Cost Of Insuring Mirant Debt Tumbles On Naked CDS Sales

June 18 2010 - 5:41PM

Dow Jones News

The cost of protecting debt issued by Mirant North America LLC

has been falling because speculators are selling protection in the

belief that there could be no debt left once the company has merged

with RRI Energy Inc. (RRI).

Debt protection in the form of credit default swaps has been

falling since June 3 and touched 225 basis points on Friday, down

from 250 Thursday and 287 at the start of the week, according to

data provider Markit. That means it costs $225,000 annually to

insure $10 million of the company's debt against default for five

years.

An equal amount of protection cost $638,000 before April 12,

when Mirant said it would merge with RRI, formerly known as

Reliant, by the end of 2010. They have told investors they plan to

"address" $1.8 billion in debt at the combined company, which will

be called GenOn Energy.

The companies were no more specific about their plan for the

debt, but speculators are betting GenOn will pay off Mirant's

debts. That has led speculators to write so-called naked CDS--where

they do not own the underlying bonds--on the assumption they will

be able to collect fees to insure debts that is likely to be

retired.

"There is a high probability that (Mirant) CDS will become

orphaned, and sellers of CDS will collect a five-year stream of

payments for insuring a bond that no longer exists," Andrew

DeVries, a senior analyst at CreditSights, wrote in a recent

report.

Together, Mirant and RRI had $2.9 billion in cash as of Dec. 31;

Mirant had $2.1 billion itself. GenOn could use it to buy back a

series of bonds that, according to their covenant terms, investors

can sell back to the company at a small premium if the company is

sold or merged. It is unclear if bondholders will do this, however,

since the bonds are trading above the premium price.

Also unclear is whether GenOn will choose to issue debt under

the name of Mirant North America LLC, also known as Mirna, at some

point in the future.

"The potential to issue from Mirna, I believe it still there,"

said Peter Molica, a director at Fitch Ratings. "Every indication

is that they will issue at GenOn...but Mirna doesn't go away. I am

not sure there is anything that prohibits them from issuing at

Mirna."

As of the end of the first quarter, Mirna had $850 million in

cash bonds with a 7.375% coupon and $307 million under a senior

secured term loan, both falling due 2013. Reliant had $279 million

in secured bonds due 2014 and $371 million in industrial revenue

bonds due 2036.

There are covenants attached to the debt, which in the case of

RRI require any new subsidiaries to guarantee its issuances.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

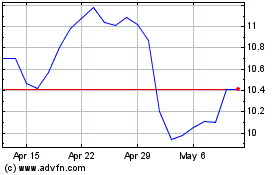

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

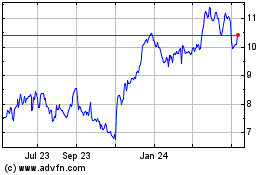

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Apr 2023 to Apr 2024