SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment

No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant

[x]

Check the appropriate box:

| [ ] |

Preliminary Proxy Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] |

Definitive Proxy Statement |

| [X] |

Definitive Additional Materials |

| [ ] |

Soliciting Material Under Rule 14a-12 |

MGM Resorts International

(Name of Registrant as Specified In Its Charter)

Land & Buildings Investment Management,

LLC

Land & Buildings Capital Growth Fund,

L.P.

Jonathan Litt

Matthew J. Hart

Richard Kincaid

Marc A. Weisman

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| [X] |

No fee required. |

| |

|

| [ ] |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| [ ] |

Fee paid previously with preliminary materials. |

| [ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

On May 6, 2015, Land & Buildings Investment Management,

LLC and its affiliates (collectively, "Land & Buildings") issued a press release announcing that they had posted

a video to http://www.RestoreMGM.com (the "Website"). Copies of the press release and the transcript from the video are

filed herewith as Exhibit 1 and Exhibit 2, respectively.

Also on May 6, 2015, Land & Buildings posted additional

references to the home page and the "Press Releases" page of the Website. A copy of such additional references is filed

herewith as Exhibit 3. Other than materials filed herewith, all materials posted to the Website that are required to be filed on

Schedule 14A have been previously filed with the Securities and Exchange Commission as soliciting material under Rule 14a-12 or

definitive additional materials on Schedule 14A.

EXHIBIT 1

Land and Buildings Announces Release of ‘Restore

MGM’ Video

Stamford, CT (May 6, 2015) – Land and Buildings today

announced the release of a video narrative detailing why Land and Buildings believes there is an urgent need for change at MGM

Resorts International (NYSE: MGM) (“MGM”) (“The Company”), and how the MGM Board has failed to address

the issues that have plagued the Company’s performance. The video can be seen at: www.RestoreMGM.com.

Topics addressed in the video include:

| · | MGM’s Underperformance

– The Company has underperformed its peer group by 453% since Jim Murren became Chairman and CEO in 2008[i].

Over these seven years MGM has incurred numerous impairment losses, while its peers have prospered in comparison. |

| · | May

Be Repeating the Same Mistakes – MGM has a track record of bad capital allocation decisions that have hurt shareholders,

in our view, with the CityCenter development the most striking, but not only, example reflected in the $2 billion of impairments

the Company has recorded unrelated to CityCenter since 2009 (e.g. land on Renaissance Pointe in Atlantic City). Even though this

highly leveraged approach had the Company teetering on the brink of bankruptcy in 2009, MGM is currently driving debt levels even

higher as it undertakes $5 billion in new developments. |

| · | The Safe Bet to Fix MGM –

The 2015 election of directors presents a fresh choice. Land and Buildings has put together a slate of new director nominees who

we believe have the expertise needed to fix MGM: |

| o | Matt Hart, former President and COO at Hilton

Hotels Corporation |

| o | Richard Kincaid, former CEO of Equity Office

Properties Trust |

| o | Mark Weisman, former CFO of Oppenheimer |

| o | Jonathan Litt, the Founder and CIO of Land

and Buildings |

###

About Land and Buildings:

Land and Buildings is a registered investment manager specializing

in publicly traded real estate and real estate related securities. Land and Buildings seeks to deliver attractive risk adjusted

returns by opportunistically investing in securities of global real estate and real estate related companies, leveraging its investment

professionals' deep experience, research expertise and industry relationships.

Investor Contact:

Scott Winter / Jonathan Salzberger

Innisfree M&A Incorporated

212-750-5833

Media Contact:

Elliot Sloane / Dan Zacchei

Sloane & Company

212-486-9500

Esloane@sloanepr.com or

Dzacchei@sloanepr.com

LAND & BUILDINGS CAPITAL GROWTH FUND,

L.P., LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC AND JONATHAN LITT (COLLECTIVELY, "LAND & BUILDINGS") AND MATTHEW

J. HART, RICHARD KINCAID AND MARC A. WEISMAN (TOGETHER WITH LAND & BUILDINGS, THE "PARTICIPANTS") FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION (THE "SEC") ON APRIL 16, 2015 A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF

PROXY CARD TO BE USED IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF MGM RESORTS INTERNATIONAL

(THE "COMPANY") FOR USE AT THE COMPANY'S 2015 ANNUAL MEETING OF STOCKHOLDERS (THE "PROXY SOLICITATION"). ALL

STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION

BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY

STATEMENT AND AN ACCOMPANYING PROXY CARD HAVE BEEN FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER

RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/. IN ADDITION, INNISFREE M&A INCORPORATED,

LAND & BUILDING'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT

CHARGE UPON REQUEST.

[i]

Gaming peers consist of all publicly traded casino companies disclosed in MGM’s 2015 proxy peers excluding Caesars, which

filed for Chapter 11 bankruptcy earlier this year: BYD, LVS, PENN, PNK, WYNN. Lodging peers consist of a subset of MGM's 2015 proxy

peers that are focused in higher chain-scale and vacation destinations: HLT, H, MAR, HOT.

EXHIBIT 2

The following is a transcript from the video available at

http://www.RestoreMGM.com:

Legal Disclaimer

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical

or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,”

“seeks,” “could” or the negative of such terms or other variations on such terms or comparable terminology.

Similarly, statements that describe our objectives, plans or goals are forward-looking. Land & Buildings' forward-looking statements

are based on its current intent, belief, expectations, estimates and projections regarding the Company and projections regarding

the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties,

assumptions and other factors that are difficult to predict and that could cause actual results to differ materially. Accordingly,

you should not rely upon forward-looking statements as a prediction of actual results and actual results may vary materially from

what is expressed in or indicated by the forward-looking statements.

On April 16, 2015, Land & Buildings Capital Growth Fund, L.P.,

Land & Buildings Investment Management, LLC, Jonathan Litt, Matthew J. Hart, Richard Kincaid and Marc A. Weisman (collectively

referred to as the "participants") filed with the Securities and Exchange Commission a definitive proxy statement and

accompanying form of proxy card to be used in connection with the proxy solicitation. All stockholders of the company are advised

to read the definitive proxy statement and other documents related to the proxy solicitation because they contain important information,

including additional information related to the participants. The definitive proxy statement and an accompanying proxy card have

been furnished to some or all of the company's stockholders and are, along with other relevant documents, available at no charge

on the SEC's web site at http://www.sec.gov. In addition, Innisfree M&A Incorporated, Land & Buildings' proxy solicitor,

will provide copies of the definitive proxy statement and accompanying proxy card without charge upon request.

MGM Resorts – How Can Shareholders Trust MGM?

To say that MGM Resorts, the iconic owner of the Bellagio and other

world-famous properties, has not reached its full potential, is, in our view, a vast understatement. We believe that, in light

of the actions of MGM’s Board since the current CEO took office, shareholders are left with a most disturbing question: How

can MGM be trusted?

Woeful Underperformance

453%… that’s how far below the median performance of

its peer group MGM Resorts has underperformed since Jim Murren became Chairman and CEO, in 2008. Over the past seven years, the

company has suffered one impairment loss after another, costing shareholders approximately 4.5 billion dollars in value. That’s

seven years of value destruction, with MGM trading at a steep discount. Meanwhile, those peer companies have prospered in comparison,

with rising share prices and record earnings.

With this track record, how can the current board be trusted to

make the right choices to restore value for MGM’s shareholders?

Repeating the Same Mistakes

From 2005 to 2008, the cost of the City Center development project

more than doubled – from $4 billion to $9.2 billion – and after promising robust cash flows to its shareholders, MGM

delivered a whopping 50% write-down.

By 2009, MGM was teetering on Bankruptcy under a mountain of debt.

And yet, Mr. Murren still refuses to acknowledge that the project

was a disaster for MGM.

Unfortunately, we believe that history may be repeating itself:

The key problems that MGM faced in 2009 – an overleveraged balance sheet and risky investments – again plague the company.

MGM has reported a staggering $2.0B in impairment losses unrelated

to City Center since Mr. Murren took the reins, including losses with respect to the Borgata, and land on Renaissance Point in

Atlantic City.

At the groundbreaking of MGM Springfield in March, Mr. Murren finally

admitted, “We have a history of overinvesting in our developments.”

And here they go again, launching $5 billion in new developments,

driving debt levels even higher.

Should MGM be allowed to keep taking these kinds of risks to the

detriment of its shareholders?

The Safe Bet to Fix MGM

Despite our best intentions and desire for constructive engagement

with the Company, we have found a Board and CEO resistant to fresh perspectives and creative solutions that we believe have the

potential to create value for shareholders.

And yet, despite this cavalier treatment of a critical value-enhancing

proposal on top of dismal performance over the past seven years, there’s no reason MGM has to keep losing value for its shareholders.

Fortunately for shareholders – the 2015 election of directors

presents a fresh choice. Land and Buildings has put together a slate of new director nominees who we believe all have proven track

records of creating value for shareholders and the expertise needed to fix MGM.

What we view as woeful underperformance, a marathon of mistakes

and a lack of accountability… it has to stop.

It's time to restore MGM.

EXHIBIT 3

| Land and Buildings Announces Release of 'Restore MGM' Video |

May 06, 2015 |

| Land and Buildings Comments on MGM Resorts Earnings Call |

May 04, 2015 |

| Land and Buildings Comments on Statement from Tracinda Corporation |

May 01, 2015 |

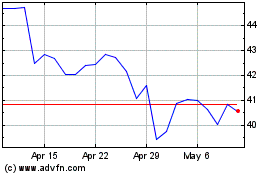

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

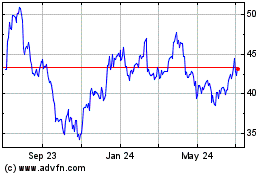

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024