Oliver Wyman Announces the Release of a Comprehensive Fact Base to Support Dialogue Between Industry & Policy Makers on Regul...

October 04 2016 - 5:03PM

Business Wire

A report published today by global management consultancy,

Oliver Wyman, analyses Brexit’s potential impact on the UK-based

financial services sector. Commissioned by TheCityUK and developed

with input from its Senior Brexit Steering Committee, senior

industry practitioners, and the major trade associations, the

comprehensive analytical toolkit enables quantification of the

impact of potential regulatory options arising from Brexit in terms

of jobs, tax and industry revenues.

It estimates that a Brexit where the UK is outside the European

Economic Area but delivers passporting and equivalence – allowing

access to the Single Market on terms similar to those that UK-based

firms currently have – will cause only a modest reduction in

UK-based activity. In this scenario, revenues are predicted to

decline by up to £2BN (2% of total wholesale and international

business), 4,000 jobs would be at risk, and tax revenues would fall

by less than £0.5BN per annum.

Under conditions where the UK moves to a third country

arrangement with the EU, without any regulatory equivalence and its

relationship with the EU is defined by terms set out under the

World Trade Organization, up to 50% of EU-related activity (£20BN

in revenue) and an estimated 35,000 jobs could be at risk, along

with £5BN of tax revenues per annum.

When taking into consideration the knock-on impact to the whole

financial services ecosystem – the possibility of shifting of

entire business units, or the closure of lines of business due to

increased costs it could almost double the effect of Brexit.

Sir Hector Sants, Vice Chairman, Oliver Wyman, says: “Our work

provides a robust and definitive fact base to facilitate the

dialogue between the sector and policy makers. It highlights that

the impact of the UK’s exit from the EU on the UK-based financial

services – and the jobs, income and taxes it generates – will vary

dramatically with how much access to the EU is retained.

“It is in everyone’s best interests for there to be a positive

outcome to the negotiations that is mutually beneficial to the UK

and the EU, causes minimum disruption to the industry and benefits

customers who have come to rely on the UK as a uniquely skilled and

connected ecosystem for financial services.”

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With

offices in 50+ cities across 26 countries, Oliver Wyman combines

deep industry knowledge with specialized expertise in strategy,

operations, risk management, and organization transformation. The

firm's 4,000 professionals help clients optimize their business,

improve their operations and risk profile, and accelerate their

organizational performance to seize the most attractive

opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh

& McLennan Companies [NYSE: MMC]. For more information, visit

www.oliverwyman.com. Follow Oliver Wyman on Twitter

@OliverWyman.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161004006623/en/

Oliver Wyman Media:Gregor Ridley, +44 7342

053449Gregor.ridley@oliverwyman.com

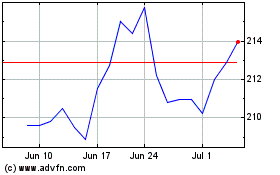

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024