New Fleets Could Generate 98 Million Terabytes of Data Annually by 2026 According to Oliver Wyman’s MRO Survey

April 05 2016 - 1:37PM

Business Wire

Industry Struggling on How to Incorporate

Data into Aging Infrastructure

The latest aircraft designs now entering fleets are equipped

with technologies that can deliver unprecedented collection and

transmission of data at the system and part level according to

Oliver Wyman’s annual MRO (maintenance, repair, and overhaul)

Survey. The global fleet could generate upwards of 98 million

terabytes of data annually by 2026 according to forecast estimates

creating new opportunities for more prognostic maintenance.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160405006597/en/

(Graphic: Business Wire)

The survey, which was released at Aviation Week’s MRO Americas

Conference, examines a variety of technology and innovation themes,

including how operators, MROs, and OEMs (original equipment

manufacturers) are adopting, utilizing, and investing in big data

capabilities – particularly relating to aircraft health monitoring

(AHM) and predictive maintenance (PM) systems.

“Many carriers are enjoying improved margins and also ramping up

investments in new aircraft despite current low fuel costs and

impact on new aircraft economics,” said Tim Hoyland, Oliver Wyman

partner and report co-author. “These new next-gen aircraft provide

a robust data stream which will enable operators and providers to

better forecast, plan, and deploy aircraft assets. However, the

industry faces a real disconnect on how to integrate this data into

aging IT infrastructure at many airlines. Until this is resolved,

the real power of this data cannot be leveraged.”

Key survey highlights include:

Although adoption of AHM and PM is growing, sophistication at

the user level remains spotty and/or targeted at point

solutions:

- Fifty six percent utilize AHM for some

or all of their aircraft fleet. The most common application of AHM

is engine condition monitoring (ECM), a long-established OEM

offering. Use is less widespread within airframe and component

maintenance applications, areas in which third-party or captive

MROs are more common primary providers.

- Predictive maintenance adoption lags

that of AHM at only 44 percent, with less than half of those

respondents applying PM to all aircraft.

- Fifty-nine percent of airline

respondents plan to restrict AHM use to small subsets of data,

either directly or through a third party, rather than pursuing a

broad or comprehensive approach. For those using PM, 83 percent

focus on narrow subsets, while only one in five expect to apply

predictive techniques to all available data.

- The business case for a wide-scale

roll-out of big data solutions remains elusive for many

respondents. While 63 percent cite reliability improvements from

AHM and 30 percent for PM, roughly 1/3 of respondents or less are

currently seeing hard dollar cost savings across engines,

components and airframe maintenance costs.

- Additionally many carriers have other

immediate technology priorities. They report a great portion of

their IT budget aligned to initiatives such as repair and

maintenance of existing systems (29 percent), migration to new

software (19 percent), building/improving inventory system (9

percent), introducing new hardware to enable front line operations,

and other technology initiatives (24 percent). According to

respondents, only 8 percent of airline IT budgets are allotted to

building/improving AHM or PM systems.

- Despite this, respondents said they

plan to invest further in these technologies and expect them to

become a core part of decision making in the future.

In terms of the aftermarket segments, the authors expect:

- OEMs to continue to press adoption,

investing in understanding of the technology’s potential and

advancing usage at airlines.

- Carriers to become more purposeful and

outcome-oriented in their big data programs, engage a cross-section

of stakeholders to understand and prioritize available data, and

develop more robust business cases supporting greater

adoption.

- Other providers, including MROs,

consultancies, and IT firms, will search for sustainable niches in

the value chain surrounding big data. This may include partnering

or building in-house capability to package data-centric services –

collection, analysis, reporting, decision support, and compliance –

with traditional touch maintenance.

“The obvious challenge for carriers is a focused execution which

produces tangible and demonstrable improvements in cost and

reliability. For OEMs accelerating adoption and profitably

monetizing investments in predictive maintenance will be a

significant challenge,” says Chris Spafford, Oliver Wyman partner

and report co-author.

To download the entire report, please click here.

About the MRO Survey

Going on its second decade, the annual MRO survey produced by

Oliver Wyman is an industry standard for information about changing

trends in the MRO sector. The survey queries leaders across the MRO

industry, including top executives from airline operations,

procurement and engineering departments, captive and independent

maintenance providers, OEM aftermarket divisions, and financing and

leasing professionals. Our respondents are overwhelmingly in

C-suite and senior executive positions and represent a global cross

section of the industry.

The MRO Survey findings also include forecast data from our

2016-2025 Fleet and MRO Market Forecast (see

www.PlaneStats.com/betterinsight for more information about the

forecast data).

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With

offices in 50+ cities across 26 countries, Oliver Wyman combines

deep industry knowledge with specialized expertise in strategy,

operations, risk management, and organization transformation. The

firm's 3,700 professionals help clients optimize their business,

improve their operations and risk profile, and accelerate their

organizational performance to seize the most attractive

opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh

& McLennan Companies [NYSE:MMC]. For more information, visit

www.oliverwyman.com. Follow Oliver Wyman on Twitter

@OliverWyman.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160405006597/en/

Oliver WymanFrancine Minadeo,

212-345-6417francine.minadeo@oliverwyman.com

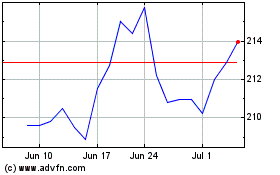

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024