Aquiline Raises $1.1 Billion for Third Fund

April 06 2016 - 10:00AM

Dow Jones News

Private-equity firm Aquiline Capital Partners has plenty of

capital to take advantage of shifts in the financial services

industry, after wrapping up its third financial services fund at

over $1.1 billion.

Aquiline Financial Services Fund III LP not only surpassed its

$1 billion target, but also exceeded the $743 million that the firm

raised for the fund's predecessor back in 2012.

Aquiline, one of only a few private-equity firms focused

exclusively on midmarket financial services, was formed in 2005 by

Jeff Greenberg, former head of Marsh & McLennan Cos. and son of

former American International Group head Hank Greenberg. In its 11

years, Aquiline has invested across a range of subsectors,

including insurance, banking and credit, financial technology and

capital markets. The firm will maintain the same basic strategy for

its third fund, but it will adapt to subtle shifts in the finance

industry, Mr. Greenberg said.

"The industries that we invest in are constantly being reshaped,

and the changes that occur, whether cyclical or secular, are what

create opportunity," Mr. Greenberg said.

For example, Aquiline hopes to take advantage of the insurance

industry's shift toward electronic and tech-based operations,

financial services companies' growing interest in outsourcing

previously internal operations and, potentially, the consolidation

of the community banking sector. It also sees opportunities abroad,

including in Mexico, Brazil and developing markets.

The New York firm has already backed five companies out of the

new fund, using capital it raised through earlier fund closings in

2014 and 2015, according to Mr. Greenberg.

The portfolio includes Ascensus Inc., the second-biggest record

keeper for 401(k) plans sponsored by small businesses; Fenergo, a

Dublin-based maker of compliance software for the financial

industry; OmegaFi, a payments processor for fraternities and

sororities; and Wellington Insurance Group, which provides

outsourced underwriting for residences.

"Most of what we do is out of the limelight. These are smaller

companies and we can be pretty busy without the press or the rest

of the world knowing," he said.

In recent years, Aquiline has taken advantage of banks' pullback

from lending since the financial crisis to invest in

specialty-finance companies. Aquiline made about five investments

in nonbank lenders in recent years, including Engs Commercial

Finance, a truck leasing company that it backed from its new fund.

However, as bank credit continues to improve, specialty finance

will likely be less of an emphasis, Mr. Greenberg said.

The firm enjoyed strong support for the new fund from investors

in its prior fund: about 90% of investors in the second fund backed

its third offering. One such investor is the Oregon Public

Employees Retirement Fund, which committed $100 million, the same

amount the pension system pledged to the second fund. That fund had

generated a 14.2% internal rate of return as of the end of

September 2015, according to a pension document.

Mr. Greenberg said the firm's midmarket focus and specialized

expertise in financial services resonated with investors. In

addition to Mr. Greenberg, Aquiline's senior executive team

includes G. Kennedy "Ken" Thompson, former chief executive of

Wachovia Corp., who co-heads the firm's banking and credit

operations, and Geoffrey Kalish, who leads investments in financial

technology and capital markets.

Stanwich Advisors LLC in Stamford, Conn., served as the primary

placement agent.

Write to Chris Cumming at Chris.Cumming@wsj.com

(END) Dow Jones Newswires

April 06, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

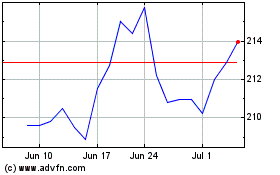

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024