Guy Carpenter Reports Moderating Reinsurance Pricing Decline at January 1, 2017 Renewals

January 05 2017 - 10:09AM

Business Wire

Innovation in Client Solutions Showed

Increasing Importance

Guy Carpenter & Company, LLC, a leading global risk and

reinsurance specialist and wholly owned subsidiary of Marsh &

McLennan Companies (NYSE:MMC), reports the decline in reinsurance

pricing moderated at the January 1, 2017 renewal across most

classes of business and geographies, as compared to the past three

renewal seasons. Several sectors experienced increased loss

activity, which had only a localized impact on pricing while

capacity remained plentiful. After remaining fairly stable in 2015,

dedicated reinsurance capital increased by 5 percent from January

1, 2016 to January 1, 2017 as calculated by Guy Carpenter and A.M.

Best. The convergence capital segment increased by 10 percent.

The Guy Carpenter Global Property Catastrophe Rate-on-Line index

tracking property catastrophe pricing fell 3.7% at January 1, as

compared to close to 9.0% a year ago. The ILS space, in contrast

saw dramatic movement in pricing during the fourth quarter with

decreases as high as 30 percent.

While catastrophe bond issuance in the first quarter of 2016

made it the most active first quarter in the market’s history,

second quarter catastrophe bond issuance fell to its lowest

quarterly level since 2011. In response to this diminished

pipeline, catastrophe bond providers responded with greater

flexibility in coverage and significant decreases in price. While

it is too early to judge the broader impact of these changes, the

last round of market-wide reinsurance price decreases were

triggered in part by catastrophe bond competition.

As the reinsurance sector continues to be flush with capital and

price points are very attractive, product innovation and coverage

customization remain a key focus. Continued exploration in the

reinsurance space paved the way for many new advances, including

expansion of solutions for historically difficult and under

(re)insured risks such as flood. As risk from increasingly complex

sources including climate change, cyberspace and nascent

technologies continue to expand, this focus on broadening solutions

will translate into ongoing positive market evolution.

“Although current renewals indicate that the decline in

reinsurance pricing is slowing, this moderation was not surprising

and the more interesting development may be the continued evolution

of coverage and solutions to meet changing client needs,” said

Peter Hearn, CEO of Guy Carpenter. “An abundance of available

capital and improving analytics tools are essential components to

create support for notable advances. An innovative mindset is the

key to success in today’s marketplace as the increasing complexity

of risk brings new levels of uncertainty.”

Significant global insured loss activity reached a four-year

high in 2016, with insured loss increasing over 50 percent from

2015. Losses were spread throughout several regions and perils with

no single mega-event driving the increase. Renewal pricing impacts

were localized.

2017 Outlook

“The 2017 (re)insurance market will be challenged to offer

solutions that utilize increasing amounts of capital effectively in

a complex landscape, requiring insurers to be increasingly diligent

and responsive to prepare for the uncertainty ahead,” said David

Priebe, Vice Chairman of Guy Carpenter and Head of GC Securities.*

“We’re continually adapting to evolving markets to ensure our

clients are provided with the product offerings that best meet

their needs and the needs of their constituents to adequately

insure a vast range of problems. With the current abundance of

capacity and low interest rate environment, the complexity of the

industry’s issues will make for a challenging yet impactful year

ahead.”

While there are many areas of focus for product expansion and

evolution in the coming year, with political volatility increasing

globally, terrorism coverage needs will require a high level of

vigilance. In keeping up with insurer needs, reinsurance is

adapting to the evolving nature of terrorism and striving to close

gaps in existing coverage. In addition, new technologies, big data

and predictive analytics, coupled with the “sharing” economy will

continue to present both challenges and opportunities for insurers

in the year ahead.

About Guy Carpenter

Guy Carpenter & Company, LLC is a leading global risk and

reinsurance specialist. Since 1922, the company has delivered

integrated reinsurance and capital market solutions to clients

across the globe. As a most trusted and valuable reinsurance broker

and strategic advisor, Guy Carpenter leverages its intellectual

capital to anticipate and solve for a range of business challenges

and opportunities on behalf of its clients. With over 2,300

professionals in more than 60 offices around the world, Guy

Carpenter delivers a powerful combination of broking expertise,

strategic advisory services and industry-leading analytics to help

clients achieve profitable growth. For more information on Guy

Carpenter’s complete line-of-business expertise and range of

business units, including GC Specialties, GC Analytics®, GC Fac®,

Global Strategic Advisory, GC Securities*, Client Services and GC

Micro Risk Solutions®, please visit www.guycarp.com and follow Guy

Carpenter on LinkedIn and Twitter @GuyCarpenter.

Guy Carpenter is a wholly owned subsidiary of Marsh &

McLennan Companies (NYSE: MMC), a global professional services firm

offering clients advice and solutions in the areas of risk,

strategy, and people. With annual revenue of $13 billion and 60,000

colleagues worldwide, Marsh & McLennan Companies provides

analysis, advice, and transactional capabilities to clients in more

than 130 countries through: Marsh, a leader in insurance broking

and risk management; Mercer, a leader in talent, health,

retirement, and investment consulting; and Oliver Wyman, a leader

in management consulting. Marsh & McLennan is committed to

being a responsible corporate citizen and making a positive impact

in the communities in which it operates. Visit www.mmc.com for more

information and follow us on LinkedIn and Twitter @MMC_Global.

*Securities or investments, as applicable, are offered in the

United States through GC Securities, a division of MMC Securities

LLC, a US registered broker-dealer and member FINRA/NFA/SIPC. Main

Office: 1166 Avenue of the Americas, New York, NY 10036. Phone:

(212) 345-5000. Securities or investments, as applicable, are

offered in the European Union by GC Securities, a division of MMC

Securities (Europe) Ltd. (MMCSEL), which is authorized and

regulated by the Financial Conduct Authority, main office 25 The

North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products

are placed through qualified affiliates of Guy Carpenter &

Company, LLC. MMC Securities LLC, MMC Securities (Europe) Ltd. and

Guy Carpenter & Company, LLC are affiliates owned by Marsh

& McLennan Companies. This communication is not intended as an

offer to sell or a solicitation of any offer to buy any security,

financial instrument, reinsurance or insurance product. **GC

Analytics is a registered mark with the U.S. Patent and Trademark

Office.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170105005951/en/

Guy CarpenterPaul Caricone,

1.917.937.3317Paul.caricone@guycarp.comorGuy CarpenterJennifer

Ainslie, 44.207.357.2058Jennifer.ainslie@guycarp.com

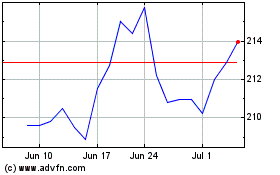

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024