Current Report Filing (8-k)

August 21 2015 - 11:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2015

ALTRIA GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Virginia | | 1-08940 | | 13-3260245 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

| |

6601 West Broad Street, Richmond, Virginia | | 23230 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (804) 274-2200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

Effective August 19, 2015, Altria Group, Inc. (“Altria”) entered into an extension agreement (the “Extension Agreement”) to amend its $3.0 billion senior unsecured 5-year revolving credit agreement, dated as of August 19, 2013 (the “Credit Agreement”), with the lenders party thereto and JPMorgan Chase Bank, N.A. (“JPMCB”) and Citibank, N.A. (“Citibank”), as administrative agents. The Extension Agreement extends the expiration date of the Credit Agreement from August 19, 2019 to August 19, 2020.

All other terms and conditions of the Credit Agreement remain in full force and effect.

Some of the lenders under the Credit Agreement and their affiliates have various relationships with Altria and its subsidiaries involving the provision of financial services, including cash management, investment banking and trust services.

The foregoing description of the Extension Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Extension Agreement, which is attached as Exhibit 10.1 and incorporated by reference in this Current Report on Form 8-K. The Credit Agreement was previously filed as Exhibit 10.1 to Altria’s Current Report on Form 8-K (File No. 1-08940) filed with the Securities and Exchange Commission (the “SEC”) on August 23, 2013. A prior extension agreement to the Credit Agreement was filed as Exhibit 10.1 to Altria’s Current Report on Form 8-K (File No. 1-08940) filed with the SEC on August 21, 2014.

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

10.1 |

| Extension Agreement, effective August 19, 2015, among Altria, the lenders party thereto and JPMCB and Citibank, as administrative agents |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ALTRIA GROUP, INC. |

| | |

| By: | /s/ W. HILDEBRANDT SURGNER, JR. |

| Name: | W. Hildebrandt Surgner, Jr. |

| Title: | Corporate Secretary and |

| | Senior Assistant General Counsel |

DATE: August 21, 2015

EXHIBIT INDEX

|

| |

10.1 | Extension Agreement, effective August 19, 2015, among Altria, the lenders party thereto and JPMCB and Citibank, as administrative agents |

Exhibit 10.1

AMENDED AND RESTATED CREDIT AGREEMENT

EXTENSION AGREEMENT

JPMorgan Chase Bank, N.A. and Citibank, N.A.,

as Administrative Agents for the Lenders party to the

Credit Agreement referred to below

Ladies and Gentlemen:

Each of the undersigned Lenders (each such Lender, an “Extending Lender”) hereby agrees to extend, effective August 19, 2015 (the “Effective Date”), its Commitment and the Maturity Date under the Amended and Restated Credit Agreement, dated as of August 19, 2013 (as amended or modified from time to time, the “Credit Agreement,” the terms defined therein being used herein as therein defined), among Altria Group, Inc. (“Altria”), the Lenders party thereto and JPMorgan Chase Bank, N.A. and Citibank, N.A., as Administrative Agents, for an additional one year period to August 19, 2020 pursuant to Section 2.20 of the Credit Agreement.

Each Extending Lender, Altria and the Administrative Agents hereby further agree that, from and after the Effective Date, Schedule I to the Credit Agreement shall be amended and restated in its entirety, including, without limitation, the Commitment of each Extending Lender, as set forth in Exhibit A hereto.

Except as expressly provided hereby, all of the terms and provisions of the Credit Agreement are and shall remain in full force and effect and are hereby ratified and confirmed.

This Extension Agreement shall be governed by, and construed in accordance with, the laws of the State of New York. This Extension Agreement may be signed in any number of counterparts, each of which when executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement.

[Signature pages omitted.]

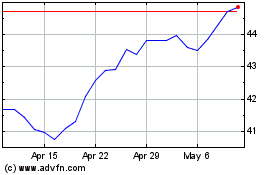

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

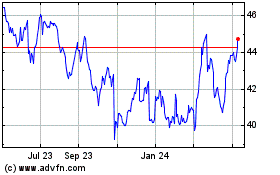

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024