UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

_______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2015

ALTRIA GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Virginia | | 1-08940 | | 13-3260245 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

6601 West Broad Street, Richmond, Virginia | | 23230 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (804) 274-2200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

As Altria Group, Inc. (“Altria”) previously announced, its Executive Vice President and Chief Financial Officer, Billy Gifford, will be giving a live presentation today, September 9, 2015, at the Barclays Global Consumer Staples Conference in Boston, Massachusetts. In connection with the presentation, Altria is furnishing the following documents attached as exhibits to and incorporated by reference in this Current Report on Form 8-K: the text of Mr. Gifford’s remarks, attached as Exhibit 99.1, and the press release addressing aspects of the presentation, attached as Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| |

99.1 | Remarks by Billy Gifford, Executive Vice President and Chief Financial Officer, Altria Group, Inc., dated September 9, 2015 (furnished under Item 7.01) |

99.2 | Altria Group, Inc. Press Release, dated September 9, 2015 (furnished under Item 7.01) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ALTRIA GROUP, INC. |

| | |

| By: | /s/ W. HILDEBRANDT SURGNER, JR. |

| Name: | W. Hildebrandt Surgner, Jr. |

| Title: | Corporate Secretary and |

| | Senior Assistant General Counsel |

DATE: September 9, 2015

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | Remarks by Billy Gifford, Executive Vice President and Chief Financial Officer, Altria Group, Inc., dated September 9, 2015 (furnished under Item 7.01) |

| |

99.2 | Altria Group, Inc. Press Release, dated September 9, 2015 (furnished under Item 7.01) |

Exhibit 99.1

Remarks by Billy Gifford, Altria Group, Inc.’s (Altria) Chief Financial Officer

Thank you and good morning, everyone.

Before I begin, please review the Safe Harbor statement in today’s presentation and the Forward-Looking and Cautionary Statements section in today’s press release for a description of the various factors that could cause our actual results to differ materially from projections included in today’s remarks. Reconciliations and further explanations of the non-GAAP financial measures discussed today are available on altria.com and on the Altria Investor App. Future dividend payments and share repurchases remain subject to the discretion of Altria’s Board of Directors. The timing of share repurchases depends on marketplace conditions and other factors.

This morning, our remarks will focus on the progress we’ve made this year against our financial goals and business strategies and our track record of delivering consistent financial performance and shareholder value. Then, I’ll open it up to your questions.

We believe Altria is a compelling, long-term investment, and our track record for delivering shareholder value is strong. In fact, of the 57 companies included in each FORTUNE 500 list since it began in 1955, Altria has had the highest annualized return to shareholders at more than 20%.

We continue to pursue two long-term financial goals: to grow adjusted diluted earnings per share (EPS) at an average annual rate of 7% to 9% and to maintain a target dividend payout ratio of approximately 80% of adjusted diluted EPS. And we’re proud of our track record of delivering against them. From 2009 through 2014, Altria grew adjusted diluted EPS at a compounded annual rate of 8%.

We’ve also consistently grown our dividend. Over the same five-year period, we raised our dividend six times for a compounded annual growth rate of almost 9%, reflecting dividend increases in line with

1

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

adjusted diluted EPS growth and our 80% target dividend payout ratio. In 2014, we paid shareholders $3.9 billion in dividends.

In the first half of 2015, Altria grew its adjusted diluted EPS over 13% led by excellent performance in our smokeable products segment. And, in August, we raised our dividend 8.7% to an annualized rate of $2.26 per share, the 49th increase in the past 46 years.

We believe we are well positioned to deliver against our financial goals in 2015. Therefore, Altria reaffirms its guidance for 2015 full-year adjusted diluted EPS in the range of $2.76 to $2.81, representing a growth rate of 7.5% to 9.5% from an adjusted diluted EPS base of $2.57 in 2014.

Given the recent transaction involving our competitors, some quick thoughts on changes to the U.S. tobacco industry. As you should expect, we prepare for a variety of scenarios across our businesses. We have faced many changes in our industry - for example, the signing of the Master Settlement Agreement, the 2004 consolidation of two competitors, the 2009 federal excise tax increase and the beginning of U.S. Food and Drug Administration (FDA or the Agency) regulation of tobacco products. Thanks to our companies’ extraordinary brands, superior execution, talented people, long-term focus and preparation, we have grown through these changes and delivered outstanding results.

In fact, during this period of change of over 15 years, Philip Morris USA Inc. (PM USA) grew Marlboro’s retail share almost seven points, and we delivered a total shareholder return of more than 1,000%, over five times the S&P 500’s return.

As always, we manage our business for the long term by pursuing three strategies:

| |

• | first, to maximize income from our core tobacco businesses over the long term; |

| |

• | second, to grow new income streams with innovative tobacco products; and |

| |

• | third, to manage our diverse income streams and strong balance sheet to deliver consistent financial performance. |

2

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

Altria’s core tobacco businesses operate within an attractive domestic tobacco industry. U.S. tobacco profits have grown 5.5% annually from 2009 through 2014. And last year, Altria earned more than half of those profits. In addition, our tobacco businesses benefit from generally low input costs and operate without the currency pressures many global consumer packaged goods (CPG) companies face.

So, we remain focused on maximizing income from our core tobacco businesses over the long term.

Let’s begin with our smokeable products segment, which includes cigarettes and machine-made large cigars. In the second half of 2014, adult tobacco consumers began to feel incrementally better about their economic situation, which is reflected in two key dynamics supporting the cigarette category’s recent performance.

First, the premium cigarette segment continued to grow. In fact, the premium segment now accounts for over 75% of the category. And Marlboro remains the undisputed leader as measured by both retail share and brand equity strength. Marlboro’s retail share, at over 44% for the first half of 2015, is larger than the next 10 brands combined, and Marlboro’s brand equity score remains significantly higher than its key competitors as of the latest third-party study performed earlier this year.

Second, PM USA estimates that the cigarette industry volume decline rate has recently moderated, declining half of a percent in the first six months of 2015. Cigarette volumes have been declining in a range of 3% to 4% for many years. Historically, there have been short-term fluctuations in the cigarette volume decline rate outside of this trend, and it’s important to remember that at this conference last year, we were talking about a 4.5% rate of decline. So we believe it’s best to view cigarette volume dynamics with an eye on the long term.

Our strategy for the smokeable products segment is to maximize income, while maintaining modest share momentum over time on Marlboro and Black & Mild. For the first half of 2015, the smokeable segment delivered excellent performance, driven by the continued strength of Marlboro. Adjusted operating companies income (OCI) grew over 14% to $3.8 billion, and adjusted OCI margins expanded almost three

3

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

percentage points to 47%. And PM USA grew Marlboro’s retail share by three tenths to 44.1%, driven by retail share gains in both Marlboro’s menthol and non-menthol offerings. In addition, pricing has been and continues to be a key income driver in the smokeable segment. For the first half of 2015, revenues net of excise taxes per thousand units grew nearly 5%.

Marlboro anchors our smokeable products segment. PM USA has supported Marlboro’s brand equity with careful investments over decades, which have produced remarkable retail share growth over the past 60 years. A few years ago, PM USA established the Marlboro architecture highlighting the brand’s four flavor families - Red, Gold, Green and Black - to open exciting new doors for the brand. Marlboro is now able to express the brand’s core values, which include masculinity, freedom and adventure, through the unique lens of each of Marlboro’s flavor families.

Additionally, the architecture unlocked innovative ways to build the brand and connect with adult smokers 21 and older. For example, through Marlboro.com, adult smokers can engage with the brand through picture and video uploads and user-generated content promotions. Today, Marlboro Black’s “Way of the Bold” promotion celebrates bold stories from around the globe that define modern masculinity, while offering adult smokers a chance to win in a daily sweepstakes. Let’s take a look:

[Video]

The promotion has led to nearly four million entries into the daily sweepstakes and over 50,000 new, registered adult smokers 21 and older on Marlboro.com.

In the second quarter of 2015, Marlboro Black grew retail share for its 18th consecutive quarter and continued to build on its strength among the important 21 to 29 year old demographic. For total Marlboro, its share among 21 to 29 year old smokers exceeds that of its overall retail share, based on PM USA’s and the latest government data.

4

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

More recently, PM USA further invested to build mobile functionality by expanding its pioneering mobile coupon approach and entering the world of age-verified, mobile apps. In total, mobile log-ins have grown nearly 1,000% since 2011 as a result of our digital investments. According to comScore, Marlboro.com is among the leading CPG mobile sites in the U.S.

So, Marlboro is strong, both overall and with adult smokers 21 to 29, thanks to wise stewardship and disciplined investments for the long term.

Let’s now turn to the smokeless products segment, where the category dynamics are, of course, different. Over the five years ended in 2014, U.S. Smokeless Tobacco Company LLC (USSTC) estimates that smokeless category volumes grew at a 5% annual rate. As of June 30, estimated smokeless category volumes have grown approximately 3% on a trailing 12-month basis due, in part, to adult tobacco consumers’ exploration across other tobacco categories.

The strategy in the smokeless products segment is to increase income by growing volume at or ahead of the category while maintaining modest share momentum on Copenhagen and Skoal combined. For the first half of 2015, reported shipment volume grew 2.6% as the combined shipment growth in Copenhagen and Skoal was partially offset by losses in Other brands. Adjusted OCI grew over 4.5%, and the smokeless segment’s category-leading adjusted OCI margins expanded to nearly 65%. Further, Copenhagen and Skoal’s combined retail share grew by three tenths of a share point over the first six months of the year.

Copenhagen and Skoal are the two leading premium smokeless brands, commanding more than 51% retail share of the category in the first half of 2015. Throughout its long history, Copenhagen has developed into an outstanding brand. And today, the brand continues to perform well, having grown its retail share by an average of 1.6 share points per year from 2011 through 2014.

Copenhagen complemented its long history as the leading brand in the natural segment by entering the largest and fastest growing segment with Long Cut Wintergreen in late 2009. Copenhagen Long Cut

5

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

Wintergreen has grown retail share in 18 of the last 19 quarters, with one quarter of unchanged retail share.

Next month, Copenhagen plans to launch its seasonal “Own the Hunt” promotion with an interactive experience on FreshCope.com that is authentic to the hunting experience. “Own the Hunt” offers adult dippers 21 and older an opportunity to win prizes for the outdoorsman by answering hunting-related questions on the site.

USSTC has also pursued greater stability on Skoal to strengthen the combined performance of its two premium brands. In 2014, the company began investing to enhance Skoal’s brand equity with its “A Pinch Better” campaign. It also took steps to narrow price gaps on Skoal Classic. While there is still work to be done on Skoal’s long-term value equation, we are encouraged by our research showing adult dippers increasingly connecting Skoal’s “A Pinch Better” tagline with the brand. Strengthening a brand takes time, and we will continue to monitor the strategy behind Skoal with a focus on long-term results.

While we are maximizing income in our core tobacco businesses, we are also investing for our future. Today, the performance of our large and successful core tobacco businesses helps fund our second long-term strategy of growing new income streams with innovative tobacco products. We are taking a disciplined and strategic approach and a long-term view of the category.

We know that adult smokers are interested in exploring innovative tobacco products, and the categories remain very dynamic. Based on annualized first-half 2015 sales information, we estimate full-year 2015 consumer e-vapor expenditures to be nearing $2.5 billion. This would represent a growth rate of roughly 25% versus 2014 - marking a slowdown in growth from last year, during which there were two national product launches and an expansion of retail vape shops.

Importantly, adult tobacco consumers continue to try e-vapor products. Still, products often fall short of their expectations, including performance and taste, requiring further innovation and new choices in the marketplace. So Nu Mark LLC (Nu Mark) is building a portfolio of innovative tobacco products to meet

6

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

the varied and evolving preferences of adult tobacco consumers. This year, Nu Mark launched MarkTen XL in several lead markets. MarkTen XL is a larger product with twice the liquid and battery strength as previous MarkTen products. While it’s early, we are encouraged by the feedback we’ve received on MarkTen XL. Additionally, Nu Mark expanded Green Smoke’s retail distribution into several lead markets with new packaging and promotional tools.

We believe that the evolving preferences of adult smokers and vapers could one day be met with the right technology, whether it’s e-vapor or something yet to be developed. To that end, in July, we supplemented our 2013 agreement with Philip Morris International Inc. to include a joint research, development and technology-sharing agreement on e-vapor products. This is the latest step in our ongoing portfolio approach to product development and commercialization.

While the business opportunity is comparatively small today, we’re investing in the potential it may hold for long-term growth. We will continue to invest prudently in building a successful pipeline of products. In addition, we will invest in the regulatory and government affairs efforts that we consider necessary for Nu Mark’s long-term success in the category.

While we’re on the subject of regulation, I’ll provide a brief overview of the regulatory landscape. It’s been over one year since the comment period closed on FDA’s proposed deeming regulations, and the final rule could come any day. As we’ve previously said, we support FDA extending its regulatory authority over all tobacco products, including those containing tobacco-derived nicotine. And we believe the Agency has an unprecedented opportunity to advance public health goals by implementing a regulatory structure that recognizes that some types of tobacco products may have significantly lower risks compared to cigarettes.

We were encouraged that the proposed deeming regulations recognized a continuum of risk for different tobacco products. FDA’s implementation of a comprehensive tobacco harm reduction strategy would be among the most meaningful actions the Agency could take to reduce the health effects of tobacco use.

7

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

Our third strategy is to manage our diverse income streams and strong balance sheet to deliver consistent financial performance.

In addition to our total tobacco platform, our wine and beer assets complement Altria’s core tobacco companies. These include Ste. Michelle Wine Estates Ltd. (Ste. Michelle) and our equity investment in SABMiller plc (SABMiller).

In the wine segment, Ste. Michelle’s goal is to grow income by expanding its share and distribution of premium wines. The wine business continues to perform very well. For the first half of 2015, Ste. Michelle grew OCI by 24% and expanded OCI margins by almost three percentage points.

Additionally, Altria’s approximate 27% equity investment in SABMiller allows us to participate in the growing global beer profit pool. Earnings from our equity investment in SABMiller have been a nice contributor to Altria’s earnings over time. From 2011 through 2014, adjusted equity earnings from our investment have grown at a compounded annual rate of more than 8%. As of August 31, the market value of our SABMiller investment was approximately $20 billion.

As we’ve said previously, we regularly evaluate our SABMiller investment, and at this time we believe maintaining the asset is in our shareholders’ best interests. Our goal always has been and remains to manage this investment in a way that delivers the best value for Altria’s shareholders.

Our diverse business model, strong balance sheet and cash flow allow us to return large amounts of cash to shareholders, primarily through dividends. Our 2014 dividend payout ratio of approximately 80% was the highest in the S&P Food, Beverage and Tobacco Index. Compared to other income generating investments as of August 31, Altria has a dividend yield of 4.2%. A strong and growing dividend is an important part of why we believe Altria is an attractive investment in any environment.

8

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

To further reward shareholders, in July, Altria announced a new $1 billion share repurchase program that we expect to complete by the end of 2016. Combining dividends paid and share repurchases, Altria has returned over $16 billion to shareholders from the end of 2011 through June 30, 2015.

To sum up, we believe Altria is well positioned for continued success. We are maximizing our core businesses for the long-term. Our core tobacco businesses are strong thanks to investments in their leading premium brands. We are making disciplined investments behind our portfolio of innovative tobacco products for the promise they may hold in the future.

And finally, we manage our diverse business model with the goal of delivering stable financial performance and consistent shareholder returns year after year. From 2007 through 2014, Altria’s adjusted diluted EPS growth has been both more stable and higher than the S&P 500’s operating EPS growth, which excludes corporate and unusual items in a manner similar to our adjusted diluted EPS measure. From the end of 2007 through 2014, Altria has produced a total shareholder return of nearly 220%, significantly outpacing the S&P 500 and S&P Food, Beverage and Tobacco Index.

Thanks for your attention. I’ll now take your questions.

Altria’s Profile

Altria’s wholly-owned subsidiaries include PM USA, USSTC, John Middleton Co., Nu Mark, Ste. Michelle and Philip Morris Capital Corporation. Altria holds a continuing economic and voting interest in SABMiller.

The brand portfolios of Altria’s tobacco operating companies include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, MarkTen® and Green Smoke®. Ste. Michelle produces and markets premium wines sold under various labels, including Chateau Ste. Michelle®, Columbia Crest®, 14 Hands® and Stag’s Leap Wine CellarsTM, and it imports and markets Antinori®, Champagne Nicolas Feuillatte™,

9

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

Torres® and Villa Maria Estate™ products in the United States. Trademarks and service marks related to Altria referenced in these remarks are the property of Altria or its subsidiaries or are used with permission. More information about Altria is available at altria.com and on the Altria Investor app.

Forward-Looking and Cautionary Statements

Today’s remarks contain projections of future results and other forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to differ materially from those contained in the projections and forward-looking statements included in today’s remarks are described in Altria’s publicly filed reports, including its Annual Report on Form 10-K for the year ended December 31, 2014 and its Quarterly Report on Form 10-Q for the period ended June 30, 2015.

These factors include the following: significant competition; changes in adult consumer preferences and demand for Altria’s operating companies’ products; fluctuations in raw material availability, quality and price; reliance on key facilities and suppliers; reliance on critical information systems, many of which are managed by third-party service providers; fluctuations in levels of customer inventories; the effects of global, national and local economic and market conditions; changes to income tax laws; federal, state and local legislative activity, including actual and potential federal and state excise tax increases; increasing marketing and regulatory restrictions; the effects of price increases related to excise tax increases and concluded tobacco litigation settlements on trade inventories, consumption rates and consumer preferences within price segments; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; privately imposed smoking restrictions; and, from time to time, governmental investigations.

10

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

Furthermore, the results of Altria’s tobacco businesses are dependent upon their continued ability to promote brand equity successfully; to anticipate and respond to evolving adult consumer preferences; to develop, manufacture, market and distribute products that appeal to adult tobacco consumers (including, where appropriate, through arrangements with, and investments in, third parties); to improve productivity; and to protect or enhance margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal, state and local government regulation, including broad-based regulation of PM USA and USSTC by the FDA. Altria and its subsidiaries continue to be subject to litigation, including risks associated with adverse jury and judicial determinations, courts reaching conclusions at variance with the companies’ understanding of applicable law, bonding requirements in the limited number of jurisdictions that do not limit the dollar amount of appeal bonds and certain challenges to bond cap statutes.

Altria cautions that the foregoing list of important factors is not complete and does not undertake to update any forward-looking statements that it may make except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Altria or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Non-GAAP Financial Measures

Altria reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Altria’s management reviews OCI, which is defined as operating income before amortization of intangibles and general corporate expenses, to evaluate the performance of, and allocate resources to, the segments. Altria’s management also reviews certain financial results, including OCI, operating margins and diluted EPS, on an adjusted basis, which excludes certain income and expense items that management believes are not part of underlying operations. These items may include, for example, loss on early extinguishment of debt, restructuring charges, SABMiller special items, certain tax items, charges

11

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

associated with tobacco and health litigation items, and settlements of, and determinations made in connection with, certain non-participating manufacturer (NPM) adjustment disputes (such settlements and determinations are referred to collectively as NPM Adjustment Items). Altria’s management does not view any of these special items to be part of Altria’s sustainable results as they may be highly variable, are difficult to predict and can distort underlying business trends and results. Altria’s management believes that adjusted financial measures provide useful insight into underlying business trends and results and provide a more meaningful comparison of year-over-year results. Altria’s management uses adjusted financial measures for planning, forecasting and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets. These adjusted financial measures are not consistent with GAAP, and should thus be considered as supplemental in nature and not considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. Reconciliations of historical adjusted financial measures to corresponding GAAP financial measures are provided below.

Altria’s full-year adjusted diluted EPS guidance excludes the impact of certain income and expense items, including those items noted above. Altria’s management cannot estimate on a forward-looking basis the impact of these items on Altria’s reported diluted EPS because these items, which could be significant, are difficult to predict and may be highly variable. As a result, Altria does not provide a corresponding GAAP financial measure for, or reconciliation to, its adjusted diluted EPS guidance.

12

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Full-Year Adjusted Earnings Per Share Results |

| | Full Year Ended December 31, |

| | 2014 | | 2009 | | Compounded Annual Growth Rate |

Reported diluted EPS | | $ | 2.56 |

| | $ | 1.54 |

| | |

NPM Adjustment Items | | (0.03 | ) | | — |

| | |

Asset impairment, exit, implementation, integration, and acquisition-related costs | | 0.01 |

| | 0.25 |

| | |

Tobacco and health litigation items | | 0.01 |

| | — |

| | |

SABMiller special items | | 0.01 |

| | — |

| | |

Loss on early extinguishment of debt | | 0.02 |

| | — |

| | |

Tax items | | (0.01 | ) | | (0.04 | ) | | |

Adjusted diluted EPS | | $ | 2.57 |

| | $ | 1.75 |

| | 8.0 | % |

| | | | | | |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Adjusted Earnings Per Share Results |

| | Six Months Ended June 30, |

| | 2015 | | 2014 | | Change |

Reported diluted EPS | | $ | 1.25 |

| | $ | 1.23 |

| | |

NPM Adjustment Items | | — |

| | (0.03 | ) | | |

Tobacco and health litigation items | | 0.02 |

| | 0.01 |

| | |

SABMiller special items | | 0.03 |

| | 0.01 |

| | |

Loss on early extinguishment of debt | | 0.07 |

| | — |

| | |

Asset impairment, exit and integration costs, and tax items | | 0.01 |

| | — |

| | |

Adjusted diluted EPS | | $ | 1.38 |

| | $ | 1.22 |

| | 13.1 | % |

| | | | | | |

13

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeable Products | |

($ in millions) | | | | | | |

| | Six Months Ended June 30, |

| | 2015 | | 2014 | | Change |

Net revenues | | $ | 11,195 |

| | $ | 10,569 |

| | |

Excise taxes | | (3,194 | ) | | (3,118 | ) | | |

Revenues net of excise taxes | | $ | 8,001 |

| | $ | 7,451 |

| | |

| | | | | | |

Reported OCI | | $ | 3,710 |

| | $ | 3,320 |

| | |

NPM Adjustment Items | | — |

| | (43 | ) | | |

Asset impairment and exit costs | | — |

| | (8 | ) | | |

Tobacco and health litigation items | | 48 |

| | 19 |

| | |

Adjusted OCI | | $ | 3,758 |

| | $ | 3,288 |

| | 14.3 | % |

Adjusted OCI margins1 | | 47.0% |

| | 44.1% |

| | 2.9 pp |

|

| | | | | | |

1 Adjusted OCI margins are calculated as adjusted OCI divided by revenues net of excise taxes. | |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeable Products |

($ in millions) | | | | | | |

| | Six Months Ended June 30, |

| | 2015 | | 2014 | | Change |

Net revenues | | $ | 11,195 |

| | $ | 10,569 |

| | |

Excise taxes | | (3,194 | ) | | (3,118 | ) | | |

Revenues net of excise taxes | | $ | 8,001 |

| | $ | 7,451 |

| | |

| | | | | | |

Shipment volume (units in millions)1 | | 62,958 |

| | 61,488 |

| | |

| | | | | | |

Revenues net of excise taxes per 1,000 units2 | | $ | 127.08 |

| | $ | 121.18 |

| | 4.9 | % |

| | | | | | |

1 Shipment volume includes cigarette units sold as well as promotional units, but excludes units sold in Puerto Rico and U.S. Territories, to Overseas Military and by Philip Morris Duty Free Inc., none of which, individually or in aggregate, is material to the smokeable products segment. |

2 Revenues net of excise taxes per 1,000 units are calculated as revenues net of excise taxes divided by shipment volume multiplied by 1,000. |

14

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeless Products | |

($ in millions) | | | | | | |

| | Six Months Ended June 30, |

| | 2015 | | 2014 | | Change |

Net revenues | | $ | 911 |

| | $ | 879 |

| | |

Excise taxes | | (66 | ) | | (66 | ) | | |

Revenues net of excise taxes | | $ | 845 |

| | $ | 813 |

| | |

| | | | | | |

Reported OCI | | $ | 544 |

| | $ | 524 |

| | |

Asset impairment and exit costs | | 4 |

| | — |

| | |

Adjusted OCI | | $ | 548 |

| | $ | 524 |

| | 4.6 | % |

Adjusted OCI margins1 | | 64.9% |

| | 64.5% |

| | 0.4 pp |

|

| | | | | | |

1 Adjusted OCI margins are calculated as adjusted OCI divided by revenues net of excise taxes. | |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Earnings from Equity Investment in SABMiller |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2014 | | 2011 | | Compounded Annual Growth Rate |

Reported earnings from equity investment in SABMiller | | $ | 1,006 |

| | $ | 730 |

| | |

SABMiller special items | | 25 |

| | 82 |

| | |

Adjusted earnings from equity investment in SABMiller | | $ | 1,031 |

| | $ | 812 |

| | 8.3 | % |

| | | | | | |

15

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Full-Year Adjusted Earnings Per Share Results | |

| | | Full Year Ended December 31, | |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

Reported diluted EPS | $ | 2.56 |

| | $ | 2.26 |

| | $ | 2.06 |

| | $ | 1.64 |

| | $ | 1.87 |

| | $ | 1.54 |

| | $ | 1.48 |

| | $ | 1.48 |

|

NPM Adjustment Items | (0.03 | ) | | (0.21 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Asset impairment, exit, implementation, integration and acquisition-related costs | 0.01 |

| | — |

| | 0.01 |

| | 0.07 |

| | 0.05 |

| | 0.25 |

| | 0.17 |

| | 0.15 |

|

Gain on sale of corporate headquarters building | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (0.12 | ) | | — |

|

Recoveries from airline industry exposure | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (0.06 | ) |

Interest on tax reserve transfers to Mondelez International, Inc. | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 0.02 |

|

Tobacco and health litigation items | 0.01 |

| | 0.01 |

| | — |

| | 0.05 |

| | — |

| | — |

| | — |

| | 0.01 |

|

SABMiller special items | 0.01 |

| | 0.01 |

| | (0.08 | ) | | 0.03 |

| | 0.03 |

| | — |

| | 0.03 |

| | — |

|

Loss on early extinguishment of debt | 0.02 |

| | 0.34 |

| | 0.28 |

| | — |

| | — |

| | — |

| | 0.12 |

| | — |

|

PMCC leveraged lease (benefit)/charge | — |

| | — |

| | (0.03 | ) | | 0.30 |

| | — |

| | — |

| | — |

| | — |

|

Tax items1 | (0.01 | ) | | (0.03 | ) | | (0.03 | ) | | (0.04 | ) | | (0.05 | ) | | (0.04 | ) | | (0.03 | ) | | (0.09 | ) |

Adjusted diluted EPS | $ | 2.57 |

| | $ | 2.38 |

| | $ | 2.21 |

| | $ | 2.05 |

| | $ | 1.90 |

| | $ | 1.75 |

| | $ | 1.65 |

| | $ | 1.51 |

|

Adjusted diluted EPS (year/year % change) | 8.0 | % | | 7.7 | % | | 7.8 | % | | 7.9 | % | | 8.6 | % | | 6.1 | % | | 9.3 | % | | |

CAGR 2007-2014 | 7.9 | % | | | | | | | | | | | | | | |

1 Excludes the tax impact of the PMCC leveraged lease (benefit)/charge. | |

16

Remarks by Altria’s Chief Financial Officer at Barclays Global Consumer Staples Conference, September 9, 2015

ALTRIA PRESENTS AT THE BARCLAYS GLOBAL CONSUMER STAPLES CONFERENCE; REAFFIRMS 2015 ADJUSTED DILUTED EPS GUIDANCE

RICHMOND, Va. - September 9, 2015 - Altria Group, Inc. (Altria) (NYSE: MO) is participating today in the Barclays Global Consumer Staples Conference in Boston, Massachusetts. Billy Gifford, Altria’s Chief Financial Officer, will highlight the company’s financial goals and strategies, diverse business model and track record of delivering consistent returns to shareholders.

2015 Full-Year Guidance

Altria reaffirms its guidance for 2015 full-year adjusted diluted earnings per share (EPS), which excludes the special items discussed in Schedule 1, to be in the range of $2.76 to $2.81, representing a growth rate of 7.5% to 9.5% from an adjusted diluted EPS base of $2.57 in 2014, as shown in Schedule 1.

The factors described in the Forward-Looking and Cautionary Statements section of this release represent continuing risks to Altria’s forecast.

Remarks and Presentation

The presentation is being webcast live at altria.com in a listen-only mode, beginning at approximately 9:45 a.m. Eastern Time. A copy of the prepared remarks and business presentation and a replay of the audio webcast will be available at altria.com and via the Altria Investor app.

Altria’s Profile

Altria’s wholly-owned subsidiaries include Philip Morris USA Inc. (PM USA), U.S. Smokeless Tobacco Company LLC (USSTC), John Middleton Co., Nu Mark LLC, Ste. Michelle Wine Estates Ltd. (Ste. Michelle) and Philip Morris Capital Corporation. Altria holds a continuing economic and voting interest in SABMiller plc (SABMiller).

The brand portfolios of Altria’s tobacco operating companies include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, MarkTen® and Green Smoke®. Ste. Michelle produces and markets premium wines sold under various labels, including Chateau Ste. Michelle®, Columbia Crest®, 14 Hands® and Stag’s Leap Wine Cellars™, and it imports and markets Antinori®, Champagne Nicolas Feuillatte™, Torres® and Villa Maria Estate™ products in the United States. Trademarks and service marks related to

6601 West Broad Street, Richmond, VA 23230

Altria referenced in this release are the property of Altria or its subsidiaries or are used with permission. More information about Altria is available at altria.com and on the Altria Investor app.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and other forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to differ materially from those contained in the projections and forward-looking statements included in this press release are described in Altria’s publicly filed reports, including its Annual Report on Form 10-K for the year ended December 31, 2014 and its Quarterly Report on Form 10-Q for the period ended June 30, 2015.

These factors include the following: significant competition; changes in adult consumer preferences and demand for Altria’s operating companies’ products; fluctuations in raw material availability, quality and price; reliance on key facilities and suppliers; reliance on critical information systems, many of which are managed by third-party service providers; fluctuations in levels of customer inventories; the effects of global, national and local economic and market conditions; changes to income tax laws; federal, state and local legislative activity, including actual and potential federal and state excise tax increases; increasing marketing and regulatory restrictions; the effects of price increases related to excise tax increases and concluded tobacco litigation settlements on trade inventories, consumption rates and consumer preferences within price segments; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; privately imposed smoking restrictions; and, from time to time, governmental investigations.

Furthermore, the results of Altria’s tobacco businesses are dependent upon their continued ability to promote brand equity successfully; to anticipate and respond to evolving adult consumer preferences; to develop, manufacture, market and distribute products that appeal to adult tobacco consumers (including, where appropriate, through arrangements with, and investments in, third parties); to improve productivity; and to protect or enhance margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal, state and local government regulation, including broad-based regulation of PM USA and USSTC by the U.S. Food and Drug Administration. Altria and its subsidiaries continue to be subject to litigation, including risks associated with adverse jury and judicial determinations, courts reaching conclusions at variance with the companies’ understanding of applicable law, bonding requirements in the limited number of jurisdictions that do not limit the dollar amount of appeal bonds and certain challenges to bond cap statutes.

Altria cautions that the foregoing list of important factors is not complete and does not undertake to update any forward-looking statements that it may make except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Altria or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Source: Altria Group, Inc.

|

| | | |

Altria Client Services | | Altria Client Services | |

Investor Relations | | Media Relations | |

804-484-8222 | | 804-484-8897 | |

Schedule 1

ALTRIA GROUP, INC.

and Subsidiaries

First Six Months 2015 Special Items and Reconciliation of 2014 Adjusted Results

|

| | | |

Altria’s First Six Months 2015 Special Items |

| |

Tobacco and health litigation items | $ | 0.02 |

|

SABMiller special items | 0.03 |

|

Loss on early extinguishment of debt | 0.07 |

|

Asset impairment, exit and integration costs, and tax items | 0.01 |

|

| $ | 0.13 |

|

|

| | | |

Reconciliation of Altria’s 2014 Adjusted Results |

| |

| Full Year |

| 2014 |

Reported diluted EPS | $ | 2.56 |

|

NPM Adjustment Items | (0.03 | ) |

Asset impairment, exit, integration and acquisition-related costs | 0.01 |

|

Tobacco and health litigation items | 0.01 |

|

SABMiller special items | 0.01 |

|

Loss on early extinguishment of debt | 0.02 |

|

Tax items | (0.01 | ) |

Adjusted diluted EPS | $ | 2.57 |

|

Altria reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Altria’s management reviews certain financial results, including diluted EPS, on an adjusted basis, which excludes certain income and expense items that management believes are not part of underlying operations. These items may include, for example, loss on early extinguishment of debt, restructuring charges, SABMiller special items, certain tax items, charges associated with tobacco and health litigation items, and settlements of, and determinations made in connection with, certain non-participating manufacturer (NPM) adjustment disputes (such settlements and determinations are referred to collectively as NPM Adjustment Items). Altria’s management does not view any of these special items to be part of Altria’s sustainable results as they may be highly variable, are difficult to predict and can distort underlying business trends and results. Altria’s management believes that adjusted financial measures provide useful insight into underlying business trends and results and provide a more meaningful comparison of year-over-year results. Altria’s management uses adjusted financial measures for planning, forecasting and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets. These adjusted financial measures are not consistent with GAAP, and should thus be considered as supplemental in nature and not considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP.

Altria’s full-year adjusted diluted EPS guidance excludes the impact of certain income and expense items, including those items noted in the preceding paragraph. Altria’s management cannot estimate on a forward-looking basis the impact of these items on its reported diluted EPS because these items, which could be significant, are difficult to predict and may be highly variable. As a result, Altria does not provide a corresponding GAAP financial measure for, or reconciliation to, its adjusted diluted EPS guidance.

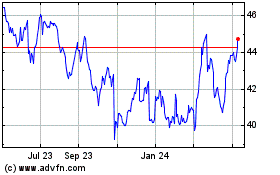

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

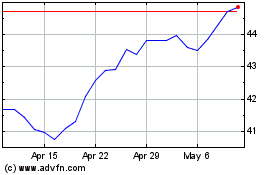

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024