SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment

No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant

[x]

Check the appropriate box:

| [ ] |

Preliminary Proxy Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] |

Definitive Proxy Statement |

| [X] |

Definitive Additional Materials |

| [ ] |

Soliciting Material Under Rule 14a-12 |

MGM Resorts International

(Name of Registrant as Specified In Its Charter)

Land & Buildings Investment Management,

LLC

Land & Buildings Capital Growth Fund,

L.P.

Jonathan Litt

Matthew J. Hart

Richard Kincaid

Marc A. Weisman

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| [X] |

No fee required. |

| |

|

| [ ] |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| [ ] |

Fee paid previously with preliminary materials. |

| [ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

On April 20, 2015, Land & Buildings Investment Management,

LLC and its affiliates (collectively, "Land & Buildings") commenced the mailing of its proxy materials, including

its definitive proxy statement, to stockholders of MGM Resorts International ("MGM"). Such materials also included a

letter urging stockholders to support Land & Buildings in its proxy solicitation to elect Land & Buildings' four nominees

to replace four incumbent members of the board of directors of MGM (the "Letter"). A copy of the Letter is filed herewith

as Exhibit 1.

Also on April 20, 2015, Land & Buildings issued a press release

that announced the foregoing and included a copy of the Letter. A copy of the press release is filed herewith as Exhibit 2.

EXHIBIT 1

Land and Buildings Believes MGM Suffers From

a Broken Boardroom Culture Which Values Self-Preservation Over Independent Inquiry

MGM Stock Returns Have Materially Underperformed

its Gaming and Lodging Peers

Land and Buildings’ Four Independent,

Highly-Qualified Director Nominees Have the Experience and Fresh Perspectives We Believe Are Needed to Exert Effective Board Stewardship

and Evaluate Strategic Options, including a REIT

Disturbing Corporate Culture Exemplified by

the Pressure Applied to a Land and Buildings Nominee to Resign from the Board of an Unrelated Company

Vote for our Nominees on the GOLD

Proxy Card Today

April 20, 2015

Dear Fellow MGM Shareholder:

Land and Buildings is an investment firm that specializes in

investing in publicly traded real estate and real estate related securities. We are seeking your support to elect four independent,

highly-qualified individuals to the Board of Directors of MGM (the “Board”) — Matthew Hart, Richard Kincaid,

Jonathan Litt and Marc Weisman. We believe that these candidates have experience in precisely the areas in which MGM has a poor

track record and where the Board needs the most help: lodging, balance sheet management, capital allocation, real estate expertise

and exploration of alternatives in today’s capital markets. Our nominees will bring fresh perspectives and accountability

to a Board that we believe is in desperate need of improved stewardship.

We urge you to vote the enclosed GOLD

proxy card TODAY by telephone, over the Internet, or by signing, dating and returning your GOLD proxy card in the

postage-paid envelope provided.

MGM is a Relentless Underperformer

The Board has presided over consistent underperformance to its

peers. Strikingly, since Jim Murren became Chairman and CEO in 2008, MGM has underperformed its peer group median by 453%.

MGM Has Underperformed its Peers by Approximately

453% Since Jim Murren Became Chairman and CEO

Table Reflects MGM's Performance Relative

to that of its Peers over the Last 1-, 3- and 5-Year Periods and Since Mr. Murren Became CEO

| |

Source: Bloomberg; Note: As of March 16, 2015 unaffected closing

price

Jim Murren became Chairman and CEO on December 1, 2008

Figures represent MGM total shareholder returns relative to each

peer company

Gaming peers consist of all publicly traded casino companies disclosed

in MGM’s 2015 proxy peers excluding Caesars, which filed for Chapter 11 bankruptcy earlier this year

Lodging peers consist of a subset of MGM's 2015 proxy peers that

are focused in higher chain-scale and vacation destinations |

The Board has clearly failed to appreciate

the magnitude of this underperformance as the status quo has continued: poor capital allocation, poor balance sheet management

and failure to capitalize on the underlying value embedded in the Company’s real estate.

MGM’s Persistent and Consistent

Undervaluation

The Board has failed to address the continual and substantial

EBITDA multiple discount to its closest peers[i], in our view. We believe one of the key reasons for the persistent

discounted valuation is the Company’s overleveraged balance sheet combined with a history of poor investment decisions (e.g.

CityCenter). Rather than take advantage of the current favorable capital markets environment to reduce debt – which could

help MGM close its persistent valuation gap – the Board continues to make the same capital-allocation mistakes it made

leading up to the Company teetering on bankruptcy seven years ago. The Company is currently further leveraging its balance sheet

by embarking on $5 billion of new development.

MGM’s Valuation is Significantly

Discounted to its Closest Peers While Leverage Levels are Significantly Higher

|

Source: JP Morgan, April 13, 2015

Note: For MGM, adjusted net debt and EBITDA calculations back

out 49.0% stake of MGM Macau and add back MGM’s share of CityCenter and Borgata debt and EBITDA

Note: For Wynn, adjusted net debt and EBITDA calculations back

out 27.7% stake of Wynn Macau debt and EBITDA

Note: For Sands, adjusted net debt and EBITDA calculations back

out 29.7% stake of Sands China debt and EBITDA |

Significant Upside to Intrinsic Value in MGM

We believe the net asset value of MGM is at least $33 per

share, indicating an approximately 50% further upside to intrinsic value

above and beyond the 13% rise in the stock since our announcement of Board nominations and proposal to enhance shareholder value

on March 17, 2015[ii]. We have utilized our extensive experience in evaluating real estate, lodging and gaming companies

to arrive at what we believe is the intrinsic value of the company and there is broad agreement within the investment community

based on our conversations that MGM is meaningfully undervalued.

MGM’s Credibility Issues

Prior to our involvement, there was no evidence that

the Board had recently thoroughly evaluated alternatives to unlock shareholder value. For example:

| · | Decide for Yourself: If the management team was truthfully evaluating

a REIT, would they have done a $1.25 billion bond offering in November 2014 that was subject to an onerous prepayment penalty? |

| · | Knee-Jerk Reaction: After meeting with us – but prior to

any announcement of our public involvement – MGM’s Chairman and CEO suggested on CNBC that the Company might explore

a REIT proposed structure. We believe that Mr. Murren’s assertion that the Company could explore a REIT structure lacks credibility

and that his statements were nothing more than an attempt to pacify the numerous shareholders who have told us they believe that

the REIT structure should be independently evaluated during this window of opportunity to permanently revalue MGM’s assets

at higher levels. |

| · | Too Little, Too Late: Under pressure from our director nominations,

MGM announced a $400 million special dividend from CityCenter. We believe the CityCenter dividend is being used by the Company

to deflect the justified criticism it has received about the CityCenter project – which nearly put the Company into Chapter

11 and whose massive debt load has contributed to MGM’s persistent valuation gap. To this day – the senior executives

at MGM have not been held accountable for the value destruction at MGM, including CEO and Chairman Jim Murren – who pioneered

and widely supported the project – and Robert Baldwin – a current director and CEO of CityCenter since inception. |

We are Concerned about the Board’s Poor Stewardship

We believe there are a host of reasons which indicate that the

Board would benefit from shareholder-elected independent directors. Specifically we highlight the following tangible issues which

we believe indicate that the Board would benefit from shareholder-elected independent directors:

| · | Lack of accountability for consistent underperformance |

During Jim Murren’s tenure as Chairman

and CEO, MGM has underperformed its peer group median by 453% and traded at a large EBITDA multiple discount to its closest peers

– yet the Board has demonstrated no ability or willingness to hold his team accountable for such poor performance.

| · | A history of poor compensation practices |

CEO

and Chairman, Jim Murren, has received $64 million since 2009 and the Company has received a consistent compensation grade of “D”

from Glass Lewis since 2011. The Company’s short-term incentive bonus is based off of annual EBITDA targets rather than total

shareholder return – and – Mr. Murren has sold the vast majority of his stock, owning 30% fewer shares then he did

the year prior to being appointed CEO[iii].

Shareholders need to look no further than the

dead-hand put incorporated into recent bond offerings which serve no purpose other than to entrench the incumbents; if a majority

of the Board is replaced, the bond would be immediately required to be pre-paid in full.

| · | Being disingenuous with the Company’s annual meeting dates |

This year, the Board accelerated both the record

date and meeting date materially from their historical dates in what we believe was an effort to limit the full impact of shareholder

democracy.

The Lead Independent Director Should Be Beyond Reproach

A board led by Lead Independent Director Roland Hernandez

pressured one of our nominees, Richard Kincaid, to resign from the Vail Resorts, Inc. (NYSE:MTN) (“Vail Resorts”) Board

of Directors.

Roland Hernandez is currently MGM’s Lead

Independent Director and has been on the Board for 13 years, making it difficult for him, in our view, to be truly

independent, or in a position to hold the combined Chairman and CEO

accountable. We would also ask shareholders to consider Mr. Hernandez's background and most recent maneuver at Vail

Resorts:

| | v | Mr. Hernandez,

in addition to being Lead Independent Director of MGM, is the Lead Independent Director

of Vail Resorts, where he and one of our nominees, Richard Kincaid, have jointly sat

on the Board for eight years. Just days after Land and Buildings sent Mr. Hernandez a

letter requesting that in his capacity as Lead Independent Director of MGM to form a

special committee of independent board members and hire an independent financial advisor

to analyze all available options to create sustained shareholder value, Mr. Kincaid was

given an ultimatum by Vail– pull out of Land and Buildings' slate for MGM or resign

from the board of Vail Resorts. Mr. Kincaid resigned from Vail Resorts’ Board. |

| v | We find it notable that Mr. Hernandez was on the Lehman Brothers board

of directors from 2005-2008 and was a member of the Finance and Risk Committee at the time of the Lehman collapse. |

| v | Mr. Hernandez received the lowest support of any director at MGM’s

2014 shareholder meeting with just 65% of the outstanding common stock voting in support of his candidacy despite the fact that

neither ISS nor Glass Lewis issued a recommendation against him. |

| v | Mr. Hernandez also received the lowest support of any director at

the last six Vail Resorts shareholder meetings – averaging 84% of the outstanding common stock voting in support of his candidacy

despite the fact that neither ISS nor Glass Lewis issued a recommendation against him. This compares to Richard Kincaid’s

average support of 93% of the outstanding common stock over the same period. |

L&B Board Nominees: Highly-Qualified and Independent

The Land and Buildings nominees will not only seek to ensure

that the Company takes a clear-eyed assessment of the Land and Buildings REIT proposal, among others, but that the Board adopts

a culture of accountability to shareholders. Given the substantial underperformance of MGM and the Board’s lackluster response

to this underperformance, we believe that the addition of our independent nominees would compel the Company to take the necessary

steps to close its persistent and material discount to its potential valuation.

Land and Buildings’ slate of proposed nominees possess track

records that speak for themselves:

| ü | Matthew J. Hart: Former President, COO and CFO, Hilton Hotels

Corporation (NYSE: HLT), and former CFO, Host Marriott Corporation |

| ü | Richard Kincaid: Former President and CEO of Equity Office

Properties Trust |

| ü | Jonathan Litt: Founder and CIO of Land and Buildings |

| ü | Marc Weisman: Former Partner of Weil Gotshal & Manges,

and former CFO of Oppenheimer & Co., Inc. |

Now is the Time to Unlock Value at MGM

Land and Buildings has conducted extensive due diligence

to understand the potential value and feasibility of its proposals to MGM. This has included consulting with leading legal advisors

with extensive experience in the area of REIT conversions in an effort to propose a structure that would be cost and tax efficient.

There are a number of factors that make now an ideal time

for MGM to explore our proposals:

| · | Fundamentals in Las Vegas are especially strong |

| v | Limited new construction benefits MGM’s premier position |

| v | All relevant gaming and lodging metrics indicate cycle “sweet-spot” |

| · | Numerous recent precedent transactions make our proposal compelling |

| v | Two other gaming companies have either implemented a REIT structure

or have publicly committed to the structure and in each of these situations tremendous value was created for shareholders |

| · | MGM will be a tax-payer for the first time in 2015 |

| v | The urgency of creating a tax efficient REIT structure has never been

higher with a growing tax bill looming |

| · | Debt Repayment Opportunity |

| v | The window is open for MGM to repay half of its debt in the near-term

with no penalty |

| v | A significant portion of MGM’s debt matures in the next 12 months |

THE MARKET PRICE INCREASED

SUBSTANTIALLY SINCE WE RELEASED OUR PROPOSAL – DRIVING UP THE COMPANY’S STOCK PRICE BY 13% AND CREATING $1.2 BILLION

IN MARKET VALUE

THE COMPANY’S RESISTANCE

TO TAKING MEANINGFUL ACTION, HOWEVER, COULD CAUSE MUCH OF THAT VALUE CREATION TO ERODE

We have been extremely disappointed by the lack of appropriate

urgency and apparent unwillingness of the Board and Management to take meaningful action. This includes the Board’s apparent

decision to ignore for months our call to hire independent financial advisors to evaluate our proposals and other available options

for the benefit of all shareholders. As a result of the Company’s apparent inaction, we were compelled to do what the Board

had not done, retain an independent financial advisor, Houlihan Lokey, to conduct a thorough strategic review of our proposed structure.

Whether it is the proposal Land and Buildings has outlined,

or a variation thereof, we believe it is important for the Land and Buildings nominees to be in the boardroom of MGM to ensure

that all value creating ideas are evaluated.

Vote FOR our Nominees on the GOLD Proxy Card Today

As detailed above, we believe MGM has lacked the Board stewardship

necessary to create long term shareholder value. Today, significant value is being trapped in MGM and we believe our Board nominees

can help unlock that value. We believe the net asset value of MGM is $33 per share, indicating an approximately 50%

further upside to intrinsic value. We believe strongly that our four candidates would help realized the intrinsic value for the

benefit of all our fellow shareholders.

Sincerely,

Jonathan Litt

Founder & CIO

Land and Buildings

| |

REMEMBER:

Your broker provides

for voting by telephone or via the Internet.

Please follow the easy instructions on

the enclosed proxy card.

If

you have any questions or need assistance in voting

your

shares, please call our proxy solicitor,

INNISFREE M&A INCORPORATED

TOLL-FREE, at 1-888-750-5834.

|

|

Investor Contact:

Scott Winter / Jonathan Salzberger

Innisfree M&A Incorporated

212-750-5833

Media Contact:

Elliot Sloane / Dan Zacchei

Sloane & Company

212-486-9500

Esloane@sloanepr.com or

Dzacchei@sloanepr.com

LAND & BUILDINGS CAPITAL GROWTH FUND, L.P., LAND &

BUILDINGS INVESTMENT MANAGEMENT, LLC AND JONATHAN LITT (COLLECTIVELY, "LAND & BUILDINGS") AND MATTHEW J. HART, RICHARD

KINCAID AND MARC A. WEISMAN (TOGETHER WITH LAND & BUILDINGS, THE "PARTICIPANTS") FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION (THE "SEC") ON APRIL 16, 2015 A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED

IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM

THE

STOCKHOLDERS OF MGM RESORTS INTERNATIONAL (THE "COMPANY") FOR USE AT THE COMPANY'S 2015 ANNUAL MEETING OF

STOCKHOLDERS (THE "PROXY SOLICITATION"). ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY

STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING

ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD HAVE BEEN

FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE

ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/. IN ADDITION, INNISFREE M&A INCORPORATED, LAND & BUILDING'S PROXY

SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT CHARGE UPON

REQUEST.

i

Closest peers represent Las Vegas Sands and Wynn Resorts, which are the most comparable in size, revenue sources and geographic

footprint.

ii

Stock price through April 15, 2015.

iii

Based on the number of shares beneficially owned as of March 30, 2015, as disclosed in MGM's proxy statement filed on April 13,

2015, and the number of shares beneficially owned as of June 12, 2009 (the year following Mr. Murren’s appointment as CEO),

as disclosed in MGM's proxy statement filed on June 25, 2009.

EXHIBIT 2

LAND AND BUILDINGS SENDS LETTER TO SHAREHOLDERS

OF

MGM RESORTS INTERNATIONAL

Land and Buildings Believes MGM Suffers From

a Broken Boardroom Culture Which Values Self-Preservation Over Independent Inquiry

MGM Stock Returns Have Materially Underperformed

its Gaming and Lodging Peers

Land and Buildings’ Four Independent,

Highly-Qualified Director Nominees Have the Experience and Fresh Perspectives We Believe Are Needed to Exert Effective Board Stewardship

and Evaluate Strategic Options, including a REIT

Disturbing Corporate Culture Exemplified by

the Pressure Applied to a Land and Buildings Nominee to Resign from the Board of an Unrelated Company

Vote for our Nominees on the GOLD

Proxy Card Today

Stamford, CT— (April 20, 2014) – Land and

Buildings Investment Management, LLC (“Land and Buildings”) sent a letter to shareholders of MGM Resorts International

(NYSE:MGM) (“MGM” or the “Company”) announcing that today it is distributing definitive proxy materials

in support of electing Land and Buildings’ four independent, highly qualified, nominees to the Board of MGM who Land and

Buildings believes have the experience and independent perspectives needed to fix what we view as the broken boardroom culture

at MGM and explore value-unlocking alternatives.

The full text of the letter is as follows:

April 20, 2015

Dear Fellow MGM Shareholder:

Land and Buildings is an investment firm that specializes in

investing in publicly traded real estate and real estate related securities. We are seeking your support to elect four independent,

highly-qualified individuals to the Board of Directors of MGM (the “Board”) — Matthew Hart, Richard Kincaid,

Jonathan Litt and Marc Weisman. We believe that these candidates have experience in precisely the areas in which MGM has a poor

track record and where the Board needs the most help: lodging, balance sheet management, capital allocation, real estate expertise

and exploration of alternatives in today’s capital markets. Our nominees will bring fresh perspectives and accountability

to a Board that we believe is in desperate need of improved stewardship.

We urge you to vote the enclosed GOLD

proxy card TODAY by telephone, over the Internet, or by signing, dating and returning your GOLD proxy card in the

postage-paid envelope provided.

MGM is a Relentless Underperformer

The Board has presided over consistent underperformance to its

peers. Strikingly, since Jim Murren became Chairman and CEO in 2008, MGM has underperformed its peer group median by 453%.

MGM Has Underperformed its Peers by Approximately

453% Since Jim Murren Became Chairman and CEO

Table Reflects MGM's Performance Relative

to that of its Peers over the Last 1-, 3- and 5-Year Periods and Since Mr. Murren Became CEO

|

Source: Bloomberg; Note: As of March 16, 2015 unaffected closing

price

Jim Murren became Chairman and CEO on December 1, 2008

Figures represent MGM total shareholder returns relative to each

peer company

Gaming peers consist of all publicly traded casino companies disclosed

in MGM’s 2015 proxy peers excluding Caesars, which filed for Chapter 11 bankruptcy earlier this year

Lodging peers consist of a subset of MGM's 2015 proxy peers that

are focused in higher chain-scale and vacation destinations |

The Board has clearly failed to appreciate the magnitude of

this underperformance as the status quo has continued: poor capital allocation, poor balance sheet management and failure to capitalize

on the underlying value embedded in the Company’s real estate.

MGM’s Persistent and Consistent Undervaluation

The Board has failed to address the continual and substantial

EBITDA multiple discount to its closest peers[i], in our view. We believe one of the key reasons for the persistent

discounted valuation is the Company’s overleveraged balance sheet combined with a history of poor investment decisions (e.g.

CityCenter). Rather than take advantage of the current favorable capital markets environment to reduce debt – which could

help MGM close its persistent valuation gap – the Board continues to make the same capital-allocation mistakes it made

leading up to the Company teetering on bankruptcy seven years ago. The Company is currently further leveraging its balance sheet

by embarking on $5 billion of new development.

MGM’s Valuation is Significantly

Discounted to its Closest Peers While Leverage Levels are Significantly Higher

|

Source: JP Morgan, April 13, 2015

Note: For MGM, adjusted net debt and EBITDA calculations back

out 49.0% stake of MGM Macau and add back MGM’s share of CityCenter and Borgata debt and EBITDA

Note: For Wynn, adjusted net debt and EBITDA calculations back

out 27.7% stake of Wynn Macau debt and EBITDA

Note: For Sands, adjusted net debt and EBITDA calculations back

out 29.7% stake of Sands China debt and EBITDA |

Significant Upside to Intrinsic Value in MGM

We believe the net asset value of MGM is at least $33 per

share, indicating an approximately 50% further upside to intrinsic value

above and beyond the 13% rise in the stock since our announcement of Board nominations and proposal to enhance shareholder value

on March 17, 2015[ii]. We have utilized our extensive experience in evaluating real estate, lodging and gaming companies

to arrive at what we believe is the intrinsic value of the company and there is broad agreement within the investment community

based on our conversations that MGM is meaningfully undervalued.

MGM’s Credibility Issues

Prior to our involvement, there was no evidence that

the Board had recently thoroughly evaluated alternatives to unlock shareholder value. For example:

| · | Decide for Yourself: If the management team was truthfully evaluating

a REIT, would they have done a $1.25 billion bond offering in November 2014 that was subject to an onerous prepayment penalty? |

| · | Knee-Jerk Reaction: After meeting with us – but prior to

any announcement of our public involvement – MGM’s Chairman and CEO suggested on CNBC that the Company might explore

a REIT proposed structure. We believe that Mr. Murren’s assertion that the Company could explore a REIT structure lacks credibility

and that his statements were nothing more than an attempt to pacify the numerous shareholders who have told us they believe that

the REIT structure should be independently evaluated during this window of opportunity to permanently revalue MGM’s assets

at higher levels. |

| · | Too Little, Too Late: Under pressure from our director nominations,

MGM announced a $400 million special dividend from CityCenter. We believe the CityCenter dividend is being used by the Company

to deflect the justified criticism it has received about the CityCenter project – which nearly put the Company into Chapter

11 and whose massive debt load has contributed to MGM’s persistent valuation gap. To this day – the senior executives

at MGM have not been held accountable for the value destruction at MGM, including CEO and Chairman Jim Murren – who pioneered

and widely supported the project – and Robert Baldwin – a current director and CEO of CityCenter since inception. |

We are Concerned about the Board’s Poor Stewardship

We believe there are a host of reasons which indicate

that the Board would benefit from shareholder-elected independent directors. Specifically we highlight the following tangible issues

which we believe indicate that the Board would benefit from shareholder-elected independent directors:

| · | Lack of accountability for consistent underperformance |

During Jim Murren’s tenure as Chairman

and CEO, MGM has underperformed its peer group median by 453% and traded at a large EBITDA multiple discount to its closest peers

– yet the Board has demonstrated no ability or willingness to hold his team accountable for such poor performance.

| · | A history of poor compensation practices |

CEO

and Chairman, Jim Murren, has received $64 million since 2009 and the Company has received a consistent compensation grade of “D”

from Glass Lewis since 2011. The Company’s short-term incentive bonus is based off of annual EBITDA targets rather than total

shareholder return – and – Mr. Murren has sold the vast majority of his stock, owning 30% fewer shares then he did

the year prior to being appointed CEO[iii].

Shareholders need to look no further than the

dead-hand put incorporated into recent bond offerings which serve no purpose other than to entrench the incumbents; if a majority

of the Board is replaced, the bond would be immediately required to be pre-paid in full.

| · | Being disingenuous with the Company’s annual meeting dates |

This year, the Board accelerated both the record

date and meeting date materially from their historical dates in what we believe was an effort to limit the full impact of shareholder

democracy.

The Lead Independent Director Should Be Beyond Reproach

A board led by Lead Independent Director Roland Hernandez

pressured one of our nominees, Richard Kincaid, to resign from the Vail Resorts, Inc. (NYSE:MTN) (“Vail Resorts”) Board

of Directors.

Roland Hernandez is currently MGM’s Lead Independent

Director and has been on the Board for 13 years, making it difficult for him, in our view, to be truly independent, or in a position

to hold the combined Chairman and CEO accountable. We would also ask shareholders to consider Mr. Hernandez's background and most

recent maneuver at Vail Resorts:

| | v | Mr. Hernandez,

in addition to being Lead Independent Director of MGM, is the Lead Independent Director

of Vail Resorts, where he and one of our nominees, Richard Kincaid, have jointly sat

on the Board for eight years. Just days after Land and Buildings sent Mr. Hernandez a

letter requesting that in his capacity as Lead Independent Director of MGM to form a

special committee of independent board members and hire an independent financial advisor

to analyze all available options to create sustained shareholder value, Mr. Kincaid was

given an ultimatum by Vail– pull out of Land and Buildings' slate for MGM or resign

from the board of Vail Resorts. Mr. Kincaid resigned from Vail Resorts’ Board. |

| v | We find it notable that Mr. Hernandez was on the Lehman Brothers board

of directors from 2005-2008 and was a member of the Finance and Risk Committee at the time of the Lehman collapse. |

| v | Mr. Hernandez received the lowest support of any director at MGM’s

2014 shareholder meeting with just 65% of the outstanding common stock voting in support of his candidacy despite the fact that

neither ISS nor Glass Lewis issued a recommendation against him. |

| v | Mr. Hernandez also received the lowest support of any director at

the last six Vail Resorts shareholder meetings – averaging 84% of the outstanding common stock voting in support of his candidacy

despite the fact that neither ISS nor Glass Lewis issued a recommendation against

him. This compares to Richard Kincaid’s average support of 93% of the outstanding common stock over the same period. |

L&B Board Nominees: Highly-Qualified and Independent

The Land and Buildings nominees will not only seek to ensure

that the Company takes a clear-eyed assessment of the Land and Buildings REIT proposal, among others, but that the Board adopts

a culture of accountability to shareholders. Given the substantial underperformance of MGM and the Board’s lackluster response

to this underperformance, we believe that the addition of our independent nominees would compel the Company to take the necessary

steps to close its persistent and material discount to its potential valuation.

Land and Buildings’ slate of proposed nominees possess track

records that speak for themselves:

| ü | Matthew J. Hart: Former President, COO and CFO, Hilton Hotels

Corporation (NYSE: HLT), and former CFO, Host Marriott Corporation |

| ü | Richard Kincaid: Former President and CEO of Equity Office

Properties Trust |

| ü | Jonathan Litt: Founder and CIO of Land and Buildings |

| ü | Marc Weisman: Former Partner of Weil Gotshal & Manges,

and former CFO of Oppenheimer & Co., Inc. |

Now is the Time to Unlock Value at MGM

Land and Buildings has conducted extensive due diligence

to understand the potential value and feasibility of its proposals to MGM. This has included consulting with leading legal advisors

with extensive experience in the area of REIT conversions in an effort to propose a structure that would be cost and tax efficient.

There are a number of factors that make now an ideal time

for MGM to explore our proposals:

| · | Fundamentals in Las Vegas are especially strong |

| v | Limited new construction benefits MGM’s premier position |

| v | All relevant gaming and lodging metrics indicate cycle “sweet-spot” |

| · | Numerous recent precedent transactions make our proposal compelling |

| v | Two other gaming companies have either implemented a REIT structure

or have publicly committed to the structure and in each of these situations tremendous value was created for shareholders |

| · | MGM will be a tax-payer for the first time in 2015 |

| v | The urgency of creating a tax efficient REIT structure has never been

higher with a growing tax bill looming |

| · | Debt Repayment Opportunity |

| v | The window is open for MGM to repay half of its debt in the near-term

with no penalty |

| v | A significant portion of MGM’s debt matures in the next 12 months |

THE MARKET PRICE INCREASED

SUBSTANTIALLY SINCE WE RELEASED OUR PROPOSAL – DRIVING UP THE COMPANY’S STOCK PRICE BY 13% AND CREATING $1.2 BILLION

IN MARKET VALUE

THE COMPANY’S RESISTANCE

TO TAKING MEANINGFUL ACTION, HOWEVER, COULD CAUSE MUCH OF THAT VALUE CREATION TO ERODE

We have been extremely disappointed by the lack of appropriate

urgency and apparent unwillingness of the Board and Management to take meaningful action. This includes the Board’s apparent

decision to ignore for months our call to hire independent financial advisors to evaluate our proposals and other available options

for the benefit of all shareholders. As a result of the Company’s apparent inaction, we were compelled to do what the Board

had not done, retain an independent financial advisor, Houlihan Lokey, to conduct a thorough strategic review of our proposed structure.

Whether it is the proposal Land and Buildings has outlined,

or a variation thereof, we believe it is important for the Land and Buildings nominees to be in the boardroom of MGM to ensure

that all value creating ideas are evaluated.

Vote FOR our Nominees on the GOLD Proxy Card Today

As detailed above, we believe MGM has lacked the Board stewardship

necessary to create long term shareholder value. Today, significant value is being trapped in MGM and we believe our Board nominees

can help unlock that value. We believe the net asset value of MGM is $33 per share, indicating an approximately 50%

further upside to intrinsic value. We believe strongly that our four candidates would help realized the intrinsic value for the

benefit of all our fellow shareholders.

Sincerely,

Jonathan Litt

Founder & CIO

Land and Buildings

| |

REMEMBER:

Your broker provides

for voting by telephone or via the Internet.

Please follow the easy instructions on

the enclosed proxy card.

If

you have any questions or need assistance in voting

your

shares, please call our proxy solicitor,

INNISFREE M&A INCORPORATED

TOLL-FREE, at 1-888-750-5834.

|

|

Investor Contact:

Scott Winter / Jonathan Salzberger

Innisfree M&A Incorporated

212-750-5833

Media Contact:

Elliot Sloane / Dan Zacchei

Sloane & Company

212-486-9500

Esloane@sloanepr.com or

Dzacchei@sloanepr.com

LAND & BUILDINGS CAPITAL GROWTH FUND,

L.P., LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC AND JONATHAN LITT (COLLECTIVELY, "LAND & BUILDINGS") AND MATTHEW

J. HART, RICHARD KINCAID AND MARC A. WEISMAN (TOGETHER WITH LAND & BUILDINGS, THE "PARTICIPANTS") FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION (THE "SEC") ON APRIL 16, 2015 A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF

PROXY CARD TO BE USED IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF MGM RESORTS INTERNATIONAL

(THE "COMPANY") FOR USE AT THE COMPANY'S 2015 ANNUAL MEETING OF STOCKHOLDERS (THE "PROXY SOLICITATION"). ALL

STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION

BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY

STATEMENT AND AN ACCOMPANYING PROXY CARD HAVE BEEN FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER

RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/. IN ADDITION, INNISFREE M&A INCORPORATED,

LAND & BUILDING'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT

CHARGE UPON REQUEST.

i

Closest peers represent Las Vegas Sands and Wynn Resorts, which are the most comparable in size, revenue sources and geographic

footprint.

ii

Stock price through April 15, 2015.

iii

Based on the number of shares beneficially owned as of March 30, 2015, as disclosed in MGM's proxy statement filed on April 13,

2015, and the number of shares beneficially owned as of June 12, 2009 (the year following Mr. Murren’s appointment as CEO),

as disclosed in MGM's proxy statement filed on June 25, 2009.

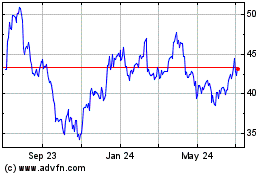

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

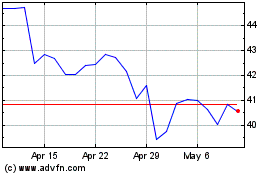

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024