Report of Foreign Issuer (6-k)

November 10 2015 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: November 2015

Commission File Number: 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: |

November 10 , 2015 |

|

MAGNA INTERNATIONAL INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ “Bassem A. Shakeel” |

|

|

|

Bassem A. Shakeel |

|

|

|

Vice-President and Corporate Secretary |

2

EXHIBIT 99

Press release issued November 10, 2015, in which the Registrant announced acceptance by The Toronto Stock Exchange of its notice to commence a normal course issuer bid.

3

Exhibit 99

|

|

Magna International Inc. |

|

337 Magna Drive |

|

Aurora, Ontario L4G 7K1 |

|

Main (905) 726-2462 |

|

magna.com |

PRESS RELEASE

TSX ACCEPTS NOTICE OF INTENTION

TO MAKE NORMAL COURSE ISSUER BID

November 10, 2015 Aurora, Ontario, Canada……Magna International Inc. (TSX: MG, NYSE: MGA) today announced that the Toronto Stock Exchange (“TSX”) had accepted its Notice of Intention to Make a Normal Course Issuer Bid (the “Notice”). Pursuant to the Notice, Magna may purchase up to 40,000,000 Magna Common Shares (the “Bid”), representing approximately 9.9% of its public float. As at November 3, 2015 Magna had 404,380,164 issued and outstanding Common Shares, including a public float of 401,988,149 Common Shares. During the previous 12 months, Magna has purchased 12,044,890 Common Shares (after giving effect to the two-for-one stock split implemented by way of a stock dividend on March 25, 2015) pursuant to a normal course issuer bid at a weighted average purchase price of US$47.66 per Common Share.

The primary purposes of the Bid are purchases for cancellation, as well as purchases to fund Magna’s stock-based compensation awards or programs and/or Magna’s obligations to its deferred profit sharing plans. Magna may purchase its Common Shares, from time to time, if it believes that the market price of its Common Shares is attractive and that the purchase would be an appropriate use of corporate funds and in the best interests of the Corporation.

The Bid will commence on November 13, 2015 and will terminate no later than November 12, 2016. All purchases of Common Shares under the Bid may be made on the TSX, at the market price at the time of purchase in accordance with the rules and policies of the TSX or on the New York Stock Exchange (“NYSE”) in compliance with Rule 10b-18 under the U.S. Securities Exchange Act of 1934. Purchases may also be made through alternative trading systems in Canada and/or the United States or by private agreement pursuant to an issuer bid exemption order issued by a securities regulatory authority. Purchases made by way of such private agreements under an issuer bid exemption order will be at a discount to the prevailing market price. The rules and policies of the TSX contain restrictions on the number of shares that can be purchased under the Bid, based on the average daily trading volumes of the Common Shares on the TSX. Similarly, the safe harbor conditions of Rule 10b-18 impose certain limitations on the number of shares that can be purchased on the NYSE per day. As a result of such restrictions, subject to certain exceptions for block purchases, the maximum number of shares which can be purchased per day during the Bid on the TSX is 259,621 based on 25% of the average daily trading volume for the prior six months (being 1,038,487 Common Shares on the TSX). Subject to certain exceptions for block purchases, the maximum number of shares which can be purchased per day on the NYSE will be 25% of the average daily trading volume for the four calendar weeks preceding the date of purchase. Subject to regulatory requirements, the actual number of Common Shares purchased and the timing of such purchases, if any, will be determined by Magna having regard to future price movements and other factors. All purchases will be subject to Magna’s normal trading blackouts. Any purchases made during a blackout period will only be made pursuant to a pre-defined automatic securities purchase plan.

CONTACT

For further information, please contact Vince Galifi, Executive Vice-President and Chief Financial Officer at 905-726-7100 or Louis Tonelli, Vice-President, Investor Relations at 905-726-7035.

ABOUT MAGNA

We are a leading global automotive supplier with 285 manufacturing operations and 83 product development, engineering and sales centres in 29 countries. We have approximately 125,000 employees focused on delivering superior value to our customers through innovative processes and World Class Manufacturing. Our product capabilities include producing body, chassis, exterior, seating, powertrain, electronic, vision, closure and roof systems and modules, as well as complete vehicle engineering and contract manufacturing. Our Common Shares trade on the Toronto Stock Exchange (MG) and the New York Stock Exchange (MGA). For further information about Magna, visit our website at www.magna.com.

FORWARD-LOOKING STATEMENTS

This press release may contain statements that, to the extent that they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of applicable securities legislation, including, but not limited to, future purchases of our Common Shares under the Normal Course Issuer Bid or pursuant to private agreements under an issuer bid exemption order issued by the Ontario Securities Commission. Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, objectives or economic performance, or the assumptions underlying any of the foregoing. We use words such as “may”, “would”, “could”, “should” “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “forecast”, “outlook”, “project”, “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements. Any such forward-looking statements are based on information currently available to us, and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks, assumptions and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict. These risks, assumptions and uncertainties include, without limitation, the impact of: economic or political conditions on consumer confidence, consumer demand for vehicles and vehicle production; fluctuations in relative currency values; legal claims and/or regulatory actions against us; liquidity risks as a result of an unanticipated deterioration of economic conditions; the unpredictability of, and fluctuation in, the trading price of our Common Shares; changes in laws and governmental regulations; and other factors set out in our Annual Information Form filed with securities commissions in Canada and our annual report on Form 40-F filed with the United States Securities and Exchange Commission, and subsequent filings. In evaluating forward-looking statements, we caution readers not to place undue reliance on any forward-looking statements and readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements. Unless otherwise required by applicable securities laws, we do not intend, nor do we undertake any obligation, to update or revise any forward-looking statements to reflect subsequent information, events, results or circumstances or otherwise.

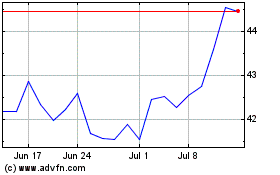

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

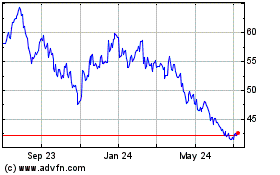

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024