By Saabira Chaudhuri

LONDON--A public spat continued Thursday between Anheuser-Busch

InBev NV and its would-be takeover target SABMiller PLC, increasing

the uncertainty of an accepted deal by Wednesday's U.K.

deadline.

AB InBev said SABMiller's claim that its latest acquisition

proposal undervalues the London-based brewer "lacks credibility."

The world's largest brewer, based in Belgium, said SABMiller's

shareholders should "voice their views and should not allow the

board of SABMiller to frustrate this process and let this

opportunity slip away."

"We've noted their announcement--it contains nothing new," an

SABMiller spokeswoman responded. The maker of Pilsner Urquell and

Peroni Nastro Azzurro previously accused AB InBev of making

proposals that are "highly conditional," with several regulatory

and structural uncertainties, and said the latest proposal "very

substantially undervalues" it.

Over the past three weeks, second-ranked global brewer SABMiller

has dug in, rejecting three proposals from AB InBev. On Wednesday,

SABMiller took just six hours to reject AB InBev's proposed offer

of GBP42.15 ($64.80) a share in cash alongside a less valuable

cash-and-stock deal available to 41% of SABMiller's shareholders.

Under U.K. takeover rules, AB InBev has until Oct. 14 to make a

firm offer or walk away for at least six months.

Despite the posturing on both sides, many analysts think a deal

will be announced.

"Both parties have a lot at stake," said Berenberg analyst

Javier Gonzalez Lastra. AB InBev, he said, "needs a sizable

transaction for its next cycle of growth as profit growth becomes

more difficult to come by in its two core markets of U.S. and

Brazil." Meanwhile, "the SABMiller board is increasingly under

pressure" now that AB InBev's proposal is public and Marlboro

cigarette maker Altria Group Inc., SABMiller's largest shareholder,

has declared support.

The sparring is "more as a form of public negotiation than

serious marking of their respective territories," said RBC analyst

James Edwardes Jones. "Neither side can afford this deal to fall

through."

SABMiller's share price has weakened from a year ago, while AB

InBev's performance has worsened. Consumers in North America and

Europe have been steadily shifting toward wine or spirits such as

bourbon over two decades. When drinking beer, more are bypassing

the mass-market lagers that are the mainstays of global beer giants

in favor of craft beers and Mexican imports.

Still, SABMiller's shares closed at GBP36.41 in London on

Thursday, implying that investors are baking in the likelihood that

a deal might not go through--either due to antitrust issues or

because SABMiller's board won't budge.

AB InBev Chief Executive Carlos Brito on Wednesday said the

cash-and-stock alternative was designed "with and for" SABMiller's

second-largest shareholder, the Santo Domingo family of Colombia.

The family and Altria between them hold 41% of the company. The

package comes with tax and accounting advantages for those holders

that would balance out the lower nominal value.

Altria has indicated it would accept a deal at or above AB

InBev's latest proposed price, but the Santo Domingos continue to

hold out. Whether AB InBev can turn that around is a key issue.

Referring to both Altria and the Santo Domingo family, Mr. Brito

said: "There's no transaction without both of these big

shareholders supporting and taking the paper."

Alejandro Santo Domingo, one of the family's representatives on

the SABMiller board, declined to comment Thursday.

Investors have been burned lately by a string of deals that have

fallen through. Following the news that AbbVie Inc. could abandon a

$54 billion takeover for Shire PLC last year, Shire's share price

sank 22% in a day. When Monsanto Co. in August dropped its $46

billion bid for Syngenta AG, the Swiss agribusiness giant's shares

fell 18%.

Shares can also trade well below a likely offer price to account

for the time it would take for a deal to be completed. Given the

antitrust hurdles that would be tied to a merger between the

world's two largest brewers, some antitrust experts have estimated

the deal could take as long as a year to close.

Many in the industry think AB InBev will go higher than its

latest offer.

Sterne Agee analyst April Scee said AB InBev's current offer

undervalues SABMiller "given Africa is the last frontier in beer."

SABMiller has a long-standing presence in Africa, with operations

in 38 African markets.

"We expect a deal to be done at around GBP44 per share," Mr.

Edwardes Jones said, referring to the all-cash component. With the

cash-and-stock alternative, the overall per-share deal price would

come in lower.

While AB InBev's recent overtures have been far from friendly,

many industry experts said they would be surprised if the brewer

went hostile, or took an offer to shareholders without the blessing

of the board. Roughly 30% of SABMiller's earnings last year came

from joint ventures and associates, a tangled web of relationships

that AB InBev would need its cooperation to navigate.

AB InBev is used to hard negotiating. The company's $20.1

billion deal for Mexican brewer Grupo Modelo in 2012 was no walk in

the park. The Justice Department in 2013 sued AB InBev, seeking to

block its deal with the Corona brand owner. The suit eventually was

settled after AB InBev agreed to sell Modelo's entire U.S. business

to Constellation Brands Inc. and acquire the 50% of Modelo it

didn't already own.

Tripp Mickle in Atlanta contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 13:54 ET (17:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

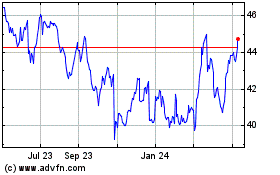

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

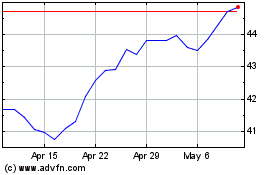

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024