By Cassandra Sweet

Three big casino companies that run glittering resorts on the

Las Vegas Strip are trying to break free from Nevada's electric

power monopoly, NV Energy.

Hoteliers including Wynn Resorts Ltd., MGM Resorts International

and Las Vegas Sands Corp., which operate more than a dozen massive

gambling palaces in Nevada, say they could cut millions of dollars

from their electric bills if they could buy power directly from

solar farms or power-plant owners.

But NV Energy, which is owned by Warren Buffett's Berkshire

Hathaway Inc., is pushing state regulators to make it very

expensive for the casinos to stop buying its power, according to

documents released by the state's Public Utilities Commission. NV

Energy declined to comment.

The same struggle is occurring across the country as large power

users watch wholesale energy prices fall while their utility bills

rise. New York, Texas and 11 other states allow residents and

businesses to buy their electricity from competitive suppliers, but

Nevada is among the majority of states that require most customers

to buy power from monopoly utilities.

The fight is particularly acute in Vegas, where keeping the

bright lights of the Strip shining--and creating permanent daylight

indoors so the gambling never stops--requires a lot of juice.

Data from MGM Resorts International show that its Las Vegas

properties, including the Bellagio and Mandalay Bay, use more

electricity than Key West, Fla., a tourist destination with more

than 2.5 million visitors each year. According to the commission,

the three casino owners challenging the power utility account for

more than 5% of the electricity sales of NV Energy, which generates

power and also buys it from other companies.

The casinos say they would like to use more renewable energy to

live up to commitments they have made to shareholders and

customers. Many other large companies, including Wal-Mart Stores

Inc. and General Motors Co., have joined together to push for

better access to renewables but say some utilities are charging too

high a premium for it.

Casinos say that is part of what is going on in Nevada. After

Berkshire bought NV Energy in December 2013, the utility signed

long-term contracts to buy solar power for as little as 3.9 cents a

kilowatt-hour from First Solar Inc. and SunPower Corp., according

to documents NV Energy filed in July with the state regulatory

commission. Wholesale conventional power is even cheaper, going for

an average of 3.5 cents a kilowatt-hour at a hub in southern

California, where Nevada gets some of its power. That is down 34%

from 2014, and 57% below 2008 prices, according to data from

Intercontinental Exchange Inc.

The company charges the casinos and other big commercial clients

between nine and 10 cents a kilowatt-hour for a mix of conventional

and renewable power, according to the casinos, utility documents

and data from the U.S. Energy Department.

Matt Maddox, president of Wynn Resorts, calls the markups

excessive.

Wynn could cut its power costs by as much as 40%, or $7 million

a year, by purchasing electricity directly from energy suppliers,

Mr. Maddox said, adding he can't see why the resort should be

forced to buy power from NV Energy when the utility is doing little

to keep costs down for its consumers.

"They are over-earning and not passing on savings," he said.

Las Vegas Sands wants to buy more renewable power as part of an

effort to cut its energy use and be more environmentally

responsible, but the company can't reach its goals without more

buying options, said Rob Goldstein, the company's president and

chief operating officer.

MGM declined to comment.

So far, state regulators are taking the utility's side. Despite

a 2001 law that allows large energy users to switch power

suppliers, the Public Utilities Commission of Nevada has never

granted customers permission to leave the Las Vegas utility.

A commission spokesman declined to comment. But when a large

data-storage company tried to leave the utility last year,

regulators said that the departure of a big customer was

unacceptable because other customers' bills would rise sharply to

make up for the loss of revenue.

In the current case, the commission has proposed that the

casinos together pay about $130 million--$90 million for MGM, $24

million for Sands and $17 million for Wynn--in one-time fees to the

utility to cover the costs that the commission staff fears would

otherwise fall on remaining customers. The casinos plan to continue

to pay the utility fees for transmitting the power they buy.

The casinos say that sum--which represents years of electricity

bills--would make it too expensive for them to leave.

The Public Utilities Commission of Nevada is expected to make a

decision by December.

Meanwhile, Sands and MGM are already generating electricity from

rooftop solar panels at their properties. The ones atop MGM's

Mandalay Bay hotel and convention center supply as much as 20% of

the complex's electricity. Las Vegas Sands said solar panels at its

Palazzo Resort provide a small portion of the hotel's electricity,

while a separate array heats water used in the building's swimming

pools and spas.

Wynn said it is considering installing panels at its

resorts.

Write to Cassandra Sweet at cassandra.sweet@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 04, 2015 19:12 ET (23:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

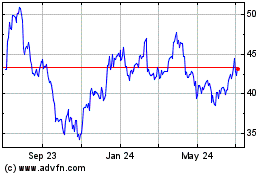

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

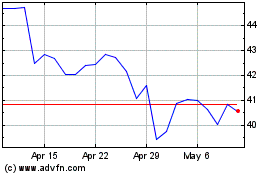

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024