in London.

If completed, the deal would the largest acquisition of a

London-listed stock and the largest acquisition in the drinks

industry, according to Dealogic. It would easily be the largest

deal agreed on so far this year.

SABMiller has asked the U.K. Takeover Panel to extend the

so-called put-up-or-shut-up deadline, under which AB InBev needs to

make a firm offer for it or walk away, to Oct 28. The previous

deadline was Wednesday.

If AB InBev can't get the necessary regulatory clearances for

the deal to close, or its shareholders don't approve the deal, the

brewer would pay SAB Miller a breakup fee of $3 billion. AB InBev

said it would pay for the cash part of the deal through its

internal resources and issuing new debt.

The revised proposal is the fifth AB InBev has made for

SABMiller in recent weeks and comes after the Belgian brewer on

Monday said it was prepared to offer SABMiller's shareholders

GBP43.50 a share in cash and a partial-share alternative of

GBP38.88, translating into a combined price of GBP67.4 billion.

SABMiller had rejected several prior proposals, saying they

significantly undervalued it.

SABMiller's two largest shareholders, Altria and the Santo

Domingo family, which have a 41% stake in the London-headquartered

brewer between them--had initially come down on different sides of

the offer. Altria, last week offered its support, but the Santo

Domingo family joined the rest of the board in rejecting AB InBev's

offer.

Tuesday's deal is unanimously supported by SABMiller's board,

meaning the Santo Domingo family changed its mind.

A tie-up between the two beer companies, if successful, would

bring household brands such as Budweiser, Corona and Stella Artois

together with Pilsener Urquell, Grolsch and Peroni, and give the

combined company a major presence in the U.S., China, Europe,

Africa and Latin America. Together, AB InBev and SABMiller sell

over 30% of the world's beer.

AB InBev's next big challenge is to get regulatory approval for

the deal, which is expected to face antitrust scrutiny around the

world and could take as long as a year to close according to some

antitrust experts.

The biggest regulatory hurdle is likely to be the crucial U.S.

market, where AB InBev already has a roughly 45% market share and

London-based SABMiller controls a further 25% through its

MillerCoors LLC joint venture with Molson Coors Brewing Co. AB

InBev was forced to dramatically restructure its $20.1 billion

acquisition of Mexican brewing giant Grupo Modelo SAB in 2013 after

the U.S. Justice Department sued to block the deal.

Another potential regulatory headache is China, where AB InBev

had a 14% market share last year, according to Euromonitor. Chinese

authorities could require the brewer to exit SABMiller's joint

venture with China Resources Enterprise Ltd., which controls 23% of

the market and produces the top-selling Snow brand. Some

divestitures could also be required In Latin America.

A question mark also hangs over the fate of the two brewers'

bottling arrangements with arch rivals Coca-Cola Co. and PepsiCo

Inc. SABMiller has disclosed in regulatory filings that a change of

control at the company would give Coke "certain rights" under their

bottling agreements. AB InBev's bottling agreements with PepsiCo

are set to expire at the end of 2017. The agreements are

automatically extended for another 10 years unless either company

gives written notice at least two years before they expire.

The acquisition of SABMiller, with its big presence in Africa,

would give AB InBev a major launchpad for its beers in markets

where it has virtually no presence. Consumption in developed

markets has slowed so much that the global beer market is expected

to decline this year for the first time in 30 years, falling by

0.1%, according to industry tracker Plato Logic. The bulk of global

growth will come from Africa, which is expected to grow by 2.6%

A deal between SABMiller and AB InBev has been rumored for

years, and has been described by some analysts as the last major

piece of consolidation that remains in the beer industry. Research

firm Euromonitor has estimated that the combined company's market

share would be 29% after the deal after likely divestments, giving

it a 20 percentage point lead over the next biggest brewer,

Heineken NV.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 13, 2015 04:46 ET (08:46 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

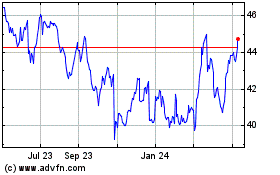

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

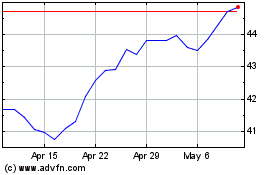

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024