Insurers have begun to propose big premium increases for

coverage next year under the 2010 health law, as some struggle to

make money in a market where their costs have soared.

The companies also have detailed the challenges in their

Affordable Care Act business in a round of earnings releases, the

most recent of which came on Wednesday when Humana Inc. said it

made a slim profit on individual plans in the first quarter, not

including some administrative costs, but still expects a loss for

the full year. The Louisville, Ky.-based insurer created a special

reserve fund at the end of last year to account for some expected

losses on its individual plans in 2016.

The rate picture will vary by state and by company, analysts

said, and not all insurers will need large premium increases to

bolster their financial performance. Indeed, some companies,

including Medicaid-focused insurers such as Centene Corp., have

already said plans sold through the health law's exchanges are

profitable.

Still, the analysts said, a number of insurers are likely to

seek significant hikes as they aim to cover costs that have

continued to outstrip their estimates—in some cases coming after

earlier premium increases.

The increases, along with the continued lagging results for

insurers, are a sign that the exchange business hasn't stabilized

for insurers in the first few years of the health law's full

implementation, prompting health plans to continue to push for more

changes to the law.

The health law instigated a sweeping overhaul to the way

insurance is priced and sold in the U.S. Insurers can't deny

coverage to consumers with risky medical histories, or charge them

more for plans. A number of popular insurers say the enrollees who

bought plans through the exchanges have had higher health costs

than they originally predicted—when they knew less about the impact

of the law.

"It's a pretty good bet if a plan lost money in 2016, it will

adjust pricing in 2017," said Sam Glick, a partner with consulting

firm Oliver Wyman, a unit of Marsh & McLennan Cos.

In Oregon and Virginia, the first two states to make insurers'

premium proposals for 2017 public, several big insurers are showing

how those projections bear out.

Providence Health Plan, currently the largest insurer for people

buying coverage through the Oregon health exchange, is seeking an

average increase of 29.6%.

In Virginia, where premium increases had been relatively modest

to date, Anthem Inc. is asking for an average increase of

15.8%.

Proposed average increases are just one indicator of coming

premium changes for individuals, which vary depending on the

specific plan a person buys, and they must be evaluated by

regulators before they can take effect. Increases can be blunted

for many lower-income consumers by federal subsidies that flow

directly to the insurer, offsetting the consumer's premium

bill.

Officials from the Department of Health and Human Services

emphasized the role of those subsidies and said that after

increases last year, by one estimate the average additional amount

paid by people with tax credits was only a few dollars a month.

"Averages based on proposed premium changes aren't a reliable

indicator of what typical consumers will actually pay because tax

credits reduce the cost of coverage for the vast majority of

people, shopping gives all consumers a chance to find the best

deal, and public rate review can bring down proposed increases,"

said Ben Wakana, an agency spokesman.

At the same time, the average increases present a vivid picture

of how insurers feel they are faring year-on-year.

Humana said it would make changes to its exchange offerings for

next year "to retain a viable product for individual consumers,

where feasible," and its moves may include "statewide market and

product exits both on and off exchange, service area reductions and

pricing commensurate with anticipated levels of risk by state."

Humana sold plans on exchanges in 15 states this year.

Humana's announcement follows a disclosure from UnitedHealth

Group Inc. last month that, amid deepening losses, it will next

year withdraw from all but a handful of the 34 states where it was

offering exchange plans.

Anthem and Aetna Inc. were far more upbeat about their prospects

on the health-law marketplaces in recent earnings calls, but both

have also said they aren't yet achieving their targeted margins and

aim to improve results next year.

Insurers seeking rate increases—which include several other big

plans in Oregon and Virginia—all cite the higher-than-expected

medical costs incurred by their enrollees as factors in their

decision.

In Oregon, regulators' filings show Moda Health Plan Inc., once

the largest insurer on the exchange, saying it needs to hike

premiums there by an average of 32.3%. That is coming on the heels

of an increase of around 25% last year; the insurer also said it

would stop selling individual plans in Alaska.

Kaiser Foundation Health Plan of the Northwest asked for an

increase of 14.5%, the second lowest percentage increase in

Oregon.

Oregon's insurance commissioner has the power to block proposed

premium changes, but indicated Tuesday she was looking to make sure

rates were sufficient for insurers to pay out claims as well as

affordable for consumers.

"For the next two months, we will analyze the requested rates to

ensure they adequately cover costs without being too high or too

low," said the commissioner, Laura Cali.

In Virginia, CareFirst BlueCross BlueShield's proposed average

increases are around 25%, though that number reflects the insurer's

decision to withdraw all of its lowest-premium plans, the so-called

bronze tier that has the highest cost-sharing for participants, and

the increase is around 11% for plans that have a similar level of

benefits, the insurer said.

Insurers are pointing to factors beyond medical claims that will

affect their pricing next year. Aetna has said the phasing out of

two programs designed to stabilize the Affordable Care Act

exchanges would push up the prices of exchange plans by about 6% in

2017, though the suspension of a tax on insurers will partly

mitigate that impact.

In addition, UnitedHealth's withdrawals may prod competitors to

boost rates, said Raj Bal, an insurance-industry consultant. He

suggested the remaining insurers will anticipate the effect of

signing up some of the costly enrollees that resulted in red ink

for UnitedHealth. "People will anticipate that risk will migrate to

them, and they want to price for it," he said.

Write to Louise Radnofsky at louise.radnofsky@wsj.com and Anna

Wilde Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

May 05, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

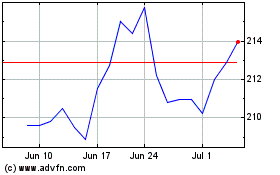

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024