As filed with the Securities and Exchange

Commission on August 7, 2015

Registration No. 333-

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

MARSH & McLENNAN COMPANIES, INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

36-2668272 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

| |

1166 Avenue of the Americas

New York, NY 10036-2774

(212) 345-5000

|

|

| (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

|

Peter J. Beshar, Esq.

Executive Vice President and General

Counsel

Marsh & McLennan Companies, Inc.

1166 Avenue of the Americas

New York, NY 10036-2774

(212) 345-5000

|

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

| |

| Copy to: |

Richard D. Truesdell, Jr.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000 |

Approximate date

of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities

being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. o

If any of the securities

being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a

registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a

post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

| Large accelerated filer x |

Accelerated filer o |

| |

|

| Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

| CALCULATION OF REGISTRATION FEE(1) |

| Title of Each Class of Securities to Be Registered |

Amount to Be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering Price |

Amount of

Registration Fee |

| Common Stock, $1.00 par value |

|

|

|

|

| Preferred Stock, $1.00 par value |

|

|

|

|

| Depositary Shares representing Preferred Stock |

|

|

|

|

| Senior Debt Securities |

|

|

|

|

| Subordinated Debt Securities |

|

|

|

|

| Warrants |

|

|

|

|

| Purchase Contracts |

|

|

|

|

| Units |

|

|

|

|

| (1) | An indeterminate amount of securities to be offered at indeterminate prices is being registered pursuant to this registration

statement. The registrant is deferring payment of the registration fee pursuant to Rule 456(b) and is omitting this information

in reliance on Rule 456(b) and Rule 457(r). |

PROSPECTUS

Marsh & McLennan Companies, Inc.

Common Stock, Preferred Stock, Depositary

Shares, Debt Securities,

Warrants, Purchase Contracts and Units

We may offer from time to time common stock,

preferred stock, depositary shares representing preferred stock, debt securities, warrants, purchase contracts or units. In addition,

certain selling securityholders may offer and sell these securities from time to time, in amounts, at prices and on terms that

will be determined at the time the securities are offered. We urge you to read this prospectus and the accompanying prospectus

supplement, which will describe the specific terms of the securities being offered, carefully before you make your investment decision.

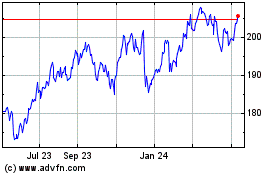

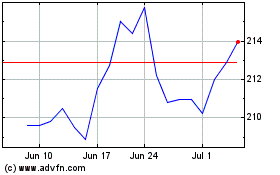

Our common stock is listed on the New York

and Chicago Stock Exchanges under the trading symbol “MMC” and on the London Stock Exchange under the trading symbol

“MHM.”

Investing in these securities involves

certain risks. See “Risk Factors” beginning on page 11 of our Annual Report on Form 10-K for the year ended December 31,

2014, which is incorporated by reference herein, as well as in any other recently filed quarterly or current reports. The prospectus

supplement applicable to each type or series of securities we offer may contain a discussion of additional risks applicable

to an investment in us and the particular type of securities we are offering under that prospectus supplement.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to sell

securities unless accompanied by a prospectus supplement.

The date of this prospectus is August

7, 2015

You should rely only on the information

contained in or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information.

We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. You should

not assume that the information contained in or incorporated by reference in this prospectus is accurate as of any date other than

the date on the front of this prospectus. The terms “the Company,” “we,” “us,” and “our”

refer to Marsh & McLennan Companies, Inc. and its subsidiaries.

Table of Contents

| |

Page |

|

| About This Prospectus |

3 |

|

| Marsh & McLennan Companies, Inc. |

3 |

|

| Use of Proceeds |

3 |

|

| Ratio of Earnings to Fixed Charges |

3 |

|

| Description of Securities |

4 |

|

| Description of Capital Stock |

4 |

|

| Depositary Shares Representing Preferred Stock |

7 |

|

| Description of Debt Securities |

7 |

|

| Description of Warrants |

17 |

|

| Description of Purchase Contracts |

17 |

|

| Description of Units |

17 |

|

| Plan of Distribution |

18 |

|

| Where You Can Find More Information |

19 |

|

| Information Concerning Forward-Looking Statements |

20 |

|

| Legal Opinions |

21 |

|

| Experts |

21 |

|

About This Prospectus

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration

process. Under this shelf process, we may sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we or any selling securityholders

sell securities pursuant to the registration statement, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add, update or change information contained or incorporated

by reference in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional

information described under the heading “Where You Can Find More Information” before deciding to invest in any of the

securities being offered.

We have filed or incorporated by reference

exhibits to the registration statement of which this prospectus forms a part. You should read the exhibits carefully for provisions

that may be important to you.

Marsh & McLennan Companies, Inc.

The Company is a global professional services

firm offering clients advice and solutions in risk, strategy and people. The Company's subsidiaries include Marsh, the insurance

broker, intermediary and risk advisor; Guy Carpenter, the risk and reinsurance specialist; Mercer, the provider of HR and related

financial advice and services; and Oliver Wyman Group, the management, economic and brand consultancy. The Company's approximately

57,000 employees worldwide provide analysis, advice and transactional capabilities to clients in over 130 countries.

Our principal offices are located at 1166

Avenue of the Americas, New York, New York 10036, and our telephone number is (212) 345-5000. We maintain a website at http://www.mmc.com,

where general information about us is available. We are not incorporating the contents of our website into this prospectus.

Use of Proceeds

Except as otherwise disclosed in a prospectus

supplement, the net proceeds from the sale of the securities by us will be used for general corporate purposes. In the case of

a sale by a selling securityholder, we will not receive any of the proceeds from such sale.

Ratio of Earnings to Fixed Charges

The following table sets forth our ratio

of earnings to fixed charges for the periods indicated.

| |

Fiscal Year Ended December 31, |

Six Months Ended June 30, |

| |

2014 |

2013 |

2012 |

2011 |

2010 |

2015 |

2014 |

| Ratio of earnings to fixed charges |

7.9 |

7.6 |

6.3 |

5.1 |

3.1 |

9.7 |

9.0 |

Description of Securities

This prospectus contains a summary of the

securities that the Company or certain selling securityholders may sell. These summaries are not meant to be a complete description

of each security. However, this prospectus and the accompanying prospectus supplement contain the material terms of the securities

being offered.

Description of Capital Stock

The following description is based upon

our restated certificate of incorporation, our amended and restated by-laws and applicable provisions of law. We have summarized

certain portions of the restated certificate of incorporation and amended and restated by-laws below. The summary is not complete.

The restated certificate of incorporation and amended and restated by-laws are incorporated by reference into this prospectus in

their entirety. You should read the restated certificate of incorporation and amended and restated by-laws for the provisions that

are important to you.

The Company's authorized capital stock

consists of 1,600,000,000 shares of common stock and 6,000,000 shares of preferred stock. As of July 24,

2015, there were 529,992,560 shares

of common stock issued and outstanding. No shares of preferred stock were issued or outstanding as of July 24, 2015.

Common Stock

Voting Rights. Each holder of common

stock is entitled to one vote for each share held on all matters to be voted upon by stockholders.

Dividends. The holders of common

stock, after any preferences of holders of any preferred stock, are entitled to receive dividends when and if declared by the board

of directors out of legally available funds.

Liquidation and Dissolution. If

the Company is liquidated or dissolved, the holders of the common stock will be entitled to share in the assets of the Company

available for distribution to stockholders in proportion to the amount of common stock they own. The amount available for common

stockholders is calculated after payment of liabilities. Holders of any preferred stock will receive their preferential share of

the assets of the Company before the holders of the common stock receive any assets.

Other rights. Holders of the common

stock have no right to:

| • | convert the stock into any other security; |

| • | have the stock redeemed; or |

| • | purchase additional stock or to maintain their proportionate ownership interest |

The common stock does not have cumulative

voting rights. Holders of shares of the common stock are not required to make additional capital contributions.

Directors' Liability

Our restated certificate of incorporation

provides that a member of the board of directors will not be personally liable to the Company or its stockholders for monetary

damages for breaches of their legal duties to the Company or its stockholders as a director, except for liability:

| • | for any breach of the director's legal duty to act in the best interests of the Company and its stockholders; |

| • | for acts or omissions by the director with dishonest intentions or which involve intentional misconduct or an intentional violation

of the law; |

| • | for declaring dividends or authorizing the purchase or redemption of shares in violation of Delaware law; or |

| • | for transactions where the director derived an improper personal benefit. |

Our restated certificate of incorporation

also allows us to indemnify directors and officers to the fullest extent authorized by Delaware law.

Transfer Agent and Registrar

Wells Fargo Bank, National Association

is transfer agent and registrar for the common stock.

Provisions of the Company's Restated Certificate of Incorporation

and Amended and Restated By-laws and Delaware Law That May Have Anti-Takeover Effects

Stockholder Nomination of Directors.

The Company's amended and restated by-laws provide that a stockholder must notify the Company in writing of any stockholder nomination

of a director not earlier than 5:00 p.m. Eastern Time on the 120th day and not later than 5:00 p.m. Eastern Time on the 90th day

prior to the first anniversary of the preceding year's annual meeting; provided, that if the date of the annual meeting is advanced

or delayed by more than 30 days from such anniversary date, notice by the stockholder to be timely must be so delivered not earlier

than 5:00 p.m. Eastern Time on the 120th day prior to the date of such annual meeting and not later than 5:00 p.m. Eastern Time

on the later of (x) the 90th day prior to the date of such annual meeting and (y) the 10th day following the day on which

public announcement of the date of such annual meeting is first made by the Company.

No Action By Written Consent. Our

restated certificate of incorporation provides that stockholders of the Company may not act by written consent and may only act

at duly called meetings of stockholders.

10% Stockholder Provision.

Article Eighth of our restated certificate of incorporation changes the voting requirements for stockholders to approve

certain transactions involving, or proposed by or on behalf of, a 10% stockholder or an affiliate or associate of a

10% stockholder. Business combinations are an example of the type of transaction addressed. These transactions must be

approved by the holders of a majority of the Company's outstanding voting power, voting together as a single class. Any

voting stock owned by a 10% stockholder is not counted in the vote. These transactions, however, can also be approved by a

majority of unbiased directors. In that case, the voting requirements of Delaware law, our restated certificate of

incorporation and our amended and restated by-laws that otherwise apply would govern the vote. Article Eighth does not affect

the voting requirements of holders of preferred stock, if any, which arise under Delaware law and the restated certificate of

incorporation.

Transactions covered by Article Eighth

include:

| • | mergers of the Company or any of its subsidiaries with a 10% stockholder, |

| • | sales of all or any substantial part of the assets of the Company and its subsidiaries to a 10% stockholder, |

| • | sales of all or any substantial part of the assets of a 10% stockholder to the Company, |

| • | the issuance or delivery of securities of the Company or any of its subsidiaries to a 10% stockholder, or of securities of

a 10% stockholder to the Company, |

| • | any substantial loan, advance or guarantee, pledge or other financial assistance provided by the Company or any of its subsidiaries

to a 10% stockholder, |

| • | the adoption of a plan for the voluntary dissolution or liquidation of the Company or amendment to the Company's amended and

restated by-laws, |

| • | any reclassification of securities or recapitalization of the Company or other transaction which increases a 10% stockholder's

proportionate share of any class of the Company's capital stock, or |

| • | any agreement or other arrangement to do any of the foregoing. |

A 10% stockholder is described in Article

Eighth as an “Interested Stockholder.” A 10% stockholder is generally considered to be any other corporation, person

or entity which:

| • | beneficially owns or controls, directly or indirectly, 10% or more of the voting stock of the Company or has announced a plan

or intention to acquire such securities, or |

| • | is an affiliate or associate of the Company and at any time within two years prior to the date in question was the beneficial

owner of 10% or more of the voting stock of the Company. |

The following are not considered to be

10% stockholders:

| • | the Company and any of its subsidiaries, and |

| • | any profit-sharing, employee stock ownership or other employee benefit plan of the Company or any subsidiary, or trustees or

fiduciaries for these plans. |

An unbiased director is described in Article

Eighth as a “Disinterested Director.” An unbiased director is generally considered to be a director who:

| • | is not related to a 10% stockholder, and was a member of the board of directors prior to the time that the relevant 10% stockholder

became a 10% stockholder, or |

| • | is a successor to an unbiased director, who is not related to a 10% stockholder and was nominated by a majority of unbiased

directors. |

A director is considered related to a 10%

stockholder if he is an affiliate, associate, representative, agent or employee of the 10% stockholder.

Any proposal by a 10% stockholder, or

by an affiliate or associate of a 10% stockholder, to change or repeal all or any part of Article Eighth requires

the affirmative vote of the holders of a majority of the Company's outstanding voting power, voting together as a single

class. Any voting stock owned by a 10% stockholder will not be counted in the vote. However, if a majority of unbiased

directors recommends a change in Article Eighth, the standard voting requirements of Delaware law, our restated certificate

of incorporation and our amended and restated by-laws that otherwise apply will govern the vote.

Delaware Business Combination Statute.

Section 203 of the General Corporation Law of the State of Delaware (the “DGCL”), is applicable to the Company.

Section 203 of the DGCL restricts some types of transactions and business combinations between a corporation and a 15% stockholder.

A 15% stockholder is generally considered by Section 203 to be a person owning 15% or more of the corporation's outstanding

voting stock. Section 203 refers to a 15% stockholder as an “interested stockholder.” Section 203 restricts

these transactions for a period of three years from the date the stockholder acquires 15% or more of the Company's outstanding

voting stock. With some exceptions, unless the transaction is approved by the board of directors and the holders of at least two-thirds

of the outstanding voting stock of the corporation, Section 203 prohibits significant business transactions such as:

| • | a merger with, disposition of significant assets to or receipt of disproportionate financial benefits by the interested stockholder,

and |

| • | any other transaction that would increase the interested stockholder's proportionate ownership of any class or series of the

Company's capital stock. |

The shares held by the interested stockholder

are not counted as outstanding when calculating the two-thirds of the outstanding voting stock needed for approval.

The prohibition against these transactions

does not apply if:

| • | prior to the time that any stockholder became an interested stockholder, the board of directors approved either the business

combination or the transaction in which such stockholder acquired 15% or more of the Company's outstanding voting stock, or |

| • | the interested stockholder owns at least 85% of the outstanding voting stock of the Company as a result of the transaction

in which such stockholder acquired 15% or more of the Company's outstanding voting |

| | stock. Shares held by persons who are both directors and officers or by some types of employee stock plans are not counted

as outstanding when making this calculation. |

Listing. Our common stock is listed

on the New York and Chicago Stock Exchanges under the trading symbol “MMC” and on the London Stock Exchange under the

trading symbol “MHM.”

Preferred Stock

General. The Company is authorized

to issue 6,000,000 shares of preferred stock. No shares of preferred stock are currently issued or outstanding. The board of directors

of the Company may, without stockholder approval, issue shares of preferred stock. The board of directors can issue more than one

series of preferred stock. The board of directors has the right to fix the number of shares, dividend rights, conversion rights,

voting rights, redemption rights, sinking fund provisions, liquidation preferences and any other rights, preferences, privileges

and restrictions applicable to the preferred stock it decides to issue.

Voting Rights. The DGCL provides

that the holders of preferred stock will have the right to vote separately as a class on any proposal involving fundamental changes

in the rights of holders of such preferred stock.

Conversion or Exchange. If we offer

preferred stock, the applicable prospectus supplement will describe the terms, if any, on which the preferred stock may be convertible

into or exchangeable for common stock, debt securities or other preferred stock of the Company. These terms will include provisions

as to whether conversion or exchange is mandatory, at the option of the holder or at the option of the Company. These provisions

may allow or require the number of shares of common stock or other securities of the Company to be received by the holders of preferred

stock to be adjusted.

Depositary Shares Representing Preferred

Stock

The applicable prospectus supplement will

include a description of the material terms of any depositary shares representing preferred stock offered hereby.

Description of Debt Securities

The debt securities will be our direct

unsecured general obligations. The debt securities will be either senior debt securities or subordinated debt securities. The debt

securities will be issued under one or more separate indentures between us and The Bank of New York Mellon, as trustee. Senior

debt securities will be issued under a senior indenture between us and The Bank of New York Mellon, as trustee, which we refer

to as the senior indenture. Subordinated debt securities will be issued under a subordinated indenture to be executed between us

and The Bank of New York Mellon, as trustee, which we refer to as the subordinated indenture. Together the senior indenture and

the subordinated indenture are called the indentures.

We have summarized all of the material

provisions of the indentures below. The senior indenture and subordinated indenture have been filed as exhibits to the registration

statement of which this prospectus forms a part, and you should read the indentures for provisions that may be important to you.

In the summary below, we have included references to section numbers of the indentures so that you can easily locate these provisions.

General

The debt securities will be our direct

unsecured general obligations. The senior debt securities will rank equally with all of our other senior and unsubordinated debt.

The subordinated debt securities will have a junior position to all of our senior debt.

Because we are a holding company that conducts

all of its operations through subsidiaries, holders of the debt securities will have a junior position to claims of creditors of

our subsidiaries, including trade creditors, debt holders, secured creditors, taxing authorities, guarantee holders and any preferred

stockholders.

The provisions of each indenture allow

us to “reopen” a previous issue of a series of debt securities and issue additional debt securities of that series.

A prospectus supplement relating to any

series of debt securities being offered will include specific terms relating to the offering. The terms will be established in

an officers' certificate or a supplemental indenture. The officers' certificate or supplemental indenture will be signed at the

time of issuance and will contain important information. The officers' certificate or supplemental indenture will be filed as an

exhibit to a Current Report on Form 8-K of the Company, which will be publicly available. The officers' certificate or supplemental

indenture will include some or all of the following terms for a particular series of debt securities:

| • | the title of the securities; |

| • | any limit on the amount that may be issued; |

| • | whether or not the debt securities will be issued in global form and who the depositary will be; |

| • | the interest rate or the method of computing the interest rate; |

| • | the date or dates from which interest will accrue, or how such date or dates will be determined, and the interest payment date

or dates and any related record dates; |

| • | the place(s) where payments will be made; |

| • | the Company's right, if any, to defer payment of interest and the maximum length of any deferral period; |

| • | the terms and conditions on which the debt securities may be redeemed at the option of the Company; |

| • | the date(s), if any, on which, and the price(s) at which the Company is obligated to redeem, or at the holder's option to purchase,

such series of debt securities and other related terms and provisions; |

| • | any provisions granting special rights to holders when a specified event occurs; |

| • | any changes to or additional events of default or covenants; |

| • | any special tax implications of the debt securities; |

| • | the denominations in which the debt securities will be issued, if other than denominations of $1,000 and whole multiples of

$1,000; |

| • | the subordination terms of any subordinated debt securities; and |

| • | any other terms that are not inconsistent with the indenture. (section 2.01) |

Fixed Rate Debt Securities

Each fixed rate debt security will mature

on the date specified in the applicable prospectus supplement.

Each fixed rate debt security will bear

interest from the date of issuance at the annual rate stated on its face until the principal is paid or made available for payment.

Interest on fixed rate debt securities will be computed on the basis of a 360-day year of twelve 30-day months. Interest on fixed

rate debt securities will accrue from and including the most recent interest payment date in respect of which interest has been

paid or duly provided for, or, if no interest has been paid or duly provided for, from and including the issue date or any other

date specified in a prospectus supplement on which interest begins to accrue. Interest will accrue to but excluding the next interest

payment date, or, if earlier, the date of maturity or earlier redemption or repayment, as the case may be.

Payments of interest on fixed rate debt

securities will be made on the interest payment dates specified in the applicable prospectus supplement. However, if the first

interest payment date is less than 15 days after the date of issuance, interest will not be paid on the first interest payment

date, but will be paid on the second interest payment date.

Unless otherwise specified in the applicable

prospectus supplement, if any scheduled interest payment date, maturity date or date of redemption or repayment is not a business

day, then we may pay the applicable interest, principal and premium, if any, on the next succeeding business day, and no additional

interest will accrue during the period from and after the scheduled interest payment date, maturity date or date of redemption

or repayment. (section 13.07)

A fixed rate debt security may pay a level

amount in respect of both interest and principal amortized over the life of the debt security. Payments of principal and interest

on amortizing debt securities will be made on the interest payment dates specified in the applicable prospectus supplement, and

at maturity or upon any earlier redemption or repayment. Payments on amortizing debt securities will be applied first to interest

due and payable and then to the reduction of the unpaid principal amount. We will provide to the original purchaser, and will furnish

to subsequent holders upon request to us, a table setting forth repayment information for each amortizing debt security.

Floating Rate Debt Securities

Each floating rate debt security will mature

on the date specified in the applicable prospectus supplement.

Unless otherwise specified in the applicable

prospectus supplement, each floating rate debt security will bear interest at “LIBOR” plus a margin to be specified

in the applicable prospectus supplement. A floating rate debt security may also have either or both of the following limitations

on the interest rate:

| • | a maximum limitation, or ceiling, on the rate of interest which may accrue during any interest period, which we refer to as

the “maximum interest rate”; and/or |

| • | a minimum limitation, or floor, on the rate of interest that may accrue during any interest period, which we refer to as the

“minimum interest rate.” |

Any applicable maximum interest rate or

minimum interest rate will be set forth in the applicable prospectus supplement.

Interest on floating rate debt securities

will accrue from and including the most recent interest payment date to which interest has been paid or duly provided for, or,

if no interest has been paid or duly provided for, from and including the issue date or any other date specified in a prospectus

supplement on which interest begins to accrue. Interest will accrue to but excluding the next interest payment date, or, if earlier,

the date on which the principal has been paid or duly made available for payment, except as described below.

The interest rate in effect from the date

of issue to the first interest reset date for a floating rate debt security will be the initial interest rate specified in the

applicable prospectus supplement. We refer to this rate as the “initial interest rate.” The interest rate on each floating

rate debt security may be reset daily, weekly, monthly, quarterly, semiannually or annually. This period is the “interest

reset period” and the first day of each interest reset period is the “interest reset date.” The “interest

determination date” for any interest reset date is the day the calculation agent will refer to when determining the new interest

rate at which a floating rate will reset.

“LIBOR” for each interest reset

date, other than for the initial interest rate, will be determined by the calculation agent as follows:

| i. | LIBOR will be the offered rate for deposits in U.S. dollars for the three month period which appears on “Telerate Page

3750” at approximately 11:00 a.m., London time, two “London banking days” prior to the applicable interest reset

date. |

| ii. | If this rate does not appear on the Telerate Page 3750, the calculation agent will determine the rate on the basis of the rates

at which deposits in U.S. dollars are offered by four major banks in the London interbank market (selected by the calculation agent

after consulting with us) at approximately 11:00 a.m., London time, two London banking days prior to the applicable interest reset

date to prime banks in the London interbank market for a period of three months commencing on that interest reset date and in principal

amount equal to an amount not less than $1,000,000 that is representative for a single transaction in such market at such time.

In such case, the calculation agent will request the principal London office of each of the aforesaid major banks to provide a

quotation of such rate. If at least two such quotations are provided, LIBOR for that interest reset date will be the average of

the quotations. If fewer than two quotations are provided as requested, LIBOR for that interest reset date will be the average

of the rates quoted by three major banks in New York, New York (selected by the calculation agent after consulting with us) at

approximately 11:00 a.m., New York time, two London banking days prior to the applicable interest reset date for loans in U.S.

dollars to leading banks for a period of three months commencing on that interest reset date and in a principal amount equal to

an amount not less than $1,000,000 that is representative for a single transaction in such market at such time; provided that if

fewer than three quotations are provided as requested, for the period until the next interest reset date, LIBOR will be the same

as the rate determined on the immediately preceding interest reset date. |

The interest reset dates will be specified

in the applicable prospectus supplement. If an interest reset date for any floating rate debt security falls on a day that is not

a business day, it will be postponed to the following business day, except that, if that business day is in the next calendar month,

the interest reset date will be the immediately preceding business day.

A “London banking day” is any

day in which dealings in U.S. dollar deposits are transacted in the London interbank market. “Telerate Page 3750” means

the display page so designated on the Telerate Service for the purpose of displaying London interbank offered rates of major banks

(or any successor page).

The applicable prospectus supplement will

specify a calculation agent for any issue of floating rate debt securities. The calculation agent will, upon the request of the

holder of any floating rate debt security, provide the interest rate then in effect. All calculations made by the calculation agent

in the absence of willful misconduct, bad faith or manifest error shall be conclusive for all purposes and binding on us and the

holders of the floating rate debt securities. We may appoint a successor calculation agent at any time at our discretion and without

notice.

All percentages resulting from any calculation

of the interest rate with respect to the floating rate debt securities will be rounded, if necessary, to the nearest one-hundred

thousandth of a percentage point, with five one-millionths of a percentage point rounded upward (e.g., 9.876545% (or .09876545)

would be rounded to 9.87655% (or .0987655) and 9.876544% (or .09876544) would be rounded to 9.87654% (or .0987654)), and all dollar

amounts in or resulting from any such calculation will be rounded to the nearest cent (with one-half cent being rounded upward).

Interest on the floating rate debt securities

will be computed and paid on the basis of a 360-day year and the actual number of days in each interest payment period. The interest

rate on the floating rate debt securities will in no event be higher than the maximum rate permitted by New York law, as the same

may be modified by United States law of general application.

We will pay interest on floating rate debt

securities on the interest payment dates specified in the applicable prospectus supplement. However, if the first interest payment

date is less than 15 days after the date of issuance, interest will not be paid on the first interest payment date, but will be

paid on the second interest payment date. If

any scheduled interest payment date, other than the maturity

date or any earlier redemption or repayment date, for any floating rate debt security falls on a day that is not a business day,

it will be postponed to the following business day, except that if that business day would fall in the next calendar month, the

interest payment date will be the immediately preceding business day. If the scheduled maturity date or any earlier redemption

or repayment date of a floating rate debt security falls on a day that is not a business day, the payment of principal, premium,

if any, and interest, if any, will be made on the next succeeding business day, but interest on that payment will not accrue during

the period from and after the maturity, redemption or repayment date.

Conversion or Exchange Rights

The prospectus supplement will describe

the terms, if any, on which a series of debt securities may be convertible into or exchangeable for our common stock, preferred

stock, debt securities or other securities, or securities of third parties. These terms will include provisions as to whether conversion

or exchange is mandatory, at the option of the holder or at the option of the Company. These provisions may allow or require adjustment

of the number of shares of common stock or other securities of the Company to be received by the holders of such series of debt

securities. (section 2.01)

Optional Redemption

Unless the prospectus supplement relating

to any series of debt securities provides otherwise with respect to such series, each series of debt securities will be redeemable

in whole at any time or in part from time to time, at our option, at a redemption price equal to the greater of:

| • | 100% of the principal amount of the series of debt securities to be redeemed; or |

| • | the sum of the present values of the remaining scheduled payments of principal and interest on the series of debt securities

to be redeemed (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis

(assuming a 360-day year consisting of twelve 30-day months) at the then current Treasury Rate plus a spread as specified in the

applicable prospectus supplement. |

In each case we will pay accrued and unpaid

interest on the principal amount to be redeemed to the date of redemption.

“Comparable Treasury Issue”

means the United States Treasury security selected by the Independent Investment Banker as having a maturity comparable to the

remaining term (“Remaining Life”) of the series of debt securities to be redeemed that would be utilized, at the time

of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable

maturity to the remaining term of such series of debt securities.

“Comparable Treasury Price”

means, with respect to any redemption date, (1) the average of the Reference Treasury Dealer Quotations for such redemption

date, after excluding the highest and lowest Reference Treasury Dealer Quotations, or (2) if the Independent Investment Banker

obtains fewer than four such Reference Treasury Dealer Quotations, the average of all such quotations.

“Independent Investment Banker”

means the investment banking institution or institutions specified in the applicable prospectus supplement and their respective

successors, or, if such firms or the successors, if any, to such firm or firms, as the case may be, are unwilling or unable to

select the Comparable Treasury Issue, an independent investment banking institution of national standing appointed by us.

“Reference Treasury Dealer”

means the investment banking institutions specified as such in the applicable prospectus supplement; provided, however, that if

any of them ceases to be a primary U.S. Government securities dealers (each a “Primary Treasury Dealer”), we will substitute

another Primary Treasury Dealer.

“Reference Treasury Dealer Quotations”

means, with respect to each Reference Treasury Dealer and any redemption date, the average, as determined by the Independent Investment

Banker, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal

amount) quoted in writing to the Independent Investment Banker by such Reference Treasury Dealer at 5:00 p.m., New York City time,

on the third business day preceding such redemption date.

“Treasury Rate” means, with

respect to any redemption date, the rate per year equal to:

| i. | the yield, under the heading which represents the average for the immediately preceding week, appearing in the most recently

published statistical release designated “H.15(519)” or any successor publication which is published weekly by the

Board of Governors of the Federal Reserve System and which establishes yields on actively traded United States Treasury securities

adjusted to constant maturity under the caption “Treasury Constant Maturities,” for the maturity corresponding to the

Comparable Treasury Issue; provided that, if no maturity is within three months before or after the remaining life of the series

of debt securities to be redeemed, yields for the two published maturities most closely corresponding to the Comparable Treasury

Issue shall be determined and the Treasury Rate shall be interpolated or extrapolated from those yields on a straight line basis,

rounding to the nearest month; or |

| ii. | if such release (or any successor release) is not published during the week preceding the calculation date or does not contain

such yields, the rate per year equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, calculated

using a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury

Price for such redemption date. |

The Treasury Rate will be calculated on

the third business day preceding the redemption date. As used in the immediately preceding sentence and in the definition of “Reference

Treasury Dealer Quotations” above, the term “business day” means any day that is not a Saturday, Sunday or other

day on which commercial banks in New York City are authorized or required by law to remain closed.

Notice of any redemption will be mailed

at least 30 but not more than 90 days before the redemption date to each holder of record of the series of debt securities to be

redeemed at its registered address. The notice of redemption will state, among other things, the amount of the series of debt securities

to be redeemed, the redemption date, the manner in which the redemption price will be calculated and the place or places that payment

will be made upon presentation and surrender of the series of debt securities to be redeemed. If less than all of a series of debt

securities are to be redeemed at our option, the trustee will select, in a manner it deems fair and appropriate, the debt securities

of that series, or portions of the debt securities of that series, to be redeemed. Unless we default in the payment of the redemption

price with respect to any debt securities called for redemption, interest will cease to accrue on such debt securities at the redemption

date. (sections 3.02 and 3.03)

The Company will not be required (i) to

issue, register the transfer of or exchange any series of debt securities during a period beginning at the opening of business

15 days before the day of mailing of a notice of redemption and ending at the close of business on the day of such mailing, or

(ii) to register the transfer of or exchange any debt securities of any series so selected for redemption in whole or in part,

except the unredeemed portion of any such series of debt securities being redeemed in part. (section 2.05)

Covenants

Under the indentures, the Company agrees

to pay the interest, principal and any premium on the debt securities when due (section 4.01), and to maintain a place of payment

(section 4.02). In addition, we must comply with the covenants described below:

Limitation on Liens on Stock of our

Significant Subsidiaries. The indentures prohibit us and our subsidiaries from directly or indirectly creating, assuming, incurring

or permitting to exist any Indebtedness secured by any lien

on the voting stock or voting equity interest of Marsh Inc.

or Mercer Inc. (each a “Significant Subsidiary”) unless the debt securities then outstanding (and, if we so elect,

any other Indebtedness of the Company that is not subordinate to such debt securities and with respect to which we are obligated

to provide such security) are secured equally and ratably with such Indebtedness for so long as such Indebtedness is so secured.

“Indebtedness” is defined as the principal of and any premium and interest due on indebtedness of a person (as defined

in the indentures), whether outstanding on the original date of issuance of a series of debt securities or thereafter created,

incurred or assumed, which is (a) indebtedness for money borrowed, and (b) any amendments, renewals, extensions, modifications

and refundings of any such indebtedness. For the purposes of this definition, “indebtedness for money borrowed” means

(1) any obligation of, or any obligation guaranteed by, such person for the repayment of borrowed money, whether or not evidenced

by bonds, debentures, notes or other written instruments, (2) any obligation of, or any obligation guaranteed by, such person

evidenced by bonds, debentures, notes or similar written instruments, including obligations assumed or incurred in connection with

the acquisition of property, assets or businesses (provided, however, that the deferred purchase price of any business or property

or assets shall not be considered Indebtedness if the purchase price thereof is payable in full within 90 days from the date on

which such indebtedness was created), and (3) any obligations of such person as lessee under leases required to be capitalized

on the balance sheet of the lessee under generally accepted accounting principles and leases of property or assets made as part

of any sale and lease-back transaction to which such person is a party. For purposes of this covenant only, Indebtedness also includes

any obligation of, or any obligation guaranteed by, any person for the payment of amounts due under a swap agreement or similar

instrument or agreement, or under a foreign currency hedge or similar instrument or agreement. If we are required to secure outstanding

debt securities equally and ratably with other Indebtedness under this covenant, we will be required to document our compliance

with the covenant and thereafter the trustee will be authorized to enter into a supplemental agreement or indenture and to take

such action as it may deem advisable to enable it to enforce the rights of the holders of the outstanding debt securities so secured.

(section 4.06)

Provision of Compliance Certificate.

We are required under the indentures to deliver to the trustee within 120 days after the end of each fiscal year an officer's certificate

certifying as to our compliance with all conditions and covenants under the relevant indenture, or if we are not in compliance,

identifying and describing the nature and status of such non-compliance. (section 4.08)

Consolidation, Merger or Sale

The indentures do not restrict the ability

of the Company to merge or consolidate, or sell, convey, transfer or lease all or substantially all of its assets as long as certain

conditions are met. We may only merge or consolidate with, or convey, transfer or lease all of our assets to, any person, if doing

so will not result in an event of default. Any such successor, acquiror or lessor of such assets must expressly assume all of the

obligations of the Company under the indentures and the debt securities and will succeed to every right and power of the Company

under the indentures. Thereafter, except in the case of a lease, the predecessor or transferor of such assets will be relieved

of all obligations and covenants under the relevant indenture and debt securities. (sections 10.01 and 10.02)

Events of Default Under the Indentures

The following are events of default under

the indentures with respect to any series of debt securities issued:

| • | we fail to pay interest when due and such failure continues for 90 days, unless the time for payment has been properly extended

or deferred in accordance with the terms of the particular series; |

| • | we fail to pay the principal or any premium when due, unless the maturity has been properly extended in accordance with the

terms of the particular series; |

| • | we fail to observe or perform any other covenant or agreement contained in the debt securities or the indentures, other than

a covenant or agreement specifically relating to another series of debt securities, and such failure continues for 90 days after

we receive a notice of default from the trustee or from the holders of at least 25% in aggregate principal amount of the outstanding

debt securities of all of the affected series; |

| • | certain events of bankruptcy or insolvency, whether voluntary or not; and |

| • | any additional events of default that may be established with respect to a particular series of debt securities under the indentures,

as may be specified in the applicable prospectus supplement. (section 6.01) |

If, with regard to any series, an event

of default resulting from a failure to pay principal, any premium or interest occurs and is continuing, the trustee or the holders

of at least 25% in aggregate principal amount of the outstanding debt securities of that series may declare the principal of all

debt securities of that series immediately due and payable. (section 6.01)

If an event of default other than a failure

to pay principal, any premium or interest occurs and is continuing, the trustee or the holders of at least 25% in aggregate principal

amount of the outstanding debt securities of all affected series (all such series voting together as a single class) may declare

the principal of all debt securities of such affected series immediately due and payable. (section 6.01)

The holders of a majority in principal

amount of the outstanding debt securities of all affected series (voting together as a single class) may waive any past default

with respect to such series and its consequences, except a default or events of default regarding payment of principal, any premium

or interest, in which case the holders of the outstanding debt securities of each affected series shall vote to waive such default

or event of default as a separate class. Such a waiver will eliminate the default. (section 6.06)

Unless otherwise specified in the indentures,

if an event of default occurs and is continuing, the trustee will be under no obligation to exercise any of its rights or powers

under the relevant indenture unless the holders of the debt securities have offered the trustee reasonable indemnity satisfactory

to the trustee against the costs, expenses and liabilities that it might incur. The holders of a majority in principal amount of

the outstanding debt securities of all series affected by an event of default, voting together as a single class, or, in the event

of a default in the payment of principal, any premium or interest, the holders of a majority of the principal amount outstanding

of each affected series voting as a separate class, will have the right to direct the time, method and place of conducting any

proceeding for any remedy available to the trustee, or exercising any trust or power conferred on the trustee with respect to the

debt securities of such series, provided that:

| • | such direction is not in conflict with any law or the applicable indenture or unduly prejudicial to the rights of holders of

any other series of debt securities outstanding under the applicable indenture; and |

| • | unless otherwise provided under the Trust Indenture Act, the trustee need not take any action that might involve it in personal

liability. (section 6.06) |

A holder of the debt securities of a particular

series will only have the right to institute a proceeding under the indentures or to appoint a receiver or trustee, or to seek

other remedies, in each case with respect to such series of debt securities, if:

| • | the holder has given written notice to the trustee of a continuing event of default; |

| • | in the case of an event of default relating to the payment of principal, any premium or interest, the holders of at least 25%

in aggregate principal amount of the outstanding debt securities of the particular series have made written request to the trustee

to institute proceedings as trustee; |

| • | in the case of an event of default not relating to payment of principal, any premium or interest, the holders of at least 25%

in aggregate principal amount of the outstanding debt securities of all series affected by such event of default (voting together

as a single class) have made written request to the trustee to institute proceedings as trustee; |

| • | such holders have offered the trustee such reasonable indemnity as the trustee may require to cover the cost of the proceedings;

and |

| • | the trustee does not institute a proceeding, and does not receive conflicting directions from a majority in principal amount

of the outstanding debt securities of (i) the particular series, in the case of an event of default relating to the payment

of principal, any premium or interest or (ii) all affected series, in the case of |

| | an event of default not relating to the payment of principal, any premium or interest, in each case, within 60 days of receiving

the written notice of an event of default. (section 6.04) |

Modification of Indenture; Waiver

Without the consent of any holders of debt

securities, the Company and the trustee may change an indenture:

| • | to fix any ambiguity, defect or inconsistency in the indenture; |

| • | to effect the assumption of a successor corporation of our obligations under such indenture and the outstanding debt securities; |

| • | to add to our covenants for the benefit of the holders of all or any series of debt securities under such indenture or surrender

any right or power we have under such indenture; |

| • | to change anything that does not materially adversely affect the interests of any holder of debt securities of any series;

and |

| • | to effect certain other limited purposes described in the indenture. (section 9.01) |

The rights of holders of a series of debt

securities may be changed by the Company and the trustee with the written consent of the holders of a majority of the principal

amount of the outstanding debt securities of all series then outstanding under the relevant indenture (all such series voting together

as a single class). However, the following changes may only be made with the consent of each holder of debt securities of each

series affected by the change:

| • | extending the fixed maturity; |

| • | reducing the principal amount; |

| • | reducing the rate of or extending the time of payment of interest; |

| • | reducing any premium payable upon redemption; |

| • | reducing the percentage of debt securities referred to above, the holders of which are required to consent to any amendment;

or |

| • | in respect of the subordinated indenture, making any change to the subordination terms of any debt security that would adversely

affect the holders of the debt securities of that series. (section 9.02) |

Form, Exchange, and Transfer

The debt securities of each series will

be issued only in fully registered form without coupons in denominations of $1,000 and whole multiples of $1,000 in excess thereof.

The indentures provide that debt securities of a series may be issued in temporary or permanent global form and may be issued as

book-entry securities that will be deposited with The Depository Trust Company or another depositary named by the Company and identified

in a prospectus supplement with respect to such series. (sections 2.03, 2.06 and 2.11)

A holder of debt securities of any series

can exchange such debt securities for other debt securities of the same series, in any authorized denomination and with the same

terms and aggregate principal amount. A holder may present debt securities for exchange or for registration of transfer at the

office of the security registrar or at the office of any transfer agent designated by the Company for such purpose. Unless otherwise

provided in the debt securities to be transferred or exchanged, no service charge will be made for any registration of transfer

or exchange, but the Company may require payment of any related taxes or other governmental charges. The prospectus supplement

will name the security registrar and any transfer agent initially designated for any series of debt securities. The Company may

at any time change the transfer agent by written notice delivered to the trustee. (section 2.05)

If the debt securities of any series are

to be redeemed, the Company will not be required to:

| • | issue, register the transfer of, or exchange any debt securities of that series during a period beginning 15 days before the

day of mailing of a notice of redemption and ending at the close of business on the day of mailing; or |

| • | register the transfer of or exchange any debt securities of a series, or a portion of a series, that has been called for redemption.

(section 2.05) |

Rights and Duties of the Trustee

The trustee, except when there is an event

of default, will perform only those duties as are specifically stated in the indentures. If an event of default has occurred with

respect to any series of debt securities, the trustee must exercise with respect to such debt securities the rights and powers

it has under the indenture and use the same degree of care and skill as a prudent person would exercise or use in the conduct of

his or her own affairs. Except as provided in the preceding sentence, the trustee is not required to exercise any of the powers

given it by the indentures at the request of any holder of debt securities unless it is offered reasonable security or indemnity

satisfactory to it against the costs, expenses and liabilities that it might incur. The trustee is not required to spend or risk

its own money or otherwise become financially liable while performing its duties or exercising its rights or powers unless it reasonably

believes that it will be repaid or receive adequate indemnity. The trustee will not be deemed to have any notice of any default

or event of default unless a responsible officer of the trustee has actual knowledge of or receives written notice of the default

which specifies the affected securities and the relevant indenture. Furthermore, the rights and protections of the trustee, including

its right of indemnification under the indentures, extend to the trustee's officers, directors, agents and employees, and will

survive the trustee's resignation and removal. (sections 7.01 and 7.02)

Payment and Paying Agents

We will pay interest on any debt securities

to the person in whose name the debt securities are registered on the regular record date for the applicable interest payment date.

(section 2.03)

We will pay principal, any premium and

interest on the debt securities of a particular series at the office of one or more paying agents that we designate for that series.

Unless otherwise stated in the applicable supplemental indenture and prospectus supplement, we will initially designate the corporate

trust office of the trustee in the City of New York as our sole paying agent. We will be required to maintain a paying agent in

each place of payment for the debt securities. (sections 4.01, 4.02 and 4.03)

All money we pay to a paying agent or the

trustee for the payment of principal, any premium or interest on any debt security which remains unclaimed for a period of two

years after the principal, premium or interest has become due and payable will, upon our request, be repaid to us, and the holder

of the debt security may then look only to us for payment of those amounts. (section 11.05)

Governing Law

The indentures and the debt securities

will be governed by and interpreted in accordance with the laws of the State of New York. (section 13.05)

Subordination of Subordinated Debt Securities

The subordinated debt securities will be

unsecured and will be subordinate and junior in priority of payment to our other indebtedness on the terms described in the prospectus

supplement relating to such securities. The

subordinated indenture does not limit the amount of subordinated

debt securities which we may issue, nor does it limit our ability to issue any other secured or unsecured debt. (sections 6.03

and 14.01)

The prospectus supplement relating to any

series of subordinated debt securities will disclose the amount of debt of the Company that will be senior to those subordinated

debt securities.

Description of Warrants

The applicable prospectus supplement will

include a description of the material terms of any warrants offered hereby.

Description of Purchase Contracts

The applicable prospectus supplement will

include a description of the material terms of any purchase contracts offered hereby.

Description of Units

The applicable prospectus supplement will

include a description of the material terms of any units offered hereby.

Plan of Distribution

The Company and/or the selling securityholders,

if applicable, may sell the securities in one or more of the following ways (or in any combination) from time to time:

| • | through underwriters or dealers; |

| • | directly to a limited number of purchasers or to a single purchaser; |

| • | through a combination of any such methods; or |

| • | through any other methods described in a prospectus supplement. |

The applicable prospectus supplement will

state the terms of the offering of the securities, including:

| • | the name or names of any underwriters, dealers or agents; |

| • | the purchase price of such securities and the proceeds to be received by the Company, if any; |

| • | any initial public offering price; |

| • | any underwriting discounts or agency fees and other items constituting underwriters' or agents' compensation; |

| • | any discounts or concessions allowed or reallowed or paid to dealers; and |

| • | any securities exchanges on which the securities may be listed. |

Any initial public offering price and any

discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

If we and/or the selling securityholders,

if applicable, use underwriters in the sale, the securities will be acquired by the underwriters for their own account and may

be resold from time to time in one or more transactions, including:

| • | negotiated transactions; |

| • | at a fixed public offering price or prices, which may be changed; |

| • | at market prices prevailing at the time of sale; |

| • | at prices related to prevailing market prices; or |

Unless otherwise stated in a prospectus

supplement, the obligations of the underwriters to purchase any securities will be conditioned on customary closing conditions

and the underwriters will be obligated to purchase all securities of a series, if any are purchased.

We and/or the selling securityholders,

if applicable, may sell the securities through agents from time to time. The prospectus supplement will name any agent involved

in the offer or sale of the securities and any commissions we pay to them. Generally, any agent will be acting on a best efforts

basis for the period of its appointment.

We and/or the selling securityholders,

if applicable, may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the securities

from the Company and/or the selling securityholders, if applicable, at the public offering price set forth in the prospectus supplement

pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts will

be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions

paid for solicitation of these contracts.

Underwriters and agents may be entitled

under agreements entered into with the Company and/or the selling securityholders, if applicable, to indemnification by the Company

and/or the selling securityholders, if applicable, against certain civil liabilities, including liabilities under the Securities

Act of 1933, as amended, or to contribution with respect to payments which the underwriters or agents may be required to make.

Underwriters and agents may

be customers of, engage in transactions with, or perform services

for the Company and its affiliates in the ordinary course of business.

Each series of securities will be a new

issue of securities and will have no established trading market other than the common stock, which is listed on the New York, Chicago

and London Stock Exchanges. Any underwriters to whom securities are sold for public offering and sale may make a market in the

securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

The securities, other than the common stock, may or may not be listed on a national securities exchange.

Where You Can Find More Information

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. You may read and copy any document that we file at the Public Reference Room

of the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room

by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site at http://www.sec.gov, from which interested

persons can electronically access our SEC filings, including the registration statement of which this prospectus forms a part and

the exhibits and schedules thereto.

The SEC allows us to “incorporate

by reference” in this prospectus certain documents we file with the SEC, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus,

and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference

into this prospectus the documents listed below, which are all filings we have made pursuant to Sections 13(a), 13(c), 14 or 15(d) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of the date of the filing of the registration

statement of which this prospectus forms a part:

| • | Annual Report on Form 10-K for the year ended December 31, 2014, including information specifically incorporated by reference

therein from our Proxy Statement for the 2015 Annual Meeting of Stockholders; |

| • | Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2015 and June 30, 2015; and |

| • | Current Reports on Form 8-K filed on March 6, 2015, March 19, 2015, May 7, 2015 and May 26, 2015. |

With respect to each offering of securities

under this prospectus, we also incorporate by reference all documents subsequently filed with the SEC pursuant to Sections 13(a),

13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offerings of all of the securities covered by this prospectus.

The Company will provide without charge,

upon written or oral request, a copy of any or all of the documents which are incorporated by reference in this prospectus. Requests

should be directed to Investor Relations, Marsh & McLennan Companies, Inc., 1166 Avenue of the Americas, New York, New

York 10036-2774 (telephone number (212) 345-5000).

Information Concerning Forward-Looking

Statements

This prospectus and documents incorporated

by reference in this prospectus contain “forward-looking statements,” as defined in the Private Securities Litigation

Reform Act of 1995. These statements, which express management's current views concerning future events or results, use words like

“anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,”

“future,” “intend,” “plan,” “project” and similar terms, and future or conditional

tense verbs like “could,” “may,” “might,” “should,” “will” and “would.”

For example, we may use forward-looking statements when addressing topics such as: the outcome of contingencies; the expected impact

of acquisitions and dispositions; the impact of competition; pension obligations; the impact of foreign currency exchange rates;

our effective tax rates; changes in our business strategies and methods of generating revenue; the development and performance

of our services and products; changes in the composition or level of our revenues; our cost structure, dividend policy, cash flow

and liquidity; future actions by regulators; and the impact of changes in accounting rules.

Forward-looking statements are subject to

inherent risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied

in our forward-looking statements include, among other things:

| • | our ability to maintain adequate safeguards to protect the security of confidential, personal or proprietary information, and

the potential for the improper disclosure or use of such information, whether due to human error, improper action by employees,

vendors or third parties, or as a result of a cyberattack; |

| • | the impact of competition on our business, including the impact of our corporate tax rate, which is higher than the tax rate

of our international competitors; |

| • | the impact of fluctuations in foreign currency exchange rates, particularly in light of the recent strengthening of the U.S.

dollar against most other currencies worldwide; |

| • | the impact on our global pension obligations of changes in discount rates and asset returns, as well as projected salary increases,

mortality rates, demographics, and inflation, and the impact of cash contributions required to be made to our global defined benefit

pension plans due to changes in the funded status of those plans; |

| • | our exposure to potential liabilities arising from errors and omissions claims against us; |

| • | our exposure to potential civil remedies or criminal penalties if we fail to comply with foreign and U.S. laws that are applicable

in the domestic and international jurisdictions in which we operate; |

| • | the extent to which we are able to retain existing clients and attract new business, and our ability to effectively incentivize

and retain key employees; |

| • | our ability to make acquisitions and dispositions and to integrate, and realize expected synergies, savings or benefits from,

the businesses we acquire; |

| • | our ability to successfully recover should we experience a disaster or other business continuity problem; |

| • | the impact of changes in interest rates and deterioration of counterparty credit quality on our cash balances and the performance

of our investment portfolios; |

| • | the impact of potential rating agency actions on our cost of financing and ability to borrow, as well as on our operating costs

and competitive position; |

| • | changes in applicable tax or accounting requirements; and |

| • | potential income statement effects from the application of FASB's ASC Topic No. 740 (“Income Taxes”) regarding

accounting treatment of uncertain tax benefits and valuation allowances, including the effect of any subsequent adjustments to

the estimates we use in applying this accounting standard. |

The factors identified above are not exhaustive. The Company

and its subsidiaries operate in a dynamic business environment in which new risks may emerge frequently. Accordingly, we caution

readers not to place undue reliance

on any forward-looking statements, which are based only on information

currently available to us and speak only as of the dates on which they are made. The Company undertakes no obligation to update

or revise any forward-looking statement to reflect events or circumstances arising after the date on which it is made. Further

information concerning the Company and its businesses, including information about factors that could materially affect our results

of operations and financial condition, is contained in the Company's filings with the SEC, including the “Risk Factors”

section and the “Management's Discussion and Analysis of Financial Condition and Results of Operations” section of

our most recently filed Annual Report on Form 10-K.

Legal Opinions

The validity of the securities in respect

of which this prospectus is being delivered will be passed on for us by Davis Polk & Wardwell LLP, New York, New York.

Experts

The consolidated financial statements,

incorporated in this Prospectus by reference from the Company's Annual Report on Form 10-K, and the effectiveness of Marsh &

McLennan Companies, Inc.'s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent

registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial

statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting

and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs

and expenses to be borne by the Company in connection with the offerings described in this registration statement.

| Registration fee |

$ * |

| Transfer Agent and Trustee fees and expenses |

$ ** |

| Printing |

$ ** |

| Accounting fees and expenses |

$ ** |

| Legal fees and expenses |

$ ** |

| Rating Agency fees |

$ ** |

| Miscellaneous |

$ ** |

| Total |

$ ** |

* Omitted because the registration fee is being deferred pursuant

to Rule 456(b).

** Not presently known.

Item 15. Indemnification of Directors and Officers.

Section 145 of the General Corporation

Law of the State of Delaware (the “DGCL”) provides that a corporation may indemnify directors and officers, as well