MGM Resorts Profit Slumps

May 05 2016 - 10:30AM

Dow Jones News

MGM Resorts International said its first-quarter earnings fell

61% amid continued weakness in its China business and a tax

provision.

In the three-month period ended in March, MGM China's revenue

decreased 26% to $469 million, as VIP table games revenue slumped

41% and main floor table games revenue dropped 8%.

The decline was partly offset by MGM's wholly owned domestic

resorts, which include properties on the Las Vegas Strip and others

throughout the U.S. The segment's revenue rose 3%. Revenue per

available room, a key measure of performance for the lodging

industry, improved 8% at the company's Las Vegas Strip resorts, as

occupancy rates and average daily room rates both strengthened.

Chairman and Chief Executive Jim Murren in prepared remarks

Thursday also touted the company's efforts to improve its balance

sheet, including last month's initial offering of MGM Growth

Properties LLC.

The real-estate investment trust, which invests in properties

such as casino resorts, raised $1.05 billion in its initial public

offering and sold 50 million shares. MGM Resorts will remain a

majority owner.

Over all, MGM reported a profit of $66.8 million, or 12 cents a

share, down from $169.8 million, or 33 cents a share, a year

earlier.

The latest period included a tax provision of $21.3 million,

while the year-earlier period included a tax benefit of $56.3

million. The year-earlier quarter also included a per-share gain of

9 cents related to CityCenter' resolution of construction

litigation and remaining settlements.

Revenue decreased 5.3% to $2.21 billion.

Analysts polled by Thomson Reuters expected per-share profit of

11 cents and revenue of $2.28 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

May 05, 2016 10:15 ET (14:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

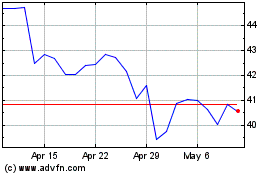

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

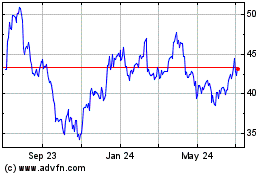

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024