UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

Marsh & McLennan Companies, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Notice of Annual Meeting of Stockholders and Proxy Statement

Dear Stockholder:

You are cordially invited to attend the annual meeting of

stockholders of Marsh & McLennan Companies, Inc. The meeting will be held at 10:00 a.m. on Thursday, May 19, 2016 at the Directors Guild of America, 110 West 57

th

Street, New York,

NY 10019.

PURPOSE:

|

1.

|

To elect eleven (11) persons named in the accompanying proxy statement to serve as directors for a one-year term;

|

|

2.

|

To approve, by nonbinding vote, the compensation of our named executive officers;

|

|

3.

|

To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm; and

|

|

4.

|

To conduct any other business that may properly come before the meeting.

|

Our Board of Directors recommends that you vote

“FOR” the election of all director nominees, “FOR” the approval of the compensation of our named executive officers and “FOR” the ratification of the selection of Deloitte & Touche LLP.

This notice and proxy statement is being mailed or made available on the Internet to stockholders on or about April 1, 2016. These materials describe the matters

being voted on at the annual meeting and contain certain other information. In addition, these materials are accompanied by a copy of the Company’s 2015 Annual Report, which includes financial statements as of and for the fiscal year ended

December 31, 2015. In these materials we refer to Marsh & McLennan Companies, Inc. as the “Company,” “we” and “our.”

Only stockholders of record as of close of business on March 21, 2016 may vote, in person or by proxy, at the annual meeting. If you plan to attend the meeting in

person, you will need proof of record or beneficial ownership of the Company’s common stock as of that date in order to enter the meeting.

If you accessed this proxy statement through the Internet after receiving a Notice of Internet Availability of Proxy Materials, you may cast

your vote by telephone or over the Internet by following the instructions in that Notice. If you received this proxy statement by mail, you may cast your vote by mail, by telephone or over the Internet by following the instructions on the enclosed

proxy card.

Whether or not you plan to attend the annual meeting, your vote is very important. We urge you to participate in electing directors and

deciding the other items on the agenda for the annual meeting.

CAREY ROBERTS

Deputy General Counsel, Chief

Compliance Officer & Corporate Secretary

April 1, 2016

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy

Statement

This summary highlights information contained elsewhere in this proxy statement. You should read the entire proxy statement carefully before

voting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voting Matters

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page number for

more information

|

|

Board vote

recommendation

|

|

|

|

|

|

Election of Directors (Item 1)

|

|

|

|

|

|

|

|

|

|

To elect eleven (11) persons named in the accompanying proxy statement to serve as directors for a one-year term

|

|

12

|

|

FOR

|

|

|

|

|

|

Advisory (Nonbinding) Vote to Approve Named

Executive Officer Compensation (Item

2)

|

|

18

|

|

FOR

|

|

|

|

|

|

To approve, by nonbinding vote, the compensation of our named executive officers

|

|

|

|

|

|

|

|

|

|

Ratification of Independent Auditor (Item 3)

|

|

|

|

|

|

|

|

|

|

To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm

|

|

52

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Governance Policies and Practices

|

|

|

|

|

ü

|

Our chairman of the Board is an independent director and the roles of chairman and CEO have been separate since 2005

|

|

|

ü

|

All of our directors other than our CEO are independent (92% independent)

|

|

|

ü

|

All of our directors are elected annually

|

|

|

ü

|

Directors must receive a majority of the votes cast to be elected in uncontested elections

|

|

|

ü

|

Our by-laws allow holders of at least 20% of the voting power of the Company’s outstanding common stock to

call a special meeting

|

|

|

ü

|

Executive sessions of independent directors are held at every regularly scheduled in-person meeting of the Board

|

|

|

ü

|

Stock ownership guidelines for directors and senior executives

|

|

|

ü

|

Prohibition on hedging transactions by directors and employees, including senior executives

|

|

|

ü

|

Directors and senior executives must obtain pre-approval for any proposed pledges of Company stock

|

i Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Proxy

Summary

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

Key Executive Compensation Policies and Practices

|

|

|

|

|

ü

|

Independent compensation consultant to the Compensation Committee

|

|

|

ü

|

High percentage of variable (‘‘at risk’’) pay for our senior executives

|

|

|

ü

|

Long-term incentive compensation for our senior executives is delivered predominantly in stock options and performance stock unit awards, the value of which is contingent on stock price appreciation or achievement of

specific Company financial objectives

|

|

|

ü

|

Clawback policies for senior executive annual bonus awards and for equity-based compensation

|

|

|

ü

|

Severance protections for our senior executives, including our CEO, are at a 1x multiple of base salary and bonus

|

|

|

ü

|

“Double-trigger” vesting of equity-based awards and payment of severance benefits following a change in control of the Company

|

|

|

ü

|

No golden parachute excise tax gross-ups upon a change in control of the Company

|

|

|

ü

|

Mitigation of the potential dilutive effect of equity-based awards through our share repurchase program

|

|

|

ü

|

Annual advisory vote on named executive officer compensation by stockholders and strong stockholder support

of the executive compensation program (98% in 2015 and 97% in 2014)

|

|

|

|

|

|

|

|

|

|

|

|

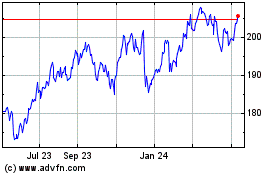

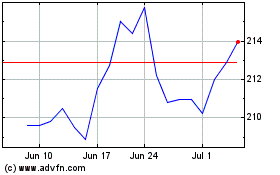

Highlights of Our 2015 Performance

|

|

|

In 2015, we continued to execute on our long-term financial and strategic objectives.

|

|

•

|

|

Our adjusted earnings per share (“EPS”) growth for 2015 was 8.2%*. Excluding the impact from currency exchange rate fluctuations, our adjusted EPS growth was 14.5%

|

|

|

|

•

|

|

We delivered 4% growth in underlying revenue while limiting underlying expense growth, leading to increased profitability for both the Risk and Insurance Services and Consulting segments for the sixth consecutive year

|

|

|

|

•

|

|

Our total stockholder return was 18.1% on a five-year annualized basis and -1.1% for 2015

|

|

|

|

•

|

|

We increased our quarterly dividend by 10.7%, from $0.28 to $0.31 per share, beginning in the third quarter of 2015

|

|

|

|

•

|

|

We used approximately $1.4 billion in cash to repurchase approximately 24.8 million shares, reducing our outstanding common stock by approximately 18 million shares on a net basis

|

|

|

|

*

|

GAAP EPS for 2015 was $2.98. The impact from currency exchange rate fluctuations was ($0.18) per share. For a reconciliation of our non-GAAP financial measures to GAAP financial measures and related disclosures, please

see Exhibit A.

|

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

ii

|

|

|

|

|

|

|

|

|

Proxy

Summary

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

Highlights of Our 2015 Executive Compensation

|

|

|

|

|

•

|

|

Our strong performance with respect to 2015 financial and strategic objectives led to above-target bonuses for our named executive officers

|

|

|

|

•

|

|

Based on our 12.4% three-year annualized core net operating income (“NOI”) growth compared to a 10% long-term target, the payout for our 2013 performance stock unit (“PSU”) awards was 180% of target

|

|

|

|

•

|

|

Our equity run rate** in 2015 was 0.7%. Shares repurchased during the year more than offset the increase in shares attributable to the exercise of stock options and the distribution of shares for stock units from

previously granted equity-based awards

|

|

|

|

•

|

|

We changed the financial performance measure used for corporate senior executives in the 2015 annual bonus program from EPS to NOI, each as modified for executive compensation purposes, so that NOI is now the financial

performance measure for all senior executives, either at the Company or operating company level

|

|

|

|

•

|

|

We established a broader peer group for executive compensation purposes. The companies in our 2015 peer group aligned with the comparator group that we used to assess competitive financial performance under our 2015

annual bonus program

|

|

|

|

•

|

|

For our 2015 PSU awards, we changed the performance measure from core NOI growth to adjusted EPS growth as modified for executive compensation purposes, aligning with the priorities that support our strategy for

creating long-term stockholder value, as outlined at our 2014 Investor Day. The Compensation Committee believes that it is appropriate to use different performance measures for our short-term and long-term incentive programs

|

|

|

|

**

|

“Equity run rate” means the number of shares of our common stock underlying equity-based awards granted plus the number of shares of our common stock underlying equity-based awards assumed upon an acquisition

(if any), divided by the weighted average number of shares of our common stock outstanding for the year.

|

iii Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

Marsh & McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

We

describe key features of the Company’s corporate governance environment below and in the next section of this proxy statement, captioned “Board of Directors and Committees.” Our key corporate governance materials are available online

at

http://www.mmc.com/about/governance.php

.

Overview

Our Board of Directors currently has twelve (12) members, including Lord Lang, our independent

chairman, and Daniel S. Glaser, our President and Chief Executive Officer. Mr. Glaser is the only member of management who serves as a Director. As described in more detail under “Board of Directors and Committees,” our Board

maintains an Audit Committee, a Compensation Committee, a Directors and Governance Committee, a Finance Committee, a Corporate Responsibility Committee and an Executive Committee.

Corporate Governance Practices

The Company is committed to best practices in corporate governance. Highlights of our corporate governance practices are described below.

BOARD STRUCTURE

|

|

•

|

|

Board Independence.

All of the Company’s directors are independent, with the exception of our CEO, who is the only member of management serving on the Board.

|

|

|

•

|

|

Independent Chairman.

The Company maintains separate roles of chief executive officer and chairman of the Board as a matter of policy. An independent director acts as

chairman of the Board.

|

|

|

•

|

|

Offer to Resign upon Change in Circumstances.

Pursuant to our Governance Guidelines, any director undergoing a significant change in personal or professional

circumstances must offer to resign from the Board.

|

ELECTION OF DIRECTORS/RIGHT OF STOCKHOLDERS TO CALL SPECIAL MEETINGS

|

|

•

|

|

Majority Voting in Director Elections.

The Company’s by-laws provide that, in uncontested elections, director candidates must be elected by a majority of the votes

cast. Each director candidate has previously tendered an irrevocable resignation that will be effective upon his or her failure to receive the requisite votes and the Board’s acceptance of such resignation.

|

|

|

•

|

|

Stockholder Right to Call Special Meetings

. The Company’s by-laws allow holders of record of at least twenty percent (20%) of the voting power of the

Company’s outstanding common stock to call a special meeting.

|

STOCKHOLDER RIGHTS PLAN

|

|

•

|

|

No Poison Pill.

The Company does not have a Rights Agreement.

|

DECLASSIFICATION OF BOARD

|

|

•

|

|

Annual Election of Directors.

The Company’s charter provides for the annual election of directors.

|

COMPENSATION PRACTICES

|

|

•

|

|

Compensation Structure for Independent Directors.

The Company’s director compensation structure is transparent to investors and does not provide for meeting fees or

retainers for non-chair committee membership.

|

|

|

•

|

|

Cap on Executive Severance Payments.

The Company is required as a matter of policy to obtain stockholder approval for severance agreements with certain senior executives if

they provide for cash severance that exceeds 2.99 times the executive’s base salary and three-year average annual bonus award.

|

|

|

•

|

|

“Double-Trigger” Condition for Vesting of Equity-Based Awards following a Change in Control.

Our outstanding and unvested equity-based awards contain a

“double-trigger” vesting provision, which requires both a change in control of the Company and a specified termination of employment in order for vesting to be accelerated.

|

|

|

•

|

|

“Clawback” Policies.

The Company may as a matter of policy recoup (or “claw back”) certain executive bonuses in the event of misconduct leading to a

financial restatement. Also, our 2011 Incentive and Stock Award Plan allows the Company to “claw back” outstanding or already settled equity-based awards.

|

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

1

|

|

|

|

|

|

|

|

|

Corporate

Governance

(Continued)

|

EQUITY OWNERSHIP AND HOLDING REQUIREMENTS

|

|

•

|

|

Senior Executive Equity Ownership and Holding Requirements.

The Company requires senior executives to hold shares or stock units of our common stock with a value equal to a

multiple of base salary. The multiple for our Chief Executive Officer is six, and the multiple for our other senior executives is three. Senior executives are required to hold shares of the Company’s common stock acquired in connection with

equity-based awards until they reach their ownership multiple and may not sell any shares of the Company’s common stock unless they maintain their ownership multiple.

|

|

|

•

|

|

Director Equity Ownership and Holding Requirements.

Directors are required to acquire over time, and thereafter hold (directly or indirectly), shares or stock units of our

common stock with a value equal to at least five times the Board’s basic annual retainer, or $550,000. Directors may not sell shares of the Company’s common stock until this ownership threshold is attained.

|

Guidelines for Corporate Governance

The Company and the Board of Directors formally express many of our governance policies through our Guidelines for Corporate Governance (our “Governance

Guidelines”). The Governance Guidelines are posted on our website at

http://www.mmc.com/content/dam/mmc-web/Files/corp-gov/Guidelines_for_Corporate_Governance.pdf

.

The Governance Guidelines summarize certain policies and practices designed to assist the Board in fulfilling its fiduciary

obligations to the Company’s stockholders, including the following (parenthetical references are to the relevant section of the Governance Guidelines):

|

•

|

|

Specific Board functions (Section B), such as:

|

|

|

•

|

|

selecting, regularly evaluating the performance of, and approving the compensation paid to, the CEO;

|

|

|

•

|

|

providing oversight and guidance regarding the selection, evaluation, development and compensation of other senior executives;

|

|

|

•

|

|

planning for CEO and other senior management succession;

|

|

|

•

|

|

reviewing, monitoring and, where appropriate, approving the Company’s strategic and operating plans, fundamental financial objectives and major corporate actions;

|

|

|

•

|

|

assessing major risks facing the Company and reviewing enterprise risk management programs and processes;

|

|

|

•

|

|

overseeing the integrity of the Company’s financial statements and financial reporting processes;

|

|

|

•

|

|

reviewing processes that are in place to maintain the Company’s compliance with applicable legal and ethical standards; and

|

|

|

•

|

|

reviewing and monitoring the effectiveness of the Company’s corporate governance practices.

|

|

•

|

|

Succession planning and management development. (Section C)

|

|

•

|

|

Director qualification standards and director independence. (Sections D.2 and D.3)

|

|

•

|

|

Limits on other public company board service. (Section D.5)

|

|

•

|

|

Majority voting in director elections. (Section E.3)

|

|

•

|

|

Resignation and retirement requirements for independent directors. (Section E.6)

|

|

•

|

|

Separation of independent chairman and CEO. (Section F.2)

|

|

•

|

|

Executive sessions of independent directors at every in-person meeting of the Board. (Section H.3)

|

|

•

|

|

Board access to management and professional advisors. (Section I)

|

|

•

|

|

Director and senior management stock ownership requirements. (Sections K.2 and K.3)

|

|

•

|

|

Annual Board and committee evaluations. (Section L)

|

|

•

|

|

Policy on interested stockholder transactions. (Section O)

|

2 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Corporate

Governance

(Continued)

|

Director Independence

The Board has determined that all directors other than Mr. Glaser are independent under the New York Stock Exchange (“NYSE”) listed company rules and the

standards set forth in the Governance Guidelines. Therefore, the Board has satisfied the objective, set forth in the Governance Guidelines, that a substantial majority of the Company’s directors be independent of management.

For a director to be considered “independent,” the Board must affirmatively determine that the director has no direct or indirect material relationship with the

Company. The Board has established categorical standards to assist it in making determinations of director independence. These standards conform to, or are more exacting than, the independence requirements provided in the NYSE listed company rules.

The Company’s director independence standards are set forth as Annex A to our Governance Guidelines.

All members of the Audit, Compensation and Directors and

Governance Committees must be independent directors under the NYSE listed company rules and the standards set forth in the Company’s Governance Guidelines. Members of the Audit Committee must also satisfy a separate Securities and Exchange

Commission (“SEC”) and NYSE independence requirement, which provides that they may not be affiliates and may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries,

other than their directors’ compensation. The Board evaluated each member of the Compensation Committee under the additional NYSE compensation committee member standards and also determined that these members qualify as “non-employee

directors” (as defined under Rule 16b-3 under the Securities Exchange Act of 1934) and as “outside directors” (as defined in Section 162(m) of the Internal Revenue Code).

Under our Governance Guidelines, if a director whom the Board has deemed independent has a change in circumstances or relationships that might cause the Board to

reconsider that determination, he or she must immediately notify the chairman of the Board and the chair of the Directors and Governance Committee.

Codes of Conduct

Our reputation is fundamental to our business. The Company’s directors and officers and

other employees are expected to act ethically at all times. To provide guidance in this regard, the Company has adopted a Code of Conduct,

The Greater Good

, which applies to all of our directors, officers and other employees.

The Greater

Good

has been distributed to the Company’s employees, accompanied by a comprehensive training and communication effort that includes a recent campaign requiring employees to recertify their commitment to

The Greater Good

. The Company

has also adopted a Code of Ethics for the Chief Executive Officer and Senior Financial Officers, which applies to our chief executive officer, chief financial officer and controller. Both of these codes are posted on the Company’s website at

http://www.mmc.com

, and print copies are available to any stockholder upon request. We will disclose any amendments to, or waivers of, the Code of Ethics

for the Chief Executive Officer and Senior Financial Officers on our website within four business days.

Review of Related-Person Transactions

The Company maintains a written Policy Regarding Related-Person Transactions, which sets forth standards and procedures for the review and approval or ratification of

transactions between the Company and related persons. The policy is administered by the Directors and Governance Committee with assistance from the Company’s Corporate Secretary.

In determining whether to approve or ratify a related-person transaction, the Directors and Governance Committee will review the facts and circumstances it considers

relevant. These may include: the commercial reasonableness of the terms of the transaction; the benefits of the transaction to the Company; the availability of other sources for the products or services involved in the transaction; the materiality

and nature of the related person’s direct or indirect interest in the transaction; the potential public perception of the transaction; and the potential impact of the transaction on any director’s independence. The Directors and Governance

Committee will approve or ratify a related-person transaction only if the Committee, in its sole good faith discretion based on the facts and circumstances it considers relevant, determines that the related-person transaction is in, or is not

inconsistent with, the best interests of the Company and its stockholders.

If the Directors and Governance Committee determines not to approve or ratify a

related-person transaction, the transaction may not be entered into or continued, as the case may be. No member of the Directors and Governance Committee will participate in any review or determination with respect to a related-person transaction if

the Committee member or any of his or her immediate family members is the related person.

See the discussion under “Transactions with Management and

Others” on page 58.

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

3

|

|

|

|

|

|

|

|

|

Corporate

Governance

(Continued)

|

Communicating Concerns Regarding Accounting

Matters

The Audit Committee of the Board of Directors has established procedures to enable anyone who has a concern about the Company’s accounting,

internal accounting controls or auditing practices to communicate that concern directly to the Audit Committee. These communications, which may be made on a confidential or anonymous basis, may be submitted in writing, by telephone or online as

follows:

By mail to:

Marsh &

McLennan Companies, Inc.

Audit Committee of the Board of Directors

c/o Carey Roberts—Corporate Secretary

1166 Avenue

of the Americas, Legal Department

New York, New York 10036-2774

By telephone or online:

Go to this website for

dialing instructions or to raise a concern online:

http://www.ethicscomplianceline.com

Further details of the Company’s procedures for handling complaints and concerns of employees and other interested parties

regarding accounting matters are posted on our website at

http://www.mmc.com/about/governance.php

.

Company policy prohibits retaliation against anyone who raises a concern in good faith.

Communicating with Directors

Holders of the Company’s common stock and other interested parties may send communications to the Board of Directors, the independent chairman, any of the directors

or the independent directors as a group by mail (addressed to Carey Roberts—Corporate Secretary, at the address shown above), online at

http://www.ethicscomplianceline.com

or by telephone (local dialing instructions can be found at

http://www.ethicscomplianceline.com)

. Items unrelated to the

directors’ duties and responsibilities as Board members may be excluded by the Corporate Secretary, including solicitations and advertisements, junk mail, product-related communications, surveys and job referral materials such as resumes.

4 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Board of Directors and Committees

|

Board Composition, Leadership and Size

At the 2016 annual meeting, stockholders will vote on the election of

eleven (11) directors. Lord Lang currently serves as the Board’s independent chairman. Lord Lang will retire from the Board effective as of the May 2016 annual meeting in accordance with the mandatory retirement provisions in our

Governance Guidelines. The Board has chosen H. Edward Hanway to succeed Lord Lang as chairman.

The only member of management who serves on the Board is Daniel S.

Glaser, the Company’s President and Chief Executive Officer. The position of chairman of the Board has been held by an independent director since 2005. The Board believes that this currently is the best leadership structure for the Company. The

Board will continue to periodically evaluate whether the structure is in the best interests of stockholders.

Director Qualifications and Nomination Process

As provided in our Governance Guidelines, all directors must demonstrate the highest standards of ethics and integrity, must be independent thinkers with strong

analytical ability and must be committed to representing all of the Company’s stockholders rather than any particular interest group. In addition to the foregoing characteristics, the Board evaluates each prospective director candidate by

reference to the following criteria: (i) the candidate’s personal and professional reputation and background; (ii) the candidate’s industry knowledge; (iii) the candidate’s experience with businesses or other

organizations comparable to the Company in terms of size or complexity; (iv) the interplay of the candidate’s skills and experience with those of the incumbent directors; (v) the extent to which the candidate would provide substantive

expertise that is currently sought by the Board or any committees of the Board; (vi) the candidate’s ability to commit the time necessary to fulfill a director’s responsibilities; (vii) relevant legal and regulatory requirements

and evolving best practices in corporate governance; and (viii) any other criteria the Board deems appropriate.

The Board, taking into account the

recommendation of the Directors and Governance Committee, is responsible for nominating a slate of director candidates for election at the Company’s annual meeting of stockholders. The Board has delegated to the Directors and Governance

Committee the authority, when circumstances so warrant, to identify, screen and recommend to the Board potential new director candidates and to engage one or more search firms to assist the Committee in that regard. The Directors and Governance

Committee periodically reviews with the Board the skills and characteristics to be sought in any new director candidates, as well as the overall composition and structure of the incumbent Board. The Committee has a long-standing commitment to

maintaining a diverse and inclusive Board, and when seeking new director candidates, takes into account such factors as the Board’s current mix of skills, backgrounds and experience, as well as the gender, racial, ethnic and cultural diversity

of each potential candidate.

Stockholder Nominations for Director Candidates

The Directors and Governance Committee will consider director candidates recommended by stockholders if the recommendation is submitted in writing at the address below.

As described in Article II of the Company’s by-laws, stockholders may submit nominations of persons for election as directors of the Company at an annual meeting of stockholders provided that the proposing stockholder is a stockholder of record

both at the time the nomination is submitted and at the time of the annual meeting, is entitled to vote at the annual meeting and complies with the notice procedures set forth in Section 2.10 of the by-laws. The notice of nomination must meet

certain guidelines as to timeliness and form and be delivered to the Company’s Corporate Secretary at our principal executive offices:

Marsh & McLennan Companies, Inc.

Attn:

Directors and Governance Committee

c/o Carey Roberts—Corporate Secretary

1166 Avenue of the Americas

New York, New York

10036-2774

The director nomination notice must include certain information regarding the director nominee, the proposing stockholder and any associate of the

proposing stockholder (such as the beneficial ownership of shares owned of record by the proposing stockholder), including information regarding ownership of our common stock and of derivatives of our securities. With respect to the director

nominee, the notice must include the information required to be disclosed in a proxy statement with respect to any candidates for election as directors, including a nominee’s written consent to be named in the proxy statement as a nominee and

to serve as director of the Company if elected. The notice also must be accompanied by a letter from the nominee containing certain representations regarding the nominee’s independence and compliance with the Company’s publicly disclosed

corporate governance and other policies and guidelines.

See the discussion under “Submission of Stockholder Proposals and Other Items of Business for 2017

Annual Meeting” on page 63.

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

5

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

Director Election Voting Standard

The Company’s by-laws provide that, in an uncontested election of directors (

i.e.

, where the number of nominees does not exceed the number of

directors to be elected), a director nominee must receive more votes cast “for” than “against” his or her election in order to be elected to the Board.

In connection with the Company’s majority voting standard for director elections, the Board has adopted the following procedures, which are set forth more fully in

Section E.3 of our Governance Guidelines:

|

•

|

|

The Board shall nominate for election only director candidates who agree to tender to the Board an irrevocable resignation that will be effective upon (i) a director’s failure to receive the required number of

votes for re-election at the next meeting of stockholders at which he or she faces re-election and (ii) the Board’s acceptance of such resignation.

|

|

•

|

|

Following a meeting of stockholders at which an incumbent director who was a nominee for re-election does not receive the required number of votes for election, the Directors and Governance Committee shall make a

recommendation to the Board as to whether to accept or reject such director’s resignation. Within 90 days following the certification of the election results, the Board shall decide whether to accept or reject the director’s resignation

and shall publicly disclose that decision and its rationale.

|

|

•

|

|

If the Board accepts a director’s resignation, the Directors and Governance Committee will recommend to the Board whether to fill the resultant vacant Board seat or reduce the size of the Board.

|

Attendance

The Board

held nine meetings, including telephonic meetings, during 2015. The average attendance by directors at meetings of the Board and its committees held during 2015 was approximately 96%. All directors attended at least 75% of the meetings of the Board

and committees on which they served. The Board’s policy is to have all directors attend annual meetings of stockholders. All directors were present at the 2015 annual meeting.

Retirement

Our

Governance Guidelines require our independent directors to retire no later than at the annual meeting of stockholders following their 75

th

birthday. Any director who is an employee of the Company

resigns from the Board when his or her employment ends.

Executive Sessions

Our independent directors meet in executive session without management at regularly scheduled in-person Board meetings. The independent chairman of the Board presides at

these meetings.

Risk Oversight

It is the responsibility of the Company’s senior management to assess and manage our exposure to risk and to bring to the Board of Directors’ attention the most

material risks facing the Company. The Board oversees risk management directly and through its committees. The Audit Committee regularly reviews the Company’s policies and practices with respect to risk assessment and risk management. The

Directors and Governance Committee considers risks related to CEO succession planning and the Compensation Committee considers risks relating to the design of executive compensation programs and arrangements. See below for additional information

about the Board’s committees.

Committees

Our Board maintains an Audit Committee, a Compensation Committee, a Directors and Governance Committee, a Finance Committee, a Corporate Responsibility Committee and an

Executive Committee to assist the Board in discharging its responsibilities. Following each committee meeting, the respective committee chair reports the highlights of the meeting to the full Board.

Membership on each of the Audit, Compensation and Directors and Governance Committees is limited to independent directors as required by the Company, the listing

standards of the NYSE and the SEC’s independence rules. The charters for these committees can be viewed on our website at

http://www.mmc.com/about/governance.php

.

6 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

The table below indicates committee assignments for 2015 and the number of times each committee met

in 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Audit

|

|

|

Compensation

|

|

|

Directors

and

Governance

|

|

|

Finance

|

|

|

Corporate

Responsibility

|

|

|

Executive

|

|

|

Oscar Fanjul

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

X(chair)

|

|

|

|

|

|

|

|

X

|

|

|

Daniel S. Glaser

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

X

|

|

|

H. Edward Hanway

|

|

|

|

|

|

|

|

|

X(chair)

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

X

|

|

|

Lord Lang

(1)

|

|

|

|

|

|

|

|

|

X

|

|

|

|

X

|

|

|

|

X

|

|

|

|

|

|

|

|

X(chair)

|

|

|

Elaine La Roche

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

Maria Silvia Bastos Marques

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

Steven A. Mills

|

|

|

|

|

|

|

|

|

X

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce P. Nolop

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

X(chair)

|

|

|

|

|

|

|

Marc D. Oken

|

|

|

|

|

X(chair)

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

X

|

|

|

Morton O. Schapiro

|

|

|

|

|

|

|

|

|

X

|

|

|

|

X(chair)

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

Lloyd M. Yates

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

R. David Yost

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

2015 Meetings

|

|

|

|

|

10

|

|

|

|

6

|

|

|

|

5

|

|

|

|

6

|

|

|

|

5

|

|

|

|

0

|

|

|

(1)

|

Lord Lang, the Board’s independent chairman, will retire from the Board effective as of the 2016 annual meeting. He is not standing for re-election. The Board has chosen Mr. Hanway to succeed Lord Lang as

independent chairman.

|

AUDIT COMMITTEE

The Audit Committee is charged, among other things, with assisting the Board in fulfilling its oversight responsibilities with respect to:

|

•

|

|

the integrity of the Company’s financial statements;

|

|

•

|

|

the qualifications, independence and performance of our independent registered public accounting firm;

|

|

•

|

|

the performance of the Company’s internal audit function;

|

|

•

|

|

compliance by the Company with legal and regulatory requirements; and

|

|

•

|

|

the Company’s enterprise risk management programs and processes.

|

The Audit Committee selects, oversees and approves,

pursuant to a pre-approval policy, all services to be performed by our independent registered public accounting firm. The Company’s independent registered public accounting firm reports to the Audit Committee.

All members of the Audit Committee are “financially literate,” as required by the NYSE and determined by the Board. The Board has determined that Bruce P.

Nolop, Marc D. Oken and Lloyd Yates have the requisite qualifications to satisfy the SEC definition of “audit committee financial expert.”

COMPENSATION COMMITTEE

Among other things, the Compensation Committee:

|

•

|

|

evaluates the performance and determines the compensation of our chief executive officer;

|

|

•

|

|

reviews and approves the compensation of our other senior executives; and

|

|

•

|

|

oversees the Company’s incentive compensation plans for our chief executive officer and other senior executives and equity-based plans and discharges the responsibilities of the Committee set forth in these plans.

|

Meeting Schedule.

The Compensation Committee

met six times in 2015, including a special meeting in February to complete its annual review of, and make decisions on, executive compensation. Decisions relating to significant matters are usually presented to the Compensation Committee and

discussed at more than one meeting to allow for full consideration of the implications and possible alternatives before a final decision is made. The Compensation Committee receives support from its independent compensation consultant and the

Company’s management, including the Company’s human resources staff, as described below.

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

7

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

The Compensation Committee may delegate all or a portion of its duties and responsibilities to the

chair of the Compensation Committee or a subcommittee of the Compensation Committee. If necessary, the chair is authorized to take action on behalf of the Compensation Committee between its regularly scheduled meetings, within prescribed guidelines.

If any such action is taken, the chair reports such action to the Compensation Committee at its next regularly scheduled meeting.

Independent Compensation Consultant.

The Compensation Committee has engaged Pay Governance LLC as its independent compensation consultant to provide

support to the Compensation Committee. The independent compensation consultant advises the Compensation Committee in performing its duties and makes recommendations to the Compensation Committee regarding our executive compensation program. The

independent compensation consultant reports directly to the Compensation Committee and provides advice and analysis solely to the Compensation Committee. The independent compensation consultant supports the Compensation Committee by:

|

•

|

|

participating by invitation in meetings, or portions of meetings, of the Compensation Committee to advise the Compensation Committee on specific matters that arise;

|

|

•

|

|

offering objective advice regarding the compensation and policy recommendations presented to the Compensation Committee by the Company’s management, including senior members of the Company’s human resources

staff; and

|

|

•

|

|

supplying data regarding the compensation practices of comparable companies.

|

The Compensation Committee requested and

received advice from the independent compensation consultant with respect to all significant matters addressed by the Compensation Committee during 2015. Except for the services provided to the Compensation Committee, neither the individual

compensation consultant nor Pay Governance LLC nor any of its affiliates provided any services to the Company or its affiliates in 2015.

The Compensation Committee

assessed the work of Pay Governance LLC during 2015 pursuant to SEC rules and concluded that Pay Governance’s work did not raise any conflict of interest.

Company Management.

The Company’s management, including the Company’s human resources staff, supports the Compensation Committee by:

|

•

|

|

developing meeting agendas in consultation with the chair of the Compensation Committee and preparing background materials for Compensation Committee meetings;

|

|

•

|

|

making recommendations to the Compensation Committee on the Company’s compensation philosophy, governance initiatives and short-term and long-term incentive compensation design, including by providing input

regarding the individual performance component of annual bonus awards, as discussed in the Compensation Discussion and Analysis beginning on page 19; and

|

|

•

|

|

responding to actions and initiatives proposed by the Compensation Committee.

|

In addition, our President and Chief

Executive Officer provides recommendations with respect to the compensation of our other senior executives.

Our President and Chief Executive Officer, senior members

of the Company’s human resources staff and internal legal counsel attended Compensation Committee meetings when invited but were not present for executive sessions or for any discussion of their own compensation.

Timing and Procedures of Equity-Based Compensation Awards.

Annual

awards under our long-term incentive compensation program are approved at a prescheduled meeting of the Compensation Committee each February and, consistent with our historical practice, are granted on that same date.

In addition, the Compensation Committee periodically grants restricted stock unit awards to newly hired senior executives and to continuing senior executives for

increased responsibilities that accompany changes in position and for retention purposes. These awards are approved at prescheduled meetings of the Compensation Committee. The Compensation Committee has also authorized our President and Chief

Executive Officer to make such awards to individuals who are not senior executives, subject to prescribed limitations. These awards are granted on the first calendar day of the month following approval of the award by the Compensation Committee or

our President and Chief Executive Officer, as applicable. In the event that an award is approved prior to an individual’s start date with the Company, the award will be granted on the first calendar day of the first month on or following the

individual’s start date.

8 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

Equity-based awards are typically denominated as a dollar value and then converted into a number of

performance stock units, restricted stock units or stock options. The number of performance stock units or restricted stock units is determined based on the grant date fair value of the Company’s common stock, which is defined as the average of

the high and low trading prices of the Company’s common stock on the trading day immediately preceding the grant date. The number of stock options is determined based on the grant date fair value of a stock option to purchase a share of the

Company’s common stock. The grant date fair value of stock options is determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718,

Compensation-Stock Compensation

(“FASB ASC Topic

718”). Stock options have an exercise price equal to the average of the high and low trading prices of the Company’s common stock on the trading day immediately preceding the grant date. We believe that our equity-based compensation grant

procedures effectively protect against the manipulation of grant timing for employee gain.

The Company’s human resources staff regularly monitors, and updates

the Compensation Committee on, the use of shares of the Company’s common stock for equity-based awards and the number of shares available for future awards under our equity-based compensation plans. As part of the process of granting annual

long-term incentive compensation, the Compensation Committee considers share use and equity run rate (as defined in “2015 Highlights” on page 20) so that annual long-term incentive awards, and the extent to which shares of the

Company’s common stock are used for those awards, are maintained at a reasonable level.

DIRECTORS AND GOVERNANCE COMMITTEE

The Directors and Governance Committee’s duties and responsibilities include, among other things:

|

•

|

|

assisting the Board by identifying, considering and recommending, consistent with criteria approved by the Board, qualified candidates for election as Directors, including the slate of Directors to be nominated by the

Board for election at the Company’s annual meeting of stockholders;

|

|

•

|

|

recommending to the Board nominees for each Board committee;

|

|

•

|

|

overseeing the development and implementation of succession planning for the Company’s chief executive officer; and

|

|

•

|

|

developing and recommending to the Board the Governance Guidelines applicable to the Company, including taking a leadership role in shaping the corporate governance of the Company.

|

FINANCE COMMITTEE

The Finance Committee reviews

and makes recommendations to the Board concerning, among other matters, the Company’s capital structure, capital management and methods of corporate finance (including proposed issuances of securities or other financing transactions) and

proposed acquisitions, divestitures or other strategic transactions.

CORPORATE RESPONSIBILITY COMMITTEE

In January 2016, the Board approved an amendment to the Corporate Responsibility Committee charter to update and clarify the Committee’s principal subjects of focus.

The Corporate Responsibility Committee’s purpose is to create value for our stakeholders by enhancing the Company’s reputation, business position and employee engagement. In particular, the Corporate Responsibility Committee focuses on

government relations, corporate communications, social responsibility, diversity and inclusion and sustainability and reports to the Board on a regular basis.

EXECUTIVE COMMITTEE

The Executive Committee is empowered to act for the full Board during the intervals between Board meetings, except

with respect to matters that, under Delaware law or the Company’s by-laws, may not be delegated to a committee of the Board. The Executive Committee meets as necessary, with all actions taken by the Committee reported at the next Board meeting.

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

9

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

Director Compensation

EXECUTIVE DIRECTORS

Executive directors

(currently only Mr. Glaser) receive no compensation for their service as directors.

INDEPENDENT DIRECTORS

Independent directors receive a basic annual retainer and annual stock grant as compensation for their service as directors. Our independent chairman and directors who

serve as the chair of a committee also receive a supplemental annual retainer. The basic annual retainer and the supplemental retainers are paid quarterly for pay periods ending on August 15, November 15, February 15 and

May 15. Under the terms of the Company’s Directors’ Stock Compensation Plan, independent directors may elect to receive these retainer amounts in cash, the Company’s common stock or a combination thereof and may defer receipt of

all or a portion of any compensation to be paid in the form of the Company’s common stock until a specified future date. The annual stock grant is made on June 1

st

of each year.

Independent directors are also eligible to participate in the Company’s matching-gift program for certain charitable gifts to educational institutions.

The Board’s compensation year runs from June 1 through May 31. The current compensation arrangements for independent directors are summarized in the table

below.

Elements of Independent Director Compensation

|

|

|

|

|

Basic Annual Retainer for All Independent Directors

|

|

$110,000

|

|

Supplemental Annual Retainer for Independent Chairman of the Board

|

|

$200,000

|

|

Supplemental Annual Retainer for Chair of

•

Audit Committee

•

Compensation Committee

|

|

$25,000

|

Supplemental Annual Retainer for Chairs of Committees other than

Audit and Compensation

|

|

$15,000

|

Annual Stock Grant for Independent Directors under the Company’s

Directors’ Stock Compensation Plan

|

|

Number of shares having a grant date market value of $140,000

|

|

Stock Ownership Guidelines

|

|

5 times Basic Annual Retainer

|

10 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Board of

Directors and Committees

(Continued)

|

2015 Independent Director Compensation

The table below indicates total compensation received by our independent directors for service on the Board and its committees during 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned or

Paid in

Cash

($)

(1)

|

|

|

Stock

Awards

($)

(2)

|

|

|

All

Other

Compensation

($)

(3)

|

|

|

Total ($)

|

|

|

Oscar Fanjul

|

|

|

125,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

265,000

|

|

|

H. Edward Hanway

|

|

|

135,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

275,000

|

|

|

Lord Lang

(4)

|

|

|

310,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

450,000

|

|

|

Elaine La Roche

|

|

|

110,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

250,000

|

|

|

Maria Silvia Bastos Marques

|

|

|

72,921

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

212,291

|

|

|

Steven A. Mills

|

|

|

110,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

250,000

|

|

|

Bruce P. Nolop

(5)

|

|

|

117,255

|

|

|

|

140,000

|

|

|

|

1,250

|

|

|

|

257,255

|

|

|

Marc D. Oken

|

|

|

135,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

275,000

|

|

|

Morton O. Schapiro

|

|

|

125,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

265,000

|

|

|

Adele Simmons

(6)

|

|

|

64,538

|

|

|

|

—

|

|

|

|

5,000

|

|

|

|

69,538

|

|

|

Lloyd M. Yates

|

|

|

110,000

|

|

|

|

140,000

|

|

|

|

—

|

|

|

|

250,000

|

|

|

R. David Yost

|

|

|

110,000

|

|

|

|

140,000

|

|

|

|

5,000

|

|

|

|

255,000

|

|

|

(1)

|

The amounts in this “Fees Earned or Paid in Cash” column reflect payments of the $110,000 basic annual retainer and any supplemental retainer made during fiscal 2015, as set forth in more detail below. The

chairs of the Audit and Compensation Committees each received $25,000 for such service, and the chairs of committees other than Audit and Compensation each received $15,000 for such service. The committee chairs compensated during fiscal year 2015

were: Mr. Fanjul (Finance), Mr. Hanway (Compensation), Mr. Nolop (Corporate Responsibility), Mr. Oken (Audit), Mr. Schapiro (Directors and Governance) and Ms. Simmons (Corporate Responsibility). Lord Lang received

$200,000 for his service as the independent chairman of the Board. Committee members other than the chairs receive no additional compensation for service on a committee.

|

|

|

Mr. Mills elected to receive his quarterly payments in the form of the Company’s common stock. Mr. Schapiro elected to receive 30% of his quarterly payments ($37,500) in the form of the Company’s

common stock on a deferred basis. Mr. Yost elected to receive his quarterly payments in the form of the Company’s common stock on a deferred basis. All of the other independent directors received these amounts in cash.

|

|

(2)

|

This column reflects the award of 2,390 shares of the Company’s common stock to each independent director on June 1, 2015. The shares awarded to each director had an aggregate grant date fair value of

$140,000, based on a per share price of $58.56, which was the average of the high and low prices on May 29, 2015, the trading day immediately preceding the grant. The amounts shown in this column constitute the dollar amount recognized by the

Company for financial statement reporting purposes for the fiscal year ended December 31, 2015, in accordance with FASB ASC Topic 718. Mr. Schapiro and Mr. Yost elected to defer receipt of all of the shares awarded to them.

|

|

|

As of December 31, 2015, the aggregate number of deferred shares held for the account of each director listed above who previously elected to defer shares was as follows: Mr. Schapiro, 54,218 shares;

Ms. Simmons, 68,603; and Mr. Yost, 13,689 shares. Dividend equivalents on these deferred shares are reinvested into additional deferred shares for the account of the director.

|

|

(3)

|

The Company maintains a matching gift program for employees and directors, pursuant to which the Company matches, on a dollar-for-dollar basis, charitable contributions to certain educational institutions up to a total

of $5,000 per employee or director in any one year. The amounts shown in the table represent the Company’s matching contribution to educational institutions pursuant to this program.

|

|

(4)

|

Lord Lang will retire from the Board effective as of the 2016 annual meeting.

|

|

(5)

|

Mr. Nolop was appointed chair of the Corporate Responsibility committee upon Adele Simmons’ retirement from the Board.

|

|

(6)

|

Ms. Simmons retired from the Board effective May 21, 2015.

|

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

11

Item 1 — Election of Directors

At the 2016 annual meeting, stockholders will vote on the

election of the eleven (11) nominees listed below—Oscar Fanjul, Daniel S. Glaser, H. Edward Hanway, Elaine La Roche, Maria Silvia Bastos Marques, Steven A. Mills, Bruce P. Nolop, Marc D. Oken, Morton O. Schapiro, Lloyd M. Yates and R.

David Yost—for a one-year term. Lord Lang, our independent chairman, will retire from the Board effective as of the 2016 annual meeting and is not standing for

re-election. The

Board has chosen H.

Edward Hanway to succeed Lord Lang as independent chairman.

The Board has nominated each of these individuals to serve until the 2017 annual meeting. Each nominee

has indicated that he or she will serve if elected. We do not anticipate that any of the nominees will be unable or unwilling to stand for election, but if that happens, your proxy may be voted for another person nominated by the Board or the Board

may reduce its size. Each director holds office until his or her successor has been duly elected and qualified or his or her earlier resignation, death or removal.

In nominating the following slate of director candidates for election at the Company’s annual meeting of stockholders, the Board has evaluated each nominee by

reference to the criteria described above on page 5 under the heading “Director Qualifications and Nomination Process.” In addition, the Board evaluates each individual director in the context of the Board as a whole, with the objective of

recommending a group that can best support the success of our businesses and represent stockholder interests.

The following section contains information provided by

the nominees about their principal occupations, business experience and other matters, including their 2015 committee assignments, as well as a description of how each individual’s experience qualifies him or her to serve as a director of the

Company.

The Board of Directors recommends that you vote FOR

the following Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oscar Fanjul

Compensation

Committee

Executive Committee

Finance Committee (Chair)

|

|

Director since 2001

|

|

|

|

|

|

|

|

|

Mr. Fanjul, age 66, is Vice Chairman of Omega Capital, a private

investment firm in Spain. Mr. Fanjul is the Founding Chairman and former Chief Executive Officer of Repsol.

Mr. Fanjul is a Director of Acerinox,

LafargeHolcim and Ferrovial. He is a Trustee of the Amigos del Museo del Prado Foundation. Mr. Fanjul is a former Director of Unilever, the London Stock Exchange and Areva.

We believe Mr. Fanjul’s qualifications to sit on our Board of Directors and chair our Finance Committee include his extensive experience in various international

markets with global companies and his understanding of global business practices.

|

12 Marsh & McLennan Companies, Inc.

Notice of

Annual Meeting and 2016 Proxy Statement

|

|

|

|

|

|

|

|

|

Election

of Directors

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel S. Glaser

Executive

Committee

Finance Committee

|

|

Director since 2013

|

|

|

|

|

|

|

|

|

Daniel S. Glaser, age 55, is President and Chief Executive Officer of

Marsh & McLennan Companies. Prior to assuming this role in January 2013, Mr. Glaser served as Group President and Chief Operating Officer of Marsh & McLennan Companies from April 2011 through December 2012, with strategic and operational

oversight of both the Risk and Insurance Services and the Consulting segments of the Company. Mr. Glaser rejoined Marsh in December 2007 as Chairman and Chief Executive Officer of Marsh Inc. after serving in senior positions in commercial insurance

and insurance brokerage in the United States, Europe, and the Middle East. He began his career at Marsh more than 30 years ago. Mr. Glaser was named Chairman of the Federal Advisory Committee on Insurance (FACI) in August 2014. Mr. Glaser also

serves on the International Advisory Board of BritishAmerican Business and is a member of the Board of Trustees for The Institutes (American Institute for Chartered Property Casualty Underwriters), the Insurance Information Institute and Ohio

Wesleyan University.

As the only member of the Company’s management team on the Board, Mr.

Glaser’s presence on the Board provides directors with direct access to the Company’s chief executive officer and helps facilitate director contact with other members of the Company’s senior management.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. Edward Hanway

Chairman of

the Board (elect)

Compensation Committee (Chair)

Executive Committee (Chair

elect)

Finance Committee

|

|

Director since 2010

|

|

|

|

|

|

|

|

|

Mr. Hanway, age 64, served as Chairman and Chief Executive Officer of

Cigna Corporation from 2000 to the end of 2009. From 1999 to 2000, he served as President and Chief Operating Officer of Cigna. From 1996 to 1999, he was President of Cigna HealthCare, and from 1989 to 1996 was President of Cigna International. Mr.

Hanway is a former Member of the Board of Directors of America’s Health Insurance Plans (AHIP). He is also a past Chairman of the Council on Affordable Quality Healthcare (CAQH) and has been active in a wide range of issues and initiatives

associated with children’s health and education. He serves on the Board of Trustees of the March of Dimes Foundation and Drexel Newmann Academy and is the Chairman of the Faith in the Future Foundation committed to growth of Catholic education

in the Archdiocese of Philadelphia.

We believe Mr. Hanway’s qualifications to chair our

Board of Directors include his years of executive experience in the insurance industry, together with his background in the health and benefits sector, which provide our Board with insight into important areas in which the Company conducts

business.

|

Marsh &

McLennan Companies, Inc.

Notice of Annual Meeting and 2016 Proxy Statement

13

|

|

|

|

|

|

|

|

|

Election

of Directors

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elaine La Roche

Audit

Committee

Finance Committee

|

|

Director since 2012

|

|

|

|

|

|

|

|

|

Ms. La Roche, age 66, is a Senior Advisor to China International

Capital Corporation US. She served as Chief Executive Officer of China International Capital Corporation in Beijing from 1997 to 2000. Over the course of a 20-year career at Morgan Stanley, Ms. La Roche rose from Associate to Managing Director,

serving in a variety of roles including Chief of Staff to the Chairman, and President and Head of the Asia Desk. From 2008 to 2010, Ms. La Roche was with JPMorgan Chase & Co. in Beijing, where she served as Vice Chairman, J.P. Morgan China

Securities. Ms. La Roche served on the Board of Directors of Linktone Ltd., where she was Non-Executive Chairman from 2004 to 2008. She also served on the Board of Directors of China Construction Bank (CCB) from 2006 to 2011 and from 2012 to 2015

after a mandatory one-year hiatus. Ms. La Roche currently serves on the Board of Directors of Harsco Corporation.

We believe Ms. La Roche’s qualifications to sit on our Board of Directors include her executive experience in financial services, particularly internationally, and

her corporate governance experience from prior board service.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maria Silvia Bastos Marques

Corporate Responsibility Committee

Directors and Governance Committee

|

|

Director since 2015

|

|

|

|

|

|

|

|

|

Ms. Marques, age 59, is currently Special Advisor to the Mayor for the

Rio de Janeiro 2016 Olympic Games. Prior to assuming this role in April 2014, Ms. Marques served as Chief Executive Officer of Rio’s Olympic Company, starting in 2011. Ms. Marques has served in leadership positions in both the public and

private sector, including as CEO of Icatu Hartford Seguros S.A. from 2007 to 2011, CEO of Companhia Siderurgica Nacional from 1996 to 2002, and Secretary of Finance for the City of Rio de Janeiro from 1993 to 1996. In addition to these executive

positions, Ms. Marques has served as a trustee of the Fundação Brasileira para o Desenvolvimento Sustentável (Brazilian Foundation for Sustainable Development) since 2004 and on the Advisory Board of Columbia University Global