New Oliver Wyman Wealth Management Report: Running Faster to Stand Still

July 21 2016 - 12:37PM

Business Wire

- Assets under management growth is

expected to slow from 7 percent per year over the past five years

to 5 percent per year until 2020

- To sustain profitability, the

industry will need to redesign the ‘core’ high-net worth service

model and digitize parts of the value chain

- The industry should explore new

sources of value creation, such as platforms that enable investors

to access opportunities such as growth stage financing or direct

real estate investments

Oliver Wyman released its first report on wealth management in a

new initiative that will become an annual series of in-depth

reports on the sector. The aim of the report is to provide insight

into the outlook for the wealth management industry at a time of

sustained interest in the sector among investors and financial

institutions.

“The forces that drove performance in wealth management in

recent years are changing, and firms will need to take action on

costs and develop new ways of engaging with clients to maintain

revenues,” says Christian Edelmann, global head of Oliver Wyman’s

Wealth and Asset Management practice.

Key highlights:

- Assets under management growth is

expected to slow from 7 percent per year over the past five years

to 5 percent per year until 2020 on the back of lower asset

returns. Fees may come under pressure due to higher transparency

standards, emerging competitors and the shift to passive

products.

- To sustain profitability, the industry

will need to redesign the ‘core’ high-net worth service model and

digitize parts of the value chain.

- The industry should explore new sources

of value creation such as platforms that enable investors to access

opportunities such as growth stage financing or direct real estate

investments.

- Leaders will need to sharpen their

focus on client acquisitions and managing attrition risks, in

particular with respect to inter-generational wealth

transfers.

- Wealth managers should expand their

existing philanthropy offering into full charity operations

support, following the trend of professionalisation in charitable

giving.

The report, Wealth Management: Running faster to stand still,

was co-authored with Deutsche Bank Research.

The report is available for download on the Oliver Wyman

website.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With

offices in 50+ cities across 26 countries, Oliver Wyman combines

deep industry knowledge with specialized expertise in strategy,

operations, risk management, and organization transformation. The

firm's 3,700 professionals help clients optimize their business,

improve their operations and risk profile, and accelerate their

organizational performance to seize the most attractive

opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh

& McLennan Companies (NYSE:MMC). For more information, visit

www.oliverwyman.com. Follow Oliver Wyman on Twitter

@OliverWyman.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160721006110/en/

Oliver WymanUK Media:Gregor Ridley, +44 7342

053449Gregor.ridley@oliverwyman.comorUS Media:Jung Kim, +1

646 364 8355Jung.kim@oliverwyman.com

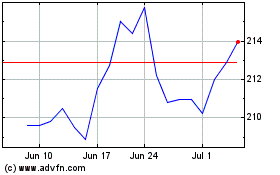

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024