UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: November, 2015

Commission File Number: 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: |

November 24, 2015 |

|

MAGNA INTERNATIONAL INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ “Bassem Shakeel” |

|

|

|

Bassem A. Shakeel |

|

|

|

Vice-President and Corporate Secretary |

2

EXHIBIT 99

Third Supplemental Indenture, dated as of November 24, 2015, among the Registrant, The Bank of New York Mellon, as trustee, and The Bank of New York Mellon, London Branch, as paying agent.

3

Exhibit 99

MAGNA INTERNATIONAL INC.

to

THE BANK OF NEW YORK MELLON

as Trustee

and

THE BANK OF NEW YORK MELLON, LONDON BRANCH

as Paying Agent

Third Supplemental Indenture

dated as of November 24, 2015

to

Indenture

dated as of June 16, 2014

€550,000,000

1.900% Senior Notes due 2023

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

|

|

|

ARTICLE I

RELATION TO INDENTURE; DEFINITIONS |

|

|

|

|

|

|

SECTION 1.01 |

Relation To Indenture |

|

1 |

|

SECTION 1.02 |

Rules of Interpretation; Definitions |

|

2 |

|

|

|

|

|

|

ARTICLE II |

|

THE SERIES OF DEBT SECURITIES |

|

|

|

|

|

|

SECTION 2.01 |

Title of the Debt Securities |

|

7 |

|

SECTION 2.02 |

Limitations on Aggregate Principal Amount |

|

7 |

|

SECTION 2.03 |

Registered Debt Securities; Global Form |

|

8 |

|

SECTION 2.04 |

Form and Terms of Notes; Payment |

|

8 |

|

SECTION 2.05 |

Registrar, Transfer Agent and Paying Agent |

|

9 |

|

SECTION 2.06 |

Applicability of Certain Indenture Provisions |

|

9 |

|

SECTION 2.07 |

Additional Amounts |

|

9 |

|

|

|

|

|

|

ARTICLE III |

|

CERTAIN COVENANTS APPLICABLE TO THE NOTES |

|

|

|

|

|

|

SECTION 3.01 |

Limitation on Secured Debt |

|

10 |

|

SECTION 3.02 |

Sale and Leaseback Transactions |

|

12 |

|

SECTION 3.03 |

Restrictions on Transfer of Principal Property to Unrestricted Subsidiaries |

|

12 |

|

SECTION 3.04 |

Right to Require Repurchase Upon a Change of Control Triggering Event |

|

13 |

|

|

|

|

|

|

ARTICLE IV |

|

REDEMPTION |

|

|

|

|

|

|

SECTION 4.01 |

Applicability of Article Four of the Indenture |

|

14 |

|

SECTION 4.02 |

Redemption at the Option of the Company |

|

14 |

|

SECTION 4.03 |

Notice of Redemption |

|

15 |

|

|

|

|

|

|

ARTICLE V |

|

MISCELLANEOUS PROVISIONS |

|

|

|

|

|

|

SECTION 5.01 |

Ratification of Indenture |

|

15 |

|

SECTION 5.02 |

Governing Law |

|

15 |

|

SECTION 5.03 |

Counterparts |

|

15 |

|

SECTION 5.04 |

Recitals |

|

16 |

|

SECTION 5.05 |

Waiver of Trial by Jury |

|

16 |

THIRD SUPPLEMENTAL INDENTURE, dated as of November 24, 2015 (this “Supplemental Indenture”), among MAGNA INTERNATIONAL INC., a corporation duly organized and existing under the laws of the Province of Ontario (the “Company”), THE BANK OF NEW YORK MELLON, a New York banking corporation, as trustee (the “Trustee”), and THE BANK OF NEW YORK MELLON, LONDON BRANCH, an office of The Bank of New York Mellon S.A./N.V., a wholly-owned subsidiary of the Trustee, as paying agent (the “Paying Agent”).

RECITALS OF THE COMPANY

WHEREAS, the Company has heretofore executed and delivered to the Trustee an Indenture, dated as of June 16, 2014, as amended and supplemented from time to time (the “Indenture”), providing for the issuance from time to time of debt securities of the Company in one or more series (the “Debt Securities”);

WHEREAS, Section 3.01 of the Indenture provides that various matters with respect to any series of Debt Securities issued under the Indenture may be established in an indenture supplemental to the Indenture;

WHEREAS, Section 11.01(i) of the Indenture provides for the Company and the Trustee to enter into an indenture supplemental to the Indenture to establish the form or terms of Debt Securities of any series as contemplated by Section 3.01 of the Indenture;

WHEREAS, the Company desires to issue €550,000,000 aggregate principal amount of 1.900% Senior Notes due 2023 (the “Notes”);

WHEREAS, the Notes will clear and settle through the facilities of Euroclear and Clearstream and otherwise outside the United States and the Company wishes to appoint The Bank of New York Mellon, London Branch as Paying Agent in respect of the Notes; and

WHEREAS, all the conditions and requirements necessary to make this Supplemental Indenture, when duly executed and delivered, a valid and legally binding agreement in accordance with its terms and for the purposes herein expressed, have been performed and fulfilled.

NOW, THEREFORE, THIS THIRD SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the purchase of the series of Debt Securities provided for herein by the Holders thereof, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders of the series of Debt Securities provided for herein, as follows:

ARTICLE I

RELATION TO INDENTURE; DEFINITIONS

SECTION 1.01 Relation To Indenture.

This Supplemental Indenture constitutes an integral part of the Indenture.

SECTION 1.02 Rules of Interpretation; Definitions.

The first paragraph of Section 1.01 of the Indenture is fully incorporated by reference into this Supplemental Indenture. For all purposes of this Supplemental Indenture, except as otherwise expressly provided or unless the context otherwise requires, all words, terms or phrases used but not defined herein shall have the respective meanings assigned to them in the Indenture.

“Business Day” means any day, other than a Saturday or a Sunday, (i) which is not a day on which banking institutions in the City of New York or London are authorized or required by law, regulation or executive order to close and (ii) on which the Trans-European Automated Real-Time Gross Settlement Express Transfer system (the TARGET2 system) or any successor thereto, is open.

“Change of Control” means the occurrence of any of the following after the date of issuance of the Notes:

(1) the direct or indirect sale, lease, transfer, conveyance or other disposition (other than by way of merger, amalgamation or consolidation), in one or a series of related transactions, of all or substantially all of the Company’s assets and the assets of the Company’s Subsidiaries taken as a whole to any “person” or “group” (as those terms are used in Section 13(d)(3) of the Exchange Act) other than to the Company or one of the Company’s Subsidiaries;

(2) the consummation of any transaction (including, without limitation, any merger, amalgamation or consolidation) the result of which is that any “person” or “group” (as those terms are used in Section 13(d)(3) of the Exchange Act) (other than the Company or one of the Company’s Subsidiaries) becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of the Company’s Voting Stock representing a majority of the voting power of the Company’s outstanding Voting Stock;

(3) the Company consolidates or amalgamates with, or merges with or into, any Person, or any Person consolidates with, or merges or amalgamates with or into, the Company, in any such event pursuant to a transaction in which any of the Company’s outstanding Voting Stock or Voting Stock of such other Person is converted into or exchanged for cash, securities or other property, other than any such transaction where the Company’s Voting Stock outstanding immediately prior to such transaction constitutes, or is converted into or exchanged for, Voting Stock representing a majority of the voting power of the Voting Stock of the surviving Person immediately after giving effect to such transaction;

(4) the first day on which the majority of the members of the Board of Directors cease to be Continuing Directors; or

(5) the adoption by the Company’s shareholders of a plan relating to the Company’s liquidation or dissolution.

2

Notwithstanding the foregoing, a transaction will not be deemed to involve a Change of Control under clause (2) above if (1) the Company becomes a direct or indirect wholly-owned Subsidiary of a holding company and (2)(A) the direct or indirect holders of the Voting Stock of such holding company immediately following that transaction are substantially the same as the holders of the Company’s Voting Stock immediately prior to that transaction or (B) immediately following that transaction no person (as that term is used in Section 13(d)(3) of the Exchange Act) (other than a holding company satisfying the requirements of this sentence) is the beneficial owner, directly or indirectly, of more than 50% of the Voting Stock of such holding company.

“Change of Control Triggering Event” means the Notes cease to be rated Investment Grade by each of the Rating Agencies on any date during the Trigger Period (which Trigger Period will be extended following consummation of a Change of Control for so long as any of the Rating Agencies has publicly announced that it is considering a possible ratings change). However, a Change of Control Triggering Event otherwise arising by virtue of a particular reduction in rating shall not be deemed to have occurred in respect of a particular Change of Control (and thus shall not be deemed a Change of Control Triggering Event for purposes of the definition of Change of Control Triggering Event) if the Rating Agencies making the reduction in rating to which this definition would otherwise apply do not announce or publicly confirm or inform the Trustee in writing at the Company’s request that the reduction was the result, in whole or in part, of any event or circumstance comprised of or arising as a result of, or in respect of, the applicable Change of Control (whether or not the applicable Change of Control shall have occurred at the time of the Change in Control Triggering Event). If a Rating Agency is not providing a rating for such Notes at the commencement of any Trigger Period, the Notes will be deemed to have ceased to be rated Investment Grade by such Rating Agency during that Trigger Period. Notwithstanding the foregoing, no Change of Control Triggering Event will be deemed to have occurred in connection with any particular Change of Control unless and until such Change of Control has actually been consummated.

“Clearstream” means Clearstream Banking, société anonyme.

“Common Depositary” means The Bank of New York, London Branch, in its capacity as common depositary for, and in respect of interests held through, Euroclear and Clearstream.

“Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation, at the discretion of an Independent Investment Banker, a German government bond whose maturity is closest to the maturity of the Notes to be redeemed (assuming for such purpose that the Notes were to mature on the Initial Par Call Date), or if the Independent Investment Banker in its discretion determines that such similar bond is not in issue, such other German government bond as such Independent Investment Banker may, with the advice of three brokers of, and/or market makers in, German government bonds selected by such Independent Investment Banker, determine to be appropriate for determining the Comparable Government Bond Rate.

“Comparable Government Bond Rate” means the gross redemption yield on the Comparable Government Bond assuming such Comparable Government Bond were to be purchased on the third Business Day prior to the date fixed for redemption at the middle market price, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded

3

upwards), for the Comparable Government Bond prevailing at 11:00 a.m. (London time) on such business day as determined by an Independent Investment Banker.

“Consolidated Current Liabilities” means the aggregate of the current liabilities of the Company and its Restricted Subsidiaries (excluding liabilities of Unrestricted Subsidiaries and excluding billings on uncompleted contracts in excess of related costs and profits) appearing on the most recent available consolidated balance sheet of the Company and its Restricted Subsidiaries, all in accordance with generally accepted accounting principles; provided, however, that in no event shall Consolidated Current Liabilities include any obligation of the Company and its Restricted Subsidiaries issued under a revolving credit or similar agreement if the obligation issued under such agreement matures by its terms within 12 months from the date thereof but by the terms of such agreement such obligation may be renewed or extended or the amount thereof reborrowed or refunded at the option of the Company or any Restricted Subsidiary for a term in excess of 12 months from the date of determination.

“Consolidated Net Tangible Assets” means Consolidated Tangible Assets after deduction of Consolidated Current Liabilities.

“Consolidated Shareholders’ Equity” means at any date the shareholders’ equity of the Company and its Consolidated Subsidiaries determined on a consolidated basis as of such date in accordance with United States generally accepted accounting principles; provided that, for purposes hereof, the consolidated shareholders’ equity of the Company and its Consolidated Subsidiaries shall be calculated without giving effect to (i) the application of ASC 715-Compensation-Retirement Benefits or (ii) the cumulative foreign currency translation adjustment.

“Consolidated Subsidiary” means, as to any Person, each subsidiary of such Person (whether now existing or hereafter created or acquired) the financial statements of which shall be (or should have been) consolidated with the financial statements of such Person in accordance with United States generally accepted accounting principles.

“Consolidated Tangible Assets” means the aggregate of all assets of the Company and its Restricted Subsidiaries (including the value of all existing Sale and Leaseback Transactions and any assets resulting from the capitalization of other long-term lease obligations in accordance with generally accepted accounting principles but excluding the value of assets or investments in any Unrestricted Subsidiary or any non-majority-owned Subsidiary) appearing on the most recent available consolidated balance sheet of the Company and its Restricted Subsidiaries at their net book values, after deducting related depreciation, amortization and other valuation reserves and excluding patent and trademark rights, good will, unamortized discounts and expenses and any other intangible items, all in accordance with generally accepted accounting principles.

“Continuing Director” means, as of any date of determination, any member of the Board of Directors who:

(1) was a member of the Board of Directors on the date of the issuance of the Notes; or

4

(2) was nominated for election or elected or appointed to the Board of Directors with the approval of a majority of the Continuing Directors who were members of the Board of Directors at the time of such nomination, election or appointment (either by a specific vote or by approval of the Company’s proxy statement in which such member was named as a nominee for election as a director, without objection to such nomination).

“Corporate Trust Office of the Paying Agent” means, initially the office of The Bank of New York Mellon, London Branch, located at One Canada Square, London E14 3AL, United Kingdom.

“Euro” or “€” means the single currency introduced at the third stage of the European Monetary Union pursuant to the Treaty establishing the European Community, as amended.

“Euroclear” means Euroclear S.A./N.V., as operator of the Euroclear System.

“Independent Investment Banker” means any of BNP Paribas, Citigroup Global Markets Limited or Merrill Lynch International and their respective successors, as selected by the Company, or, if each such firm is unwilling or unable to select the Comparable Government Bond, an independent investment banking institution of international standing appointed by the Company.

“Initial Par Call Date” means August 24, 2023.

“Investment Grade” means a rating of Baa3 or better by Moody’s (or its equivalent under any successor rating category of Moody’s) and a rating of BBB- or better by S&P (or its equivalent under any successor rating category of S&P), and the equivalent investment grade credit rating from any replacement rating agency or rating agencies selected by the Company under the circumstances permitting the Company to select a replacement rating agency and in the manner for selecting a replacement rating agency, in each case as set forth in the definition of “Rating Agency.”

“Market Exchange Rate” means the noon buying rate in the City of New York for cable transfers of Euros as certified for customs purposes (or, if not so certified, as otherwise determined) by the Federal Reserve Bank of New York.

“Moody’s” means Moody’s Investors Service, Inc., a subsidiary of Moody’s Corporation, and its successors.

“Person” means, solely for purposes of the provisions of Section 3.04, any individual, corporation, partnership, limited liability company, business trust, association, joint-stock company, joint venture, trust, incorporated or unincorporated organization or other entity or government or any agency or political subdivision thereof.

“Principal Property” means any manufacturing plant, warehouse, office building or parcel of real property located in Canada, the United States, its territories and possessions, Puerto Rico or Mexico (including fixtures and manufacturing machinery and equipment but excluding leases and other contract rights which might otherwise be deemed real property) owned by the

5

Company or any Restricted Subsidiary, whether owned on the date of this Supplemental Indenture or thereafter, other than such plant, warehouse, office building or parcel of real property or portion thereof (including fixtures and manufacturing machinery and equipment) which, in the opinion of the Board of Directors (evidenced by a certified Board Resolution thereof delivered to the Trustee), is not of material importance to the business conducted by the Company and its Restricted Subsidiaries taken as a whole.

“Rating Agency” means each of Moody’s and S&P; provided, that if any of Moody’s or S&P ceases to provide rating services to issuers or investors, the Company may appoint another “nationally recognized statistical rating organization” as defined under Section 3(a)(62) of the Exchange Act as a replacement for such Rating Agency; provided, that the Company shall give notice of such appointment to the Trustee.

“Restricted Subsidiary” means (a) any Subsidiary other than an Unrestricted Subsidiary and (b) any Subsidiary which is an Unrestricted Subsidiary but which is designated by the Board of Directors pursuant to a Board Resolution to be a Restricted Subsidiary; provided, however, that the Board of Directors may not designate any Subsidiary to be a Restricted Subsidiary if the Company would thereby breach any covenant or agreement contained in the Indenture (on the assumptions that any outstanding Secured Debt of such Subsidiary was incurred at the time of such designation and that any Sale and Leaseback Transaction to which such Subsidiary is then a party was entered into at the time of such designation).

“Sale and Leaseback Transaction” has the meaning specified in Section 3.02 of this Supplemental Indenture.

“Secured Debt” means indebtedness for money borrowed that is secured by a Security Interest in (a) any Principal Property or (b) any shares of capital stock or other equity interests or indebtedness (held as an asset) of any Restricted Subsidiary.

“Security Interest” shall mean any mortgage, pledge, lien, encumbrance, conditional sale, title retention agreement or other security interest.

“S&P” means Standard & Poor’s Ratings Services, a division of McGraw Hill Financial, Inc., and its successors.

“Trigger Period” means the period commencing 60 days prior to the first public announcement by the Company of any Change of Control (or pending Change of Control) and ending 60 days following consummation of such Change of Control.

“Unrestricted Subsidiary” means (a) any Subsidiary acquired or organized after the date hereof, provided, however, that such Subsidiary shall not be a successor, directly or indirectly, to any Restricted Subsidiary (whether by merger, consolidation or amalgamation of such Restricted Subsidiary with, or transfer of all or substantially all assets of such Restricted Subsidiary to, such Subsidiary or otherwise); (b) any Subsidiary whose principal business or assets are located outside Canada, the United States, its territories and possessions, Puerto Rico or Mexico; (c) any Subsidiary the principal business of which consists of financing or assisting in financing of customer construction projects or the acquisition or disposition of products of dealers, distributors or other customers; (d) any Subsidiary whose principal business is the ownership,

6

leasing, purchasing, selling or development of real property; or (e) any Subsidiary substantially all the assets of which consist of stock or other securities of a Subsidiary or Subsidiaries of a character described in clauses (a) through (d) of this paragraph, unless and until any such Subsidiary shall have been designated to be a Restricted Subsidiary pursuant to clause (b) of the definition of “Restricted Subsidiary.”

“value” means, as at any particular time with respect to a Sale and Leaseback Transaction, an amount equal to the present value (discounted at the rate of interest implicit in the terms of the lease) of the obligations of the lessee under such lease for net rental payments during the remaining term of the lease (including any period for which such lease has been extended). For purposes of the foregoing, “net rental payments” under any lease for any period means the sum of the rental and other payments required to be paid in such period by the lessee thereunder, not including, however, any amounts required to be paid by such lessee (whether or not designated as rental or additional rental) on account of maintenance and repairs, insurance, taxes, assessments or similar charges.

“Voting Stock” of any specified Person as of any date means the capital stock of such Person that is at the time entitled to vote generally in the election of the board of directors of such Person.

ARTICLE II

THE SERIES OF DEBT SECURITIES

SECTION 2.01 Title of the Debt Securities.

There is hereby created under the Indenture a series of Debt Securities designated the “1.900% Senior Notes due 2023.”

SECTION 2.02 Limitations on Aggregate Principal Amount.

The aggregate principal amount of the Notes shall be initially limited to €550,000,000; provided that the Company may, without the consent of the Holders of Outstanding Notes, increase the principal amount of the Notes Outstanding by issuing additional Notes (“Additional Notes”) in the future on the same terms and conditions (including, without limitation, the right to receive accrued and unpaid interest), except for differences in the issue price and issue date of the Additional Notes, and with the same CUSIP number as the Notes then Outstanding; provided that if the Additional Notes are not fungible with the Outstanding Notes for U.S. federal income tax purposes, the Additional Notes shall have a separate CUSIP number. No Additional Notes may be issued if an Event of Default has occurred and is continuing with respect to the Notes. Any Additional Notes shall rank equally and ratably with the Notes then Outstanding and shall be treated as a single series for all purposes hereunder and under the Indenture. From and after the issue date of any Additional Notes, any reference herein to “Notes” shall include such Additional Notes.

Except with respect to Additional Notes as provided in this Section 2.02, the Company shall not execute and the Trustee shall not authenticate or deliver Notes in excess of such aggregate principal amount.

7

Nothing contained in this Section 2.02 or elsewhere in this Supplemental Indenture, or in the Notes, is intended to or shall limit execution by the Company or authentication or delivery by the Trustee of the Notes under the circumstances contemplated in Section 3.06, 3.07, 4.03 and 11.04 of the Indenture.

SECTION 2.03 Registered Debt Securities; Global Form.

The Notes shall be issuable and transferable in fully registered form, without coupons. The Notes shall each be issued in the form of one or more permanent Global Debt Securities subject to any requirements of the Indenture for the issuance of definitive Notes in exchange therefor. The Depository for the Notes shall be Euroclear and Clearstream. Beneficial interests in the Global Debt Securities evidencing the Notes shall not be exchangeable for Notes in definitive form except as provided in Section 2.04 of the Indenture.

SECTION 2.04 Form and Terms of Notes; Payment.

The Notes shall be substantially in the form attached as Exhibit A hereto and shall have the terms specified therein. The Global Debt Securities evidencing the Notes shall be deposited with, or on behalf of, the Depository and shall be registered in the name of The Bank of New York Depository (Nominees) Limited, as nominee of the Common Depositary for, and in respect of interests held through, the Depository.

Principal of, and premium or Redemption Price, if any, and interest on the Notes will be payable in Euro. If Euro is unavailable to the Company due to the imposition of exchange controls or other circumstances beyond the Company’s control or the Euro is no longer used by the member states of the European Monetary Union that have adopted the Euro as their currency for the settlement of transactions by public institutions within the international banking community, then all payments in respect of the Notes will be made in Dollars until Euro is again available to the Company or so used. In such case, the amount payable on any date in Euro will be converted to Dollars on the basis of the Market Exchange Rate on the second Business Day before the date that payment is due, or if such Market Exchange Rate is not then available, on the basis of the most recently available Market Exchange Rate on or before the date that payment is due. Any payment in respect of the Notes so made in Dollars will not constitute an Event of Default under the Indenture. Neither the Trustee nor the Paying Agent (or any other Paying Agent appointed in respect of the Notes under the Indenture) shall be responsible for obtaining exchange rates, effecting conversions or otherwise handling re-denominations.

At the time of repayment of the Notes, whether on the Stated Maturity Date (as defined in the form of Note attached as Exhibit A hereto), or upon earlier repayment or redemption in accordance with the provisions set forth in Section 3.04 and Article IV hereof or Section 5.08(b) of the Indenture, the Company may designate one or more of its Subsidiaries to acquire the Notes for its own account and to pay Holders a cash purchase price for the Notes that is equal to the amounts otherwise due upon maturity or such earlier repayment or redemption. Notwithstanding the foregoing, the Company will remain the sole obligor under the Notes and Holders will continue to be entitled to look solely to the Company for payment of all amounts due under the Notes. For greater certainty, in addition to the foregoing, either the Company or one or more of its Subsidiaries may also purchase outstanding Notes at any time and from time

8

to time at prevailing market prices or at such price as the Holder of the Notes being purchased may agree.

SECTION 2.05 Registrar, Transfer Agent and Paying Agent.

The Bank of New York Mellon shall initially serve as Debt Security registrar and transfer agent for the Notes. The Bank of New York Mellon, London Branch, shall initially serve as Paying Agent for the Notes.

The execution and delivery of this Supplemental Indenture by the Bank of New York Mellon shall be deemed, in addition to acceptance of the duties as Trustee, acceptance of its responsibilities as Debt Security registrar and transfer agent for the Notes.

The execution and delivery of this Supplemental Indenture by the Bank of New York Mellon, London Branch, shall be deemed acceptance of its responsibilities as Paying Agent for the Notes.

Solely for purposes of the Notes (and not in relation to any other series of Debt Securities), Section 5.04(a)(1) of the Indenture shall be deemed to be replaced in its entirety with the following:

“The Company will, no later than 5:00 p.m., London time, on the Business Day prior to each due date of the principal of (and premium, if any) or interest on the Notes, deposit with the Paying Agent a sum sufficient to pay such amount becoming due, such sum to be held as provided by the Trust Indenture Act of 1939, and (unless the Paying Agent is the Trustee) the Company will promptly notify the Trustee of its action or failure so to act.”

SECTION 2.06 Applicability of Certain Indenture Provisions.

The provisions of Article Thirteen of the Indenture relating to defeasance and covenant defeasance shall be applicable to the Notes and the provisions of Section 13.04 thereof shall, in addition to those sections of the Indenture specified in Section 13.04 thereof, apply with respect to the covenants specified in Sections 3.01, 3.02 and 3.03 of this Supplemental Indenture.

The provisions of Section 5.10 of the Indenture are hereby expressly made applicable to the covenants specified in Sections 3.01, 3.02 and 3.03 of this Supplemental Indenture.

SECTION 2.07 Additional Amounts.

The provisions of Section 5.08 of the Indenture relating to the payment of Additional Amounts (including, without limitation, Section 5.08(b)) shall, subject to the provisions of this Section 2.07, be applicable to the Notes.

Solely for purposes of the Notes (and not in relation to any other series of Debt Securities), the second paragraph of Section 5.08(a) of the Indenture immediately following clause (8) of the first paragraph of Section 5.08(a) shall be deemed to be deleted in its entirety and Section 5.08(a) is hereby so amended for purposes of the Notes.

9

ARTICLE III

CERTAIN COVENANTS APPLICABLE TO THE NOTES

SECTION 3.01 Limitation on Secured Debt.

(a) So long as the Notes shall remain Outstanding, the Company will not at any time create, assume or guarantee, and will not cause or permit a Restricted Subsidiary to create, assume or guarantee any Secured Debt without making effective provision (and the Company covenants that in such case it will make or cause to be made effective provision) whereby the Notes then Outstanding shall be secured by such Security Interest equally and ratably with any and all other obligations and indebtedness which shall be so secured; provided, however, that the foregoing covenants shall not be applicable to the following:

(1) (a) any Security Interest on any property hereafter acquired or constructed by the Company or a Restricted Subsidiary (including any improvement on an existing property) to secure or provide for the payment of all or any part of the purchase price or construction cost of such property, including, but not limited to, any indebtedness incurred by the Company or a Restricted Subsidiary prior to, at the time of, or within 365 days after the later of the acquisition, the completion of construction (including any improvements on an existing property) or the commencement of commercial operation of such property, which indebtedness is incurred for the purpose of financing or refinancing all or any part of the purchase price thereof or construction or improvements thereon; or (b) any Security Interest upon property existing at the time of acquisition thereof, whether or not assumed by the Company or such Restricted Subsidiary; or (c) any Security Interest existing on the property or on the outstanding shares of capital stock or other equity interests or indebtedness of a Person at the time such Person or an Affiliate of such Person shall become a Restricted Subsidiary (including any such Security Interest to secure or provide for the payment of all or any part of the purchase price of or consideration for any such transaction); or (d) a Security Interest on property or shares of capital stock or other equity interests or indebtedness of a Person existing at the time such Person or an Affiliate of such Person is merged into or consolidated or amalgamated with the Company or a Restricted Subsidiary or at the time of a sale, lease or other disposition of the properties of a Person as an entirety or substantially as an entirety to the Company or a Restricted Subsidiary (including any such Security Interest to secure or provide for the payment of all or any part of the purchase price of or consideration for any such merger, consolidation, amalgamation, lease or other acquisition), provided, however, that no such Security Interest shall extend to any other Principal Property of the Company or such Restricted Subsidiary prior to such acquisition or to the other Principal Property thereafter acquired other than additions or improvements to such acquired property;

(2) Security Interests in property of the Company or a Restricted Subsidiary in favor of the United States of America or any State thereof, or any department, agency or instrumentality or political subdivision of the United States of America or any State thereof, or in favor of Canada or any province thereof or any other country, or any department, agency or instrumentality or political subdivision of Canada or any province thereof or such other country (including, without limitation, Security Interests to secure

10

indebtedness of the pollution control or industrial revenue bond type), in order to permit the Company or a Restricted Subsidiary to perform any contract or subcontract made by it with or at the request of any of the foregoing, or to secure partial, progress, advance or other payments pursuant to any contract or statute or to secure any indebtedness incurred for the purpose of financing all or any part of the purchase price or the cost of constructing or improving the property subject to such Security Interests;

(3) any Security Interest existing at the date of original issuance of the Notes;

(4) any Security Interest on any property or assets of any Restricted Subsidiary to secure indebtedness owing by it to the Company or to a Restricted Subsidiary;

(5) Mechanics’, materialmen’s, carriers’ or other like liens arising in the ordinary course of business (including construction of facilities) in respect of obligations which are not due or which are being contested in good faith;

(6) any Security Interest arising by reason of deposits with, or the giving of any form of security to, any governmental agency or any body created or approved by law or governmental regulations, which is required by law or governmental regulation as a condition to the transaction of any business, or the exercise of any privilege, franchise or license;

(7) Security Interests for taxes, assessments or governmental charges or levies not yet delinquent, or the Security Interests for taxes, assessments or government charges or levies already delinquent but the validity of which is being contested in good faith;

(8) Security Interests (including judgment liens) arising in connection with legal proceedings so long as such proceedings are being contested in good faith and, in the case of judgment liens, execution thereon is stayed;

(9) Landlords’ liens on fixtures located on premises leased by the Company or a Restricted Subsidiary in the ordinary course of business; or

(10) any extension, renewal or replacement (or successive extensions, renewals or replacements) in whole or in part of any Security Interest permitted by subsection (a) of this Section 3.01.

(b) Notwithstanding the provisions of subsection (a) of this Section 3.01, the Company and any one or more Restricted Subsidiaries may, in addition, without securing the Notes, issue, assume or guarantee Secured Debt that would otherwise be subject to the foregoing restrictions in an aggregate amount which, together with all other Secured Debt of the Company and its Restricted Subsidiaries that would otherwise be subject to the foregoing restrictions (but not including Secured Debt permitted to be secured under subsection (a) above) and the aggregate value of the Sale and Leaseback Transactions (as defined in Section 3.02) in existence at such time (not including Sale and Leaseback Transactions the proceeds of which have been or will be applied in accordance with clause (b) of Section 3.02), does not exceed 10% of Consolidated Shareholders’ Equity, determined as of a date not more than 90 days prior thereto.

11

(c) In the event that the Company shall hereafter secure the Notes equally and ratably with any other obligation or indebtedness pursuant to the provisions of this Section 3.01, the Trustee is hereby authorized to enter into an indenture or agreement supplemental to the Indenture and this Supplemental Indenture and to take such action, if any, as it may deem advisable to enable it to enforce effectively the rights of the Holders of the Notes so secured, equally and ratably with such other obligation or indebtedness.

SECTION 3.02 Sale and Leaseback Transactions.

So long as the Notes shall remain Outstanding, the Company will not, and will not permit any Restricted Subsidiary to, sell or transfer (except to the Company or one or more Restricted Subsidiaries, or both) any Principal Property owned by the Company or a Restricted Subsidiary and in full operation for more than 365 days, with the intention of taking back a lease on such property (except a lease for a term of no more than three years entered into with the intent that the use by the Company or such Restricted Subsidiary of such property will be discontinued on or before the expiration of such term) (herein referred to as a “Sale and Leaseback Transaction”) unless either (a) the Company or such Restricted Subsidiary would be permitted, pursuant to the provisions of Section 3.01, to incur Secured Debt equal in amount to the amount realized or to be realized upon such sale or transfer secured by a Security Interest on the Principal Property to be leased without equally and ratably securing the Notes or (b) the Company or a Restricted Subsidiary shall apply an amount equal to the value of the Principal Property so leased to the retirement (other than any mandatory retirement), within 365 days of the effective date of any such arrangement, of indebtedness for money borrowed of the Company and its Restricted Subsidiaries (excluding indebtedness for money borrowed of Unrestricted Subsidiaries) as shown on the most recent consolidated balance sheet of the Company and which, in the case of such indebtedness for money borrowed of the Company, is not subordinated to the Notes; provided, however, that in lieu of applying all or any part of such amount to such retirement, the Company may at its option (x) deliver to the Trustee Debt Securities of any series issued under the Indenture (including the Notes) theretofore purchased or otherwise acquired by the Company or (y) receive credit for Debt Securities of any series issued under the Indenture (including the Notes) theretofore redeemed at its option. If the Company shall so deliver Debt Securities to the Trustee (or receive credit for Debt Securities so delivered), the amount which the Company shall be required to apply to the retirement of indebtedness pursuant to this Section 3.02 shall be reduced by an amount equal to the aggregate principal amount of such Debt Securities.

SECTION 3.03 Restrictions on Transfer of Principal Property to Unrestricted Subsidiaries.

So long as the Notes remain Outstanding, the Company will not itself, and will not cause or permit any Restricted Subsidiary to, transfer (whether by merger, consolidation, amalgamation or otherwise) Principal Property that has a gross book value (without deduction for any depreciation reserves) at the date as of which the determination is being made in excess of two percent of the Consolidated Net Tangible Assets of the Company and the Restricted Subsidiaries to any Unrestricted Subsidiary, unless it shall apply, within one year after the effective date of such transaction, or shall have committed within one year after such effective date to apply, an amount equal to the fair value of such Principal Property at the time of such transfer, as determined by the Board of Directors, (a) to the acquisition, construction, development or

12

improvement of properties, facilities or equipment which are, or, upon, such acquisition, construction, development or improvement will be, a Principal Property or Properties or a part thereof, (b) to the redemption of Debt Securities of any series in accordance with the provisions of Article Four of the Indenture, (c) to the repayment of indebtedness for borrowed money of the Company or of any Restricted Subsidiary (other than any such indebtedness owed to any Restricted Subsidiary or any subordinated indebtedness of the Company), or (d) in part to an acquisition, construction, development or improvement and in part to such redemption and/or repayment, in each case as set forth in clauses (a) through (c) above; provided that, in lieu of applying an amount equivalent to all or any part of such fair value to such redemption, the Company may, within one year after such transfer, deliver to the Trustee Debt Securities (other than Debt Securities made the basis of a reduction in a mandatory sinking fund payment pursuant to Section 4.05 of the Indenture) for cancellation and thereby reduce the amount to be applied to the redemption of the Debt Securities of that series pursuant to clause (b) above by an amount equivalent to the aggregate principal amount of the Debt Securities so delivered. The fair value of any Principal Property for purposes of this Section 3.03 will be as determined by the Board of Directors.

SECTION 3.04 Right to Require Repurchase Upon a Change of Control Triggering Event.

Upon the occurrence of a Change of Control Triggering Event with respect to the Notes, unless the Company has exercised its right to redeem the Notes in whole in accordance with the provisions of Article IV hereof by giving irrevocable notice to the Trustee in accordance with the Indenture, each Holder of Notes will have the right to require the Company to purchase all or a portion of such Holder’s Notes pursuant to the offer described below (the “Change of Control Offer”), at a purchase price equal to 101% of the principal amount thereof plus accrued and unpaid interest to, but excluding, the date of purchase (the “Change of Control Payment”).

Within 30 days following the date upon which the Change of Control Triggering Event occurs or, at the Company’s option, prior to any Change of Control but after the public announcement of the pending Change of Control, the Company shall send, by first class mail, a notice to each holder of Notes, with a copy to the Trustee, which notice will govern the terms of the Change of Control Offer. Such notice shall state, among other things, the purchase date, which must be no earlier than 30 days nor later than 60 days from the date such notice is mailed, other than as may be required by law (the “Change of Control Payment Date”). The notice, if mailed prior to the date of consummation of the Change of Control, shall state that the Change of Control Offer is conditioned on the Change of Control being consummated on or prior to the Change of Control Payment Date. Holders of Notes electing to have Notes purchased pursuant to a Change of Control Offer will be required to surrender their Notes to the Paying Agent at the address specified in the notice, or transfer their Notes to the Paying Agent by book-entry transfer pursuant to the applicable procedures of the Paying Agent, prior to the close of business on the third Business Day prior to the Change of Control Payment Date.

On the Change of Control Payment Date, the Company shall, to the extent lawful:

(1) accept or cause a third party to accept for payment all Notes or portions of Notes properly tendered pursuant to the Change of Control Offer;

13

(ii) at or prior to 10:00 a.m., London time, deposit or cause a third party to deposit with the Paying Agent an amount equal to the Change of Control Payment in respect of all Notes or portions of Notes properly tendered; and

(iii) deliver or cause to be delivered to the Trustee the Notes properly accepted together with an Officers’ Certificate stating the aggregate principal amount of Notes or portions of Notes being repurchased.

The Company shall not be required to make a Change of Control Offer with respect to the Notes if a third party makes such an offer in the manner, at the times and otherwise in compliance with the requirements for such an offer made by the Company and such third party purchases all the Notes properly tendered and not withdrawn under its offer. In addition, the Company shall not repurchase any Notes if there has occurred and is continuing on the Change of Control Payment Date an Event of Default under the Indenture, other than a default in the payment of the Change of Control Payment on the Change of Control Payment Date.

The Company must comply in all material respects with the requirements of Rule 14e-1 under the Exchange Act, and any other securities laws and regulations thereunder to the extent such laws and regulations are applicable in connection with the repurchase of the Notes as a result of a Change of Control Triggering Event. To the extent that the provisions of any such securities laws or regulations conflict with the Change of Control Offer provisions of the Notes, the Company shall be required to comply with such securities laws and regulations and shall not be deemed to have breached the Company’s obligations under the Change of Control Offer provisions of the Notes by virtue of any such conflict.

ARTICLE IV

REDEMPTION

SECTION 4.01 Applicability of Article Four of the Indenture.

The provisions of Article Four of the Indenture shall be applicable with respect to the Notes.

SECTION 4.02 Redemption at the Option of the Company.

The Company may redeem the Notes, in whole or in part, at any time and from time to time, prior to the Initial Par Call Date, at its option, at the Redemption Price equal to the greater of:

(a) 100% of the principal amount of the Notes to be redeemed; and

(b) the sum of the present values of the remaining scheduled payments of principal and interest on the Notes to be redeemed that would be due if such Notes matured on the Initial Par Call Date but for the redemption (not including any portion of such payments of interest accrued to the Redemption Date), discounted to the Redemption Date on an annual basis (ACTUAL/ACTUAL (ICMA) (as defined in the rulebook of International Capital Market Association)) at the applicable Comparable Government Bond Rate plus 25 basis points,

14

plus, in each case, accrued and unpaid interest on the Notes being redeemed to the Redemption Date.

On or after the Initial Par Call Date, the Company may redeem the Notes, in whole or in part, at any time and from time to time, at a Redemption Price equal to 100% of the principal amount of the Notes to be redeemed plus accrued and unpaid interest on the Notes being redeemed to, but excluding, the Redemption Date.

Unless the Company shall default in payment of the Redemption Price, on and after the Redemption Date, interest will cease to accrue on the Notes or portions thereof called for redemption on such date.

SECTION 4.03 Notice of Redemption.

The Company shall provide Holders of Notes to be redeemed notice thereof by first-class mail at least 30 and not more than 60 days prior to the date fixed for redemption. If fewer than all the Notes are to be redeemed, the Trustee shall select, not more than 60 days prior to the Redemption Date, the particular Notes or portions thereof for redemption from the Notes Outstanding not previously called by such method as the Trustee deems fair and appropriate or, if the Notes are issued in the form of one or more Global Debt Securities and beneficial interests therein are held in book-entry form through the facilities of Euroclear and Clearstream, in accordance with the procedures of Euroclear or Clearstream, as the case may be; provided that unredeemed portions of any Notes redeemed in part shall remain in denominations of €100,000 and integral multiples of €1,000 in excess thereof.

ARTICLE V

MISCELLANEOUS PROVISIONS

SECTION 5.01 Ratification of Indenture.

Except as expressly modified or amended hereby, the Indenture continues in full force and effect and is in all respects confirmed and preserved and this Supplemental Indenture shall be deemed part of the Indenture in the manner and to the extent herein and therein provided.

SECTION 5.02 Governing Law.

This Supplemental Indenture and each Note shall be governed by and construed in accordance with the laws of the State of New York. This Supplemental Indenture is subject to the provisions of the Trust Indenture Act of 1939, as amended, and shall, to the extent applicable, be governed by such provisions.

SECTION 5.03 Counterparts.

This Supplemental Indenture may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this Supplemental Indenture by facsimile or other electronic transmission (i.e., a “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart hereof.

15

SECTION 5.04 Recitals.

The recitals contained herein shall be taken as statements of the Company, and the Trustee assumes no responsibility for their correctness. The Trustee makes no representations as to the validity or sufficiency of this Supplemental Indenture.

SECTION 5.05 Waiver of Trial by Jury.

EACH OF THE PARTIES HERETO, AND EACH HOLDER AND BENEFICIAL OWNER, BY ACCEPTANCE OF THE DEBT SECURITIES OR A BENEFICIAL INTEREST THEREIN, IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS SUPPLEMENTAL INDENTURE OR THE NOTES.

[signature page follows]

16

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed by their respective officers hereunto duly authorized, all as of the day and year first written above.

|

|

MAGNA INTERNATIONAL INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Paul Brock |

|

|

|

Name: Paul Brock |

|

|

|

Title: Vice-President and Treasurer |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Bassem A. Shakeel |

|

|

|

Name: Bassem A. Shakeel |

|

|

|

Title: Vice-President and Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

THE BANK OF NEW YORK MELLON, as Trustee, Debt Security registrar and transfer agent |

|

|

|

|

|

|

|

|

By: |

/s/ James Briggs |

|

|

|

Authorized Representative |

|

|

|

|

|

THE BANK OF NEW YORK MELLON, LONDON BRANCH, as Paying Agent |

|

|

|

|

|

|

|

|

By: |

/s/ James Briggs |

|

|

|

Authorized Representative |

Exhibit A to

Third Supplemental Indenture

UNLESS THIS SECURITY IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE BANK OF NEW YORK MELLON, LONDON BRANCH, AS COMMON DEPOSITARY (THE “COMMON DEPOSITARY”) FOR EUROCLEAR BANK, S.A./N.V. AS OPERATOR OF THE EUROCLEAR SYSTEM, AND CLEARSTREAM BANKING, SOCIÉTÉ ANONYME, TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND SUCH SECURITY ISSUED IS REGISTERED IN THE NAME OF THE BANK OF NEW YORK DEPOSITORY (NOMINEES) LIMITED, OR SUCH OTHER NAME AS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE COMMON DEPOSITARY, ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL, SINCE THE REGISTERED OWNER HEREOF, THE BANK OF NEW YORK DEPOSITORY (NOMINEES) LIMITED, HAS AN INTEREST HEREIN.

TRANSFERS OF THIS SECURITY SHALL BE LIMITED TO TRANSFERS, IN WHOLE BUT NOT IN PART, TO NOMINEES OF THE COMMON DEPOSITARY OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE EXCEPT AS OTHERWISE PROVIDED IN THE INDENTURE REFERRED TO ON THE REVERSE SIDE OF THIS CERTIFICATE.

MAGNA INTERNATIONAL INC.

1.900% Senior Note due 2023

|

REGISTERED |

|

PRINCIPAL AMOUNT |

|

No. |

|

€ |

CUSIP NO. 559222 AS3

ISIN: XS1323910684

COMMON CODE: 132391068

MAGNA INTERNATIONAL INC., a corporation duly organized and existing under the laws of the Province of Ontario (herein referred to as the “Company” which term includes any successor entity under the Indenture herein referred to), for value received, hereby promises to pay to THE BANK OF NEW YORK DEPOSITORY (NOMINEES) LIMITED, or registered assigns, upon presentation, the principal sum of € on November 24, 2023 (the “Stated Maturity Date”) and to pay interest thereon from November 24, 2015 or from the most recent Interest Payment Date to which interest has been paid or duly provided for, annually in arrears on November 24 of each year (each, an “Interest Payment Date”), commencing November 24, 2016, at the rate of 1.900% per annum, until the principal hereof is paid or duly provided for. The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in such Indenture, be paid to the Holder in whose name this Note (or one or more Predecessor Debt Securities) is registered at the close of business on the Regular Record Date for such interest, which shall be the November 10 (whether or not a Business Day) immediately preceding such Interest Payment Date. Any such interest not so punctually paid or

A-1

duly provided for shall forthwith cease to be payable to the Holder on such Regular Record Date, and may be paid to the Holder in whose name this Note (or one or more Predecessor Debt Securities) is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee, notice whereof shall be given to Holders of Notes not less than ten days prior to such Special Record Date, or may be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Notes may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture. Interest on the Notes will be computed on the basis of an ACTUAL/ACTUAL (ICMA) (as defined in the rulebook of International Capital Market Association) day count convention. The Company will pay, to the extent lawful, interest (including post-petition interest in any proceeding under any applicable federal or state bankruptcy, insolvency, reorganization or other similar law) on overdue principal and interest at the rate per annum borne by the Notes.

Payment of the principal of and interest on the Notes will be made at the Corporate Trust Office of the Paying Agent in London, in Euro, subject to the provisions of the Indenture. The Company, however, may pay principal and interest by check payable in such money. At the option of the Company, payment of interest may be made by check mailed to the address of the Person entitled thereto as such address shall appear in the Debt Security Register; provided that, notwithstanding anything else contained herein, if the Notes are issued in the form of one or more Global Debt Securities and are held in book-entry form through the facilities of Euroclear and Clearstream, payments on the Notes will be made to the Common Depositary or its nominee in accordance with the arrangements then in effect between the Common Depositary and Euroclear and Clearstream.

In any case where any Interest Payment Date or the Stated Maturity Date or any earlier date of redemption or repurchase of the Notes shall not be a Business Day, then the related payment of interest or principal and premium, if any, need not be made on such date, but may be made on the next succeeding Business Day with the same force and effect as if made on such Interest Payment Date or on the Stated Maturity Date or such earlier date of redemption or repurchase, and, if such payment is made or duly provided for on such Business Day, no interest shall accrue on the amount so payable for the period from and after such Interest Payment Date or the Stated Maturity Date or such earlier date of redemption or repurchase, as the case may be, to such Business Day. For purposes of the Notes, the term “Business Day” means any day, other than a Saturday or a Sunday, (i) which is not a day on which banking institutions in the City of New York or London are authorized or required by law, regulation or executive order to close and (ii) on which the Trans-European Automated Real-Time Gross Settlement Express Transfer system (the TARGET2 system) or any successor thereto, is open.

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the Certificate of Authentication hereon has been executed by the Trustee by manual signature of one of its authorized signatories, this Note shall not be entitled to any benefit under the Indenture, or be valid or obligatory for any purpose.

A-2

IN WITNESS WHEREOF, the Company has caused this instrument to be executed by one of its duly authorized officers.

Dated: November 24, 2015

|

|

MAGNA INTERNATIONAL INC. |

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Name: |

|

|

|

Title: |

TRUSTEE’S CERTIFICATE OF AUTHENTICATION:

This is one of the Debt Securities of the series designated therein referred to in the within-mentioned Indenture.

Dated: November 24, 2015

|

|

THE BANK OF NEW YORK MELLON, as Trustee |

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Representative |

A-3

[Reverse of Note]

MAGNA INTERNATIONAL INC.

This Note is one of a duly authorized issue of Debt Securities of the Company designated as its “1.900% Senior Notes due 2023” (herein called the “Notes”), initially limited in aggregate principal amount to €550,000,000 issued under an Indenture, dated as of June 16, 2014, between the Company and The Bank of New York Mellon, as trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture with respect to the series of which this Debt Security is a part), as amended and supplemented by the Third Supplemental Indenture thereto, dated as of November 24, 2015, among the Company, the Trustee and the Bank of New York Mellon, London Branch, as Paying Agent (such Indenture, as so amended and supplemented, and as hereafter amended and supplemented from time to time, the “Indenture”), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the Holders of the Notes, and of the terms upon which the Notes are, and are to be, authenticated and delivered. To the extent that any provision of this Note conflicts with the express provisions of the Indenture, the provisions of this Note will govern and be controlling (to the extent permitted by law). All terms used in this Note which are defined in the Indenture shall have the meanings assigned to them in the Indenture.

The Notes will be redeemable at any time, at the option of the Company, in whole or from time to time in part, upon not less than 30 nor more than 60 days’ prior written notice, on any date prior to the Stated Maturity Date at a Redemption Price, calculated in accordance with the terms of the Indenture, which includes accrued interest thereon, if any, to, but not including, the Redemption Date. In the case of any partial redemption, selection of the Notes for redemption will be made by the Trustee by such methods, as the Trustee shall deem fair and appropriate or, if the Notes are issued in the form of one or more Global Debt Securities and beneficial interests therein are held in book-entry form through the facilities of Euroclear and Clearstream, in accordance with the procedures of Euroclear or Clearstream, as the case may be. If any Note is to be redeemed in part only, the notice of redemption relating to such Note shall state the portion of the principal amount thereof to be redeemed. A new Note in principal amount equal to the unredeemed portion hereof will be issued in the name of the Holder hereof upon cancellation of this Note; provided that the unredeemed portion hereof shall be in an authorized denomination.

Upon the occurrence of a Change of Control Triggering Event with respect to the Notes, unless the Company has exercised its right to redeem the Notes, each Holder of Notes will have the right to require the Company to purchase all or a portion of such Holder’s Notes pursuant to a Change of Control Offer, at a purchase price equal to 101% of the principal amount thereof plus accrued and unpaid interest, if any, to, but excluding, the date of purchase.

If an Event of Default with respect to the Notes shall occur and be continuing, the principal of the Notes may be declared due and payable in the manner and with the effect provided in the Indenture.

A-4

The Indenture permits, with certain exceptions as provided therein, the amendment thereof and the modification of the rights and obligations of the Company and the rights of the Holders of the Debt Securities of any series under the Indenture at any time by the Company and the Trustee with the consent of the Holders of not less than a majority of the aggregate principal amount of the Outstanding Debt Securities of such series. The Indenture also contains provisions permitting the Holders of not less than a majority of the aggregate principal amount of the Outstanding Debt Securities of any series, on behalf of the Holders of all such securities of that series, to waive compliance by the Company with certain provisions of the Indenture and to waive certain past defaults under the Indenture with respect to such series and their consequences. Any such consent or waiver by the Holders of the Notes shall be conclusive and binding upon such Holders and upon all future Holders of the Notes, whether or not notation of such consent or waiver is made upon the Notes.

No sinking fund will be established with respect to the Notes and the Notes shall not be subject to any sinking fund payments.

The Indenture contains provisions for defeasance of (i) the entire indebtedness of the Company in respect of the Notes and (ii) certain restrictive covenants and the related Events of Default, subject to compliance by the Company with certain conditions set forth in the Indenture.

No reference herein to the Indenture and no provision of the Notes or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of, premium, if any, and interest on the Notes at the times, places and rate, and in the coin or currency, herein prescribed.

The Notes are issuable only in registered form without coupons in denominations of €100,000 and integral multiples of €1,000 in excess thereof.

No service charge shall be made for any such registration of transfer or exchange, but the Company may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

The registered Holder of this Note may be treated as its owner for all purposes.

No recourse shall be had for the payment of the principal of or premium, if any, or the interest on the Notes, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any past, present or future stockholder, employee, officer or director, as such, of the Company or of any successor, either directly or through the Company or any successor, whether by virtue of any constitution, statute or rule of law or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issue hereof, expressly waived and released.

The Notes shall be governed by and construed in accordance with the laws of the State of New York.

A-5

ASSIGNMENT FORM

FOR VALUE RECEIVED, the undersigned hereby sells, assigns and transfers unto

(Please Print or Type Name and Address Including Zip Code of Assignee)

the within Debt Security of Magna International Inc. and hereby does irrevocably constitute and appoint Attorney to transfer said security on the books of the within-named Corporation with full power of substitution in the premises.

(Please Insert Social Security or Other Identifying Number of Assignee) Dated:

SIGNATURE GUARANTEE

Signatures must be guaranteed by an “eligible guarantor institution” meeting the requirements of The Bank of New York Mellon, which requirements include membership or participation in the Security Transfer Agent Medallion Program (“STAMP”) or such other “signature guarantee program” as may be determined by The Bank of New York Mellon in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of 1934 as amended.

NOTICE: The signature to this assignment must correspond with the name as it appears on the first page of the within Note in every particular, without alteration or enlargement of any change whatever.

A-6

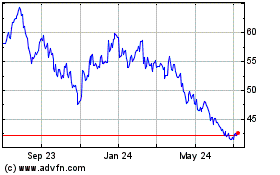

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

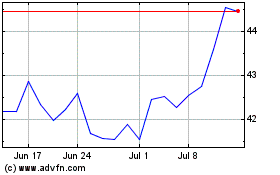

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024