UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

| |

Date of report (Date of earliest event reported) | February 4, 2016 |

|

|

Marsh & McLennan Companies, Inc. |

(Exact Name of Registrant as Specified in Charter) |

|

| | |

Delaware | 1-5998 | 36-2668272 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

1166 Avenue of the Americas, New York, NY | 10036 |

(Address of Principal Executive Offices) | (Zip Code) |

|

| |

Registrant’s telephone number, including area code | (212) 345-5000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On February 4, 2016, Marsh & McLennan Companies, Inc. issued a press release reporting financial results for the fourth quarter and full year ended December 31, 2015, and announcing that a conference call to discuss such results will be held at 8:30 a.m. Eastern time on February 4, 2016. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. For purposes of Section 18 of the Securities Exchange Act of 1934, the press release is deemed furnished not filed.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press release issued by Marsh & McLennan Companies, Inc. on February 4, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| MARSH & McLENNAN COMPANIES, INC. |

| | |

| By: | /s/ Carey Roberts |

| Name: | Carey Roberts |

| Title: | Deputy General Counsel, Chief Compliance Officer & Corporate Secretary |

Date: February 4, 2016

EXHIBIT INDEX

Exhibit No. Exhibit

|

| |

99.1 | Press release issued by Marsh & McLennan Companies, Inc. on February 4, 2016. |

Exhibit 99.1

NEWS RELEASE

MARSH & McLENNAN COMPANIES REPORTS

FOURTH QUARTER AND FULL-YEAR 2015 RESULTS

Strong Underlying Revenue Growth Across All Operating Companies

Operating Margins Expand in Both Segments

GAAP EPS Increases to $.71 in Fourth Quarter and to $2.98 for Year

Adjusted EPS Increases 8% — to $.71 in Fourth Quarter and to $3.05 for 2015

NEW YORK, February 4, 2016 — Marsh & McLennan Companies, Inc. (NYSE: MMC), a global professional services firm offering clients advice and solutions in risk, strategy and people, today reported financial results for the fourth quarter and year ended December 31, 2015.

Marsh & McLennan Companies President and CEO Dan Glaser said: "We capped off a successful year with an outstanding fourth quarter, posting our highest underlying revenue growth of 2015 at 5%. In 2015, we produced underlying revenue growth of 4% on a consolidated basis. Our adjusted operating margin expanded 100 basis points, with higher margins in both segments for the sixth consecutive year. Adjusted EPS grew 8% despite FX headwinds of approximately $.18 per share. In addition to our solid operating performance, we continued to deliver on our commitments to shareholders. We deployed $3.2 billion of capital through double-digit growth in dividends, a record level of share repurchase and an active year for acquisitions.

"We believe we are well positioned to deliver underlying revenue growth, margin expansion and strong EPS growth in 2016," concluded Mr. Glaser.

Consolidated Results

Consolidated revenue in the fourth quarter of 2015 was $3.3 billion, an increase of 3% from the fourth quarter of 2014, or 5% on an underlying basis. Operating income rose 11% to $594 million, compared with $536 million in the prior year. Adjusted operating income, which excludes noteworthy items as presented in the attached supplemental schedules, rose 5% to $582 million. Net income attributable to the Company was $375 million, or $.71 per share, compared with $294 million, or $.54 per share, in the prior year. Adjusted EPS increased 8% to $.71, compared with $.66 in the prior fourth quarter.

For the year 2015, consolidated revenue was $12.9 billion, a slight decrease from the prior year, but an increase of 4% on an underlying basis. Operating income was $2.4 billion, up 5% from the prior year. Adjusted operating income of $2.5 billion also increased 5%. Net income attributable to the Company was $2.98 per share, an increase of 12% from $2.65 per share in 2014. Adjusted EPS rose 8% to $3.05.

Risk and Insurance Services

Risk and Insurance Services revenue was $1.7 billion in the fourth quarter of 2015, an increase of 4% on an underlying basis. Operating income was $354 million, an increase of 4% compared with $339 million in the prior year. Adjusted operating income was up 3% to $364 million. For the year 2015, revenue was $6.9 billion, an increase of 3% on an underlying basis. Operating income rose to $1.5 billion, and adjusted operating income increased to $1.6 billion.

Marsh's revenue in the fourth quarter of 2015 was $1.5 billion, an increase of 4% on an underlying basis. The U.S./Canada division had underlying revenue growth of 3%. International operations produced underlying revenue growth of 5%, with EMEA rising 3%, Asia Pacific up 4% and Latin America growing 13%. Guy Carpenter's fourth quarter revenue was $217 million, an increase of 5% on an underlying basis.

Consulting

Consulting revenue of $1.6 billion in the fourth quarter increased 5% on an underlying basis from the fourth quarter of 2014. Operating income rose 18% to $294 million from $250 million in the prior period and adjusted operating income rose 5% to $265 million. For the year 2015, revenue of $6.1 billion was up 5% on an underlying basis. Operating income grew 8% to $1.1 billion, and adjusted operating income increased 4% to $1 billion.

Mercer's revenue was $1.1 billion in the fourth quarter, an increase of 5% on an underlying basis. Health, with revenue of $389 million, grew 8% on an underlying basis; Retirement, with revenue of $372 million, rose 1%; Investments, with revenue of $204 million, increased 2%; and Talent, with revenue of $175 million, was up 7%. Oliver Wyman Group’s revenue was $476 million in the fourth quarter, an increase of 7% on an underlying basis.

Other Items

In the fourth quarter of 2015, the Company repurchased 1.4 million shares of its common stock for $75 million. For the year, 24.8 million shares were repurchased for $1.4 billion. In 2015, the Company completed 27 acquisitions and investments. Recent activity included Marsh’s acquisition of UK-based insurance broker Jelf Group and Mercer’s acquisition of CPSG Partners, a provider of Workday implementation services.

Conference Call

A conference call to discuss fourth quarter and full-year 2015 results will be held today at 8:30 a.m. Eastern time. To participate in the teleconference, please dial +1 888 427 9421. Callers from outside the United States should dial +1 719 325 2474. The access code for both numbers is 3056490. The live audio webcast may be accessed at www.mmc.com. A replay of the webcast will be available approximately two hours after the event.

About Marsh & McLennan Companies

MARSH & McLENNAN COMPANIES (NYSE: MMC) is a global professional services firm offering clients advice and solutions in the areas of risk, strategy and people. Marsh is a leader in insurance broking and risk management; Guy Carpenter is a leader in providing risk and reinsurance intermediary services; Mercer is a leader in talent, health, retirement, and investment consulting; and

Oliver Wyman is a leader in management consulting. With annual revenue of $13 billion and approximately 60,000 colleagues worldwide, Marsh & McLennan Companies provides analysis, advice and transactional capabilities to clients in more than 130 countries. The Company is committed to being a responsible corporate citizen and making a positive impact in the communities in which it operates. Visit www.mmc.com for more information and follow us on LinkedIn and Twitter @MMC_Global.

INFORMATION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements," as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management's current views concerning future events or results, use words like "anticipate," "assume," "believe," "continue," "estimate," "expect," "intend," "plan," "project" and similar terms, and future or conditional tense verbs like "could," "may," "might," "should," "will" and "would." Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements.

Factors that could materially affect our future results include, among other things: our ability to maintain adequate safeguards to protect the security of confidential, personal or proprietary information; our ability to compete effectively and adapt to changes in the competitive environment, including to technological and other types of innovation; the impact of economic, political and market conditions on us and our clients; our ability to successfully recover should we experience a business continuity problem due to cyberattack, natural disaster or otherwise; our exposure to potential civil remedies or criminal penalties if we fail to comply with U.S. and non-U.S. laws and regulations applicable in the jurisdictions in which we operate; the financial and operational impact of complying with laws and regulations in the jurisdictions in which we operate; our exposure to potential losses and liabilities, including reputational impact, arising from errors and omissions, breach of fiduciary duty and similar claims against us; the impact of fluctuations in exchange and interest rates on our results; the impact of our corporate tax rate relative to our competitors; the effect of our global pension obligations on our financial position, earnings and cash flows; our ability to make acquisitions and dispositions and successfully integrate the businesses we acquire; our ability to incentivize and retain key employees; and the impact of changes in accounting rules or in our accounting estimates or assumptions.

The factors identified above are not exhaustive. Marsh & McLennan Companies and its subsidiaries operate in a dynamic business environment in which new risks emerge frequently. Accordingly, we caution readers not to place reliance on any forward-looking statements, which are based only on information currently available to us and speak only as of the dates on which they are made. The Company undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made.

Further information concerning Marsh & McLennan Companies and its businesses, including information about factors that could materially affect our results of operations and financial condition, is contained in the Company's filings with the Securities and Exchange Commission, including the "Risk Factors" section and the "Management’s Discussion and Analysis of Financial Condition and Results of Operations" section of our most recently filed Annual Report on Form 10-K.

Marsh & McLennan Companies, Inc.

Consolidated Statements of Income

(In millions, except per share figures)

(Unaudited)

|

| | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | |

| | 2015 |

| | 2014 |

| | 2015 |

| | 2014 |

| |

Revenue | | $ | 3,338 |

| | $ | 3,246 |

| | $ | 12,893 |

| | $ | 12,951 |

| |

Expense: | | | | | | | | | |

Compensation and Benefits | | 1,900 |

| | 1,896 |

| | 7,334 |

| | 7,515 |

| |

Other Operating Expenses | | 844 |

| | 814 |

| | 3,140 |

| | 3,135 |

| |

Operating Expenses | | 2,744 |

| | 2,710 |

| | 10,474 |

| | 10,650 |

| |

Operating Income | | 594 |

| | 536 |

| | 2,419 |

| | 2,301 |

| |

Interest Income | | 4 |

| | 5 |

| | 13 |

| | 21 |

| |

Interest Expense | | (46 | ) | | (36 | ) | | (163 | ) | | (165 | ) | |

Cost of Extinguishment of Debt | | — |

| | (137 | ) | | — |

| | (137 | ) | |

Investment (Loss) Income | | (1 | ) | | — |

| | 38 |

| | 37 |

| |

Income Before Income Taxes | | 551 |

| | 368 |

| | 2,307 |

| | 2,057 |

| |

Income Tax Expense | | 171 |

| | 99 |

| | 671 |

| | 586 |

| |

Income from Continuing Operations | | 380 |

| | 269 |

| | 1,636 |

| | 1,471 |

| |

Discontinued Operations, Net of Tax | | 1 |

| | 30 |

| | — |

| | 26 |

| |

Net Income Before Non-Controlling Interests | | 381 |

| | 299 |

| | 1,636 |

| | 1,497 |

| |

Less: Net Income Attributable to Non-Controlling Interests | | 6 |

| | 5 |

| | 37 |

| | 32 |

| |

Net Income Attributable to the Company | | $ | 375 |

| | $ | 294 |

| | $ | 1,599 |

| | $ | 1,465 |

| |

Basic Net Income Per Share | | | | | | | | | |

- Continuing Operations | | $ | 0.72 |

| | $ | 0.49 |

| | $ | 3.01 |

| | $ | 2.64 |

| |

- Net Income Attributable to the Company | | $ | 0.72 |

| | $ | 0.54 |

| | $ | 3.01 |

| | $ | 2.69 |

| |

Diluted Net Income Per Share | | | | | | | | | |

- Continuing Operations | | $ | 0.71 |

| | $ | 0.48 |

| | $ | 2.98 |

| | $ | 2.61 |

| |

- Net Income Attributable to the Company | | $ | 0.71 |

| | $ | 0.54 |

| | $ | 2.98 |

| | $ | 2.65 |

| |

Average Number of Shares Outstanding | | | | | | | | | |

- Basic | | 522 |

| | 541 |

| | 531 |

| | 545 |

| |

- Diluted | | 527 |

| | 548 |

| | 536 |

| | 553 |

| |

Shares Outstanding at 12/31 | | 522 |

| | 540 |

| | 522 |

| | 540 |

| |

Marsh & McLennan Companies, Inc.

Supplemental Information - Revenue Analysis

Three Months Ended December 31, 2015

(Millions) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Components of Revenue Change* |

| | Three Months Ended

December 31, | | % Change GAAP Revenue | | Currency Impact | | Acquisitions/ Dispositions Impact | | Underlying Revenue |

| | 2015 |

| | 2014 |

| | | |

Risk and Insurance Services | | | | | | | | |

| | |

| | |

|

Marsh | | $ | 1,510 |

| | $ | 1,473 |

| | 3 | % | | (6 | )% | | 4 | % | | 4 | % |

Guy Carpenter | | 217 |

| | 212 |

| | 2 | % | | (3 | )% | | 1 | % | | 5 | % |

Subtotal | | 1,727 |

| | 1,685 |

| | 3 | % | | (5 | )% | | 4 | % | | 4 | % |

Fiduciary Interest Income | | 5 |

| | 6 |

| | | | | | | | |

Total Risk and Insurance Services | | 1,732 |

| | 1,691 |

| | 2 | % | | (5 | )% | | 4 | % | | 4 | % |

Consulting | | | | |

| | | | | | | | |

Mercer | | 1,140 |

| | 1,106 |

| | 3 | % | | (6 | )% | | 4 | % | | 5 | % |

Oliver Wyman Group | | 476 |

| | 460 |

| | 4 | % | | (4 | )% | | 1 | % | | 7 | % |

Total Consulting | | 1,616 |

| | 1,566 |

| | 3 | % | | (6 | )% | | 3 | % | | 5 | % |

Corporate / Eliminations | | (10 | ) | | (11 | ) | | | | | | | | |

Total Revenue | | $ | 3,338 |

| | $ | 3,246 |

| | 3 | % | | (6 | )% | | 4 | % | | 5 | % |

Revenue Details

The following table provides more detailed revenue information for certain of the components presented above:

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Components of Revenue Change* |

| | Three Months Ended

December 31, | | % Change GAAP Revenue | | Currency Impact | | Acquisitions/ Dispositions Impact | | Underlying Revenue |

| | 2015 |

| | 2014 |

| | | | |

Marsh: | | | | | | | | | | | | |

EMEA | | $ | 468 |

| | $ | 471 |

|

| (1 | )% | | (7 | )% | | 3 | % | | 3 | % |

Asia Pacific | | 156 |

| | 163 |

|

| (5 | )% | | (9 | )% | | 1 | % | | 4 | % |

Latin America | | 118 |

| | 128 |

|

| (7 | )% | | (20 | )% | | — |

| | 13 | % |

Total International | | 742 |

| | 762 |

|

| (3 | )% | | (10 | )% | | 2 | % | | 5 | % |

U.S. / Canada | | 768 |

| | 711 |

|

| 8 | % | | (2 | )% | | 6 | % | | 3 | % |

Total Marsh | | $ | 1,510 |

| | $ | 1,473 |

|

| 3 | % | | (6 | )% | | 4 | % | | 4 | % |

Mercer: | | | | |

| | | | | | | | |

Health | | $ | 389 |

| | $ | 380 |

| | 2 | % | | (3 | )% | | (2 | )% | | 8 | % |

Retirement | | 372 |

| | 343 |

| | 8 | % | | (6 | )% | | 13 | % | | 1 | % |

Investments | | 204 |

| | 214 |

| | (5 | )% | | (10 | )% | | 3 | % | | 2 | % |

Talent | | 175 |

| | 169 |

| | 3 | % | | (7 | )% | | 3 | % | | 7 | % |

Total Mercer | | $ | 1,140 |

|

| $ | 1,106 |

| | 3 | % | | (6 | )% | | 4 | % | | 5 | % |

|

|

Notes |

Underlying revenue measures the change in revenue using consistent currency exchange rates, excluding the impact of certain items that affect comparability such as: acquisitions, dispositions and transfers among businesses. The impact of the gain from the disposal of Mercer's U.S. defined contribution recordkeeping business is included in acquisitions/dispositions in Mercer's Retirement business. |

|

* Components of revenue change may not add due to rounding. |

Marsh & McLennan Companies, Inc.

Supplemental Information - Revenue Analysis

Twelve Months Ended December 31, 2015

(Millions) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Components of Revenue Change* |

| | Twelve Months Ended

December 31, | | % Change GAAP Revenue | | Currency Impact | | Acquisitions/ Dispositions Impact | | Underlying Revenue |

| | 2015 |

| | 2014 |

| | | | |

Risk and Insurance Services | | | | | | | | | | | | |

Marsh | | $ | 5,727 |

| | $ | 5,753 |

| | — |

| | (7 | )% | | 3 | % | | 3 | % |

Guy Carpenter | | 1,121 |

| | 1,154 |

| | (3 | )% | | (4 | )% | | (1 | )% | | 2 | % |

Subtotal | | 6,848 |

| | 6,907 |

| | (1 | )% | | (6 | )% | | 2 | % | | 3 | % |

Fiduciary Interest Income | | 21 |

| | 24 |

| | | | | | | | |

Total Risk and Insurance Services | | 6,869 |

| | 6,931 |

| | (1 | )% | | (6 | )% | | 2 | % | | 3 | % |

Consulting | | | | |

| | | | | | | | |

Mercer | | 4,313 |

| | 4,350 |

| | (1 | )% | | (7 | )% | | 2 | % | | 4 | % |

Oliver Wyman Group | | 1,751 |

| | 1,709 |

| | 3 | % | | (6 | )% | | 2 | % | | 7 | % |

Total Consulting | | 6,064 |

| | 6,059 |

| | — |

| | (7 | )% | | 2 | % | | 5 | % |

Corporate / Eliminations | | (40 | ) | | (39 | ) | | | | | | | | |

Total Revenue | | $ | 12,893 |

| | $ | 12,951 |

| | — |

| | (6 | )% | | 2 | % | | 4 | % |

| | | | | | | | | | | | |

Revenue Details

The following table provides more detailed revenue information for certain of the components presented above:

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Components of Revenue Change* |

| | Twelve Months Ended

December 31, | | % Change GAAP Revenue | | Currency Impact | | Acquisitions/ Dispositions Impact | | Underlying Revenue |

| | 2015 |

| | 2014 |

| | | | |

Marsh: | | | | | | | | | | | | |

EMEA | | $ | 1,848 |

| | $ | 1,980 |

| | (7 | )% | | (10 | )% | | 1 | % | | 2 | % |

Asia Pacific | | 636 |

| | 683 |

| | (7 | )% | | (10 | )% | | 1 | % | | 2 | % |

Latin America | | 380 |

| | 413 |

| | (8 | )% | | (18 | )% | | 2 | % | | 8 | % |

Total International | | 2,864 |

| | 3,076 |

| | (7 | )% | | (11 | )% | | 1 | % | | 3 | % |

U.S. / Canada | | 2,863 |

| | 2,677 |

| | 7 | % | | (1 | )% | | 5 | % | | 3 | % |

Total Marsh | | $ | 5,727 |

| | $ | 5,753 |

| | — |

| | (7 | )% | | 3 | % | | 3 | % |

Mercer: | | | | |

| | | | | | | | |

Health | | $ | 1,558 |

| | $ | 1,553 |

| | — |

| | (3 | )% | | (2 | )% | | 6 | % |

Retirement | | 1,345 |

| | 1,375 |

| | (2 | )% | | (7 | )% | | 5 | % | | — |

|

Investments | | 818 |

| | 836 |

| | (2 | )% | | (12 | )% | | 2 | % | | 7 | % |

Talent | | 592 |

| | 586 |

| | 1 | % | | (7 | )% | | 3 | % | | 5 | % |

Total Mercer | | $ | 4,313 |

| | $ | 4,350 |

| | (1 | )% | | (7 | )% | | 2 | % | | 4 | % |

| | | | | | | | | | | | |

|

|

Notes |

Underlying revenue measures the change in revenue using consistent currency exchange rates, excluding the impact of certain items that affect comparability such as: acquisitions, dispositions and transfers among businesses. The impact of the gain from the disposal of Mercer's U.S. defined contribution recordkeeping business is included in acquisitions/dispositions in Mercer's Retirement business. |

|

* Components of revenue change may not add due to rounding. |

Marsh & McLennan Companies, Inc.

Non-GAAP Measures

Three Months Ended December 31

(Millions) (Unaudited)

|

|

The Company presents below certain additional financial measures that are "non-GAAP measures," within the meaning of Regulation G under the Securities Exchange Act of 1934. These measures are: adjusted operating income (loss); adjusted operating margin; and adjusted income, net of tax. |

The Company presents these non-GAAP measures to provide investors with additional information to analyze the Company's performance from period to period. Management also uses these measures to assess performance for incentive compensation purposes and to allocate resources in managing the Company's businesses. However, investors should not consider these non-GAAP measures in isolation from, or as a substitute for, the financial information that the Company reports in accordance with GAAP. The Company's non-GAAP measures reflect subjective determinations by management, and may differ from similarly titled non-GAAP measures presented by other companies. |

|

Adjusted Operating Income (Loss) and Adjusted Operating Margin |

Adjusted operating income (loss) is calculated by excluding the impact of certain noteworthy items from the Company's GAAP operating income or loss. The following tables identify these noteworthy items and reconcile adjusted operating income (loss) to GAAP operating income or loss, on a consolidated and segment basis, for the three months ended December 31, 2015 and 2014. The following tables also present adjusted operating margin, which is calculated by dividing adjusted operating income by consolidated or segment GAAP revenue less the gain on the disposal of Mercer's U.S. defined contribution recordkeeping business. |

|

| | | | | | | | | | | | | | | | |

| | Risk & Insurance Services | | Consulting | | Corporate/ Eliminations | | Total |

Three Months Ended December 31, 2015 | | | | | | | | |

Operating income (loss) | | $ | 354 |

| | $ | 294 |

| | $ | (54 | ) | | $ | 594 |

|

Add (Deduct) impact of Noteworthy Items: | | | | | | | | |

Restructuring charges (a) | | 5 |

| | 8 |

| | 7 |

| | 20 |

|

Adjustments to acquisition related accounts (b) | | 5 |

| | — |

| | — |

| | 5 |

|

Disposal of business (c) | | — |

| | (37 | ) | | — |

| | (37 | ) |

Operating income adjustments | | 10 |

| | (29 | ) | | 7 |

| | (12 | ) |

Adjusted operating income (loss) | | $ | 364 |

| | $ | 265 |

| | $ | (47 | ) | | $ | 582 |

|

Operating margin | | 20.4 | % | | 18.2 | % | | N/A |

| | 17.8 | % |

Adjusted operating margin | | 21.1 | % | | 16.7 | % | | N/A |

| | 17.6 | % |

Three Months Ended December 31, 2014 | | |

| | |

| | |

| | |

|

Operating income (loss) | | $ | 339 |

| | $ | 250 |

| | $ | (53 | ) | | $ | 536 |

|

Add impact of Noteworthy Items: | | | | | | | | |

Restructuring charges (a) | | 1 |

| | 1 |

| | — |

| | 2 |

|

Adjustments to acquisition related accounts (b) | | 15 |

| | — |

| | — |

| | 15 |

|

Operating income adjustments | | 16 |

| | 1 |

| | — |

| | 17 |

|

Adjusted operating income (loss) | | $ | 355 |

| | $ | 251 |

| | $ | (53 | ) | | $ | 553 |

|

Operating margin | | 20.1 | % | | 16.0 | % | | N/A |

| | 16.5 | % |

Adjusted operating margin | | 21.0 | % | | 16.1 | % | | N/A |

| | 17.0 | % |

|

|

(a) Primarily severance for center led initiatives, future rent under non-cancellable leases, and integration costs related to recent acquisitions. |

(b) Primarily includes the change in fair value as measured each quarter of contingent consideration related to acquisitions. |

(c) Relates to a gain on the disposal of Mercer's U.S. defined contribution recordkeeping business. This $37 million gain is also removed from GAAP revenue in the calculation of adjusted operating margin. |

Marsh & McLennan Companies, Inc.

Non-GAAP Measures

Twelve Months Ended December 31

(Millions) (Unaudited)

|

|

The Company presents below certain additional financial measures that are "non-GAAP measures," within the meaning of Regulation G under the Securities Exchange Act of 1934. These measures are: adjusted operating income (loss); adjusted operating margin; and adjusted income, net of tax. |

The Company presents these non-GAAP measures to provide investors with additional information to analyze the Company's performance from period to period. Management also uses these measures to assess performance for incentive compensation purposes and to allocate resources in managing the Company's businesses. However, investors should not consider these non-GAAP measures in isolation from, or as a substitute for, the financial information that the Company reports in accordance with GAAP. The Company's non-GAAP measures reflect subjective determinations by management, and may differ from similarly titled non-GAAP measures presented by other companies. |

|

Adjusted Operating Income (Loss) and Adjusted Operating Margin |

Adjusted operating income (loss) is calculated by excluding the impact of certain noteworthy items from the Company's GAAP operating income or loss. The following tables identify these noteworthy items and reconcile adjusted operating income (loss) to GAAP operating income or loss, on a consolidated and segment basis, for the twelve months ended December 31, 2015 and 2014. The following tables also present adjusted operating margin, which is calculated by dividing adjusted operating income by consolidated or segment GAAP revenue less the gain on the disposal of Mercer's U.S. defined contribution recordkeeping business. |

|

| | | | | | | | | | | | | | | | |

| | Risk & Insurance Services | | Consulting | | Corporate/ Eliminations | | Total |

Twelve Months Ended December 31, 2015 | | | | | | | | |

Operating income (loss) | | $ | 1,539 |

| | $ | 1,075 |

| | $ | (195 | ) | | $ | 2,419 |

|

Add (Deduct) impact of Noteworthy Items: | | | | | | | | |

Restructuring charges (a) | | 8 |

| | 8 |

| | 12 |

| | 28 |

|

Adjustments to acquisition related accounts (b) | | 56 |

| | (5 | ) | | — |

| | 51 |

|

Disposal of business (c) | | — |

| | (37 | ) | | — |

| | (37 | ) |

Other | | — |

| | — |

| | (1 | ) | | (1 | ) |

Operating income adjustments | | 64 |

| | (34 | ) | | 11 |

| | 41 |

|

Adjusted operating income (loss) | | $ | 1,603 |

| | $ | 1,041 |

| | $ | (184 | ) | | $ | 2,460 |

|

Operating margin | | 22.4 | % | | 17.7 | % | | N/A |

| | 18.8 | % |

Adjusted operating margin | | 23.3 | % | | 17.3 | % | | N/A |

| | 19.1 | % |

Twelve Months Ended December 31, 2014 | | |

| | |

| | |

| | |

|

Operating income (loss) | | $ | 1,509 |

| | $ | 996 |

| | $ | (204 | ) | | $ | 2,301 |

|

Add impact of Noteworthy Items: | | | | | | | | |

Restructuring charges (a) | | 5 |

| | 1 |

| | 6 |

| | 12 |

|

Adjustments to acquisition related accounts (b) | | 37 |

| | — |

| | — |

| | 37 |

|

Other | | — |

| | — |

| | (1 | ) | | (1 | ) |

Operating income adjustments | | 42 |

| | 1 |

| | 5 |

| | 48 |

|

Adjusted operating income (loss) | | $ | 1,551 |

| | $ | 997 |

| | $ | (199 | ) | | $ | 2,349 |

|

Operating margin | | 21.8 | % | | 16.4 | % | | N/A |

| | 17.8 | % |

Adjusted operating margin | | 22.4 | % | | 16.5 | % | | N/A |

| | 18.1 | % |

|

|

(a) Primarily severance for center led initiatives, future rent under non-cancellable leases, and integration costs related to recent acquisitions. |

(b) Primarily includes the change in fair value as measured each quarter of contingent consideration related to acquisitions. |

(c) Relates to a gain on the disposal of Mercer's U.S. defined contribution recordkeeping business. This $37 million gain is also removed from GAAP revenue in the calculation of adjusted operating margin. |

Marsh & McLennan Companies, Inc.

Non-GAAP Measures

Three and Twelve Months Ended December 31

(Millions) (Unaudited)

|

|

Adjusted income, net of tax |

Adjusted income, net of tax is calculated as: the Company’s GAAP income from continuing operations, adjusted to reflect (i) the after-tax impact of the operating income adjustments set forth in the preceding tables and (ii) for 2014, due to its significance, the cost of extinguishment of debt of $137 million. Adjusted diluted EPS is calculated as Adjusted income, net of tax, divided by MMC's average number of shares outstanding-diluted for the relevant period.

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of the Impact of Non-GAAP Measures on diluted earnings per share - | | | | |

| | Three Months Ended December 31, 2015 | | Three Months Ended December 31, 2014 |

| | Amount | | Diluted EPS | | Amount | | Diluted EPS |

Income from continuing operations | | | | $ | 380 |

| | | | | | $ | 269 |

| | |

Less: Non-controlling interest, net of tax | | | | 6 |

| | | | | | 5 |

| | |

Subtotal | | | | $ | 374 |

| | $ | 0.71 |

| | | | $ | 264 |

| | $ | 0.48 |

|

Operating income adjustments | | $ | (12 | ) | | | | | | $ | 17 |

| | | | |

Adjustment for cost of extinguishment of debt | | — |

| | | | | | 137 |

| | | | |

Impact of income taxes | | 10 |

| | | | | | (55 | ) | | | | |

| | | | (2 | ) | | — |

| | | | 99 |

| | 0.18 |

|

Adjusted income, net of tax | | | | $ | 372 |

| | $ | 0.71 |

| | | | $ | 363 |

| | $ | 0.66 |

|

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2015 | | Twelve Months Ended December 31, 2014 |

| | Amount | | Diluted EPS | | Amount | | Diluted EPS |

Income from continuing operations | | | | $ | 1,636 |

| | | | | | $ | 1,471 |

| | |

Less: Non-controlling interest, net of tax | | | | 37 |

| | | | | | 32 |

| | |

Subtotal | | | | $ | 1,599 |

| | $ | 2.98 |

| | | | $ | 1,439 |

| | $ | 2.61 |

|

Operating income adjustments | | $ | 41 |

| | | | | | $ | 48 |

| | | | |

Adjustment for cost of extinguishment of debt | | — |

| | | | | | 137 |

| | | | |

Impact of income taxes | | (5 | ) | | | | | | (66 | ) | | | | |

| | | | 36 |

| | 0.07 |

| | | | 119 |

| | 0.21 |

|

Adjusted income, net of tax | | | | $ | 1,635 |

| | $ | 3.05 |

| | | | $ | 1,558 |

| | $ | 2.82 |

|

| | | | | | | | | | | | |

Marsh & McLennan Companies, Inc.

Supplemental Information

(Millions) (Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| | 2015 |

| | 2014 |

| | 2015 |

| | 2014 |

|

Depreciation and amortization expense | | $ | 81 |

| | $ | 77 |

| | $ | 314 |

| | $ | 302 |

|

Identified intangible amortization expense | | $ | 30 |

| | $ | 22 |

| | $ | 109 |

| | $ | 86 |

|

Stock option expense | | $ | 2 |

| | $ | 3 |

| | $ | 20 |

| | $ | 17 |

|

Capital expenditures | | $ | 76 |

| | $ | 83 |

| | $ | 325 |

| | $ | 368 |

|

Marsh & McLennan Companies, Inc.

Consolidated Balance Sheets

(Millions) (Unaudited)

|

| | | | | | | | |

| | December 31, 2015 | | December 31, 2014* |

ASSETS | | | | |

| | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 1,374 |

| | $ | 1,958 |

|

Net receivables | | 3,471 |

| | 3,377 |

|

Other current assets | | 199 |

| | 198 |

|

Total current assets | | 5,044 |

| | 5,533 |

|

| | | | |

Goodwill and intangible assets | | 8,925 |

| | 7,933 |

|

Fixed assets, net | | 773 |

| | 809 |

|

Pension related assets | | 1,159 |

| | 967 |

|

Deferred tax assets | | 1,138 |

| | 1,358 |

|

Other assets | | 1,177 |

| | 1,193 |

|

TOTAL ASSETS | | $ | 18,216 |

| | $ | 17,793 |

|

| | | | |

LIABILITIES AND EQUITY | | | | |

| | | | |

Current liabilities: | | | | |

Short-term debt | | $ | 12 |

| | $ | 11 |

|

Accounts payable and accrued liabilities | | 1,886 |

| | 1,883 |

|

Accrued compensation and employee benefits | | 1,656 |

| | 1,633 |

|

Accrued income taxes | | 154 |

| | 150 |

|

Total current liabilities | | 3,708 |

| | 3,677 |

|

| | | | |

Fiduciary liabilities | | 4,146 |

| | 4,552 |

|

Less - cash and investments held in a fiduciary capacity | | (4,146 | ) | | (4,552 | ) |

| | — |

| | — |

|

Long-term debt | | 4,402 |

| | 3,368 |

|

Pension, post-retirement and post-employment benefits | | 2,058 |

| | 2,244 |

|

Liabilities for errors and omissions | | 318 |

| | 341 |

|

Other liabilities | | 1,128 |

| | 1,030 |

|

| | | | |

Total equity | | 6,602 |

| | 7,133 |

|

TOTAL LIABILITIES AND EQUITY | | $ | 18,216 |

| | $ | 17,793 |

|

|

| | | | | |

* Amended to reflect the adoption in 2015 of new Financial Accounting Standards Board guidance related to the presentation of deferred taxes and debt issuance costs. |

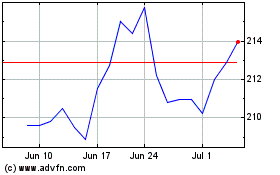

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024