Mirant Corporation And RRI Energy To Merge

April 11 2010 - 2:52PM

Dow Jones News

U.S. independent power generators Mirant Corp. (MIR) and RRI

Energy Inc. (RRI) announced plans to merge Sunday in a bid to cut

costs and strengthen their financial standing in the face of

challenging wholesale power markets.

Mirant and RRI Energy would become GenOn Energy, creating one of

the nation's largest merchant power companies.

Both generators rely on market prices rather than regulated

rates for the power they produce and don't own electric utilities.

The all-stock deal is considered a merger of equals, with

shareholders receiving equity in the new company based on their

recent share prices.

Investors will be issued shares based on the volume-weighted,

average price for the last 10 trading days, with Mirant

stockholders getting a fixed ratio of 2.835 shares of RRI Energy

for each of their shares.

On Friday, Mirant shares closed at $10.73, while RRI Energy

shares closed at $3.95.

The deal comes as merchant power companies face near-term

challenges. Wholesale power prices have been hit hard by

back-to-back years of declining electricity demand in the U.S. and

low natural gas prices, which have a strong influence on

electricity prices.

The new, combined company will have generation in most U.S.

electricity markets, with a total power plant capacity of nearly

25,000 megawatts, and a combined market capitalization of $3.1

billion.

-By Mark Peters, Dow Jones Newswires; 212-416-2457;

mark.peters@dowjones.com

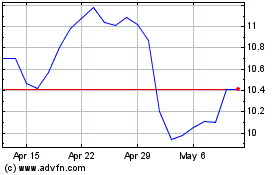

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

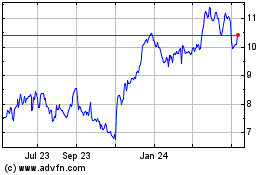

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Apr 2023 to Apr 2024