Red Rock Resorts IPO Seeks to Raise Half a Billion Dollars

April 26 2016 - 1:40PM

Dow Jones News

Red Rock Resorts Inc. is betting the time is right for a

stock-market debut.

The Las Vegas-based casino operator is set to price its initial

public offering, which is aiming to raise around half a billion

dollars, later Tuesday, according to people familiar with the

deal.

The offering comes a week after casino-resort focused

real-estate investment trust MGM Growth Properties LLC priced at

the high end of its target range and raised more than $1 billion in

its initial public offering. It was the first U.S.-listed IPO to

raise more than $1 billion since October, according to

Dealogic.

Red Rock Resorts' offering comes amid a weak stretch for the IPO

market—the first quarter was the slowest for U.S.-listed IPOs since

the financial crisis. There were tentative signs of improvement

last week as three companies made their U.S. stock-market debuts,

including the first tech IPO since December. MGM Growth Properties

priced at the high end of expectations and rose in its first day of

trading, while SecureWorks Corp., the tech IPO, priced below

expectations and opened trading below its IPO price.

Red Rock Resorts and selling shareholders plan to offer about

27.3 million shares in the IPO, raising about $531 million at the

midpoint of the expected $18 to $21 per share range, according to

regulatory filings.

Red Rock Resorts operates Las Vegas casinos that aren't on the

Las Vegas strip tourism corridor, and the company says in

regulatory filings that it depends on locals and repeat visitors as

its key markets.

Much of the payout will go to the Fertitta family, which has

maintained a significant ownership in the company since it was

founded in 1976, according to a regulatory filing. The family will

retain control of the gambling company.

Red Rock Resorts was previously publicly traded under the name

Station Casinos before it was taken private in 2007 in a

management-led leveraged buyout, according to a regulatory filing.

Following the financial crisis, the company finished a

restructuring in 2011.

Still, its debt levels are a concern for some potential

investors, some analysts said.

Total debt for Red Rock Resorts at the end of 2015 was nearly

$2.2 billion, while adjusted earnings before interest, taxes

depreciation and amortization as of Dec. 31 was $451 million,

according to regulatory filings.

A spokeswoman for the company declined to comment on the

offering.

The resort and casino operator will list its shares on the

Nasdaq Stock Market under the symbol "RRR." Deutsche Bank, J.P.

Morgan, Bank of America Merrill Lynch and Goldman Sachs & Co.

are leading the offering.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

April 26, 2016 13:25 ET (17:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

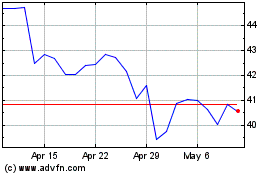

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

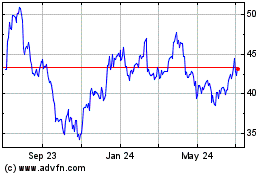

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024