Report of Foreign Issuer (6-k)

September 16 2015 - 5:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: September, 2015

Commission File Number: 001-11444

MAGNA INTERNATIONAL INC.

(Exact Name of Registrant as specified in its Charter)

337 Magna Drive, Aurora, Ontario, Canada L4G 7K1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: September 16, 2015 |

MAGNA INTERNATIONAL INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ “Bassem Shakeel” |

|

|

|

Bassem A. Shakeel |

|

|

|

Vice-President and Corporate Secretary |

2

EXHIBIT 99

Press release issued September 16, 2015, in which the Registrant announced that it has entered into an underwriting agreement providing for the issuance of U.S.$650 million aggregate principal amount of its senior unsecured notes pursuant to an effective shelf registration statement previously filed with the Securities and Exchange Commission.

3

Exhibit 99

|

|

|

Magna International Inc. |

|

|

|

337 Magna Drive |

|

|

|

Aurora, Ontario L4G 7K1 |

|

|

|

Tel (905) 726-2462 |

|

|

|

Fax (905) 726-7164 |

PRESS RELEASE

MAGNA ANNOUNCES SENIOR NOTES OFFERING

September 16, 2015, Aurora, Ontario, Canada……Magna International Inc. (TSX: MG, NYSE: MGA) today announced that it has entered into an underwriting agreement providing for the issuance of U.S.$650 million aggregate principal amount of its senior unsecured notes pursuant to an effective shelf registration statement previously filed with the Securities and Exchange Commission.

The notes will bear interest at an annual rate of 4.150% and will mature on October 1, 2025. The offering is expected to close on September 23, 2015, subject to customary closing conditions.

Magna intends to use the net proceeds from the offering for general corporate purposes, including capital expenditures and the previously announced acquisition of the Getrag Group of Companies.

Citigroup Global Markets Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and RBC Capital Markets, LLC are acting as joint book-running managers for the offering.

The notes are not being qualified for distribution in Canada but will be offered in Canada on a private placement basis.

This release shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of these securities, in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The offering of these securities may be made only by means of a prospectus supplement and accompanying prospectus. Copies of the prospectus supplement and the accompanying prospectus can be obtained from:

|

Citigroup Global Markets Inc. |

|

Merrill Lynch, Pierce, |

|

RBC Capital Markets, LLC |

|

c/o Broadridge Financial Solutions |

|

Fenner & Smith Incorporated |

|

Three World Financial Center |

|

1155 Long Island Avenue |

|

222 Broadway |

|

200 Vesey Street |

|

Edgewood, NY 11717 |

|

New York, NY 10038 |

|

New York, NY 10281 |

|

1-800-831-9146 |

|

Attn: Prospectus Department |

|

Attn: Debt Capital Markets |

|

prospectus@citi.com |

|

dg.prospectus_requests@baml.com |

|

1-866-375-6829 |

|

|

|

|

|

usdebtcapitalmarkets@rbccm.com |

CONTACT

For further information, please contact Vince Galifi, Executive Vice-President and Chief Financial Officer at 905-726-7100 or Louis Tonelli, Vice-President, Investor Relations at 905-726-7035.

ABOUT MAGNA

We are a leading global automotive supplier with 287 manufacturing operations and 81 product development, engineering and sales centres in 29 countries. We have approximately 124,000 employees focused on delivering superior value to our customers through innovative products and processes, and World Class Manufacturing. Our product capabilities include producing body, chassis, exterior, seating, powertrain, electronic, vision, closure and roof systems and modules, as well as complete vehicle engineering and contract manufacturing. Our Common Shares trade on the Toronto Stock Exchange (MG) and the New York Stock Exchange (MGA).

FORWARD LOOKING STATEMENTS

This release may contain statements which constitute “forward-looking statements” under applicable securities legislation and are subject to, and expressly qualified by, the cautionary disclaimers that are set out in Magna’s regulatory filings. Please refer to the prospectus supplement relating to the offering of senior unsecured notes, as well as Magna’s most current Management’s Discussion and Analysis of Results of Operations and Financial Position, Annual Information Form and Annual Report on Form 40-F, as replaced or updated by any of Magna’s subsequent regulatory filings, which set out the cautionary disclaimers, including the risk factors that could cause actual events to differ materially from those indicated by such forward-looking statements.

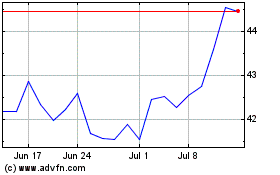

Magna (NYSE:MGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

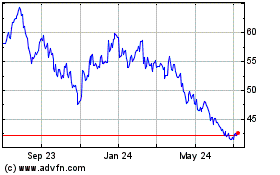

Magna (NYSE:MGA)

Historical Stock Chart

From Apr 2023 to Apr 2024