By Saabira Chaudhuri

LONDON-- SABMiller PLC rejected a takeover proposal from

Anheuser-Busch InBev NV on Wednesday that valued it as high as

GBP68.24 billion ($103.88 billion), the latest salvo in what is

quickly becoming a tense negotiation between the world's No. 1 and

No. 2 brewers.

The tensions extend to SABMiller's two largest shareholders,

U.S. tobacco company Altria Group Inc. and the Santo Domingo family

of Colombia. Altria, which holds a stake of more than 25%, said it

would support a deal at or above AB InBev's proposed price. The

Santo Domingos' BevCo Ltd. investment vehicle, with about 15%,

joined with the rest of the SABMiller board in rejecting the

proposal.

AB InBev said it had proposed a cash price of GBP42.15 a share,

with a so-called partial-share alternative aimed at pleasing

SABMiller's largest shareholders. The latest proposal was the third

it has made to SABMiller's board, which rejected the earlier two,

each company said.

SABMiller said its 16-member board, excluding the three

directors nominated by Altria "unanimously rejected" the GBP42.15

proposal "as it still very substantially undervalues SABMiller, its

unique and unmatched footprint, and its stand-alone prospects."

In a separate release Wednesday, Altria said it supports the

current proposal, including the share alternative, and recommended

that SABMiller's management engages "promptly and constructively"

in talks.

The cash proposal represented a premium of about 44% to

SABMiller's closing share price of GBP29.34 on Sept. 14, the day

before SABMiller shares started climbing amid speculation about an

approach from AB InBev.

AB InBev had said the share alternative--essentially a

less-valuable offer of cash and shares--would be available for 41%

of SABMiller shares outstanding. That corresponds to the amount

held by Altria and the Santo Domingo family. That separate offer

valued each SABMiller share at GBP37.49, or a 28% premium, but

offers tax advantages to Altria and the Santo Domingos.

The deal's structure has been a key point in negotiations. If

SABMiller had agreed to the proposal, and Altria and the Santo

Domingo family elected to accept the lower cash-and-stock proposal,

AB InBev would have ended up paying GBP65.14 billion for SABMiller.

BevCo didn't immediately respond to a request for comment.

SABMiller shares were up 0.8% at GBP36.49 on Wednesday

afternoon, having risen as much as 4.4% earlier.

AB InBev said it has made two prior written proposals in private

to SABMiller, the first for GBP38 a share in cash and the second,

on Monday, for GBP40 in cash. SABMiller said AB InBev on Monday

also indicated the possibility of a raised all-cash price of GBP42

a share alongside the partial stock alternative. SABMiller said its

board--excluding the directors nominated by Altria--concluded that

even if AB InBev formalized the GBP42-a-share proposal, it would

reject this.

"AB InBev is disappointed that the board of SABMiller has

rejected both of these prior approaches without any meaningful

engagement," said the brewer. "AB InBev believes that the revised

cash proposal of GBP42.15 per share is at a level that the board of

SABMiller should recommend."

SABMiller said earlier Wednesday that AB InBev had timed the

initial approach to take advantage of SABMiller's recently

depressed share price, that the structure of the proposals

discriminates against some SABMiller shareholders, and that AB

InBev hasn't offered it comfort on the significant regulatory

hurdles in the U.S. and China.

Under U.K. takeover rules, AB InBev has until 5 p.m. on Oct. 14

to announce a "firm intention" to make an offer for SABMiller and

specify the details of the offer. Wednesday's proposal doesn't

constitute this, said AB InBev, cautioning that there is no

certainty that a firm offer will be made.

A tie-up between the two beer companies would bring household

brands such as Budweiser, Corona and Stella Artois together with

Pilsner Urquell, Grolsch and Peroni, and give the combined company

a major presence in the U.S., China, Europe, Africa and Latin

America. Together, AB InBev and SABMiller sell more than 30% of the

world's beer volume.

Combined, the two companies would generate annual revenue of $64

billion and earnings before interest, taxes, depreciation and

amortization of $24 billion.

Because of the global reach of AB InBev and SABMiller, they will

likely have to seek antitrust clearance from jurisdictions around

the world, a process that could easily take a year.

The biggest regulatory hurdle is in the crucial U.S. market,

where AB InBev already has a roughly 45% market share and

U.K.-based SABMiller controls a further 25% through its MillerCoors

LLC joint venture with Molson Coors Brewing Co. Another potential

regulatory headache is China, where AB InBev had an estimated 14%

volume market share last year, according to Euromonitor. Chinese

authorities could require the brewer to exit SABMiller's joint

venture with China Resources Enterprise Ltd., which has 23% of the

market and produces the top-selling Snow brand.

In Wednesday's statement, AB InBev said it is "committed to

working proactively with regulators," and said in the U.S. and

China in particular it would "seek to resolve any regulatory or

contractual considerations promptly and proactively."

AB InBev said it would establish a secondary listing on the

Johannesburg stock exchange and have a local board there.

SABMiller's third-largest investor, South Africa's Public

Investment Corp., said the offer from AB InBev "addresses one of

its concerns," namely that the company remain listed in

Johannesburg. PIC said before the rejection that it would wait for

guidance from SABMiller's board on the financial benefits of the

proposed merger.

A deal between AB InBev and SABMiller has been rumored for

years, and some analysts have described it as the last major piece

of consolidation that remains in the beer industry. Research firm

Euromonitor has estimated that the combined company's market share

would be 29% after the deal after likely divestments, giving it a

20-percentage-point lead over the next-biggest brewer, Heineken

NV.

SABMiller on Tuesday brought forward a trading statement

originally slated for Oct. 15, a move that was intended to give its

shareholders information ahead of a formal proposal being made by

AB InBev.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 10:54 ET (14:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

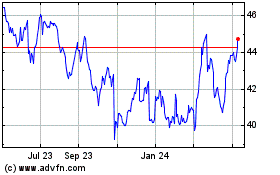

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

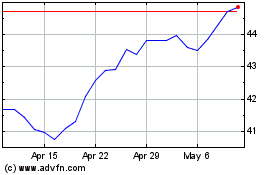

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024