Mercer Launches the Mercer Pension Risk ExchangeSM – Innovative Solution to Streamline and Support Buyout Process

June 09 2015 - 10:12AM

Business Wire

First-of-its-kind platform to provide

enhanced price transparency and liquidity to group annuity

market

Mercer, a global consulting leader in advancing health, wealth

and careers, and a wholly-owned subsidiary of Marsh & McLennan

Companies (NYSE: MMC), today announced the launch of the Mercer

Pension Risk ExchangeSM (the “exchange”).The exchange is a

groundbreaking solution that helps plan sponsors execute group

annuity buyouts in a shorter timeframe and in a more competitive

pricing environment. As the first platform of its kind, the

exchange increases liquidity and price transparency by enabling

plan sponsors to continuously monitor pricing and contract terms

available in the group annuity market. The exchange also provides

sponsors with greater exposure to a wider array of insurers that

could potentially act as transactional counterparts for a

buyout.

“Market pricing changes continuously based on interest rates and

insurers’ needs. The way to really know when the market is moving

in a direction favorable to the sponsor is to monitor prices

specifically for their plan. The exchange creates the platform for

sponsors to do exactly this,” said Jacques Goulet, President of

Mercer's Retirement, Health, and Benefits business.

The exchange provides real-time online annuity pricing and

trigger monitoring, combining a suite of buyout advisory and

execution services. These include:

- Deal

readiness: streamlining the process by creating an industry

standard for data preparation and document specification.

- Dynamic

monitoring: monitoring prices and metrics in real time to

identify when conditions are optimal to execute.

- Execution

support: providing comprehensive support to sponsors and

fiduciaries to help navigate the complexities of the buyout

execution – ranging from insurer due diligence and asset

preparation through to contract negotiation.

“Though sponsors’ appetite to transfer pension risk is high,

they face some barriers to execution. Lack of clear information

about the true cost of a buyout, limited transparency and the

fluctuation of market rates and plan dynamics are all major

challenges,” said Phil de Cristo, president and group executive of

Mercer’s investment business. “We wanted to empower plan sponsors

to be more strategic and sophisticated in their approach and to

execute buyouts at the best times and at competitive prices. The

exchange offers a significant advantage to sponsors considering a

buyout.”

Notes for editors:

Mercer will conduct a webcast on Wednesday, June 24, 2015 at 2pm

EDT/1pm CDT/12pm MDT/11am PDT. Link to register for the webcast can

be found here: http://ow.ly/NVKAT

About Mercer

Mercer is a global consulting leader in talent, health,

retirement and investments. Mercer helps clients around the world

advance the health, wealth and performance of their most vital

asset – their people. Mercer’s more than 20,000 employees are based

in more than 40 countries and the firm operates in over 130

countries. Mercer is a wholly owned subsidiary of Marsh &

McLennan Companies (NYSE: MMC), a global professional services firm

offering clients advice and solutions in the areas of risk,

strategy and people. With 57,000 employees worldwide and annual

revenue exceeding $13 billion, Marsh & McLennan Companies is

also the parent company of Marsh, a leader in insurance broking and

risk management; Guy Carpenter, a leader in providing risk and

reinsurance intermediary services; and Oliver Wyman, a leader in

management consulting. For more information, visit www.mercer.com.

Follow Mercer on Twitter @MercerInsights.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150609006132/en/

MercerAlayna Francis,

212-345-1315Alayna.Francis@mercer.comFollow Mercer on Twitter:

@MercerInsights

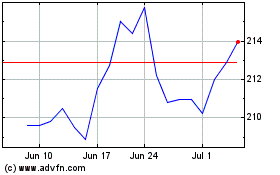

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024