Insurance Broker Aon Acquires Cyber-Risk Specialist Stroz Friedberg

October 11 2016 - 6:10AM

Dow Jones News

Aon PLC agreed to acquire cybersecurity specialist Stroz

Friedberg Inc., as more insurance companies and brokers aim to turn

corporations' exposure to potential hacking into a business

opportunity.

Stroz Friedberg was founded in 2000 by a former agent of the

Federal Bureau of Investigation and a former federal prosecutor,

both of whom worked on computer crime. The New York City-based

firm, which has more than 550 employees world-wide, will augment

Aon's risk-mitigation services, while also providing insights to

help insurers expand and create new cyber offerings, the firms said

in interviews with The Wall Street Journal.

The transaction is to be announced Tuesday. The companies aren't

disclosing terms of the deal.

World-wide, property-casualty insurers sold an estimated $2

billion to $3 billion of cyberrisk coverage in 2015, mostly in the

U.S., according to industry estimates. Cyber insurance can be

obtained from about 50 insurers, with such purchases increasing by

27% in 2015, compared with the year before, on top of a 32%

increase in 2014, according to Marsh & McLennan Cos. in a

report earlier this year.

Aon is one of the world's biggest insurance brokerages and is a

benefits consultant. Insurance brokers are middlemen who work on

behalf of companies as they buy insurance, and many develop

expertise in specific types of risk to make their services more

valuable to policyholders. They also work with insurers to help

them design policies that address clients' needs.

Aon executives said the acquisition reflects an urgency on the

part of the insurance industry to respond to clients who

increasingly are worried about hacking that could damage their

operations, as risk spreads far beyond the retailing industry and

the credit-card data that many cyberthieves covet, to factory

floors, power plants and even semiautonomous vehicles.

"There is a need front and center, in our face every day, and it

is growing in magnitude," Aon Chief Executive Gregory Case said in

an interview Monday.

Industry executives said there is a race within the insurance

industry to find ways to help clients understand and model

cyber-risk. American International Group Inc., and other insurers

and brokers have made investments in or joined with cyber-risk

specialty firms over the past couple of years.

Marsh & McLennan's Marsh brokerage unit, a rival to Aon, has

a collaboration with Cyence, a cybersecurity analytics firm, to

help the broker's clients quantify and manage cyberrisk.

Within cyber insurance, growth was strongest among manufacturing

firms in 2015, up 63% from the year before, Marsh said. With

technology incorporated into companies' essential operations,

carriers are now moving beyond an early generation of coverage that

focuses on theft of credit-card and personal data of consumers, the

brokerage said.

The traditional approach to creating coverage "would have been

taking historical data and assessing it," Mr. Case said. "The

market can't wait for the development of that history, the need is

too urgent."

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

October 11, 2016 05:55 ET (09:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

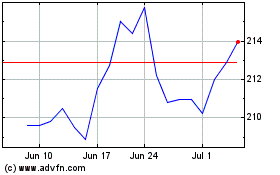

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024